The world stock markets have experienced significant fluctuations recently, with Wall Street and Asian markets both showing signs of struggle. In this in-depth analysis, we will explore specific market events, investor sentiment, and the impact of inflation and interest rates on global economies.

Wall Street: A Rough Week

Wall Street struggled to maintain its momentum last week, with major averages like the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all reporting losses. This marked a break in the multi-week winning streaks these markets have been enjoying.

“Investors are definitely exhibiting the renewed fears of a US recession, as well as a global recession,” – Greg Bassuk, CEO of AXS Investments.

The losses were widespread with over 450 S&P 500 stocks registering negative performances. Investment bank Goldman Sachs and AI company Nvidia were among the notable decliners.

In contrast, used car retailer CarMax saw its shares jump more than 9% after exceeding first-quarter revenue expectations.

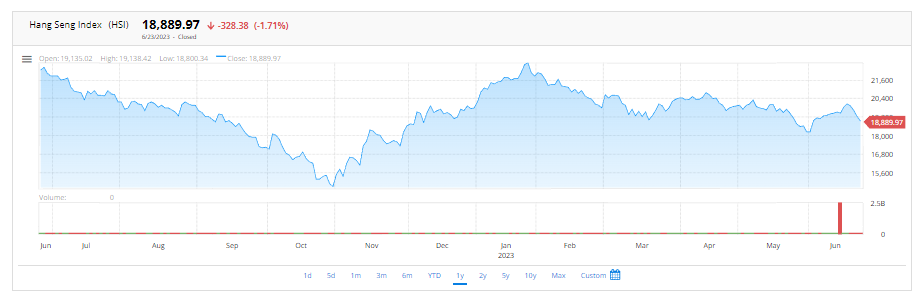

Asian Markets: A Sharp Decline

Asian markets followed suit with sharp declines after several central banks across the globe increased interest rates to combat inflation. Hong Kong and Tokyo’s markets were hit the hardest, with nearly a 2% decline each.

Japan’s inflation rate was reported to be higher than expected, sparking speculation that the central bank may have to revise its policies to accommodate these upward price pressures.

“We think there are signs of inflationary pressure building up on the supply side, but it is certainly not strong enough for the BOJ to bring about immediate tightening,” – ING Economics.

Interest Rates: The Global Picture

In the battle against inflation, central banks worldwide have been raising interest rates, making borrowing more costly and slowing economic growth. This strategy, while effective in curtailing inflation, poses the risk of stalling growth and potentially dragging economies into a recession.

The Bank of England hiked its main interest rate to a 15-year high, marking its 13th consecutive hike to combat stubbornly high inflation. Central banks in Norway, Switzerland, and Turkey also raised borrowing rates.

In the United States, Federal Reserve Chair Jerome Powell reiterated his belief that inflation is still too high, indicating that additional rate hikes may be necessary.

Impacts of High Interest Rates

High interest rates have already had noticeable impacts on different sectors of the U.S. economy, including manufacturing and banking. They have also caused three notable failures in the U.S. banking system.

“The banking industry remains under pressure, even after the federal government acted quickly to provide support.”

The number of Americans applying for unemployment benefits remained high, implying that the Fed’s rate hikes may be starting to cool the seemingly resilient labor market.

Conversely, the housing industry reported stronger sales of previously occupied homes, contradicting economists’ expectations for a decline.

Oil Prices: A Dip in the Market

U.S. benchmark crude oil and Brent crude, the international standard, both witnessed a drop in prices.

Currency Markets: The Dollar and Euro

The value of the dollar against the yen increased, and the euro also experienced a slight dip in its value.

“A weaker Japanese yen raises costs for Japanese businesses and consumers given the country’s heavy reliance on imports.”

Future Outlook: A Possibility of Recession

Given the current state of global stock markets and economies, investors are understandably concerned about the possibility of a recession. With central banks worldwide tightening their monetary policies, the impact on economic growth is potentially significant.

Investors will need to keep a close eye on inflation rates, interest rate hikes, and other economic indicators to navigate this uncertain landscape.

Conclusion

The recent fluctuations in global stock markets have highlighted the interconnectedness of economies and the delicate balance that must be maintained between inflation control and economic growth. Whether this trend will lead to a global recession remains to be seen.

In these uncertain times, investors can only hope for the best while preparing for the worst.