Crypto Market Roundup 18th May 2022:

Despite “extreme fear” prevailing in the crypto markets, the global market remains bearish. By the time this article was published, the global crypto market cap had slumped to $1.28 trillion from $1.31 trillion on Wednesday. During this time, bitcoin’s price fell below $30,000 once again.

In the past 24 hours, the volume of cryptocurrencies on the global market decreased by 11.39% to $77.44 billion. In DeFi, the total 24-hour volume was $7.66 billion, or 9.89% of the total crypto market. There was $67.5 billion worth of stable coins traded in 24 hours, which makes up 87.16% of the total crypto market volume.

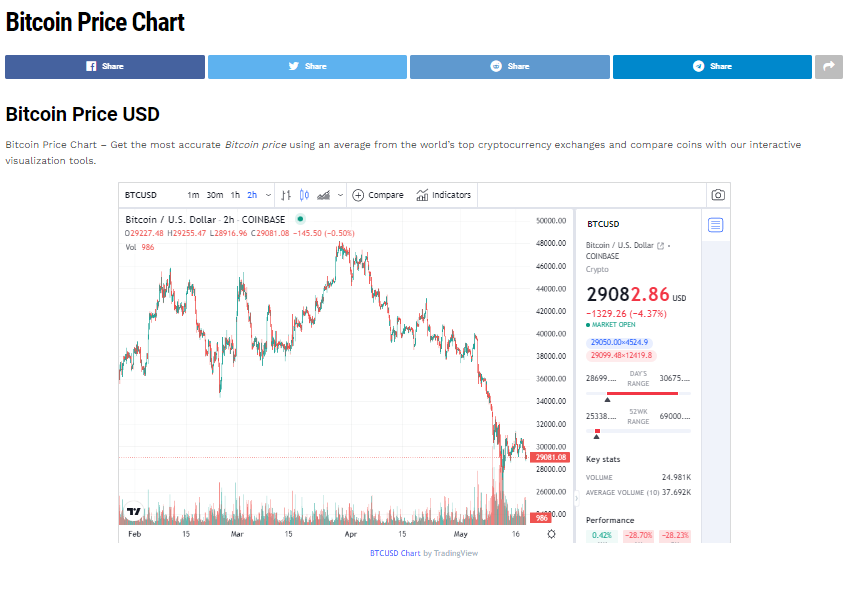

Bitcoin (BTC)

On Wednesday, cryptocurrency market conditions remain bearish, with Bitcoin hovering around the $30,000-mark. As a result, the price of bitcoin fell by 1.57 percent to $29,898.22.

On Wednesday, Bitcoin and several other significant cryptocurrencies traded in the green but fell in the red.

BTC’s price could initially face resistance at $33,000, stall its upward momentum. In addition, the market is bearish, which limits the gains in cryptocurrencies. Investors will be relieved to see that after Monday’s dip.

Ethereum (ETH)

From a macro perspective, Ethereum’s price has flipped bearish after forming a second lower low at $1,700. It is prudent for investors to prepare for a worst-case scenario in which ETH could be worth $600. The bearish hypothesis will be invalidated if a three-day candlestick close exceeds $3,396.

It is clear that the price of Ethereum remains challenging despite the recent crash and that a further downward trend will be imminent. From a macro perspective, ETH will only produce a higher high if a bullish trend emerges. Based on a fundamental perspective, recent competition has capped Ethereum blockchain upside, but continued cycle improvements and user share dominance allow further growth.

Cardano (ADA)

At 09:42 (13:42 GMT) on Wednesday, the Investing.com Index recorded a price of $0.5314 for Cardano, down 10.07 percent for the day. Since 11th May, this is the most significant percentage drop in one day.

With the move down, Cardano’s market capitalization has fallen to $18.2311B, or 1.44% of the entire cryptocurrency market cap. Cardano’s market cap reached $94.8001B at its height.

Within the past twenty-four hours, Cardano traded between $0.5313 and $0.5859.

The value of Cardano has dropped 5.88% in the last seven days. Cardano traded for $893.8929M or 1.12% of all cryptocurrency trading in the twenty-four hours when this article was written. Over the past week, its price has fluctuated between $0.4029 and $0.6123.

Cardano is currently down 82.85% from its all-time high of $3.10, which was reached on 2nd September 2021.

Ripple (XRP)

On 12th May 2022, Ripple (XRP) fell below its all-time low of $0.41 to a new low of $0.35.

A regulatory crackdown in Russia, the third-largest crypto market globally, has led to a dramatic decline for many cryptocurrencies, including XRP.

Due to the rising interest rates in America, investors have also been holding back on crypto investments due to fear of inflation.

China has also forbidden financial institutions from facilitating crypto transactions. As a result, speculative crypto trading has been forewarned to investors, resulting in a negative impact on the performance of cryptocurrencies in general.

Solana (SOL)

Since last week, price action for Solana (SOL) has mutated to the downside and is on the verge of breaking through the plateau. After the bullish breakout, we should see SOL price test the red descending trend line around $78 and, depending on the buy volume that supports the breakout, it may pierce through that trend line. It would be critical that investors get back into the market after that break and watch the price move up rapidly to $95.31 using the 55-day Simple Moving Average (SMA) as a guiding indicator.

The price of SOLO will break out in a bullish fashion and hit the red descending trend line.

If the market breaks above the trend line and the deflation of tail risks, we expect a move toward $95.31.