In the past few weeks, GameStop (GME) stock has been a hot topic of discussion in the financial world and beyond. The GME stock price has skyrocketed, and many investors are wondering if they should invest in GME stock. In this FintechZoom article, we’ll dive into the GME stock drama and explore the pros and cons of investing in GME stock. We’ll also discuss how to buy GME stock, the GME stock split, the GME stock price forecast, and more. By the end of this article, you’ll have a better understanding of GME stock and will be able to decide whether or not it’s a good investment for you.

What is GME Stock?

GME stock is the stock of GameStop, a specialty video game retailer that was founded in 1984. GameStop operates over 5,000 stores worldwide and is one of the largest video game retailers in the world. While GameStop has been struggling in recent years due to the shift towards digital gaming, the company has managed to stay afloat by diversifying its business into other areas such as collectibles and technology brands.

Despite its struggles, GME stock has been a popular investment choice for many investors who believe the company can turn things around. GME stock is traded on the New York Stock Exchange (NYSE) and is one of the most widely traded stocks on the exchange.

Recent GME Stock Price Sharp Decline

The GME stock price has been on a wild ride in the past few weeks. On January 12th, 2021, the GME stock price was around $17 per share. Then, in the span of a few weeks, the GME stock price skyrocketed to an all-time high of $483 per share in January.

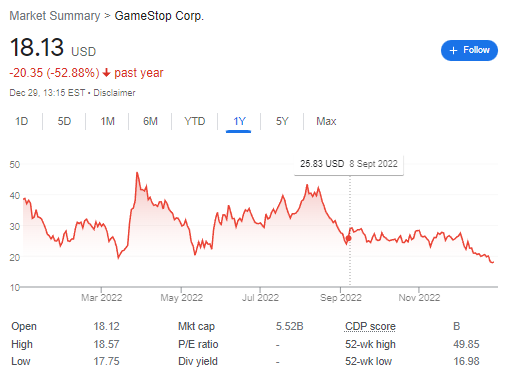

Since January 2021, GME stock has seen a sharp decline in its value. In January 2021, the stock was trading at around $39.50, but since then it has plummeted to just $18.13 – a 52.88% loss. While this may sound concerning, it’s important to remember that the stock market can be unpredictable, and prices can fluctuate greatly in the short term. As with any stock, it’s important to keep a close eye on the GME stock price and its overall performance over the long term. Despite its recent dip, GME stock has a history of being fairly resilient, and there is a good chance it will rebound in the future. Furthermore, GME offers many of the same services as other stocks, such as dividends and buybacks, which can help investors maximize their returns. With this in mind, it’s important to remember that the GME stock price is only part of the equation when it comes to investing.

The Role of Reddit in GME Stock Price Surge

The GME stock surge was largely due to a Reddit group called WallStreetBets. This group is made up of over 8 million members and is dedicated to stock market discussion. In late January, many members of WallStreetBets started to buy large amounts of GME stock in an effort to “stick it to the man” and drive up the GME stock price. This resulted in a massive surge in the GME stock price and an influx of new investors.

Pros and Cons of Investing in GME Stock

Investing in GME stock has both its pros and cons. Let’s explore each side of the argument.

Pros

The pros of investing in GME stock include:

- High Risk, High Reward – GME stock is a high-risk, high-reward investment. The stock has the potential to surge in value if the company is able to turn things around.

- Liquidity – GME stock is highly liquid, which means it’s easy to buy and sell.

- Low Cost – GME stock is relatively inexpensive, so you don’t need to have a lot of money to invest in it.

Cons

The cons of investing in GME stock include:

- Volatility – GME stock is highly volatile, which means there’s no guarantee that the stock price will remain high.

- Short Squeeze – The recent surge in GME stock price has been due to a short squeeze, which is a risky strategy that isn’t sustainable in the long term.

- Lack of Diversification – Investing in a single stock leaves you exposed to the risk of that stock. It’s important to diversify your investments by investing in multiple stocks.

How to Buy GME Stock

If you’re interested in investing in GME stock, you’ll need to open a brokerage account. You can open an account with a broker such as Robinhood, TD Ameritrade, or E-Trade. Once you have an account, you can buy GME stock by entering the stock symbol (GME) and the number of shares you want to buy.

GME Stock Split Explained

The GME stock split is a move by the company to increase the number of shares available for trading. A stock split is when a company divides its existing shares into multiple shares. For example, if a company splits its shares 2-for-1, it would mean that each share is divided into two shares. This increase in shares can make the stock more accessible to investors.

In March 2021, GameStop announced a 3-for-1 GME stock split. This means that each share of GME stock will be divided into three shares. The GME stock split is expected to take effect on April 16th, 2021.

Should You Invest in GME Stock?

The decision to invest in GME stock is a personal one, and it’s important to do your own research before investing. GME stock has the potential to be a lucrative investment, but it also carries a lot of risk. It’s important to understand the risks involved before investing in any stock, and GME stock is no exception.

GME Stock Price Forecast

It’s impossible to predict the future of GME stock with any degree of accuracy. The stock price is highly volatile, and it could go either way in the coming weeks and months. That said, many analysts believe that GME stock has the potential to continue its upward trend in the long term if the company is able to turn things around.

Resources for Investing in GME Stock

If you’re interested in investing in GME stock, there are several resources that can help you. Here are some of the best resources for researching GME stock:

- WallStreetBets – The Reddit group WallStreetBets is a great resource for discussing GME stock.

- StockTwits – StockTwits is a social media platform focused on stock market discussion.

- Yahoo Finance – Yahoo Finance is a great resource for researching stocks and getting the latest news.

- Investopedia – Investopedia is a great source for learning about investing and understanding stock market terminology.

- FintechZoom – Are you interested in investing in GME stock? If so, you should check out Fintechzoom! It’s is a great resource for investors of all levels, from those just starting out to seasoned pros. With Fintechzoom, you can access up-to-date news, analysis, and research on the GME stock. Plus, the platform offers helpful tools for managing your investments and tracking your portfolio.

Conclusion

GME stock has been the talk of the town in recent weeks. The stock price has skyrocketed, and many investors are wondering if they should invest in GME stock. In this blog article, we explored the pros and cons of investing in GME stock and discussed the GME stock split and GME stock price forecast. We also looked at some of the best resources for researching GME stock. Ultimately, the decision to invest in GME stock is a personal one, and it’s important to do your own research and understand the risks involved before investing in any stock.