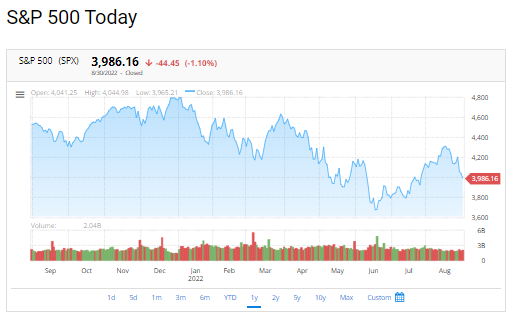

United States stocks fell for the 3rd successive day as fresh data pointed to strength in household and labor need, verifying the Federal Reserve’s willpower to continue to be hostile in its fight against inflation. Commodities from oil to copper sank as the buck climbed.

The S&P 500 and also the tech-heavy Nasdaq 100 shut at their lowest levels in a month. Treasuries finished Tuesday blended after an unanticipated rebound in August consumer confidence pressed swap rates toward pricing in another three-quarter percentage point walk for the Fed’s September meeting.

Three regional Fed head of states, in separate statements on Tuesday, stated Chair Jerome Powell’s intent to bring down rising cost of living. A reading on work openings Tuesday contributed to indications that the labor market continues to be limited as well as wage stress continue. Jobless claims will certainly broadcast Thursday before Friday’s August payrolls report.

” The effects from Friday are mosting likely to make us extra conscious a great deal of the incoming data, specifically around employment,” said Shawn Cruz, head trading strategist at TD Ameritrade. “It’s not unusual that obtaining that customer belief data today as well as the JOLTS data had a pretty solid reaction in markets. That’s most likely what you must get out of now till the September Fed meeting, in particular anything around employment.”

Analysts remain combined on what current remarks by Fed authorities and upcoming information can mean for stocks. While Debt Suisse Group AG suggested investors go undernourished global equities complying with the Jackson Hole seminar, JPMorgan Chase & Co. strategists state that a reading on the US labor market that spells bad news for the economy is in fact a favorable signal for stocks.

On the other hand, bonds are gliding toward the initial bear market in a generation, burning capitalists who erred in bets that reserve banks would certainly pivot away from rapid interest-rate hikes.

The Fed today is also set to step up the loosening up of its close to-$9 trillion balance sheet. The influence of measurable firm is going to be reasonably benign for the very first 6 to year, however could begin to amplify its impacts on the economic situation around the middle part of following year, Jeff Schulze, financial investment strategist at ClearBridge Investments, stated in a meeting.

Other risks vary from China’s economic downturn to an energy situation that endangers to tip Europe right into recession with winter season coming close to.