After an incredible sell-off last week, the Dow Jones Industrial Average (indexdjx: .dji) had a significant gain today. The index rose 345 points, or 1.1%, in what felt like a much-needed relief. The modest gain was a welcome sight after the market had lost 3.6% since last Tuesday. Investors had been worried about potential trade wars and rising interest rates, which had led to a global sell-off. But today, there was a sense of optimism that the market may be stabilizing. With the Dow climbing back investors are hoping that this is the beginning of a recovery. While there is still a lot of uncertainty in the market, today’s gain was a reminder that the markets can still be unpredictable. Only time will tell if the market will be able to sustain its gains and make a full recovery.

Beyond Meat (NASDAQ:BYND) jumped 9% after McDonald’s Corporation (NYSE:MCD) announced that its Double McPlant would be available across the UK starting January 4.

Dow Jones Today

The Dow ended the day higher on Thursday, as dip-buying frenzy in battered technology stocks and a decline in Treasury yields bolstered investor confidence in stocks.

Dow Jones Industrial Average rose 345 points or 1.1%, the Nasdaq Composite rose 2.6%, and the S&P 500 rose 1.8%.

NASDAQ Today

Meta Platforms (NASDAQ:META), which has plummeted 64% year-to-date, surged 4% after Apple (NASDAQ:AAPL), which hit its lowest level in 18 months, rose nearly 3%. Dip buyers were attracted by the latter’s recent drop.

Data indicating a slowing labor market fueled hopes for a less aggressive Federal Reserve and a dip-buying in tech stocks, in addition to a slowdown in wage growth.

Despite the tight labor market, Jefferies says in a note that it will take a little bit longer for cracks to develop, as claims are rising from near-historic low levels.

In contrast, Netflix (NASDAQ:NFLX) gained 5% after CFRA raised its target price to $310 from $225 and changed its rating from ‘sell’ to ‘buy,’ saying that it would be difficult for competitors to match the streaming giant’s ‘global scale and one of the few profitable streaming providers.’

Despite Tesla’s (NASDAQ:TSLA) 8% rally, some on Wall Street still believe Elon Musk must reach certain milestones to boost investor confidence in the company.

Musk must “announce a CEO for Twitter by the end of January; draft a 10b5-1 plan to ensure that no significant sales blocks are imminent […]; and publish conservative delivery and targets for 2023 given the current economic climate,” according to Wedbush, in order to turn Tesla’s sentiment around.

Despite a drop in oil prices after data revealed that U.S. crude inventories rose by 718,000 barrels last week, energy stocks rallied more than 1%, confounded expectations for a draw of about 1.5 million barrels.

The rise in Baker Hughes, ONEOK, and Halliburton (NYSE:HAL) stocks was more than 2%.

Beyond Meat (NASDAQ:BYND) rose 9% after McDonald’s Corporation (NYSE:MCD) announced that it would distribute the Double McPlant across the UK starting on Jan. 4.

There is always something new to read about stocks. Today, What occurred?

The Labor Department’s latest numbers on jobless claims were released on Thursday, and stocks jumped as a result.

Tesla ended a seven-session losing streak on Wednesday as an EV maker.

Apple’s stock also rose, signalling that investors were betting on a boost in sales of the company’s devices.

Today, the following also occurred:

The rise in unemployment filings last week helped stocks stage a relief rally Thursday.

The Dow Jones Industrial Average jumped 345 points, or 1.1%. The S&P 500 rose 1.8%, while the tech-heavy Nasdaq Composite surged 2.6%.

According to Dow Jones Market data, the S&P 500 and Nasdaq both recorded their best days of January on Thursday, as all three indexes continued their steady march downward this year.

The Labor Department reported last week that initial jobless claims rose 9,000 to 225,000. Economists had estimated that 223,000 claims would be filed. Therefore, the Federal Reserve may raise rates to fight inflation. A lower demand for overpriced goods signifies a weaker labor market.

Despite being close to pre-epidemic levels, numbers remain to suggest that labor market strength remains despite recent layoffs.

According to Louis Navellier, creator of growth investing firm Navellier & Associates, unemployment claims are still too low to affect Federal Reserve policy. As a result, he believes that a February 1st interest rate hike is still probable because of rising Treasury bond yields this week.

Bond prices have fallen in response to the 10-year treasury yield crossing the 3.8% mark earlier this week. The CME FedWatch tool predicts a 72% chance of a 25-basis-point rate increase in February.

Trading volumes are low, causing big moves when news breaks. This has been the case for the last two days, since year-end holidays have caused stocks to wobble. On average, 11.73 billion shares have traded daily this year; so far, the average daily volume has been 10.76 billion in December.

“Investors have little to hold onto going into year-end,” said Craig Erlam, an Oanda analyst. “That’s often the case this time of year.”

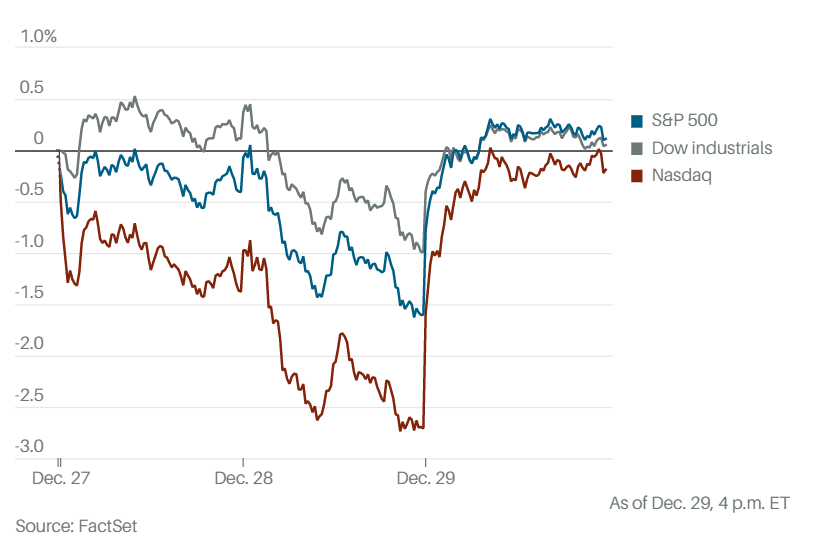

Stock investors have had a difficult time this year, as the S&P 500 has declined almost 20%, the Dow has lost 8.6%, and the Nasdaq has fared the worst, dropping 33%.

China’s fight against the virus Covid-19 has been one of the few macro forces driving sentiment towards the end of 2022, in spite of the fact that it has been a major obstacle to the stock market this year. A severe lack of growth in the world’s second-largest economy has dampened development, driving inflationary pressures. However, the government recently took steps to reduce stringent laws, giving rise to optimism about reopening, although there are still concerns about a potential outbreak of infections.

According to Tom Essaye, the founder of Sevens Report Research, Covid-19 cases are exploding higher in China, and hospitals are overwhelmed, but officials are pushing forward with a full economic liberalisation.

The West Texas Intermediate crude futures contract for June rose 0.2% Thursday, while the international standard, Brent crude, fell nearly 2%.

Investors were concerned about two things: the weakening dollar and Covid-19 cases in China.

The U.S. Dollar Index (ticker: DXY), which tracks the greenback’s moves against other currencies, was down 0.6% Thursday, making oil cheaper for holders of other currencies. On the other hand, rising cases of infection in China, which crimp demand, were behind the drop in oil prices.

Bitcoin was down 0.1% over the last 24 hours in the crypto world. This digital asset has fallen more than 64% so far this year. The demise of exchange platform FTX and the immolation of stablecoin Terra were contributory to the drop.

Investors were disappointed this week when the market gyrated, but at least there was a Santa Claus rally Thursday.

Tesla’ shares were rising as the stock ended a seven-session losing streak. Cal-Maine tumbled after quarterly earnings at the egg producer missed analysts’ estimates.

The rise in first-time unemployment claims last week was slightly higher than expected. Continuing claims also rose.

Jobless claims rose to 225,000 in the week ended Dec. 24, just above economists’ expectations of 223,000 according to the Labor Department. The previous week’s unrevised claims came in at 216,000.

The number of new claims rose 41,000 to 1.71 million, the highest level since February and above the consensus estimate of1.67 million.

Citi economist research analyst Gisela Hoxha said in a statement Thursday that it was difficult to draw meaningful conclusions from weekly unemployment claims data during November and December due to large and erratic seasonal adjustment factors. However, the labor market is still tight in comparison to historical standards, despite an increase in claims.

Even though jobless claims rose only slightly last week, the data released Thursday show that the job market remains strong, indicating that the Federal Reserve will have more occupation to do in 2023.

Traders are pouring cold water on hopes of a Santa Claus rally by betting against Bitcoin, which has been under pressure.