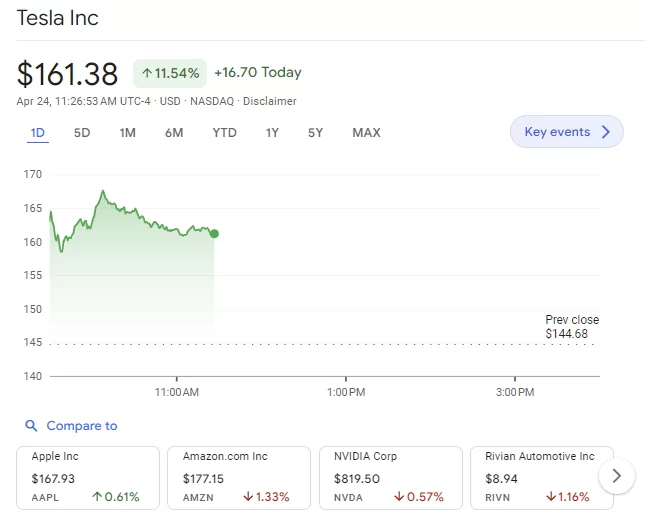

Tesla’s stock price experienced an impressive ascent, climbing by 11.7% on April 24, 2024, a boost attributed to the company’s announcement of an accelerated production timeline for new, more affordable electric vehicles (EVs). Despite a noticeable 55% dip in profits, the surged Tesla share price reflected the market’s positive response, overshadowing the financial setback and highlighting investors’ unwavering confidence in the EV giant’s roadmap.

The surge coincides with the broader momentum in the Technology (XLK) sector of the S&P 500, further fueled by rising bond yields and a notable 10-year Treasury yield leap to 4.67%, situating Tesla among key companies like Boeing, AT&T, and Texas Instruments under the investor’s microscope for the earnings reports of the “Magnificent Seven” companies in 2024. This pivot in Tesla’s stock performance beckons a deeper exploration into the factors propelling the uptick and its ripple effects across the stock market and electric vehicle industry.

Factors Influencing Tesla’s Stock Surge

Key Announcements and Analyst Reactions

- Launch of Affordable Models: Tesla’s announcement to accelerate the production of more affordable EV models significantly influenced the stock surge. The company plans to introduce these models by early 2025, utilizing both current and next-generation platforms. This strategy not only promises increased accessibility but also potential market expansion.

- Analyst Upgrades: Following the Q1 earnings report, Morningstar analyst Seth Goldstein raised his fair value estimate for Tesla shares to $200, citing the stock as undervalued. This upgrade reflects a positive shift in market perception, further boosting investor confidence.

- Innovative Developments: Tesla’s ongoing projects, including the introduction of a robotaxi, dubbed “cybercab,” and significant investments in AI infrastructure, underscore the company’s commitment to innovation and future growth. These developments are pivotal in maintaining investor interest and backing, especially in light of the upcoming shareholder vote on Elon Musk’s compensation plan.

Financial Dynamics and Market Response

- Earnings Impact: Despite a decrease in revenues and net income in Q1 2024, Tesla’s stock demonstrated resilience with a 13% surge in early trading. This response was largely driven by the CEO’s optimistic projections for vehicle deliveries in 2024, outweighing the immediate financial setbacks.

- Strategic Investments: Tesla’s substantial investment in AI and production capabilities, including a $1 billion expenditure on AI infrastructure, plays a crucial role in its long-term strategy. These investments, although impacting the free cash flow negatively in the short term, are expected to yield significant returns as the technology matures and production scales.

Market Value and Future Outlook

- Surge in Market Value: The stock’s upward trajectory following the announcements is anticipated to enhance Tesla’s market value by nearly $50 billion. This increase is a testament to the strong market faith in Tesla’s strategic direction and its ability to innovate and capture larger market shares in the evolving EV landscape.

- Long-Term Growth Prospects: Despite facing challenges such as slowing growth and thinning margins, Tesla’s aggressive push towards more affordable models and enhanced service networks positions it well for future growth. The anticipation of higher vehicle deliveries in 2024 further bolsters this outlook, promising a robust performance in the coming years.

Impact of Recent Tesla Announcements on Stock Performance

Tesla’s recent Q1 earnings call was pivotal, revealing several significant updates that directly influenced its stock performance. Firstly, the announcement to expedite the production of more affordable models, initially slated for late 2025, to as early as late 2024 or early 2025, sparked investor enthusiasm, reflecting in a substantial 13% rise in after-hours trading. This shift not only promises a broader market reach but also aligns with Tesla’s strategic adaptation towards more cost-effective electric vehicles.

Further fueling the stock surge, Tesla disclosed ongoing negotiations to license its full self-driving technology to a major automaker. This potential partnership, expected to be finalized within the year, could significantly enhance Tesla’s revenue streams and market positioning, as the integration of such advanced technology would take at least three years, projecting long-term benefits.

Moreover, the introduction of the ‘cyber cab’ robotaxi service, set for launch on August 8, and the deployment of the Optimus humanoid robot by the end of 2024, are set to create additional revenue channels. These innovations underscore Tesla’s shift towards becoming an autonomy-focused company, a vision strongly emphasized by CEO Elon Musk. This strategic pivot not only diversifies Tesla’s portfolio but also enhances its appeal to investors looking for pioneering developments in autonomy and AI.

Comparative Stock Performance with Industry Trends

Industry-Wide Financial Dynamics

- Durable Goods and Major Players:

- New orders for durable goods experienced a notable increase of 2.6% in March, exceeding the forecasted 2.3% rise.

- Despite a year-over-year revenue drop of 8%, Boeing saw its share price climb by 1.4% due to a smaller-than-expected loss.

- Visa showcased a remarkable performance, gapping up to its 50-day moving average post-Q2 results, signifying a strong market response.

- Tech and Consumer Goods Sectors:

- IBM and American Express demonstrated stability and growth potential, with IBM forming a flat base and American Express remaining in a buy zone.

- Meta Platforms and ServiceNow both approached their 50-day moving averages, indicating a steady market presence leading up to their earnings.

- Vertiv, Super Micro Computer, and Nvidia reported strong quarters, boosting their stock prices, while Chipotle Mexican Grill hovered just above its 10-week moving average.

Tesla’s Comparative Market Performance

- Challenges and Opportunities:

- Tesla has navigated through a slowdown in EV demand and heightened competition from Chinese automakers.

- Despite these challenges, Tesla’s stock has consistently outperformed the S&P 500 and the broader automotive industry, underscoring strong investor confidence and market share capture.

- Sales and Inventory Trends:

- The first quarter of 2023 saw Tesla achieving its lowest quarterly deliveries since Q2 2022, totaling 386,810 vehicles.

- An 87% increase in inventory from Q1 2023 and a gross profit margin of 16.4%, excluding regulatory credits, reflect significant shifts in Tesla’s operational and financial strategies.

EV Sector and Traditional Automakers

- Growth and Adaptation:

- The global automotive industry has faced a downturn, with declining sales in key markets such as China, the US, and Europe.

- However, the surge in EV adoption, spearheaded by Tesla, indicates a transformative phase within the industry, with traditional automakers intensifying their investments in EV technology.

- This strategic shift is aimed at rivaling Tesla’s advancements and capturing a significant portion of the evolving EV market.

Conclusion about Tesla stock price today

As demonstrated, Tesla stock surge (+11.7%) on April 24, 2024, serves as a vivid marker of the company’s enduring appeal to investors and its strategic significance in the electric vehicle (EV) sector. Despite facing financial headwinds, such as a notable dip in profits, Tesla’s aggressive timeline for rolling out affordable EV models and its ventures into AI and autonomy have reinforced its market position. This reflects a broader trend within the technology and automotive sectors, signaling a shift towards more sustainable and innovative transportation solutions that have captured the market’s imagination and investor confidence alike.

The implications of Tesla’s strategic moves and their effect on its stock performance extend well beyond the company’s financials, suggesting a transformative phase for the entire automotive industry. As traditional automakers ramp up their EV investments to compete, Tesla’s recent developments underscore the significance of innovation and market adaptation in securing long-term growth. These efforts not only highlight the dynamism within the EV landscape but also reaffirm the critical role of visionary strategy in navigating the challenges and opportunities that the future holds for the sector.