Are you looking for ways to boost your trading profits? Momentum Oscillator can be the perfect tool to help you do that. It is a technical indicator that measures the momentum of price movements. This indicator can be used to identify potential trading opportunities and help traders make more informed decisions. In this blog, we will dive into the world of Momentum Oscillator and explore how it can help boost your trading profits.

Introduction to Momentum Oscillator

Momentum Oscillator is a technical indicator that measures the momentum of price movements. It is a versatile and powerful tool that can be used to identify potential trading opportunities and help traders make more informed decisions. The Momentum Oscillator is often used to detect trend reversals, oversold and overbought conditions, and potential breakouts. By using this indicator, traders can get a better understanding of the market and make more profitable trades.

What is Momentum Oscillator?

Momentum Oscillator is a momentum-based indicator that is used to measure the strength of a price trend. It is based on the difference between the current price and the previous price. Momentum Oscillator is usually plotted as a line on a chart and is used to identify potential trading opportunities. It is often used to identify overbought and oversold conditions, as well as potential breakouts and trend reversals.

The Momentum Oscillator can be used in conjunction with other technical forex indicators for a more comprehensive approach to trading. Traders can use the Momentum Oscillator to identify potential trading opportunities and then use other indicators to confirm the trade. This approach can help traders make more informed decisions and potentially increase their trading profits.

The Benefits of Using Momentum Oscillator

Using Momentum Oscillator has many benefits for traders. First and foremost, it can help traders identify potential trading opportunities. The Momentum Oscillator is a versatile and powerful tool that can be used to identify potential breakouts, overbought and oversold conditions, and trend reversals. By using this indicator, traders can get a better understanding of the market and make more profitable trades.

Additionally, Momentum Oscillator can be used in conjunction with other indicators to confirm trades. This approach can help traders make more informed decisions and potentially increase their trading profits. Finally, Momentum Oscillator is easy to use and understand. Traders can quickly and easily identify potential trading opportunities and make more informed decisions.

How to Read Momentum Oscillator

The Momentum Oscillator is usually plotted as a line on a chart. The line oscillates between positive and negative readings. When the line is above zero, the price is considered to be in an uptrend. Conversely, when the line is below zero, the price is considered to be in a downtrend. Additionally, when the line rises above zero, it indicates that the trend is gaining strength. Conversely, when the line falls below zero, it indicates that the trend is losing strength.

Additionally, when the line crosses the zero line, it can indicate a potential trend reversal. When the line crosses from below to above the zero line, it indicates a potential bullish reversal. Conversely, when the line crosses from above to below the zero line, it indicates a potential bearish reversal.

Trading Strategies for Momentum Oscillator

There are several trading strategies that can be used with Momentum Oscillator. One of the most popular strategies is to look for overbought and oversold conditions. When the line is above zero for a prolonged period of time, it can indicate an overbought condition. Conversely, when the line is below zero for a prolonged period of time, it can indicate an oversold condition. These conditions can be used to identify potential trading opportunities.

Another popular trading strategy is to look for breakouts. When the line crosses the zero line from below to above, it can indicate a potential breakout. Similarly, when the line crosses the zero line from above to below, it can indicate a potential breakdown. These breakouts can be used to identify potential trading opportunities.

Finally, traders can also look for trend reversals. When the line crosses the zero line from below to above, it can indicate a potential bullish reversal. Conversely, when the line crosses the zero line from above to below, it can indicate a potential bearish reversal. These reversals can be used to identify potential trading opportunities.

Different Types of Momentum Oscillator

There are several different types of Momentum Oscillator. One of the most popular types is the Relative Strength Index (RSI). The RSI is a momentum-based indicator that is used to measure the strength of a price trend. It is based on the difference between the current price and the previous price. The RSI is usually plotted as a line on a chart and is used to identify potential trading opportunities.

Another popular type of Momentum Oscillator is the Stochastic Oscillator. The Stochastic Oscillator is a momentum-based indicator that is used to identify potential trading opportunities. It is based on the difference between the current price and the previous price. The Stochastic Oscillator is usually plotted as a line on a chart and is used to identify overbought and oversold conditions, as well as potential breakouts and trend reversals.

How to Use Momentum Oscillator for Breakouts

One of the most popular ways to use Momentum Oscillator is to identify potential breakouts. When the line crosses the zero line from below to above, it can indicate a potential breakout. Traders can use this signal to identify potential trading opportunities. Additionally, traders can use other indicators to confirm the breakout. This approach can help traders make more informed decisions and potentially increase their trading profits.

How to Use Momentum Oscillator for Divergences

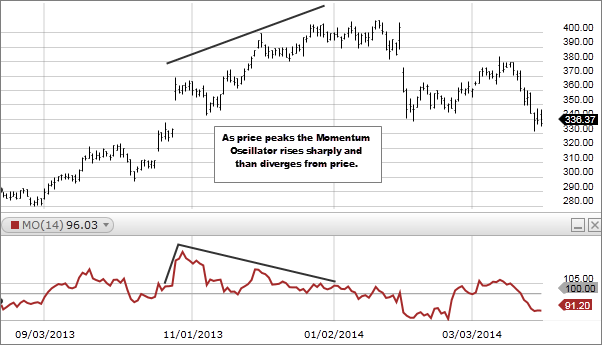

Another popular way to use Momentum Oscillator is to identify potential divergences. Divergences occur when the price and the Momentum Oscillator move in opposite directions. This can indicate a potential reversal. Traders can use this signal to identify potential trading opportunities. Additionally, traders can use other indicators to confirm the divergence. This approach can help traders make more informed decisions and potentially increase their trading profits.

How to Use Momentum Oscillator for Reversals

Finally, Momentum Oscillator can be used to identify potential reversals. When the line crosses the zero line from below to above, it can indicate a potential bullish reversal. Conversely, when the line crosses the zero line from above to below, it can indicate a potential bearish reversal. Traders can use this signal to identify potential trading opportunities. Additionally, traders can use other indicators to confirm the reversal. This approach can help traders make more informed decisions and potentially increase their trading profits.

Conclusion

Momentum Oscillator is a powerful and versatile tool that can be used to identify potential trading opportunities. It can be used to identify overbought and oversold conditions, as well as potential breakouts and trend reversals. Additionally, Momentum Oscillator can be used in conjunction with other indicators to confirm trades. This approach can help traders make more informed decisions and potentially increase their trading profits. If you are looking for ways to boost your trading profits, Momentum Oscillator may be the perfect tool for you.