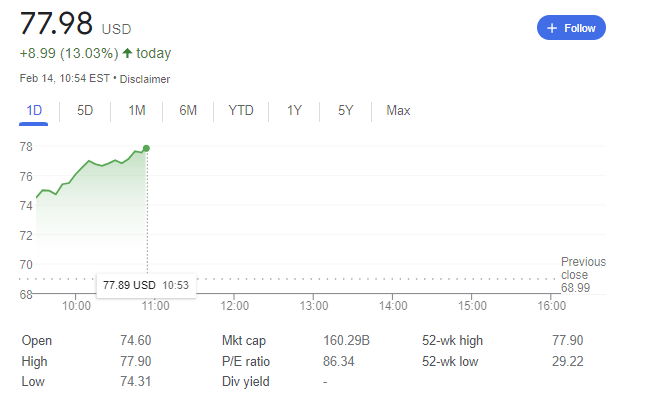

The recent announcement of Uber’s inaugural share repurchase program to buy back up to $7 billion of its common stock has caused a stir among investors and analysts: Uber Stock Surges 13%. Here’s a brief breakdown of the key points and reactions to this news:

- Share Repurchase Program Announcement: Uber Technologies revealed their first-ever share repurchase program, expressing confidence in the company’s strong financial momentum and intending to offset stock-based compensation while working towards a consistent reduction in share count [1].

- Investor and Analyst Reactions:

- Some investors expressed concerns about the company’s financials, debt levels, stretched stock valuation, and the potential value-destructive nature of the buyback [1].

- There were contrasting opinions, with one view suggesting that the move creates value for shareholders and could help address stock-based compensation concerns [1].

- The buyback was also seen as a way for employees to sell their stock compensation, while others questioned the move, highlighting the overvalued nature of the stock [1].

- Market Response: Following the announcement, Uber’s stock rose by 4.7% premarket, indicating a positive initial reaction from the market [1].

- Investment Case: Analysts noted that Uber’s impressive turnaround has led to a significant rise in the share price, with valuations not considered bargains but also not too expensive given the forecasted earnings leaps over the next few years [3].

In summary, the $7 billion share buyback by Uber has prompted mixed reactions, with concerns over financials and valuation, while others see potential benefits for shareholders and employees. The market’s positive initial response indicates some level of confidence in the company’s move [1].

References

1) https://seekingalpha.com/news/4066620-uber-stock-rises-on-first-ever-7b-share-repurchase-program

2) https://finance.yahoo.com/news/uber-announces-7-billion-buyback-115712300.html

3) https://hightechinvesting.substack.com/p/uber-stock-analysis-what-will-2024

Uber authorized the first-ever share buyback program in its history, worth up to $7 billion

Key takeaways:

- This decision follows Uber’s first profitable year and strong recovery in both ride-sharing and food delivery businesses.

- The company’s stock price rose over 5% premarket upon the announcement.

Reasons for the buyback:

- Vote of confidence: Management sees this as a sign of their belief in the company’s future financial performance.

- Reduce share count: This can boost earnings per share (EPS), potentially increasing investor value.

- Signal to investors: It indicates confidence in the company’s cash flow and ability to return value to shareholders.

Potential impact:

- Positive for stock price: Buybacks can increase demand for a company’s shares, leading to a price hike.

- Signal to competitors: It could be seen as a sign of strength and confidence, potentially impacting the competitive landscape.

- Impact on investors: Existing shareholders might benefit from increased share value, while new investors might be attracted.

It’s important to note:

- Share buybacks can be controversial, as some argue they favor existing shareholders over reinvesting in the company.

- The actual impact on the stock price and company performance remains to be seen.

After this Announce, the Uber stock jumps! Uber Stock Surges 13%

Buckle up, Uber investors! The ride-sharing giant just hit the gas on Uber stock price with a whopping 13% jump, following the announcement of a history-making $7 billion share buyback program. This marks Uber’s first-ever buyback and comes hot on the heels of their maiden year of profitability, solidifying investor confidence and sending a clear message: Uber’s bullish on its future.

The move is a multi-pronged attack, aiming to boost earnings per share, signal financial strength, and attract new investors. While some may raise eyebrows about prioritizing shareholders over reinvestment, there’s no denying the immediate impact – Uber’s stock is soaring, and the road ahead looks bright. So, whether you’re a seasoned investor or just hitching a ride on the news, fasten your seatbelts and enjoy the upward climb!