The recent seismic shift in the GME share price, marking a 20% surge almost overnight, has captivated both the stock market and the broader investment community. This significant movement not just highlights the volatile nature of meme stocks but also underscores the unpredictable dynamics of e-commerce and investments in the digital age. The GameStop phenomenon, once again, proves that what is gamestop trading at can sway not just the futures of individual investors but can have far-reaching implications for the market as a whole, especially in the realms of premarket trading and gamestop stock price history.

In exploring this upsurge, our article delves into the intricacies surrounding the GME stock surge overview, including recent price movements, comparisons to previous highs, and the underlying market reaction. Additionally, we seek to unravel the factors behind this surge, its impact on other meme stocks, and how movements in the GME share price relate to broader market phenomena such as acquisitions, charters, and earnings announcements, like those from Nvidia. By examining expert opinions and future outlooks, we aim to provide a comprehensive understanding of the current state of GME stock, navigating through the complexities of investments, meme culture in the business world, and the relentless pace of change in the stock market.

GME Stock Surge Overview

GameStop’s recent financial strategies and market activities have played a significant role in the surge of its stock price. The company successfully completed its ‘at-the-market’ equity offering program, which involved selling 45 million shares and allowed it to raise approximately $933.4 million before commissions and offering expenses. This influx of capital is intended for general corporate purposes, including potential acquisitions and investments, which could further stabilize and grow the company’s operations.

Recent Developments and Financial Performance

GameStop reported preliminary first-quarter earnings, indicating that sales are expected to be between $872 million and $892 million, down from $1.237 billion year-over-year. However, there’s a silver lining as the net loss is forecast to improve, expected to be between $27 million and $37 million, down from $50.5 million. This suggests that despite a decrease in sales, profitability is improving, likely aided by the company’s cost-cutting initiatives. Selling, general, and administrative expenses are anticipated to be between $290 million and $300 million, a reduction from $345.7 million a year ago.

Market Dynamics and Investor Actions

The surge in GME stock can be attributed to several market dynamics, including a notable short squeeze. GameStop currently has a short interest as a percentage of float of 20.5%, which is considered very high and suggests potential for further price volatility. Additionally, the involvement of figures like Keith Gill, also known as “Roaring Kitty,” who recently returned to social media, has spurred investor interest and speculation, contributing to the stock’s dramatic price movements.

Strategic Moves and Future Prospects

GameStop’s strategic financial maneuvers, such as the equity offering and the effective management of its capital, are crucial for its future. The company plans to utilize the proceeds from the equity offering for working capital and other general corporate purposes, which may include investing in interest-bearing securities. This approach not only strengthens the company’s financial footing but also supports its long-term strategic goals.

GameStop’s ongoing adjustments and market strategies continue to draw attention from investors and analysts, suggesting that the GME stock’s journey is far from over and will be keenly watched in the coming months.

Recent Price Movements

GameStop’s Strategic Stock Sale and Price Surge

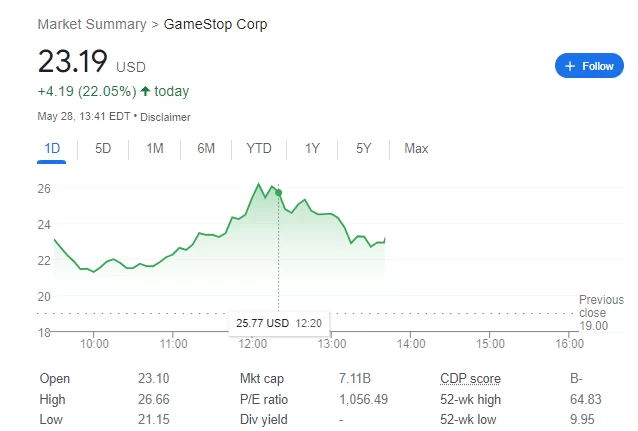

GameStop’s recent announcement of a successful stock sale significantly impacted its share price. The company disclosed that it had raised approximately $933 million from selling 45 million shares of common stock. This strategic move not only infused the company with much-needed capital but also caused a notable jump in its stock price. On the morning following the announcement, GameStop shares (GME) surged approximately 20%, reflecting the market’s positive reception to this financial maneuver.

Analysis of the Surge

The surge in GameStop’s share price can be attributed to several factors. Firstly, the substantial amount raised through the stock sale highlights the company’s proactive approach to strengthening its financial position. However, it’s noteworthy that such a significant stock sale typically raises concerns about the company’s valuation. In GameStop’s case, the market’s reaction was overwhelmingly positive, possibly due to the retailer’s cult status among retail investors and its central role in the meme stock phenomenon.

Historical Context and Investor Sentiment

GameStop’s stock has experienced remarkable volatility over the past years, marked by extreme highs and lows. The stock reached an all-time high of $120.75 on January 28, 2021, and plummeted to an all-time low of $0.64 on April 3, 2020. This volatility is a characteristic feature of meme stocks, which are often driven by retail investor frenzy rather than traditional financial metrics. The recent price movements further illustrate the unpredictable nature of GameStop’s stock, with a 9.62% rise over the previous week and an astonishing 118.07% increase over the past month.

Given these dynamics, the recent surge following the stock sale is not just a reflection of GameTime’s current financial strategies but also of the broader market’s speculative tendencies, especially concerning meme stocks. The involvement of prominent figures like Keith Gill, also known as “Roaring Kitty,” has also played a role in influencing investor sentiment and contributing to price volatility.

Conclusion of Recent Price Movements

In conclusion, GameStop’s recent price movements are a testament to the complex interplay between strategic financial decisions and market dynamics influenced by retail investors and meme culture. As the company navigates through these turbulent waters, it continues to attract significant attention from both investors and analysts, eager to see how these strategies will unfold in the longer term.

Comparison to Previous Highs

May 14 High

On May 14, GameStop’s (GME) share price reached a significant milestone, marking its highest level since the 2021 meme rally at $64.83. This peak was a part of a broader surge in May, where GameStop’s stock bolted 71% higher, although the year-to-date increase stood at a more modest 8.4%. This period of growth reflects a notable rebound, with GME stock soaring more than 20% at the open on a Tuesday, closely approaching the previous week’s high of $23.40. Despite this impressive rally, it’s crucial to note that GME stock still traded well below the May 14 high, underscoring the volatile nature of meme stocks and the challenges in maintaining such elevated price levels.

2021 Meme Rally

The 2021 meme rally represents a watershed moment for GameStop and the broader phenomenon of meme stocks. During this period, GameStop’s shares experienced an unprecedented surge, fueled in part by the re-emergence of “Roaring Kitty” Keith Gill, a key figure in the retail trading frenzy. The company’s shares jumped 14% on a Tuesday following the announcement that it had raised $933 million by capitalizing on the rally in the meme stock earlier that month. This rally saw GameStop’s shares increase nearly six times their value in the first two weeks of May. However, the aftermath of this rally was stark, with the stock losing 70% of its value up to the following Friday’s close, bringing GameStop’s market value to $5.82 billion.

This comparison to previous highs and the exploration of the 2021 meme rally highlight the significant volatility and investor sentiment driving GameStop’s stock price movements. The dramatic fluctuations underscore the influence of key figures and strategic financial decisions on the market’s reception and valuation of meme stocks like GameStop.

Market Reaction

Investor Sentiment

The GameStop stock surge, driven by a coordinated effort on social media platforms, particularly Reddit, highlighted a dramatic shift in investor sentiment. Individual investors used these platforms to discuss trading strategies and collectively influence the market, demonstrating a significant departure from traditional investment behaviors focused on corporate fundamentals. This phenomenon not only showcased the power of collective action among retail investors but also highlighted their ability to challenge institutional investors who had bet against GameStop’s success. The sharp rise in GameStop’s stock price, reaching an all-time high of $483 on January 28, 2021, was a clear indicator of this newfound investor confidence and the impact of social informedness on market dynamics.

Short Sellers Impact

The impact on short sellers during the GameStop surge was profound. Hedge funds and other institutional investors faced substantial losses due to the unexpected and rapid price increase, which was primarily fueled by the aggressive buying strategies of individual investors. The short squeeze in early 2021 resulted in a staggering 1,700% increase in GameStop’s stock price within a few weeks, causing significant financial distress for short sellers. The data from S3 Partners further illustrates the scale of these losses, with short sellers facing a mark-to-market loss of approximately $1.4 billion as GameStop shares soared. This scenario underscored the risks associated with short selling in a market increasingly influenced by retail investors and their collective actions on social media platforms.

This dynamic interplay between investor sentiment and the tangible financial impacts on short sellers underscores the evolving nature of the stock market, where traditional investment strategies are continually being challenged by new forms of investor engagement and influence.

Factors Behind the Surge

Stock Sale Announcement

GameStop’s recent surge in share price is notably linked to its announcement of a successful stock sale, where the company disclosed that it had raised approximately $933 million by selling 45 million shares of common stock. This strategic financial move was aimed at bolstering the company’s capital, which could be directed towards acquisitions or other significant investments as part of its broader corporate strategy. The sale was part of an at-the-market equity offering program, which had been previously announced, demonstrating a planned approach to capital management.

Market Conditions

The market’s reaction to GameStop’s stock sale and subsequent price surge can be attributed to several key factors. Firstly, the stock’s surge was partially fueled by a phenomenon known as a short squeeze, where the high short interest in GameStop shares, which stood at 20.5%, triggered a rapid buy-in from traders looking to cover their positions. Additionally, the re-emergence of key figures such as “Roaring Kitty,” who is widely credited with initiating the meme stock frenzy in 2021, played a significant role in attracting investor interest and driving up the stock price.

Furthermore, the broader market conditions, including the behavior of other meme stocks like AMC and BlackBerry, which also saw price increases following GameStop’s announcement, indicate a collective movement that often characterizes the volatile nature of meme stocks. This collective dynamic suggests that market sentiment and speculative trading significantly impact the pricing and trading volumes of stocks like GameStop.

By leveraging its strategic stock sale and navigating the complex market dynamics, GameStop has managed to create a substantial impact on its stock valuation, reflecting both its internal financial strategies and external market behaviors.

Impact on Other Meme Stocks

AMC Entertainment

AMC Entertainment, another prominent meme stock, experienced significant trading activity alongside GameStop. The theater chain’s shares soared by 31% in pre-market trading on a particular Tuesday, influenced by the same speculative fervor that boosted GME shares. This surge came after a remarkable 78% increase on the previous Monday, followed by an additional 80% gain early the next day, pushing the share price to $9.35. Despite these gains, AMC’s stock has faced challenges in 2024, showing a decline of about 21% for the year, even after spiking 65.2% within the month. The company also capitalized on the renewed interest by raising $250 million through the sale of almost 73 million shares and entering into a debt-for-stock swap agreement.

BlackBerry

Similarly, BlackBerry, once a dominant player in the smartphone market, also rode the wave of meme stock enthusiasm. Shares of BlackBerry increased by 12% in pre-market trading on the same day. The stock saw a modest rise of 1.4% on a Tuesday morning, with a total increase of just over 3% in May, although it had tumbled 18.6% so far in the year. This movement reflects the broader trend of volatile trading patterns that meme stocks often exhibit, driven by retail investor activity and social media influence.

Virgin Galactic

Virgin Galactic, another key player in the meme stock saga, witnessed a 22% jump in its shares following similar trends. This increase is part of a broader pattern of sharp rises and falls, characteristic of stocks popularized on forums like WallStreetBets. Despite the significant one-day gains, Virgin Galactic’s shares had a tumultuous week, with a substantial 17% drop following the initial surge. This volatility underscores the speculative nature of trading in meme stocks, where investor sentiment can shift dramatically based on social media trends and market speculation.

The impact of GameStop’s movements on other meme stocks like AMC Entertainment, BlackBerry, and Virgin Galactic highlights the interconnected nature of these high-volatility stocks. They often move in tandem based on market sentiment, social media influence, and speculative trading, leading to rapid gains and losses within short periods.

Future Outlook

Predictions

The future outlook for GME stock presents a spectrum of predictions that reflect a blend of optimism and caution. For the year 2024, predictions suggest a considerable decline in GME stock price to an average of $13.77, indicating a sharp drop from its recent highs. This forecast aligns with a broader sentiment of uncertainty and expected volatility in the stock’s future, influenced by factors such as market dynamics and investor sentiment. However, looking towards 2025, forecasts become significantly more varied, with estimates ranging from a conservative $18.81 to a more bullish outlook of $81.49. This wide range of predictions underscores the speculative nature of GME stock and the differing opinions among analysts about its future trajectory.

By 2030, the disparity in projections grows even further. The most optimistic forecast suggests a potential value of $990.70, based on long-term trends and speculative market behaviors. On the other hand, more moderate expectations place the stock at an average price of around $89.47, reflecting a cautious approach to its long-term valuation. These predictions highlight the challenges in forecasting the future of meme stocks like GameStop, which are subject to rapid and unpredictable shifts in market sentiment.

Potential Risks

As with any investment, GME stock carries its own set of potential risks that investors must consider. The stock’s volatility is a double-edged sword, offering opportunities for significant gains but also posing risks of substantial losses. The stock’s price can fluctuate widely in a short period, influenced by factors like social media trends, retail investor speculation, and market sentiment. This high volatility makes GME stock a very high-risk investment, with daily movements that can lead to substantial changes in valuation.

Moreover, the stock finds itself at a critical juncture, with support levels just below its current price. If these support levels are broken, it could signal a trend shift and potentially lead to further declines in price. Such a scenario underscores the natural risk involved in investing in GME stock, as breaking through support levels can trigger a cascade of selling, further depressing the stock’s price.

Investors must also be mindful of the signals from moving averages and the Moving Average Convergence Divergence (MACD). While there is a general buy signal from the long-term average, the stock holds a sell signal from the short-term Moving Average. This mixed signal indicates a need for caution, as it reflects the stock’s uncertain short-term trajectory. Furthermore, the presence of a buy signal from the 3-month MACD suggests potential for gains, but this must be balanced against the inherent risks of such a volatile investment.

In conclusion, the future outlook for GME stock is marked by a combination of optimistic predictions and significant potential risks. Investors considering GME stock must weigh these factors carefully, taking into account the stock’s volatility, market sentiment, and the broader dynamics of meme stocks. As the landscape for meme stocks continues to evolve, the path for GME stock remains uncertain, with both substantial opportunities and risks on the horizon.

Expert Opinions

Analyst Insights

Analysts have been closely monitoring GameStop’s stock, with varying opinions on its future trajectory. Recent evaluations suggest a wide range of price targets, reflecting the inherent uncertainty and volatility associated with GME stock. Wedbush has consistently rated GameStop as underperform, maintaining this stance across multiple reviews throughout the year. The most recent analysis by Wedbush set a price target of $7.00, indicating a potential downside of approximately 69.87% from the current trading price. This perspective is underscored by a broader consensus among analysts that the stock could face significant downward pressure, with a current average price target of $6.2, suggesting a substantial decline.

Market Predictions

Market predictions for GameStop’s stock are equally mixed, with some forecasts indicating potential growth while others suggest a decline. The stock is currently seen as overvalued, trading 71.69% above projected values, which could indicate a forthcoming correction. In contrast, the long-term outlook based on a 10-year growth rate is more optimistic, predicting that the stock could reach $464.80 by 2030, marking a significant increase of 1,903.43% from its current level. Short-term predictions are less favorable, with a projected decrease of 4.40% in the next day and a further 5.57% drop within a week. These mixed signals reflect the complex dynamics at play, influenced by both internal corporate actions and broader market trends.

Conclusion

Throughout this article, we’ve explored the dynamic surge in GME’s share price and its wider implications on the stock market, punctuated by strategic corporate decisions, intense investor interest, and the overarching influence of meme culture on stock valuations. The significant capital raised through strategic stock sales, coupled with the market’s speculative response, underscores a complex interplay between traditional financial strategies and modern-day trading phenomenons driven by social media and community speculation. This fine balance between strategic foresight and the unpredictable nature of retail investment has marked a new chapter in how we understand stock market dynamics and investor behavior.

As GameStop continues to navigate the tumultuous waters of the stock market, its journey offers crucial insights into the volatile world of meme stocks and the power of collective retail trading. The broader implications of GameStop’s story extend beyond mere price fluctuations, encompassing the evolving narrative of market participation, the challenges of forecasting in an increasingly speculative environment, and the potential impact on traditional investment strategies. Moving forward, the GameStop phenomenon remains a pivotal study case, highlighting the shifting paradigms of wealth, power, and influence in the financial markets, and sounding a call to both investors and analysts to re-evaluate their approaches amidst the ever-changing landscape of the digital age stock market.