The stock market has been in a constant state of flux for the past few months, with the rollercoaster ride of Tesla stock price being a major highlight. Tesla Inc. (TSLA) has seen its share price dive in recent months, with its stock price down over -69% since the beginning of the last year 2022. This has caused a lot of speculation and speculation around the future of the company and its stock price. In this FintechZoom article, we’ll take a look at the history of TSLA stock, the factors driving its recent surge, and what the future might hold for the company and its investors.

Introduction to TSLA Stock

Tesla Inc. is an American electric vehicle and energy storage company headquartered in Palo Alto, California. Founded in 2003, Tesla designs, manufactures, and sells electric cars and energy storage systems. The company also offers solar panel installation services and other related products. Tesla is the world’s leading electric vehicle manufacturer, with a market capitalization of over $400 billion — larger than the combined market capitalization of its two closest competitors, General Motors and Ford.

Tesla’s stock has been a favorite of investors in recent years, and its share price has seen tremendous growth since its initial public offering (IPO) in 2010. However, the stock has been volatile over the past few months due to the pandemic, geopolitical tensions, and other factors. This has caused some uncertainty about the future of the company and its stock price.

Historical Performance of TSLA Stock

Tesla’s stock has had a rollercoaster ride of peaks and valleys over the past decade. In its early days, the Tesla stock was volatile, ranging from $17 per share to $35 per share in 2010. After its IPO in 2010, the stock soared to an all-time high of $265 per share in 2014. However, the stock then took a nosedive and was trading for less than $140 per share in 2016.

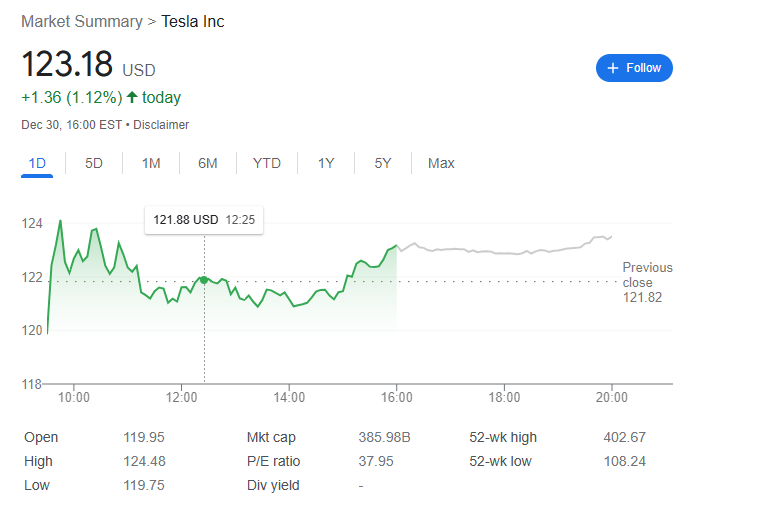

Since then, the stock has seen a steady rise, reaching an all-time high of $344 per share in early 2021. The stock is currently trading at around $121 per share.

TSLA earnings in 2022

Revenue and items delivered in the first quarter of 2022

In the first quarter, Tesla’s revenue was $18.7 billion, demonstrating a tremendous 81% surge compared to the same period the previous year. Net income was $3.3 billion with an operating margin of 19.2%. Furthermore, the company shipped 310,048 cars in the first quarter, which was a 67.7% increase from the same period in the preceding year.

Earning and dispatches in the second quarter of 2022

During the second three-month period, Tesla generated $16.9 billion in sales which was a rise of 42 percent compared to the same period a year before, with profits of $2.3 billion. Additionally, the automaker shipped 254,695 vehicles, exhibiting a 23.4 percent hike year-on-year.

Revenue and shipments projected for the third quarter of 2022

In the third quarter, Tesla’s sales amounted to $21.4 billion, a 56% boost from the same period the year before. The company earned a net income of $3.3 billion, a 103% rise from the year before. Additionally, Tesla delivered 343,830 vehicles, surpassing its previous record for a single quarter and showing a 42% jump compared to the same quarter the year prior.

The income and deliveries that will take place in the fourth quarter of 2022

Tesla will announce their financial results for the fourth quarter of 2022 at some point in January. During the same period in 2021, the electric car manufacturer stated earnings of $17.71 billion in revenue, $2.32 billion in net income, and 308,650 vehicles delivered. In all of 2021, the business shipped out 936,222 vehicles and should exceed one million cars shipped in a year in 2022.

Factors Driving the Current Surge in TSLA Stock

The recent surge in Tesla’s stock price is due to a number of factors. First, the company has seen strong demand for its electric vehicles, with sales of the Model 3 and Model Y outperforming expectations. Furthermore, the company is expanding its presence in the energy storage market, and the recent acquisition of Maxwell Technologies has further strengthened Tesla’s position in this sector.

Additionally, the company has been actively investing in new technology, such as its Autopilot and Full Self-Driving systems, as well as its batteries and charging infrastructure. This has increased investor confidence in the company and its future prospects. Finally, the company has also been increasingly focusing on sustainability, which has resonated with many investors.

Analysts’ Predictions for the Future of TSLA Stock

Analysts have been divided over the future of Tesla’s stock price. Some argue that the stock is overvalued and that its current surge is unsustainable, while others predict that the stock will continue to rise in the coming months.

Analysts who are bullish on Tesla’s stock point to the company’s strong fundamentals, its technological advancements, and its focus on sustainability as reasons why the stock could continue to climb. Additionally, the company’s aggressive expansion plans, including its plans to launch a fully-autonomous vehicle by 2023, have also been cited as potential catalysts for the stock’s future price.

On the other hand, analysts who are bearish on Tesla’s stock point to the company’s high debt load and its reliance on government subsidies as potential risks. They argue that the company’s growth could be hindered by these factors and that the stock could see a significant correction in the near future.

Pros and Cons of Investing in TSLA Stock

Investing in Tesla’s stock has its pros and cons. On the plus side, the stock has seen tremendous growth in recent months and could continue to do so in the future. The company’s innovative products and strong fundamentals have been cited as potential catalysts for further growth. Additionally, the company’s focus on sustainability has resonated with many investors, and its long-term growth prospects look promising.

On the other hand, investing in Tesla’s stock also carries some risks. The stock is highly volatile, and its current surge could be unsustainable. Additionally, the company’s high debt load and reliance on government subsidies could hinder its growth. Finally, the stock’s valuation is lofty, and there is a risk that the stock could see a significant correction in the near future.

Strategies for Investing in TSLA Stock

Investing in Tesla’s stock can be a risky proposition, but there are a few strategies that can help mitigate some of the risks. First and foremost, investors should do their research and understand the fundamentals of the company. This will help them assess whether the current surge in the stock is sustainable and whether or not the stock is a good investment.

Additionally, investors should also consider diversifying their portfolio by investing in other stocks and assets. This will help spread the risk and reduce the impact of a potential decline in Tesla’s stock price. Finally, investors should also consider the long-term prospects of the company and not get caught up in short-term fluctuations.

Alternatives to Investing in TSLA Stock

For those who are not interested in investing in Tesla’s stock, there are other options available. Investors can consider investing in other electric vehicle manufacturers such as General Motors or Ford, or in renewable energy companies such as SolarCity. Additionally, investors can also invest in ETFs that track the electric vehicle and renewable energy sectors, or in mutual funds that specialize in these sectors.

The Risks Associated with Investing in TSLA Stock

Investing in Tesla’s stock carries a number of risks. First and foremost, the stock is highly volatile and its current surge could be unsustainable. Additionally, the company’s reliance on government subsidies and its high debt load could hinder its growth. Finally, the stock’s lofty valuation means that any decline in the stock price could be significant.

What Does the Future Hold for TSLA Stock?

It is difficult to predict the future of Tesla’s stock price. However, it is clear that the company has a number of potential catalysts for growth, such as its innovative products, its focus on sustainability, and its aggressive expansion plans. Additionally, the company’s strong fundamentals and its long-term growth prospects could also be positive factors.

At the same time, there are also a number of risks associated with investing in Tesla’s stock, such as its high volatility and its reliance on government subsidies. Ultimately, only time will tell whether the stock will continue to surge or take a dive.

Predictions and Accomplishments of Tesla in the Year 2022

Despite a difficult economic climate, Tesla has achieved some major successes in 2022. As they move into 2023, they are equipped with greater production capabilities, a larger network of charging stations, and strong financial standings to support their accomplishments.

In spite of a sluggish stock market, 2022 has been a banner year for Tesla, marked by several noteworthy accomplishments. The automaker is now looking ahead optimistically to 2023, having significantly increased its production, developed a larger charging network, and established sound financial stability.

The advancement of Gigafactory is continuing steadily.

In 2020, Tesla opened two sites for their manufacturing business: one in Austin, Texas, which is the company’s current home base, and the other in the Brandenburg region of Germany, situated in Grünheide. Throughout the year, both Gigafactories have been progressively increasing production, and in December, both plants achieved their 3,000 Model Y cars-per-week capability.

Furthermore, Tesla is aiming to manufacture 75,000 Model Y vehicles at Giga Texas in the first quarter of 2023, before they start making the Cybertruck, which is scheduled for July.

Tesla increased the number of Model Y production lines at the Gigafactory Shanghai by almost a third, with a yearly output of approximately 1.2 million cars. After the improvement was finished, the car manufacturer assembled its millionth automobile at the Shanghai plant in August.

Boosters are improving over time

Around 12 months ago, Tesla had a network of 30,000 Supercharger plugs worldwide. By the end of June, the car manufacturer had added a further 5,000 charging spots, bringing the total to 38,883. By the end of the 3rd quarter, Tesla had achieved 10 years of Supercharger installation.

As part of a pilot program, Tesla has been permitting the use of its Superchargers to those who don’t own a Tesla vehicle in Europe. This practice is predicted to be available in the U.S. in the near future.

Tesla has seen an expansion in their energy division.

Despite facing issues with the supply chain and a gradual increase in production, Tesla managed to complete 500,000 solar panel and roof installations in December.

At the start of 2022, the corporation unveiled its Virtual Power Plant initiative, which is aimed at constructing expansive, dispersed energy storage systems utilizing Powerwalls and solar energy generated from residences. Tesla organized its initial Virtual Power Plant events in California, with over 3,600 family homes playing a role in supplying electricity back to the system.

Tesla has installed a few Megapack power storage facilities around the globe.

FSD Beta has been extended, and Tesla has now made its Semi truck available.

In the last several months, Tesla has steadily been widening the range of people who can check out its Full Self-Driving beta in the United States. This eventually led to a broad launch of the software in November, meaning anybody in the country who purchases the system can now test it out.

Last month, Tesla provided PepsiCo with its first shipment of Semis.

We should scrutinize Tesla’s sales and shipments for the last three months.

Conclusion

Tesla’s stock has seen a tremendous surge in recent months, but the future of the company and its stock price remains uncertain. Investors should do their research and understand the fundamentals of the company before investing. Additionally, they should also consider diversifying their portfolio and investing in other stocks and assets. Finally, investors should be aware of the risks associated with investing in Tesla’s stock.

The future of TSLA stock remains to be seen, but one thing is for sure: it will continue to be an exciting ride. So, buckle up and get ready for the rollercoaster!