The banking sector across Europe took a big hit on Friday, with stocks sinking to new depths unseen since early February. The Stoxx Europe 600 Banks index decreased by 3.8%, with the London-based FTSE 100 index closing down 1.3%. Germany’s Deutsche Bank and Switzerland’s UBS were hit especially hard, as both saw their stock prices close 8.5% and 5.2% lower respectively. This dramatic fall in share prices indicates significant doubts from investors about the health of both banks, as well as that of the wider European banking sector as a whole.

These concerns are further compounded by recent financial crises experienced by other major banks in Europe over recent months, leading investors to fear the worst for these newly at-risk institutions too. It appears that a number of investors have taken it upon themselves to sell off their shares in Deutsche Bank and UBS before possible further losses – an action that has only added fuel to market uncertainty in this time of financial turmoil.

Fear of a global financial crisis engulfed Deutsche Bank shares amid news of financial troubles reported by the German bank. According to reports, Deutsche Bank’s stock had its biggest loss in eight years on Monday and continued to drop again on Tuesday as jittery investors fretted over the fate of one of Europe’s largest lenders. Fears deepened that a scandal-ridden bank could face potential insolvency following revelations this month that two large investor groups have sold their stake in the beleaguered lender.

Read also: Is the UBS Deal of $3.3b the Starting of the Banking Crisis 2023?

The banking giant has been embroiled in scandals for more than three years, including ongoing investigations into its business practices surrounding the sale of mortgage-backed securities. Reports have caused more worry as Deutsche Bank’s precarious financial predicament is seen as an existential threat to the broader European economy and beyond. The market turbulence is likely to spread beyond banks, particularly with a key U.S rate decision due this week amid rising concerns about slowing global growth and challenges posed by U.S.-China trade tensions. A shock to markets now could severely hurt investor sentiment leaving governments scrambling to respond in hopes of preventing an economic meltdown similar to 2008’s banking crisis or even worse, another Great Depression.

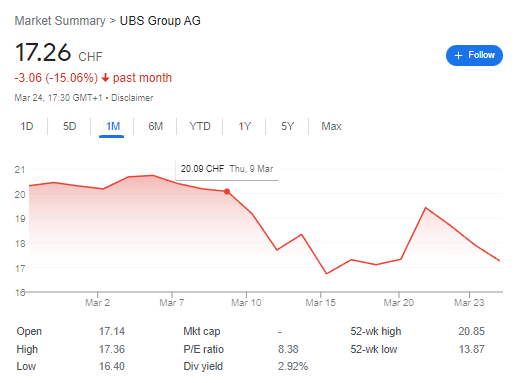

UBS Stock – UBS stock loose -15.06% in past month

According to [3], UBS stock lost 15.06% in the last month. The website provides free historical data for UBS stock, including the closing price, open, high, low, change, and percentage change for the selected range of dates. Additionally, [2] provides some performance outlook metrics for UBS, including a beta of 1.12 and a TTM PE ratio of 10.37, as well as EPS and dividend information. It is essential to note that stock prices can fluctuate frequently, and past performance is not an indicator of future results.

References:

[1] UBS Group AG (UBS) Stock Historical Prices & Data [2] UBS Group AG (UBS) Stock Price, News, Quote & History [3] UBS Group AG Historical Price Data (UBSG)

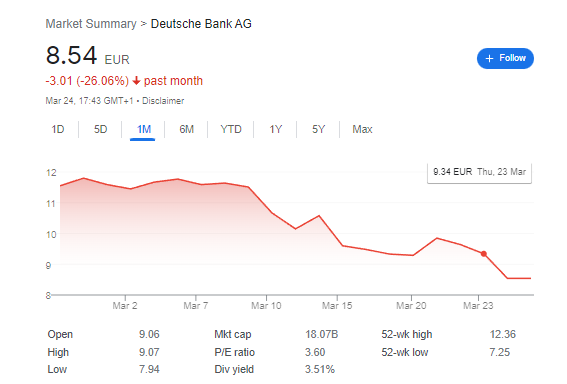

Deutsche Bank stock

Deutsche Bank stock has lost 26.06% in the past month. However, [1] mentions that Deutsche Bank’s stock closed down 8.5% on the German stock exchange after falling as much as 14% on Friday. Additionally, [3] suggests that there has been a steep rise in the cost to protect Deutsche Bank’s debt, which may have impacted the stock price. It is also mentioned in [2] that European banks fell 3.8% and were set for their third week of declines, which could have contributed to the drop in Deutsche Bank’s stock price.

References:

[1] Deutsche Bank shares slide after sudden spike in the cost … [2] European stocks fall as Deutsche Bank sparks another … [3] Shares of Germany’s largest lender Deutsche Bank fall …

FAQs

“The rising price of insuring CDS senior debt is weighing on Deutsche Bank, as well as other European banks, on concerns over the impact of rising rates on the wider economy and banks’ balance sheets,” Michael Hewson, chief market analyst at CMC Markets, told FintechZoom.

UBS and Credit Suisse declined to comment to FintechZoom.