Your credit score range is an important factor that lenders take into consideration when making decisions about your creditworthiness. It’s important to understand what your score range is and how it affects your financial life. In this blog post, we’ll discuss what a score range is, the different score ranges, factors that affect your score range, the benefits of having a high score range, tips for improving your credit score range, how to monitor your score range, score range by age, and the impact of score range on your financial life.

What Is a Credit Score ?

A credit score range is a numerical representation of your creditworthiness. It is based on the information in your credit reports and other public records. It is usually expressed as a three-digit number, from 300 to 850. A higher score range is generally considered to be better, while a lower score range is considered to be worse.

A credit score range is used by lenders to determine whether you are a good credit risk or a bad one. A higher score range means that you are more likely to be approved for a loan or credit card, while a lower score range can make it more difficult to get approved.

Your credit score range is just one factor that lenders use to determine your creditworthiness, but it is an important one. Your score range can have a significant impact on your financial life, so it’s important to understand how it works and how to improve it.

Read also: Auto Loan Scoring: Mitigating Risks and Improving Lending Decisions.

The Different Credit Score Ranges

There are several different score ranges that are used by different lenders.

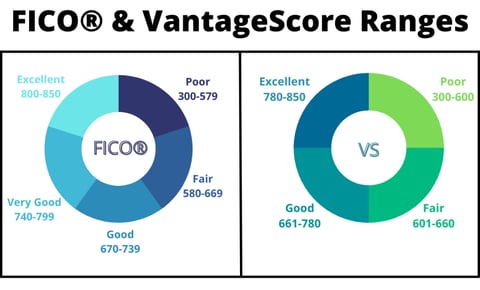

The most common credit score range is the FICO score range, which ranges from 300 to 850. This is the score range that most lenders use, so it’s important to keep an eye on your FICO score range.

The VantageScore range is another credit score range that is based on the TransUnion credit bureau. It ranges from 300 to 850, like the FICO score range.

Factors That Affect Your Credit Score

There are several different factors that can affect your score range. These include:

- Payment history: Late payments can have a negative impact on your score range.

- Credit utilization: The amount of credit you are using in relation to your available credit can have a big impact on your credit score range.

- Length of credit history: The longer your credit history, the better it can be for your score range.

- Types of credit: Different types of credit accounts can have different impacts on your score range.

- New credit: Opening new lines of credit can have a negative impact on your score range.

These are just a few of the factors that can affect your score range. It’s important to understand how each of these factors can impact your score range, so you can make informed decisions about your credit.

The Benefits of Having a High Credit Score

Having a high credit score range can be beneficial for many reasons. A high score range can help you get approved for loans and credit cards, and can also help you get better terms and interest rates.

Having a high score range can also make it easier to rent an apartment or buy a car. A good score range can also help you get better insurance rates and can even help you get a job.

Finally, having a high credt score range can make it easier to negotiate for lower interest rates on existing loans and credit cards.

Tips for Improving Your Score Range

If your credit score range is not as high as you’d like it to be, there are several steps you can take to improve it. Here are a few tips:

- Pay your bills on time: Late payments can have a significant impact on your score range, so it’s important to pay your bills on time.

- Check your credit reports: Your credit reports contain information that can affect your score range, so it’s important to check them regularly for accuracy.

- Reduce your credit utilization: Try to keep your credit utilization ratio below 30% to avoid hurting your score range.

- Don’t open too many new accounts: Opening new accounts can have a negative impact on your score range, so try to limit the number of new accounts you open.

- Monitor your score range: Track your score range regularly to make sure it’s improving.

How to Monitor Your Credit Score

It’s important to monitor your credit score range regularly, so you can catch any issues early and take steps to improve it. There are several ways to track your score range.

Many credit card issuers offer free access to your FICO score range. You can also get your score range from a credit monitoring service such as Experian, TransUnion, or Equifax.

Read also:

- What Is a Good Credit Score?

- How to Check Credit Score: The Essential Guide

- What Is a Good Credit Score?

- Getting to Know Your Credit Score: Is 700 a Good Credit Score?

- Comparing Fico Score vs Credit Score: Which One is Better for Your Finances?

- How to Increase Credit Score: 7 Proven Strategies

- Unlock the Benefits of a Free Credit Score Check

Finally, you use a free online tool such as Credit Karma or Credit Sesame to track your score range. These tools can give you a good idea of where your credit score range is at and can help you track its progress over time.

Score Range by Age

Your credit score range can vary depending on your age. Generally speaking, younger people tend to have lower credit scores than older people, since they have less of a credit history to draw from.

As you get older, your score range should improve as you build a longer credit history and make more payments on time. However, it’s important to keep in mind that age isn’t the only factor that affects your score range.

The Impact of Credit Score on Your Financial Life

Your credit score range can have a significant impact on your financial life. A higher score range can make it easier to get approved for loans and credit cards, and can also help you get better terms and interest rates.

On the other hand, a lower score range can make it more difficult to get approved for loans and credit cards, and can result in higher interest rates.

Your credit score range can also have an impact on your ability to rent an apartment or buy a car, and can even affect your ability to get a job.

Credit Score Resources

If you want to learn more about credit score ranges, there are several resources available.

The Consumer Financial Protection Bureau (CFPB) provides information about score ranges and how to improve them. You can also use the CFPB’s free Credit Score Estimator tool to get an estimate of your score range.

You can also find information about score ranges from the major credit bureaus such as Experian, TransUnion, and Equifax.

FAQs about Credit Score

The score range is typically between 300 and 850. This is the range used by most of the major credit bureaus, including Experian, Equifax, and TransUnion. A higher credit score indicates a higher level of financial responsibility and can qualify you for better loan terms and lower interest rates.

A good credit score is considered to be between 700 and 749. This range is considered to have good credit and can qualify you for a variety of loan products, including mortgages and credit cards.

An excellent score range is considered to be between 800 and 850. This range is considered to have excellent credit and can qualify you for the most competitive loan terms, including lower interest rates and fees.

A poor credit score is considered to be between 300 and 649. This range is considered to have poor credit and can make it more difficult to qualify for loans or other credit products.

How can I check my Credit Score?

There are several ways to check your credit score:

- Get a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at www.annualcreditreport.com.

- Use a credit monitoring service, such as Credit Karma or Credit Sesame, which provides free credit scores and alerts to changes in your credit report.

- Check with your bank or credit card issuer, as some offer free credit score monitoring services to their customers.

- Purchase your FICO score directly from FICO or a credit bureau.

It’s important to regularly check your credit reports and scores to ensure accuracy and detect any signs of fraud or identity theft. Keep in mind that while checking your credit score won’t hurt your credit, applying for new credit frequently can lower your score.

Conclusion

Your score range is an important factor that lenders use to determine your creditworthiness. It’s important to understand what your credit score range is and how it affects your financial life.

By understanding the factors that affect your score range, you can make informed decisions to improve it. Paying your bills on time, reducing your credit utilization, and monitoring your score range are all good ways to improve your score range.

If you need help understanding your credit score range or improving it, there are several resources available. The CFPB and major credit bureaus are good places to start.