Welcome to the world of candlestick charts! If you’ve been trading stocks, forex, commodities, or cryptocurrencies for a while, then you’ve probably heard of candlestick charts. But do you really know what they are, and how to use them?

In this blog post, we’ll uncover the truth behind candlestick charts and explore the world of technical analysis. We’ll look at the history of candlestick charts, the anatomy of a candlestick chart, how to read candlestick charts, types of candlestick patterns, candlestick chart analysis, benefits of using candlestick charts, and the limitations of candlestick charts. We’ll also help you find the right candlestick charting tools. So, let’s begin!

What are candlestick charts?

A candlestick chart is a type of chart used in financial analysis to visually display the price action of an asset over a certain period of time. Candlestick charts are often used by traders and investors to identify potential trading opportunities.

Candlestick charts are composed of a series of bars, each representing the high, low, open, and close prices for a given period of time. The bars are coloured to indicate whether the market closed higher or lower than the open price. For example, a green bar indicates that the market closed higher than the open, while a red bar indicates that the market closed lower than the open.

History of candlestick charts

The origins of the candlestick chart can be traced back hundreds of years to Japan, where they were first used by rice traders. It is believed that the Japanese traders developed the charting technique to help them make more informed trading decisions.

The Japanese candlestick charting technique was first introduced to the West in the late 19th century, when a Japanese trader named Homma Munehisa wrote a book about his experiences trading rice futures. He described the technique of using the candlestick chart to identify patterns in the price action.

Since then, the technique has been adopted by traders and investors around the world. Today, candlestick charts are one of the most popular chart types used in technical analysis.

The anatomy of a candlestick chart

A candlestick chart is composed of two main elements: the body and the wick. The body is the rectangular box that is formed between the open and close prices, while the wick is a line that extends from the high and low prices.

The colour of the body can indicate whether the market closed higher or lower than the open price. A green body indicates that the market closed higher, while a red body indicates that the market closed lower.

The length of the body and the wick can also provide valuable information about the price action. A long body indicates strong buying or selling pressure, while a short body indicates weak buying or selling pressure. The same is true for the wick. A long wick indicates that the market tested the high or low, but was unable to break through.

How to read candlestick charts

Reading a candlestick chart is relatively easy. All you need to do is look at the colour of the body and the length of the body and wick.

If the body is green, then the market closed higher than the open price. This indicates that buying pressure was strong. If the body is red, then the market closed lower than the open price. This indicates that selling pressure was strong.

The length of the body and wick can also provide valuable information about the price action. A long body indicates strong buying or selling pressure, while a short body indicates weak buying or selling pressure. The same is true for the wick. A long wick indicates that the market tested the high or low, but was unable to break through.

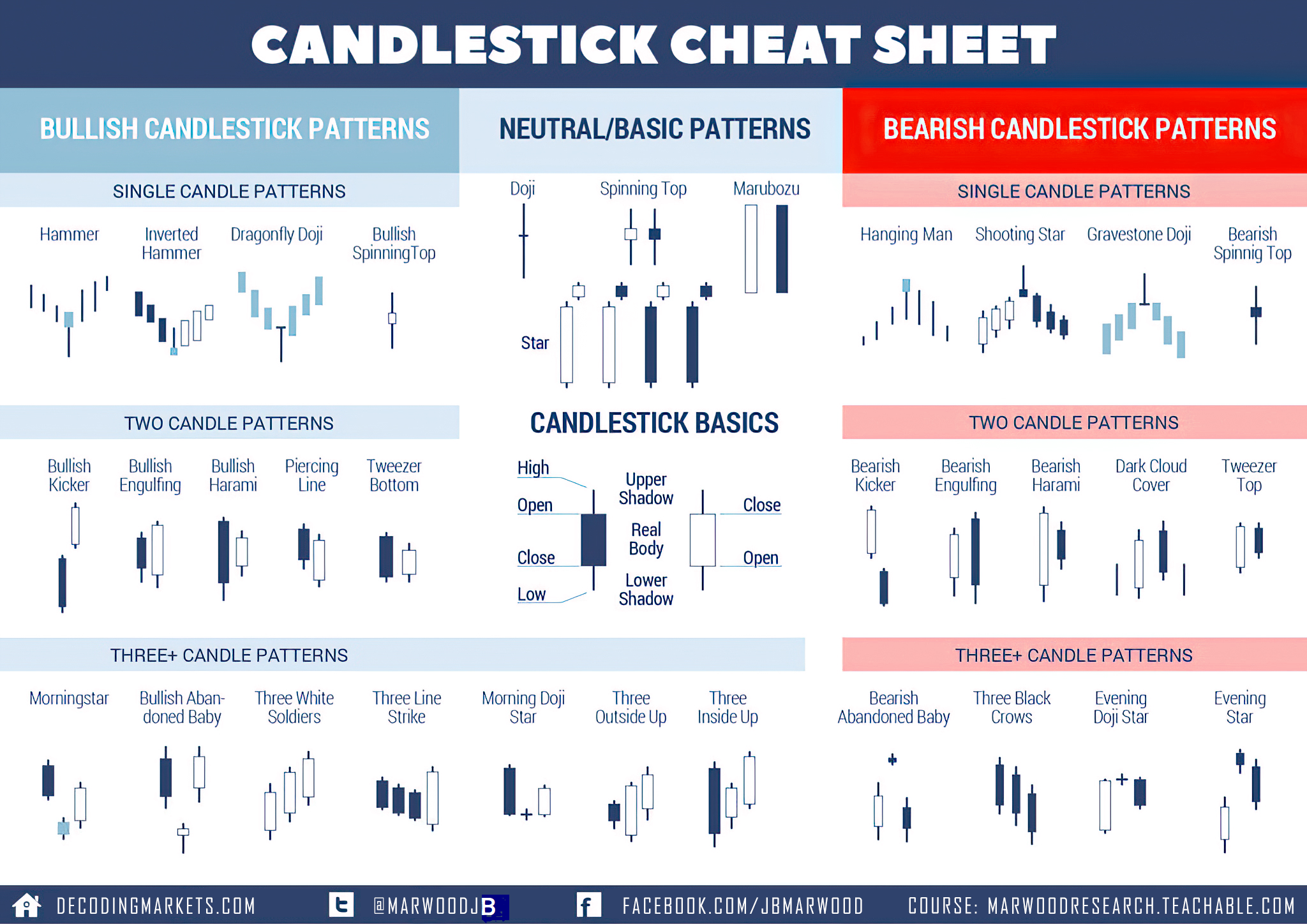

Types of candlestick patterns

Candlestick patterns are certain formations of candlesticks that can indicate potential trading opportunities. There are many different types of patterns, but the most common are the “hammer” and the “inverted hammer”.

A hammer is a candlestick that has a short body and a long lower wick. This is an indication that the market tested the low, but was unable to break through. This could be a sign that the market is about to reverse and go higher.

An inverted hammer is the opposite of a hammer. It has a short body and a long upper wick. This is an indication that the market tested the high, but was unable to break through. This could be a sign that the market is about to reverse and go lower.

Candlestick chart analysis

Once you’ve identified a candlestick pattern, it’s important to use other forms of technical analysis to confirm your analysis. This could include looking at other indicators such as moving averages, support and resistance levels, and trendlines.

It’s also important to keep an eye on the overall market sentiment. If the market is bullish, then a hammer pattern could be a sign that the market is about to go higher. If the market is bearish, then an inverted hammer could be a sign that the market is about to go lower.

Benefits of using candlestick charts

There are many benefits to using candlestick charts. Firstly, they are easy to read and interpret. They can also be used to identify potential trading opportunities.

Candlestick charts can also be used to confirm technical indicators and market sentiment. For example, if a hammer pattern appears on a chart, it could be a sign that the market is about to reverse and go higher.

Finally, candlestick charts can be used to identify potential support and resistance levels. This can be done by looking for patterns such as double tops and double bottoms.

Limitations of candlestick charts

Despite the numerous benefits of using candlestick charts, there are some limitations to be aware of.

Firstly, candlestick charts can be subjective. Different traders may interpret the same pattern differently. This can lead to confusion and poor trading decisions.

Secondly, candlestick patterns can be difficult to identify, especially for novice traders. It takes practice and experience to be able to accurately identify patterns and make trading decisions.

Finally, candlestick charts can be unreliable in choppy markets. In these conditions, the patterns may not be as reliable and the signals may be false.

Candlestick charting tools

If you’re looking to use candlestick charts for your trading, then you’ll need the right tools. There are a number of different tools available, ranging from free to paid.

If you’re just starting out, then you may want to try a free tool such as TradingView or Investing.com. These tools offer basic charting capabilities and are a great way to get started.

If you’re looking for more advanced tools, then you may want to try a paid service such as MetaStock or eSignal. These tools offer more advanced charting capabilities and can help you make more informed trading decisions.

Conclusion

Candlestick charts are an important part of technical analysis. They can be used to identify potential trading opportunities, confirm technical indicators, and identify potential support and resistance levels.

Although candlestick charts can be a powerful tool, they can also be subjective and unreliable in choppy markets. It’s important to use other forms of technical analysis to confirm your analysis and be aware of the limitations of candlestick charts.

It’s also important to find the right candlestick charting tools for your trading. There are a number of different tools available, ranging from free to paid.

If you’re just starting out, then a free tool such as TradingView or Investing.com may be a good option. If you’re looking for more advanced tools, then a paid service such as MetaStock or eSignal may be a better option.

At the end of the day, it’s important to remember that candlestick charts are just one part of a successful trading strategy. It’s important to use them in combination with other forms of analysis and to be aware of their limitations.

So, the next time you’re looking to trade, don’t forget to light up the markets with candle power!