On Monday, the Dow Jones Industrial Average INDEXDJX: .DJI rose as it looked to capitalize on the major market gains on Friday. This week, results from the Dow Jones members JPMorgan Chase and UnitedHealth Group will be released and keenly watched. Tesla’s stock also kept going up after hitting its lowest point on Friday. The global markets and oil prices saw a surge following the encouraging remarks from a People’s Bank of China official on Sunday. This drove the prices of Tesla and other Chinese-based stocks, as well as chip stocks such as ASML Holding and Nvidia to the top of the Nasdaq 100 in the start of the day’s trading. Companies that released their earnings on Monday morning include Acuity Brands and Commercial Metals.

Acuity Brands rose by 1% after posting numbers that beat the expectations for its first fiscal quarter. Commercial Metals’ shares rose by almost 3% after strong results. On the other hand, Lululemon Athletica dropped by 10% after it said that its fourth-quarter gross margin will be lower than expected. Other companies that will release their earnings later this week are Jefferies, KB Home, Taiwan Semiconductor Manufacturing, Bank of America, Citigroup, and Wells Fargo.

Read also: Top Stocks That Will Skyrocket On Earnings Season.

The current status of the stock market as of today.

KeyBanc recently upgraded both Visa (V) and Mastercard (MA) to overweight ratings, with V shares increasing by 0.5% and MA by 0.8%. Tesla stocks jumped 5% on Monday, and Apple (AAPL) and Microsoft (MSFT) saw a rise in the market opening. Cardinal Health (CAH), Deere (DE), Medpace (MEDP), and Neurocrine Biosciences (NBIX) – which is included in the IBD Leaderboard – as well as Dow Jones’ own Caterpillar (CAT), Chevron (CVX), and Walmart (WMT) are all seen as stocks to buy and watch, given the market is in rally mode. Neurocrine was a recent IBD Leaderboard stock, Caterpillar and Medpace were both IBD Stock of the Day companies, and Cardinal Health was featured in a Stocks Near a Buy Zone column.

The Dow Jones Industrial Average INDEXDJX: .DJI today is being affected by changes in the cost of oil and the returns on Treasury investments.

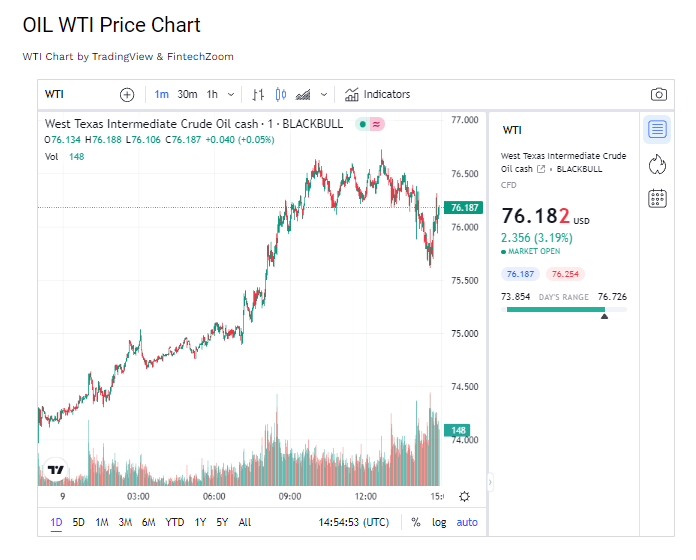

After the first bell sounded on Monday, the Dow Jones Industrial Average went up 0.3% and the S&P 500 increased 0.55%. Additionally, the tech-filled Nasdaq composite rose 0.9% during the morning. Among the US-based exchange-traded funds, the Nasdaq 100 Invesco QQQ Trust (QQQ) increased 0.9% and the SPDR S&P 500 ETF (SPY) traded 0.5% higher in the morning. The 10-year Treasury yield climbed to 3.58% on Monday morning, looking to make a comeback after last week’s sharp descent. The huge losses on Friday were caused by the December jobs report. Simultaneously, oil prices bounced back on Monday morning after going down the week before. West Texas Intermediate futures increased more than 2%, trading around $76 per barrel.

An upsurge in the values of stocks in the marketplace.

On Friday, the Dow Jones Industrial Average INDEXDJX: .DJI increased by 2.1%, the S&P 500 raised by 2.3%, and the Nasdaq composite saw a 2.6% increase. The Big Picture column commented that the high volume of positive action has caused the IBD market outlook to switch to a “market in confirmed uptrend”. In spite of this, the market remains questionable and investments should be raised slowly. It is suggested that investors keep their exposure between 20-40% for now. In the midst of current stock market uncertainty, it is critical to be aware of The Big Picture column.

It is recommended that investors consider purchasing stock in Caterpillar, Chevron, and Walmart, which are all listed on the Dow Jones.

On Friday, Caterpillar (CAT) closed above the flat base’s 239.95 buy point, with a 3.6% increase, as shown by IBD MarketSmith pattern recognition. The buy zone is up to 251.95. Additionally, the stock’s relative strength line is at new highs, and shares have risen slightly by 0.1% on Monday. CAT stock has a strong 98 out of a maximum 99 IBD Composite Rating, which is a tool to assist investors in finding good growth stocks. Chevron (CVX) is attempting to climb above its 50-day line while forming a cup base with a 189.78 buy point. Additionally, on Monday CVX shares increased by 0.6% due to higher oil prices. Walmart (WMT) reclaimed its 50-day line on Friday with a 2.45% surge. The stock is constructing a cup with handle, with a 154.74 buy point, and is around 5% away from the latest entry. WMT shares dropped 0.5% Monday morning.

Potential investments to research and consider include Cardinal Health, Deere, Medpace, and Neurocrine.

Cardinal Health, recently featured as an IBD Stock Of The Day, increased 2.6% on Friday and was up by 0.1% on Monday. Deere, another IBD Stock Of The Day, is developing a flat base with a 448.50 purchase point and is close to this point after its 2.8% surge on Friday. MEDP stock rose 1.2% on Friday. Neurocrine Biosciences is rebounding from support at its 50-day line and a new flat base presents a buy point at 129.39 with an earlier purchase option at 122.93. NBIX stock dropped 0.1%.

Investors must be adept in selecting the right stocks to purchase and monitor during a new stock market rally.

Today’s stock market contains six noteworthy stocks that traders should keep an eye on, including the top three stocks of the Dow Jones Industrial Average as of January 9th, 2023.

Shares of Tesla, Inc. are traded on the stock market.

Tesla shares recovered from their considerable losses on Friday, finishing the day 2.5% higher. The stock reached its lowest point in the past year on Friday, closing at 101.81 and down 71% from its peak. Continuing to rally, Tesla shares increased more than 5% Monday morning.

The two companies at the forefront of the Dow Jones Index are Apple and Microsoft.

Apple shares bounced back 3.7% on Friday, after reaching a 52-week low of 124.17 the same week. Even with the recovery, the stock is still approximately 30% below its highest price over the past year. On Monday morning, the shares rose further by 1.3%. Microsoft also saw a 1.2% rise on Friday, which put an end to its four-day losing trend. MSFT is still a bit away from its 52-week low of 213.43, which was recorded on November 4th.