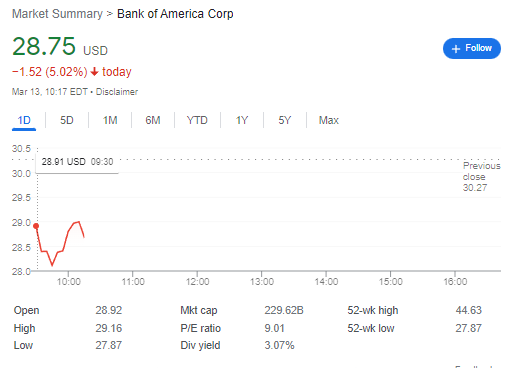

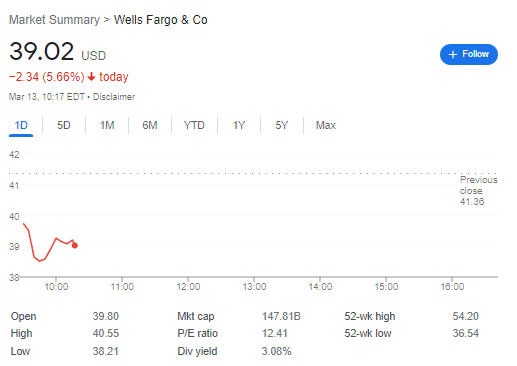

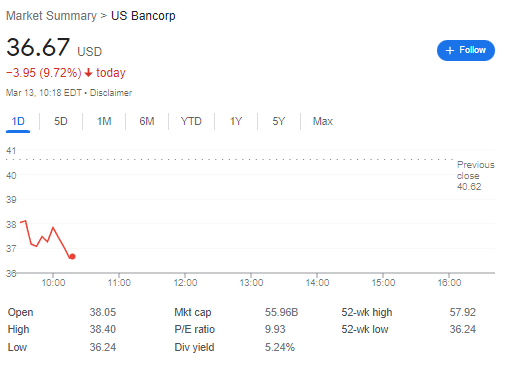

The stock market is often subject to fluctuations and can experience “red days” where many companies see a decline in their stock prices. As for the specific banks mentioned, Bank of America, Wells Fargo, US Bank, and Chase all experienced losses on the day in question. Bank of America lost 5.09%, Wells Fargo lost 5.66%, US Bank lost 9.33%, and Chase lost 0.24%. These losses could be due to a variety of factors, including economic uncertainty, changes in interest rates, or company-specific news. It’s important for investors to keep a close eye on market trends and company news to make informed decisions about their investments.

The sharp rise in interest rates since early last year has driven down the market value of bond portfolios held by European banks. For most large European banks, Moody’s considers these value declines as temporary and moderate. Smaller, deposit-funded banks can rely on the stability of their loyal depositor bases, which ensures they can wait for a recovery in bond values without incurring materially higher funding costs.

Key points

» The value of bonds declined markedly in 2022. Since December 2021, the value of fixed-rate bond holdings of EU banks has dropped markedly, in many cases to well below face value.

» Banks’ ability to recover market-value losses depends on their portfolio quality and their liquidity. The credit quality of European banks’ bond holdings is high, reflecting their emphasis on government bonds. We consider European banks are generally well placed to avoid the need to sell their bonds at a loss.

» A strong emphasis on cash is a strength. Banks’ liquidity portfolios have a high share of cash at central banks. It has ensured the banks’ regulatory liquidity ratios only suffered moderately when bond values declined and that modest deposit outflows can be met without realising a loss.

» Hedges have also limited the impact. Asset-liability management by the large banks limits the sensitivity of their capital ratios to large interest rate moves.

» Market value declines are only partially disclosed in bank’s accounts. Bond portfolios appear in banks’ accounts under various accounting categories. We estimate that around one third of government bonds is held at amortized cost rather than fair value

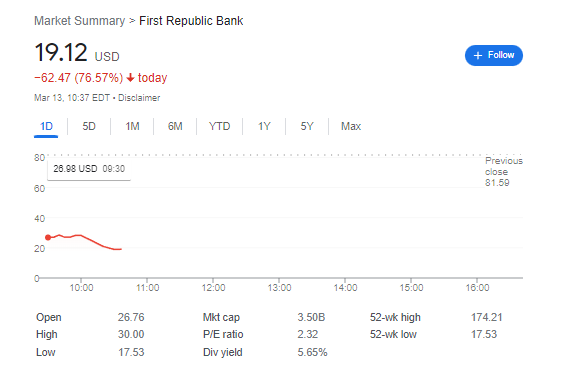

First Republic drops 76%

First Republic Bank, a San Francisco-based bank known for its private banking and wealth management services, experienced a sharp decline in its stock price, dropping 60% and leading the decline in bank stocks. This drop came despite the government’s backstop of Silicon Valley Bank (SVB), which was intended to provide stability to the banking sector during the COVID-19 pandemic. It’s unclear why First Republic saw such a significant decline, but it could be due to a variety of factors, such as concerns over loan defaults or changes in interest rates. It’s important for investors to carefully research and monitor individual banks and the broader market to make informed decisions about their investments.

S&P 500 falls in volatile session

The S&P 500 experienced a volatile session following the U.S. government’s rescue of Silicon Valley Bank (SVB) deposits. The closure of SVB by a California banking regulator led to concerns about possible hidden risks, and shares of regional U.S. banks suffered heavy losses as a result.

While S&P 500 futures initially rose overnight, they gave up their gains to trade flat, while Nasdaq futures rose 0.32%. In other news, Wells Fargo upgraded JPMorgan Chase to overweight. The Federal Reserve was also reportedly considering raising interest rates and ending years of cheap money.

Expert Comments

Dr Maria Paola Rana, Lecturer in Economics and Finance, University of Salford Business School, comments:

“Following the collapse of Silicon Valley Bank (SVB) in the US, more than 200 CEOs of tech companies in the UK have been calling for the government to intervene to protect a sector which is key and strategic for the economic growth of the country. Based on the letter sent to the government by over 200 tech entrepreneurs, several UK tech companies rely on SVB as their primary bank. Consequently, the insolvency of the bank represents an existential threat to the UK tech sector, since it leaves them without funds and liquidity to pay employees, suppliers and crucially to invest in R and D (research and development). Globally, there is also fear of a knock-on effect on other lenders, as global banking shares suffered on Friday.

“SVB UK, the UK independent subsidiary, held almost £7bn in deposits on Friday. Under the Prudential Regulation Authority protection, deposits are insured up to £85,000 (£170,000 for joint deposits). The Bank of England has confirmed there is no systematic contagion risk for the UK’s financial system – SVB UK, in fact, “has limited presence in the UK and no critical functions supporting the financial system.”

“The Chancellor, the Prime Minister and the Treasury however, all acknowledge that there is a significant risk to some of the most promising tech and life science start-ups in the UK. A deal for HSBC to acquire the UK arm of the bank has now been reached, spelling a sigh relief for the tech sector, its employees, suppliers and its future.

“With the clock ticking, the government had to act quickly to have a clear understanding of the full exposure of tech start-ups and the knock-on effects on related sectors, as well as the larger economy. Solutions needed to be found urgently to avoid larger and longer term damage to a sector that will be an essential element of the UK’s strategy for economic growth. The collapse of SVB and the exposure of UK start-ups has been a wake-up call to reflect on how strategic new businesses are funded and the role the government should have in ensuring they can start and thrive in the future.”

Dr Massimo Preziuso, Lecturer in Financial Technology, University of Salford Business School, adds:

“The US and UK governments response to this huge crisis looks appropriate, while the HSBC intervention in the UK looks intelligent and helpful. A large segment of the innovation scene was (and still is) at risk, which is something the UK cannot let happen.

“The problem is that the quick collapse of SVB further highlights the financial markets are under serious stress, which is also difficult to detect. It is mainly due to high interest rates which risk bringing light to all the problems driven by a too lengthy period of monetary expansion and ‘cheap money.’ Many innovative business models are not designed to support this phase easily and it’s likely a period of broader public intervention may well be needed, again.”

Comments from Wayne Scott, Regulatory Compliance Lead at NCC Group Software Resilience

“While more is coming to light about what triggered this specific collapse, it isn’t the first time we’ve seen failure on this scale. Since the 2008 crash, we’ve undergone some of the biggest economic shocks in history; a pandemic, major wars, and a looming global recession. All these risks combine to put significant downward financial pressure on supply chains. Given these risks, and the fact that no organisation is too big to fail, having more robust regulation in place to force better risk mitigation strategies is critical.

“The UK financial sector is ahead of the curve in this respect. For example, The Prudential Regulatory Authority introduced a set of regulations to mitigate the risk of supplier failure for financial institutions at the end of March 2022. But the US, where SVB is headquartered, lags behind – although the US regulators have consulted on similar regulations to the UK, we’ve been waiting for the results for some time. Given the sheer size of this market, and how closely linked it is to other countries, we need a coordinated global approach to protecting the financial services industry from the risks of supplier failure, service deterioration and concentration risk.

“The HSBC rescue is a great thing for the UK financial market and the tech companies who are customers of SVB, but that doesn’t mean the problem is solved. We’ll feel the ramifications of SVBs failure for some time. We can’t always rely on public and private bailouts of failing banks. There is too much at risk, from the companies intimately linked to SVB to the wider networks borrowers are part of. One of the only ways to properly mitigate the impact of inevitable future crashes is proper regulation and due diligence globally.”

Aman Behzad, founder and Managing Partner of fintech advisory Royal Park Partners:

“A great outcome today with HSBC stepping in to buy SVB UK. With 100% of deposits guaranteed, all founders with money at SVB can now go and get some rest after having their hearts in their mouths this weekend.

“Tech underpins the UK, and indeed global, economic ecosystem and it is a relief that an existential crisis has been averted. It’s inspiring to see the government working closely with the industry to find a timely solution, and safeguard the innovative businesses that are vital to our economy’s growth.

“No doubt an important test, this signals a commitment to safeguarding those building our future, and I hope to see greater support for innovators going forward.”

Meanwhile, Bitcoin rallies 10% as US provide backstop for failed banks

Bitcoin jumped over 10% last night, as the US government confirms they will step in to protect depositors of Silicon Valley Bank and Signature Bank. Last week, three banks that were the easiest for crypto businesses to get fiat banking in the US – Silvergate, Signature, and Silicon Valley Bank – closed. I think this could have significant implications for crypto regulations in the US and banks’ ability to integrate digital asset trading or custody. This is due to the narrative of crypto causing the problem, which certain politicians are trying to portray.

On Wednesday, Senator Sherrod Brown, Chair of the Senate Banking Committee, said, “As the impact of FTX’s collapse continues to ripple outward, today we are seeing what can happen when a bank is over-reliant on a risky, volatile sector like cryptocurrencies.” In addition, Senator Warren said, “As the bank of choice for crypto, Silvergate Bank’s failure is disappointing but predictable. Now, customers must be made whole & regulators should step up against crypto risk.”

What these Senators fail to realise though, is that Silvergate’s demise was not a crypto problem. Silvergate’s collapse was due to $13.3 billion of demand deposits, that depositors could withdraw in minutes, supported by only $1.4 billion of cash. As opposed to being a problem caused by digital asset trading, it was clearly due to Silvergate not having enough cash leading to the lack of capital from the bank run. Silvergate operated on fractional reserves, like every other bank, and the loss of consumer confidence which was exacerbated by a Senator letter that caused panic on social media. This undermined public trust in Silvergate, which catalysed its downfall. In this case, Silvergate was denied due process. There is a clear agenda, in my opinion, against all crypto businesses from US politicians. We could well see companies that provide digital asset trading infrastructure move offshore because of this stance.

Some confidence has been restored in the crypto market as USDC has bounced back to $0.987 from a low of around $0.90. In addition, a letter from US regulators said, “All depositors of this institution (Silicon Valley Bank) will be made whole. As with the resolution of Silicon Valley Bank, no losses will be borne by the taxpayer.” The same was said for Signature Bank too.

Ultimately, it is clear that continued hikes risk further destabilising the financial system, so the time in which the Fed will need to pause and then pivot could have been moved closer by the events of last week.

The Bank of London confirms it has submitted a formal proposal for the UK subsidiary of Silicon Valley Bank.

A consortium of leading private equity firms, led by The Bank of London, confirms it has submitted formal proposals to His Majesty’s Treasury, The Prudential Regulation Authority at The Bank of England and the Board of Silicon Valley Bank UK.

Anthony Watson, Group Chief Executive and Founder of The Bank of London said: “Silicon Valley Bank cannot be allowed to fail given the vital community it serves. This is a unique opportunity to ensure the UK has a more diversified banking sector, whilst allowing continuity of service to SVB’s UK client base. It would be deeply disappointing for this moment to lead to further consolidation of power among big banks.”

The Bank of London is the United Kingdom’s sixth principal clearing bank and only the second authorised in 250 years. It is unique among all banks in the UK in that it does not lend, invest or leverage its balance sheet – it simply holds 100% of its deposits with the Bank of England, meaning clients have 100% access to their deposits in full in real-time, all the time.