First Republic Bank fell on monday: -61.83%. According to [1], [2], and [3], First Republic Bank (FRC) suffered a significant decline in its stock price by a record-breaking 62% on Monday, closing at $31.21 per share. This was likely due to news of fresh financing concerns and fears of contagion across the banking sector, as mentioned in [2] and [3]. However, it’s important to note that sudden drops like this can be driven by a variety of factors, and it’s important for investors to stay informed and maintain a long-term perspective.

References: [1] First Republic stock falls 62% amid fears of regional bank … [2] First Republic shares dive on contagion fear, dragging U.S. … [3] Why did First Republic Bank stock crash today? Contagion …

Read also:

- Red Day for Banking? BofA -5.09%, Wells Fargo -5.66%, US Bank -9.33%, Chase -0.24% and First Republic drops 76%

- Silvergate Capital closed and Bitcoin Crash to $19,800

- Uncovering the Mystery of What Happened to FTX!

- Banking Crisis: Silicon Valley Bank was closed!

KeyFacts:

- Zions Bancorporation NA: -25.72%

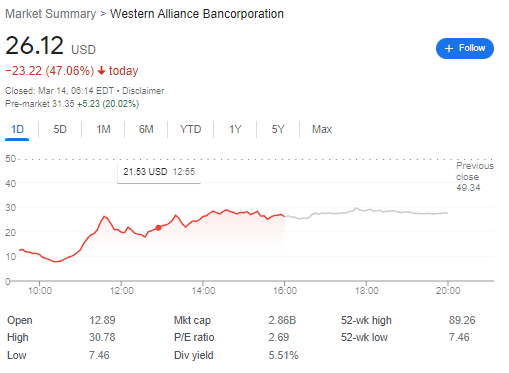

- Western Alliance Bank: -47.06%

- UMB Bank: -15.58%

- First Republic Bank: -61.83%

Western Alliance Bank fell yesterday: -47.06%

Yes, according to [2] and [3], Western Alliance Bancorporation (WAL) suffered a significant decline in its stock price by 47.06% on Monday afternoon. This was likely due to fears of contagion in the wake of the collapse of Silicon Valley Bank, as mentioned in [2]. It’s important to note that stock market volatility can be driven by a variety of factors, including global events, economic indicators, and company-specific news. While sudden drops like this can be concerning, it’s important to maintain a long-term perspective and stay focused on your investment goals.

References: [1] Western Alliance Bank Issues Updated Financial Figures in … [2] Western Alliance Bancorporation (WAL) Latest Stock News … [3] Why Regional Bank Stocks Are Getting Crushed Friday

Zions Bancorporation NA fell on monday: -25.72%

I couldn’t find any relevant search results to confirm that Zions Bancorporation (ZION) fell by 25.72% on Monday. However, based on the information from the first search result [1], you can find the historical stock charts and prices, analyst ratings, financials, and today’s real-time ZION stock price. It’s important to note that stock market volatility can be driven by a variety of factors, including global events, economic indicators, and company-specific news. It’s essential for investors to stay informed and maintain a long-term perspective.

References: [1] Zions Bancorp N.A. Stock Price & News – WSJ [2] The Covid-19 stock market puzzle and money supply in the US [3] 1ST QUARTER 2020 UPDATE – Peak Asset Management

Moody’s has just published a report discussing the implications for European banks from SVB collapse.

Monetary tightening likely still has some way to run, and developing stresses in the US banking system will also weaken investor confidence and heighten funding tensions for European institutions that, as with any bank, by construction combine maturity mismatches with leverage. These effects are magnified when rates increase faster than expected, which causes some fixed-rate assets to fall in value and liabilities to start repricing upward more quickly than assets roll off and are replaced.

However, a critical difference between the European and US systems, which will limit the impact across the Atlantic, is that European banks’ bond holdings are lower and their deposits more stable, having grown less rapidly. While European banks’ debt securities grew by 10% in the 12 months to June 2020, it was their cash placed at central banks that ballooned, in response to the ECB’s TLTRO programme and the resulting arbitrage opportunity available. This has resulted in some structural differences between Euro area and US banks.

» Cash at central banks is a bigger part of European banks’ balance sheets, and debt securities a smaller part. Debt securities are about 12% of euro area bank balance sheets, versus over 30% for US commercial banks, and about 40% of Euro area banks’ holdings are government securities, versus about 80% government and agency securities for US banks. EU banks are also subject to capital requirements on interest rate risk in the banking book. This means that European banks have less exposure to market risk on bonds, despite a similar rise in yields on the five-year benchmark from 2020 lows.

» Deposits are likely to be more stable in Europe, having grown far less rapidly in the first place, and all EU banks are subject to liquidity coverage ratio requirements.

» Strong cash balances at central banks totalling 16% of assets means European banks are less likely to require recourse to selling securities and realising any losses.

» Both the BoE and ECB have well-developed contingent liquidity facilities which are actively utilised by the banks.

These critical differences do not make European issuers invulnerable. When confidence is punctured, contagion can be rapid. Banks’ balance sheets are by definition leveraged, run maturity mismatches and are often complex and opaque, with interlinkages and exposures that are often only known after the event. In addition, the ECB likely has further to run in its tightening cycle than the Federal Reserve, and although close to half of the TLTRO has now been repaid, this leaves €1.2 trillion outstanding that has to be withdrawn. So the full effects of monetary tightening may yet lie ahead

Moody’s places INTRUST Financial Corporation’s ratings under review for downgrade

Moody’s Investors Service (“Moody’s”) has today placed all long-term and short-term ratings and assessments of INTRUST Financial Corporation and its bank subsidiary, INTRUST Bank, N.A. on review for downgrade. The review includes INTRUST Financial Corporation’s long-term local currency issuer rating of Baa2 and INTRUST Bank, N.A.’s Baseline Credit Assessment (BCA) and adjusted BCA of baa1, long-term issuer rating of Baa2, long- and short-term local currency bank deposit ratings of A2/Prime-1, long- and short-term local currency and foreign currency Counterparty Risk Ratings of Baa1/Prime-2, and long- and short-term Counterparty Risk Assessments of A3(cr)/Prime-2(cr). The outlooks on INTRUST Financial Corporation’s long-term issuer rating and INTRUST Bank, N.A.’s long-term issuer and long-term bank deposits ratings were changed to rating under review from stable.

Read here.

Moody’s places Western Alliance’s ratings on review for downgrade

Moody’s Investors Service (“Moody’s”) has placed all long-term and short-term ratings and assessments of Western Alliance Bancorporation and its bank subsidiary, Western Alliance Bank, collectively referred to as “Western Alliance” on review for downgrade. Ratings on review include Western Alliance Bank’s A2 local currency long-term deposit rating, its Baa2 local currency issuer rating, its Prime-1 local currency short-term deposit rating, its baa1 standalone baseline credit assessment (BCA), its baa1 adjusted BCA, its Baa1 long-term local and foreign currency Counterparty Risk Ratings, its Prime-2 short-term local and foreign currency Counterparty Risk Ratings, its A3(cr) long-term Counterparty Risk Assessment, its Prime-2 (cr) short-term Counterparty Risk Assessment, and its Baa2 local currency subordinate debt rating.

Read here.

Moody’s places Zions Bancorporation, N.A.’s ratings under review for downgrade (long-term deposits A1)

Moody’s Investors Service (Moody’s) has placed all long-term ratings and assessments of Zions Bancorporation, National Association (Zions) on review for downgrade. Zions’ a3 Baseline Credit Assessment (BCA) and adjusted BCA were placed on review for downgrade. Moody’s also placed the bank’s Baa1 long-term issuer rating on review for downgrade, as well as the A1 local currency long-term bank deposit ratings. The P-1 local currency short-term bank deposit rating was affirmed. The A3 long-term local and foreign currency Counterparty Risk Rating (CRR) and A2(cr)/P-1(cr) long-term and short-term Counterparty Risk (CR) assessments were placed on review for downgrade. The P-2 short-term local and foreign currency CRR was affirmed. The outlook on Zions’ long-term bank deposits rating and long-term issuer rating has been changed to rating under review from stable. Moody’s also placed Zions Bancorporation’s Baa3 (hyb) local currency Pref. Stock Non-cumulative rating on review for downgrade in the same action.

Read here.

Moody’s places UMB Financial Corporation’s ratings under review for downgrade (UMB Bank, N.A. long-term deposits Aa3)

Moody’s Investors Service (Moody’s) has placed on review for downgrade all the long-term ratings and assessments of UMB Financial Corporation (UMB) and its bank subsidiary, UMB Bank, N.A. (UMB Bank). UMB Bank’s a2 Baseline Credit Assessment (BCA) and adjusted BCA were placed on review for downgrade. Moody’s also placed UMB Bank’s A3 local currency long-term issuer rating on review for downgrade, as well as the Aa3 local currency long-term bank deposits ratings. The P-1 local currency short-term bank deposits rating was affirmed. The A2/P-1 long-term and short-term local and foreign currency Counterparty Risk Rating and A1(cr) long-term Counterparty Risk (CR) assessment were placed on review for downgrade. The P-1(cr) short-term (CR) assessment was affirmed. Moody’s also placed UMB’s A3 local currency long-term issuer rating, (P)A3 local currency senior unsecured shelf rating, A3 local currency subordinate rating, (P)A3 local currency subordinate shelf rating, (P)Baa1 local currency preferred stocks shelf rating and (P)Baa2 local currency preferred stocks non-cumulative shelf rating on review for downgrade. The outlook of UMB’s local currency long-term issuer rating was changed to ratings under review from stable. The outlook of UMB Bank’s local currency long-term issuer rating and local currency long-term bank deposit was changed to ratings under review from stable.

Read here.

Moody’s places First Republic Bank’s ratings under review for downgrade

Moody’s Investors Service (Moody’s) has today placed all long-term ratings and assessments of First Republic Bank (First Republic) on review for downgrade. First Republic’s long-term issuer ratings and local currency subordinate ratings of Baa1, and preferred stock non-cumulative rating of Baa3 (hyb) were placed on review for downgrade. First Republic’s long term local and foreign currency counterparty risk rating of A3, long-term local currency bank deposit rating of A1, long-term counterparty risk assessment of A2(cr), baseline credit assessment (BCA) and adjusted BCA of a3 were placed on review for downgrade. The short-term local currency bank deposit rating of Prime-1 and short-term counterparty risk assessment of Prime-1(cr) were also placed on review for downgrade. The bank’s local and foreign currency short-term counterparty risk ratings were affirmed at Prime-2. The outlook of the issuer ratings and long-term bank deposits changed to rating under review from stable.

Read here.

Read here the Expert Comments about this Finance Crisis

Tony Petrov, chief legal officer, Sumsub:

“Why did Silicon Valley Bank collapse? There are many articles saying that the reason is, as CBS News puts it, that SVB was “unprepared” for the Federal Reserve aggressively pushing up interest rates. In other words, SVB has invested in long-run US Treasury papers more than the others, and, when the Fed Reserve increased the rates, those papers that SVB had bought effectively lost their value. This situation provoked a bank run and SVB failed. Sounds like a mistake (don’t put all eggs together) or maybe even like an accident, bad luck.

“A cool bank that helped start ups has ended up as a start up, i.e. fell a victim of bad luck. However, different kinds of bad luck are now widely addressed in risk management, where they are called risk factors. For example, the founder of FTX also explained the recent crash of the exchange by a coincidence of unfortunate consequences and bad will of his rivals, whereas in real life we have clearly seen crimes and malpractice that in the absence of risk management practices have led to the collapse.

“According to Boeing, approximately 80 percent of airplane accidents are due to human error; I think, in fact, taken as a metaphor, can also work for the financial industry. What we are witnessing now is the crash of the economy based on “reckless capitalism”, in which compliance procedures and risk management were held in a stall in the backyard, also known as “tick box exercise”. The only sad consequence will be that the cryptocurrency businesses will have much less of the chance to find a partner bank, although they have had absolutely nothing to do with the reasons why SVB, or Signature, or Silvergate crashed.”

Justin Edgar, partner and corporate law expert specialising in the tech space, DWF

“Developments over the last 72 hours at SVB have opened eyes. Amongst many other things it raises the pertinent question about the need for businesses to have real time treasury functions and the possibility of having multiple banking relationships to spread risk. This may well be an area that acquirers look at more closely as part of their due diligence processes.”

Oliver Chapman, CEO of supply chain specialist OCI

“SVB was important for more than one reason. Much of the publicity concerning the crisis has centred on the importance of the bank in providing deposit facilities for tech startups that might otherwise have struggled to find a bank willing to provide normal services. Without support from the FED and HSBC’s takeover of SVB in the UK, these deposits may have been in jeopardy.

“But there was more to SVB than a provider of traditional banking facilities to techs without years of trading history. Techs often have complex financial requirements, as indeed do many of the Venture Capitals that fund them. In the small, closely connected world of Silicon Valley and the global tech ecosystem for which it is the core hub, SVB was a key player in providing loans and complex financial services.

“The supply chain is a good example of a complex ecosystem that requires sophisticated financial arrangements. But unfortunately, banks are not always well-placed to understand the unique challenges of the supply chain.

“This is why it is so important companies have a detailed understanding of their supply chain, funding options and, indeed, the importance of funding diversification.

Nigel Green, CEO and founder of deVere Group

Bitcoin is up as much as 20% during a historic banking crisis.

“It’s acting as a safe haven asset as the collapse of tech-focused Silicon Valley Bank sparks fears across Wall Street of contagion in the banking system which many say was being crippled by a relentless agenda of interest rate rises.

“Global financial stocks have already shed $465 billion in two days as investors reduce exposure to lenders. There are fears that financial institutions could be hit from their investments in bonds and other instruments on the back of the SVB concerns.

“This isn’t the first time that Bitcoin has shown some characteristics of a safe haven asset during times of economic uncertainty. During the pandemic in 2020, Bitcoin saw a surge in demand as investors sought alternative assets to protect their wealth from the economic fallout.”

The emergency measures that regulators announced in a joint statement from the US Treasury and the Federal Reserve also appear to have served to fuel investor interest in alternative currencies to the dollar.

The measures included that depositors with the failed bank would have access to all their money from Monday morning. Banks will also now be permitted to borrow essentially unlimited amounts from the Fed for the next year, in order to stop financial institutions from having to sell those investments that have been losing value because of the Fed’s aggressive interest rate hike agenda.

“The SVB rescue package is essentially a new form of quantitative easing (QE),” says Nigel Green, referring to the bond-buying programme used by governments around the world to stabilise the financial system after the 2008 crash and later the pandemic.

“QE increases the supply of the dollar in circulation. This can lead to a decrease in the value of the US currency relative to other currencies, as the increased supply of currency can reduce its purchasing power.

“Inevitably, this pushes investors to look for alternatives, such as Bitcoin which has a limited supply.”

The US dollar has reigned supreme for more than 75 years. But there are indications that the world could gradually be shifting away from a dollar-dominated system.

“This is because astronomic levels of debt, and the enormous, ongoing amount of money printing to monetise these debts, have caused the considerable drop in the long-term value of the global reserve currency,” notes the deVere CEO.

“Investors are therefore looking for alternative currencies, such as cryptocurrencies. Moving forward, these will increasingly compete with traditional, fiat ones and this will help trigger the decreasing dominance of currently leading international currencies.”

On the back of looming financial stability risks, deVere Group now expects the Federal Reserve to pause its plan for continuing aggressive interest rate hikes.

“Can there be anything more deflationary for the Fed than the second and third biggest bank failures in US history?” asks Nigel Green.

“We expect the stress in the banking sector, and the wider impact on confidence, now will give the central bank cause for pause on its rate hike program – which is bullish for Bitcoin.”

Lower interest rates make borrowing cheaper, which can lead to increased spending and investment, which could lead to increased demand for the world’s largest crypto as investors seek alternative assets with potential for higher returns.

“The fallout of the banking crisis appears to serve as a launching point for a larger goal for Bitcoin. It’s a historical springboard event.”