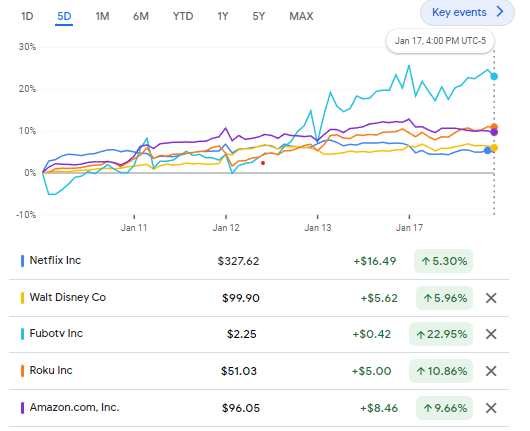

Streaming stocks past 5 days climbed! Netflix Stock price +4.85%, FuboTV Stock price +22.95%, Roku Stock Climbed +13.68%, Amazon increased +9.66%, Disney Stock increased +5.97% and Warner Stock increased +12.21%.

The streaming stocks have been on a roller coaster ride in the past 5 days! It has been an incredible journey with stocks like Netflix Stock, FuboTV Stock, Roku Stock, Amazon Stock, Disney Stock and Warner Stock all seeing some impressive gains. Netflix Stock has seen a massive 4.85% increase in its stock price since the start of the week, while FuboTV Stock has seen an even bigger 22.95% increase. Roku Stock has climbed an incredible 13.68%, Amazon has increased by 9.66%, Disney Stock has increased by 5.97% and Warner Stock has seen an impressive 12.21% increase.

This is an incredible trend that has been seen across all the major streaming stocks in the past 5 days. This is a trend that investors have been watching closely and it looks like it will continue for the foreseeable future. Streaming stocks have been one of the most popular investments of the past few years and it looks like this trend is set to continue.

The success of streaming stocks has been credited to the rise of streaming services, as more and more people are opting to watch their favorite shows and movies online instead of traditional cable or satellite TV. This has resulted in a huge demand for streaming stocks, as investors are looking for ways to capitalize on this trend.

It is clear that streaming stocks have been a big winner over the past 5 days, with Netflix Stock, FuboTV Stock, Roku Stock, Amazon Stock, Disney Stock and Warner Stock all seeing impressive gains. This trend looks set to continue as streaming services continue to grow in popularity and investors continue to look for ways to capitalize on this trend. With streaming stocks on the rise, it is certainly an exciting time for investors.

1. Netflix Stock price +4.85% (past 5 days) – Earnings Season is coming

This Thursday, the leader in streaming video will be unveiling their newest financial results. They have a lot to show.

It’s Netflix‘s (NFLX) turn to report its earnings for the season, and investors are eagerly waiting for the results after Thursday’s market close. Much is at stake with these results.

Earnings report this week may bring some obstacles to Netflix’s stock. Here are some of the factors that could be preventing progress.

According to Reuters, Netflix Inc (NFLX) is expected to report its slowest quarterly revenue growth on Thursday as its ad-supported plan struggles to attract customers in the saturating U.S. market, which could pressure the company to pull back on content spending this year.

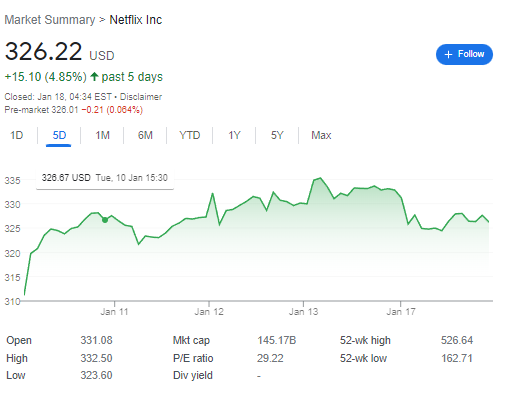

Netflix Stock increased 4.85% in past 5 days.

Netflix Stock increased +4.85% in past 5 days, closing at 326.22 USD. Investors are are eagerly waiting for the 2022 results after Thursday’s market close. Market Cap 145.17 B.

Investors are eagerly awaiting the results of Netflix stock after Thursday’s market close. The Netflix Stock (NFLX) has been on a steady climb over the past five days, increasing by 4.85% and closing at 326.22 USD. This has caused a great deal of excitement among investors and has many people wondering if they should invest in Netflix stock.

Netflix has been one of the most successful companies in the streaming market, and their stock is highly valued by investors. The company has continued to make strong profits, and investors believe that the stock will rise in value.

The stock market is on an uptrend

In 2022, Netflix, like a number of growth stocks, experienced a sharp decline in price. Its shares were cut in half during the year, but since the company reported its Q3 results, the stock has seen a 38% increase. Comparatively, the market has only risen 8% in the same time frame.

The increase in share prices is likely a sign of bullishness, however it also increases the expectations. Most likely, the strong report has already been accounted for due to the recent surge in the stock. Before the report on Thursday, some analysts made the decision to either upgrade the stock or increase their price targets. This is an appealing sign, but it also places high pressure on Netflix to produce a flawless report.

On Thursday, Andrew Uerkwitz from Jefferies upgraded the rating of the streaming video company from hold to buy and raised the stock’s price target from $310 to $385. Jason Helfstein from Oppenheimer followed suit the next day, increasing the target on the shares from $365 to $400. This has clearly made investors elated, as the stock has experienced a 38% surge in the past three months. Nevertheless, Netflix still has a lot to prove this week.

It is possible that financial gain from advertisements may not be immediate

When Netflix announced a basic subscription fee of $6.99 per month, which was a 30% reduction to its ad-free option, there were worries of contracting margins. However, the market reacted positively to the news. Moreover, in October, Netflix noted that they would be able to recoup the $3 difference through ad revenue.

It’s understandable why marketers now have the opportunity to reach the hard-to-find Netflix viewers. However, last month, Digiday released an unsatisfactory report claiming Netflix was giving back unused inventory to its initial advertisers, which doesn’t look good. Are frugal users not taking advantage of the more affordable tier? Are those customers not streaming as much content as anticipated? Is Netflix delivering less ads than they expected so they can avoid any discomfort? It’s possible one or more of these queries is true and that could put a halt to the recent surge in its stocks.

It is possible that Netflix will not be able to survive an economic recession

The bullish outlook for Netflix suggests that it will remain strong regardless of a market downturn. As people cut back on costlier social activities and other entertainment expenses if the economy keeps weak, Netflix is an attractive choice since its monthly plans are now much more affordable, with prices starting at below twenty-five cents a day.

Netflix was one of the only stocks to increase during the 2008 subprime lending crisis, making it the gold standard of streaming media stocks. Last week, however, analyst Kannan Venkateshwar of Barclays warned that the fourth quarter net additions are forecasted to fall below Netflix’s own predictions of 4.5 million, now predicting only 2.7 million more subscribers than previously. Keeping the lore alive, Netflix has now gained competition for low-priced entertainment subscriptions.

I am still optimistic about Netflix’s future prospects, and it is currently my main investment. However, I fear that the share price may take a hit following the release of the fourth-quarter report on Thursday. There were already signs that this could happen.

2. FuboTV Stock price +22.95% (past 5 days)

The entertainment industry is producing a greater than ever amount of content and streaming services are at the forefront of this surge in supply. Additionally, platforms are trying out different subscription models to make a balance between profitability and affordability. Recently, FuboTV (NYSE: FUBO) increased its subscription rate by five dollars, which caused the FUBO stock price to momentarily dip, but it quickly recovered and returned to its upward trend.

FuboTV Stock increased 22.95% in past 5 days.

FuboTV Stock increased +22.95% in past 5 days, closing at 2.25 USD. Recently, FuboTV (NYSE: FUBO) increased its subscription rate by five dollar. Market Cap is 439.48 M.

Since peaking at $16.65 in January 2022, the share value has dropped by more than 85%. Until March 2022, a downward trend was apparent, followed by a slight uptick thereafter. In July 2022 the price failed to reach the level predicted by the regression channel.

In mid-August, the stock rose dramatically by 80% and closed at $6.35 on the day. The surge happened shortly after Lynette Kaylov assumed the role of senior VP. Anchored VWAP suggests the shares are trading below the support level, while the regression trend reveals that the value sank into the sellers zone yesterday. It is possible more buying may occur before a potential decline.

Meanwhile, the FuboTV Stock has been on an impressive run in the past five days, gaining +22.95% and closing at 2.25 USD. The company, FuboTV (NYSE: FUBO) recently announced that it was raising its subscription rate by five dollar. This news has certainly attracted the attention of investors, as the FuboTV Stock price has surged since the announcement.

The market cap of FuboTV is 439.48 M and the company has a strong presence in the US, Latin America and Europe. The company has over 200 live channels for sports, news, entertainment, and more. With its latest subscription rate increase, FuboTV aims to offer even more content to its subscribers.

New subscription prices are being conducted by streaming services

Consumers have voted FuboTV as the most satisfactory streaming platform according to J.D. Power, and the company is striving to become a top-tier global TV streaming service. This ambition puts them in competition with industry heavyweights such as Netflix (NASDAQ: NFLX), Amazon (NASDAQ: AMZN), and Paramount Global (NASDAQ: PARA).

For a basic monthly fee of $9.99, Disney is the most economical choice among streaming services. Meanwhile, Paramount+ offers an ad-supported plan at the same cost, while Netflix charges a standard subscription rate of $15.49, a half-dollar more than Amazon Prime Video.

Recently, Netflix and Disney+ have both implemented new subscription plans while empowering creators. Netflix’s plan was ad-supported, while Disney+ introduced a more efficient version. Disney+ allows its service to be streamed on four devices as opposed to just one with Netflix. Furthermore, Disney+ offers higher quality video, with full HD, HDR 10 and Dolby Vision, compared to Netflix with its 720p resolution. Additionally, customers of Netflix have reported missing titles from their library, with an estimated 5% to 10% of titles missing.

Research has revealed that in 2021, streaming services earned an impressive $375 billion, with estimates predicting that this figure will skyrocket to $1.7 Trillion by the year 2030. The surge in demand for streaming technology, coupled with the development of 5G and VR, are the primary catalysts for this growth. Despite these advancements, piracy is a major concern that could impede the industry’s development. Data indicates that there are more than nine million users who are subscribed to pirated streaming services. Blockchain technology could be an effective solution to this problem.

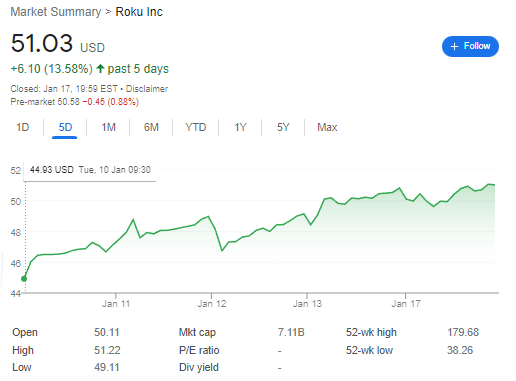

3. Roku Stock Climbed +13.68% in past 5 days

Roku Stock increased +13.58% in past 5 days, closing at 51.03 USD. Market Cap is 7.11 B.

Roku (ROKU) is not generating any notable interest from Wall Street at the moment. The originator of streaming video on TVs began 2021 with the revelation of sequential growth in active users in the fourth quarter and a daring but hazardous strategy to begin fabricating its own smart TVs.

As the earnings season begins, market observers are making their moves in anticipation of the upcoming reports. Several stocks have been upgraded or their price targets raised, including the company that runs the most popular premium video service. Unfortunately, the same cannot be said of Roku, as Wall Street has taken a different approach with the stock which could prove to be a major misstep.

Streams that are not enjoyable !?

Roku had a rocky beginning this week, with a shortened holiday trading period. Matthew Thornton from Truist decided to downgrade the stock from buy to hold on Tuesday. Even though the stock has dropped almost 90% from its peak in the summer of 2021, Thornton believes that the valuation is still difficult to justify due to the high operational expenditures and increasing losses. He decreased his price expectation for the shares from $90 to $50.

Last week, Andrew Uerkwitz of Jefferies analysts took the initiative to downgrade Roku’s stock and adjust the price target from $45 to $30. Even though the situation could have been worse, this was still a significant event.

Advertisers are becoming increasingly cautious due to an economic downturn, and the active market for connected TV ads won’t be spared. It could be an even bigger challenge for streaming video, since the two biggest streaming platforms recently made available ad-supported tiers by the end of the fourth quarter. Roku, which is a free service that is almost completely dependent on ad revenue to fund its model and subsidize its hardware, could feel the effects if premium advertisers opt to support the two new pay services instead.

Well, …Roku Stock Climbed +13.68% in past 5 days!!

The past five days have been a boon for Roku Stock investors, with the stock price increasing by 13.58% and closing at 51.03 USD. On top of this, the market cap of the company has grown exponentially to a whopping 7.11 B USD, indicating that investors are now putting their faith in Roku Stock. This surge in popularity of Roku Stock can be attributed to the strength of the company’s portfolio, which includes a range of products from streaming players to TVs and audio systems.

The recent rise in Roku Stock price has been met with a lot of enthusiasm from investors, who have been eagerly awaiting a jump in the stock’s price. This rise in Roku Stock price has been fueled by a number of positive developments within the company, such as the launch of their new streaming devices and the addition of new content partnerships. Furthermore, the company’s strong financial performance has played a key role in driving up the stock price.

This positive outlook of Roku Stock has been further bolstered by the company’s commitment to creating a better user experience. Recently, they have released a range of new features and updates that have made the streaming experience smoother and more enjoyable. Additionally, the company has also made several strategic investments in the areas of advertising and technology, which has further cemented their position as one of the leading streaming companies.

All in all, the recent surge in Roku Stock price has been a huge boon for investors and has given them newfound faith in the company’s ability to create a successful streaming experience. With the stock price now at 51.03 USD, and the market cap at a staggering 7.11 B USD, it looks like Roku Stock is in an excellent position to continue its successful run in the future.

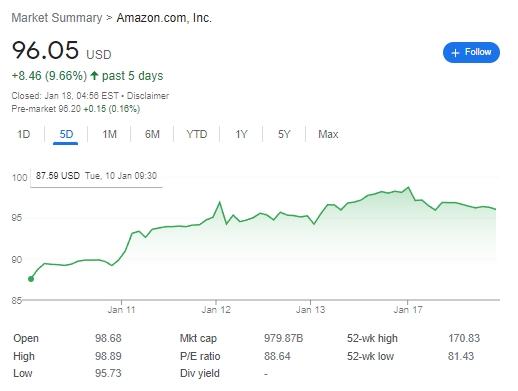

4. Amazon stock increased +9.66% in past 5 days and will cut 18.000 Employees

Amazon Stock increased +9.66% in past 5 days, closing at 96.05 USD (but yesterday was losing -2.11%). Market Cap is 978.8 B. Amazon will cut 18.000 Employees.

Amazon Stock has had an incredible week, with an impressive +9.66% increase in the past 5 days. It closed at 96.05 USD, and its market cap is now 978.8 B. The news of this significant increase in stock price has been met with both enthusiasm and concern. On the one hand, investors are delighted with the positive returns — Amazon Stock has been on a steady incline for several months, and this increase demonstrates that confidence in the company remains strong. On the other hand, many are worried about Amazon’s decision to cut 18.000 employees. While it’s understandable that the company needs to make adjustments in order to remain competitive, this could potentially have a significant impact on the local economy in these areas.

Overall, Amazon Stock is a great investment choice for those who are looking for long-term growth and stability. The company has a stellar track record of delivering consistent returns and has proven to be a reliable source of income for many investors. Moreover, Amazon’s strong financials and impressive innovation make it a great option for those who want to diversify their portfolio. The recent Amazon Stock increase is certainly a cause for celebration, but investors should also be aware of the potential downsides of the company’s decision to cut 18.000 employees.

Amazon Initiates Redundancy Program Affecting 18,000 Employees

Amazon.com Inc. revealed earlier this month that they will be initiating the largest job reduction they have ever conducted, resulting in the termination of more than 18,000 workers.

Due to a decline in e-commerce growth and the potential for an economic downturn, the retailer is forced to make reductions in their spending activities.

Beginning in the past year, the most considerable impact of the layoffs were felt by Amazon’s Devices and Services group, the makers of Alexa and Echo speakers. On Wednesday, the majority of job losses are anticipated to occur in the retail and HR sectors.

Although the layoffs make up a very small portion of the company’s overall workforce, consisting of many thousands of hourly warehouse and delivery staff, they constitute approximately 6% of Amazon’s 350,000 corporate personnel worldwide.

Andy Jassy, Amazon’s Chief Executive Officer, expressed in a memo to employees that the company has been able to remain successful even during tough economic times. He further elucidated that these shifts would make it possible to pursue future prospects with a more solid cost structure.

In 2020, the biggest internet retailer was forced to make changes due to a decrease in e-commerce activity. Amazon postponed the launch of their warehouses, stopped taking on new employees in their retail division, and then broadened the freeze by reducing their corporate workers.

Different massive tech organizations, of which Amazon is one, have been downsizing their personnel. Other companies who have been making significant job cuts include Cisco Systems Inc., Intel Corp., Meta Platforms Inc., Qualcomm Inc., and Salesforce Inc.

Jassy stated in a memorandum that Amazon would be providing severance, interim health coverage, and job assistance to employees who were going to be let go.

The impact of global warming on the environment has been profound and far-reaching. Its consequences have been felt across the world, resulting in drastic changes to ecosystems and weather patterns. From melting glaciers to rising sea levels, the effects of global warming are undeniable and deeply concerning. Extreme temperatures, flooding, and droughts are all consequences of an increasingly warming planet. It is up to us to reduce our carbon footprint and take action to protect our planet from further damage.

5. Disney Stock up +5.97% in past 5 days

Disney Stock increased +5.97% in past 5 days!, closing at 99.91 USD. Market Cap is 182.19 B.

It’s an incredible time to be a fan of Disney stock! The stock has increased by a whopping +5.97% in the past five days and is currently closing at a record-high of 99.91 USD. This is a major milestone for the company, as its market cap is now at a whopping 182.19 billion.

It’s no surprise that Disney stock is doing so well. The company is one of the most beloved and recognizable brands in the world, and its products and services are enjoyed by people of all ages. Over the past few years, Disney has been expanding its reach into new areas such as streaming, theme parks, and merchandise, and these efforts have been paying off.

Furthermore, Disney has been doing a great job at adapting to the changing landscape of the entertainment industry. The company has been able to quickly adjust its business model to take advantage of the growing demand for streaming content, and its investment in its streaming service Disney+ has been paying off.

Read also these FintechZoom articles:

- Activate Disney+ on PS4 and PS5 – The Ultimate Guide for disneyplus.com login/begin ps4

- Disneyplus.com login begin – Guide to Start Using 8-digit code on Disney Plus.

- The Best Disney Movies: Including Pixar, Disney and Star Wars | Best Disney Movies

- What Is the Current Disney Stock Price Today and Should You Invest?

- Best Free Movie and TV Streaming Services that will saving your Money

- Disney Plus Sign Up: The Ultimate Guide

- Disney Plus Billing: Everything To Know

- How to Stream Live TV on the DisneyPlus App

- Experience Disney Plus Hotstar in USA – It’s Unbelievable!

- Unlock the Magic: Disneyplus.com login/begin 8 digit code Explained

Disney also recently announced a strategic partnership with Chinese streaming giant iQiyi, which should further bolster its streaming offerings. This partnership should provide a huge boost to Disney’s stock value in the long run.

Overall, the future looks very bright for Disney stock. The company’s strong performance in the past five days is a testament to its success, and its market cap of 182.19 billion is a sign of things to come. It looks like Disney is here to stay and its stock will only continue to rise. Investors should definitely take note of Disney stock, as it could be a very lucrative investment in the future.

6. Warner Bros Discovery Stock (NASDAQ: WBD) go to 13.23 USD +12.21% in past 5 days

Warner Stock increased +12.21% in past 5 days!, closing at 13.23 USD. Market Cap is 32.1 B. Warner Bros Discovery Inc (WBD) announced that they will be increasing the subscription fee for the ad-free version of HBO Max in the United States.

The Warner Stock has been on a roll! In the past 5 days, the stock has increased by an incredible +12.21%, closing at 13.23 USD. This impressive performance has increased its market cap to an impressive 32.1 B.

This surge in stock prices is due to the recent announcement by Warner Bros Discovery Inc (WBD) that they will be increasing the subscription fee for the ad-free version of HBOmax. This move has investors feeling optimistic about the company’s prospects.

The subscription fee increase is a reflection of the increased demand for HBOmax. Subscribers have been flocking to the streaming service in droves, and the company is looking to capitalize on this momentum by raising the subscription fee. This move has helped bolster the company’s bottom line, and the stock market is rewarding Warner Stock for its decision.

Read these FintechZoom articles:

- HBO Max Price: How Much Is HBO Max and What You Get?

- HBOmax/tvsignin: How to Sign in to HBO Max?

- Can’t Get a Free HBO Max Trial? Here’s What You Can Do Instead

- All You Need To Know About HBOMax/tvsignin enter code

- New Movies – The 6 best movies to watch on HBO Max

The subscription fee increase is a shrewd move by Warner Stock, as it will help the company generate more revenue from its streaming services. Furthermore, the increased demand for HBOmax is a sign of the company’s strong market position. As the subscription fee continues to rise, investors can expect to see further gains in the stock price.

Overall, the Warner Stock has seen impressive gains over the past 5 days, closing at 13.23 USD and increasing its market cap to 32.1 B. This surge in stock prices is due to the announcement by Warner Bros Discovery Inc (WBD) that they will be increasing the subscription fee for the ad-free version of HBOmax. As the subscription fee continues to rise, investors are optimistic that the stock will continue to perform well in the long run.

U.S. Sees First Increase in Cost of HBO Max Thanks to Warner Bros Discovery

The emblem of Warner Bros was visible during the Cannes Lions International Festival of Creativity, hosted in Cannes, France, on June 22, 2022. REUTERS/Eric Gaillard/File Photo captured the moment.

On Thursday, Warner Bros Discovery Inc (WBD) announced that they will be increasing the subscription fee for the ad-free version of HBO Max in the United States, the first time they have done so since the streaming service was established in 2020. The news caused their shares to drop by 3%.

Subscribers in the U.S. will find that the cost of the streaming platform, which is playing series like “The White Lotus” and “House of the Dragon”, will be increasing by one dollar to a total of $15.99 plus taxes each month.

HBO Max, which also has a tier with ads, is feeling the strain of slowing user growth and strong competition from big-name rivals like Netflix and Disney+. Last year, both Netflix and Disney increased the cost of some of their streaming services.

Last year’s merger of AT&T Inc’s WarnerMedia and Discovery Inc created Warner Bros Discovery, and the company is now working on internal alterations, such as joining HBO Max and Discovery+.

At the end of the prior month, the media business declared that it anticipated the expense of content write-offs to go up to a maximum of $3.5 billion, representing an increase of $1 billion.