On May 2nd, the U.S. stock market saw a positive day with both the Dow Jones Industrial Average (DJIA) and the Nasdaq Composite experiencing significant gains. The Nasdaq, however, led the charge, closing up 1.5%, while the Dow Jones and S&P 500 rose by a more modest 0.9% each. This positive sentiment trickled down to individual stocks, with Worksport (NASDAQ: WKSP) experiencing a particularly impressive surge.

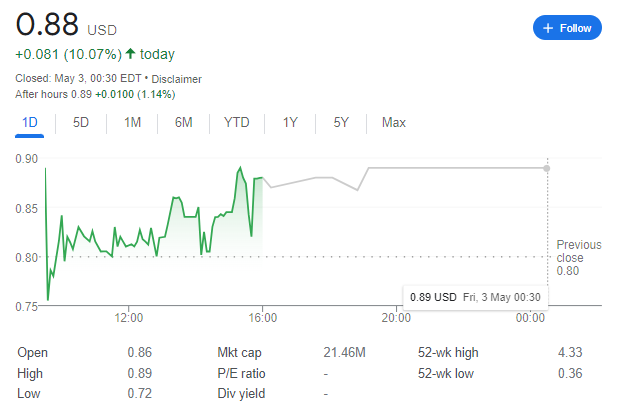

Worksport Stock Up Over 10%

Worksport stock (WKSP) was a standout performer on May 2nd, witnessing a remarkable 10.07% increase in its share price. There are a few possibilities to consider:

- Positive Company News: Worksport released positive company news, like this strategic partnership, that excited investors and drove up the stock price.

- Industry Trends: Perhaps there were positive developments within Worksport’s industry that boosted investor confidence in the company’s future prospects.

- Market Momentum: The overall positive sentiment in the market on May 2nd could have also played a role. When the broader market is up, investors are often more likely to take on risk and buy stocks, which can lead to price increases for individual companies like Worksport.

Dow Jones Climbs Over 300 Points

The Dow Jones Industrial Average, a benchmark index for the U.S. stock market, also had a strong performance on May 2nd. It closed over 300 points higher, indicating a broad-based rally across various sectors. This positive movement might be attributed to a few key factors:

- Fed Chair’s Comments: Federal Reserve Chair Jerome Powell’s press conference on May 1st likely played a significant role. Investors were reassured by his comments suggesting that another interest rate hike was unlikely in the near future. Lower interest rates tend to be positive for stocks as they make borrowing money cheaper, which can stimulate economic activity and corporate profits.

- Earnings Season: May is a busy month for corporate earnings reports. Strong earnings from companies like Boeing (BA) and Amazon (AMZN) on May 1st could have boosted investor confidence and contributed to the Dow’s rise.

- Tech Sector Strength: The technology sector, a major driver of the Dow Jones, performed well on May 2nd. Apple (AAPL), a Dow component, saw its share price rise in anticipation of its upcoming earnings report. This positive sentiment within the tech sector likely helped propel the Dow upwards.

Nasdaq Leads the Way

The Nasdaq Composite, a market index heavily weighted towards technology stocks, outperformed the Dow Jones on May 2nd. This dominance of the tech sector can be attributed to several factors:

- Strong Tech Earnings: Several major tech companies, such as Qualcomm (QCOM), reported strong earnings on May 2nd. This provided a positive outlook for the tech sector as a whole and attracted investors to Nasdaq-listed companies.

- Paramount Acquisition News: News emerged on May 2nd that Sony and Apollo Management were considering acquiring Paramount (PARA), a media company heavily weighted in the Nasdaq. This potential acquisition could have driven up the share price of PARA and boosted the overall Nasdaq index.

Also read: Apple’s 7% Surge Helps S&P 500 and Nasdaq Close at Record Highs.

Looking Ahead

The positive market performance on May 2nd suggests a continuation of the upward trend seen in recent weeks. However, the stock market is inherently volatile, and future performance depends on several factors, including upcoming company earnings reports, economic data releases, and global events. Investors should always conduct thorough research before making any investment decisions.

While Worksport’s stock price surge is promising, it’s important to remember that past performance is not necessarily indicative of future results. Investors interested in Worksport should delve deeper into the company’s financials, news, and future plans before making any investment decisions.