The Walmart Credit Card is a great way to save money on your everyday purchases. With no annual fee and a low interest rate, it’s a great choice for budget-minded shoppers. You’ll earn 3% cash back on Walmart.com purchases, 2% at Walmart gas stations, and 1% at Walmart stores. There’s also a $100 sign-up bonus after you spend $500 in the first three months. The Walmart Credit Card is a great way to save money on your everyday purchases.

Read also this FintechZoom article about: Breaking Down the Benefits of an Apple Card Credit Limit Increase: What You Need to Know.

With no annual fee and a low interest rate, it’s a great choice for budget-minded shoppers. You’ll earn 3% cash back on Walmart.com purchases, 2% at Walmart gas stations, and 1% at Walmart stores. There’s also a $100 sign-up bonus after you spend $500 in the first three months. The Walmart Credit Card is a great way to save money on your everyday purchases. With no annual fee and a low interest rate, it’s a great choice for budget-minded shoppers. You’ll earn 3% cash back on Walmart.com purchases, 2% at Walmart gas stations, and 1% at Walmart stores – plus a $100 sign-up bonus after you spend $500 in the first three months. The key to maximize your savings is to use your card for all of your everyday purchases, including gas and groceries. By doing so, you’ll quickly earn the cash back bonuses that will help offset the cost of your holiday shopping. So whether you’re looking for a way to save on your holiday shopping or simply want to earn cash back on your everyday purchases, the Walmart Credit Card is a great option.

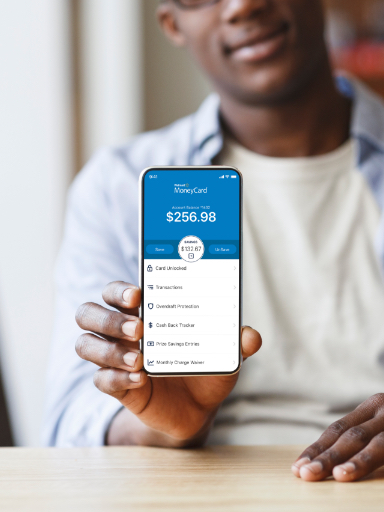

One of the best ways to save money is by using your Walmart MoneyCard (issued by green dot). Pick up some new equipment for work with an instant purchase. Use it at any store and get cashback!

Table of contents

Earn Cash Back with Walmart money card

You will make cash rear of three percent (3%) on qualifying acquisitions made at Walmart.com and also in the Walmart application using your Walmart Money Card or your Walmart Money Card number, 2 percent (2%) at Walmart gas stations, and one percent (1%) on certifying acquisitions at Walmart shops in the USA (less returns and credit histories) posted to your Walmart Money Card throughout each reward year. Grocery store distribution as well as pickup acquisitions made on Walmart.com or the Walmart Application make 1%. For the purposes of cash back rewards, a “reward year” is twelve (12) regular monthly periods in which you have paid your monthly cost or had it waived. See cardholder agreement for information.

Opt-in required. $15 fee may relate to each qualified acquisition deal that brings your account adverse. Balance needs to be given at the very least $0 within 24 hours of permission of the very first transaction that overdraws your account to prevent the charge. We require instant repayment of each overdraft account as well as over-limit cost. Overdrafts paid at our discernment, and also we do not assure that we will certainly accredit as well as pay any transaction. Discover more about over-limit protection.

- Obtain 3% Cash Back Cash back

Earn 3% cash back at Walmart.com, 2% cash back at Walmart gas stations, & 1% cash back at Walmart stores, approximately $75 each year. - Overdraft account Security. Overdraft defense.

Get satisfaction with 3 insurance coverage levels, up to $200, for purchase transactions with opt-in & eligible direct deposit. - ASAP eligible direct deposit. Get your compensate to 2 days before cash advance & your benefits up to 4 days prior to benefits day with ASAP Direct DepositTM.

- No month-to-month charge when you fill $500. No regular monthly cost. Waive your regular monthly cost when you direct eligible direct deposit $500+ in previous regular monthly duration. Or else, $5.94 a month.

- Earn 2% APY on savings. 2% passion on savings (APY).

Earn 2% yearly passion (APY) on as much as $1,000 in your savings account. Plus, obtain opportunities to win cash prizes each month! - Update to the Family Members Plan. Accounts for your family members.

Order a make up totally free for approximately 4 added authorized members ages 13+, in the application, with your triggered, personalized card.

Start using your MoneyCard today. Watch how.

Manage your money on APP

Mobile banking is made easy with the MoneyCard app. Deposit checks, monitor your balance, pay bills, transfer money You can find these features om Walmart APP:

- Account history

Whether it’s midnight or mid-morning, you can watch your equilibrium & deal history from anywhere. - Mobile deposit

Mobile check deposit: Take a picture of your check & see your cash transferred into your account at no cost within 5 company days. - Cash Reloads

Deposit cash – Make cash deposits utilizing the app at Walmart stores. Select “Deposit cash” & show the barcode at the register.1. - Lock protection

Lost you card? Press LOCK to briefly avoid new acquisitions to your MoneyCard. Press UNLOCK to recover your card promptly.2. - Bank transfer

Include cash to your Walmart MoneyCard from an additional checking account with just a few taps in the app. - Online Bill Pay

Make private or reoccurring electronic payments including your rental fee, phone, insurance, utilities, & other expenses. - Text Alerts

Keep track with account text informs. We’re just a text message away! Text HELP to 96411 & you’ll obtain your equilibrium, recent deals, history, & much more. You can additionally remain on top of your account by choosing customized alerts. We’ll send you notices via message or e-mail for direct deposit, equilibrium getting reduced, or a friendly regular account update.

Walmart money card login

You are able to bring cash to the card within whenever by way of an immediate deposit. Most you’ve to accomplish is usually to become reload with a register by obtaining confirm money at giving Walmart or even by switching to a Walmart cash facility express piece of equipment that is closest to the home of yours. The Walmart MoneyCard prepaid debit card could be a great worth for devoted Walmart clients. The card, issued by green dot, has cash back incentives for Free on-line as well as walmart buys products. There’s additionally an alternative for internet bank account transfer that additionally directs your tax return deposits straight to the card account of yours. Walmart money card login: Enter here

Direct Deposit: – Walmart Money Card

Payroll checks, as well as the federal government advantages of yours, can be packed straight right into a Walmart MoneyCard via the usage of immediate deposit choice. This particular system is definitely free from price and also you are able to decide to put everything or perhaps an aspect of the verify of yours.

Companies are going to have to notify the bank account of immediate build up previously no less than 2 times the determined genuine “payday”. Walmart then receives within touch with the merchant of yours then transfers the money to the card first.

Direct Deposit: Early schedule of straight deposit depends on timing of payroll’s repayment guidelines as well as fraudulence prevention restrictions might use. Therefore, the schedule or timing of very early straight deposit might differ from pay period to pay duration. See to it the name and also social security number on file with your employer or benefits carrier matches what gets on your Walmart MoneyCard account exactly. We will certainly not have the ability to deposit your settlement if we are not able to match receivers.

Rapid Reload

This particular alternative enables the buyers to stuff somewhere between twenty dolars as well as $1,100 to the Walmart MoneyCard of theirs by obtaining it to brush on the register at giving Walmart or even some other group participating merchant of preference. There’s, nonetheless, a three dolars rate because of this program. However the nominal re-charge is actually trend for your Preferred cardholders.

Walmart money card balance

In the event that you would like to money the paycheck of yours or maybe the federal government advantages check of yours with Walmart, subsequently the money are immediately packed into the Walmart MoneyCard of yours. No, reload costs are actually recharged because of this system, but presently there might be a re-charge incurred for cashing the verify to have the Walmart Money Card of yours loaded.

Nevertheless, this particular alternative isn’t obtainable in Jersey that is New, New York, and Rhode Island. In case you’re making use of the MoneyCard’s smartphone app, in that case you’ll have the choice to put inspections to the card bank account of yours through the smartphone digital camera of yours, based on Walmart.

Walmart money card customer service

These helps generally identify to the front side gates of Walmart shops in which the customer care division is frequently situated.

They let you include resources to the Walmart Money Card of yours, check the card sense of balance of yours, buy the money orders of yours as well as additionally, they permit you to invest in cellphone cards. Charges implement for the solutions with respect to the kind of The type and walmart MoneyCard transaction type you’re generating.

Gain access to your Walmart MoneyCard bank account the way of yours. Cardholder Customer Service: 1-877-937-4098.

Online Transfer

The online bank account transfer typically requires somewhere between anyone to 3 company days and nights as well as there’s absolutely no reloading rate because of this program. Nevertheless, the bank account of yours might charge a fee to make the electric transfer.

Tax Refunds

If you ever typically file your revenue taxes electronically, then simply you are able to choose to immediately put the income tax money back of yours into the Walmart Money Card of yours. There’s absolutely no reloading rate because of this program.

You merely need to send out the card number of yours as well as cell phone selection to Walmart that will after that textual content you the direct deposit info after which you’ve to type in identical into the tax styles of yours.

The conventional IRS processing period is going to be appropriate, though e filing for cash flow tax return shipping usually enables you to get the money back more quickly as compared to while filing by mail.

Savings Account

Rate of interest is paid each year on each enrollment wedding anniversary based upon the ordinary everyday equilibrium of the prior 365 days, as much as an optimum equilibrium of $1,000, if the account remains in excellent standing as well as has a favorable balance. 2% Annual Percent Return may alter at any time prior to or after account is opened. Annual Portion Yields are exact as of 3/27/20.

Benefits: – Walmart money network card

The Walmart MoneyCard provides to the clients of its a lot of the advantages identified on every MasterCard and Visa debit cards that also feature fraud security. The services of web based expenses fee is additionally no-cost.

Buyers are able to send out cash orders, inspections to a landlord at no cost, or perhaps establish recurring every-month payments for energy along with other costs like for the automobile insurance of yours. These Walmart cash cards additionally enable you to transmit resources to family unit or maybe buddies lifestyle anyplace inside the United States.

Buyers also can generate cash back incentives via going shopping at Walmart.com allowing for three % cashback, Murphy USA as well as Walmart energy facilities permitting two % cashback as well as Walmart retailers that provide an one percent cashback. The optimum restrict for cashback incentives capped during seventy five dolars a season.

Fees

Walmart Money Cards price somewhere between one dollars as well as four dollars to be able to purchase and also the real price depends upon the card sort you’re purchasing. The standard card has a five dollars month system rate, and that is readily waived off of in case you’ve $1,000 or higher directly into the card inside the month previously.

The Preferred card has a three dollars system rate & it’s waive off of in case you load a minimum of $500 to the card in exactly the same month or maybe in case you’ve payroll or even federal government advantages deposit straight to the card of yours.

ATM Withdrawal fee: ATM withdrawals cost you $2.50 in case you’re making use of the normal card as well as two dollars in case you’re utilizing the Preferred it. Nevertheless, the Preferred card additionally enables you to create complimentary withdrawals coming from 24,000 MoneyPass ATMs.

Additional rate differentials on the Walmart Money Card feature a three % overseas transaction rate for your normal card as well as a two % foreign transaction fee for your Preferred it. The Preferred card additionally allows you to stay away from the $0.50 sense of balance inquiry rate at giving ATMs in case you’re utilizing among the MoneyPass ATMs.

Other Store Credit Cards

- Capital One® Walmart Rewards™ Mastercard®

- Amazon Prime Rewards Visa Signature Card

- Target REDcard™ Credit Card

- Gap Visa® Credit Card

- Lowe’s Advantage Card

- TJX Rewards® Platinum Mastercard®

- Costco Anywhere Visa® Card by Citi

- Verizon Visa® Card

- My Best Buy® Credit Card by Citi

- The Home Depot® Consumer Credit Card

- Apple Credit Card

- Indigo Credit Card

- First Premier Card

- Fortiva Credit Card

Disclaimer

The Walmart MoneyCard Mastercard Card is issued by Green Dot Bank, Member FDIC, pursuant to a license by Mastercard International Inc. The Walmart MoneyCard Visa Card is issued by Green Dot Bank, Member FDIC. Green Dot Bank also operates under the following registered trade names: GO2bank, GOBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage. The use of this Card is subject to the terms of your Cardholder Agreement. Green Dot Bank is a registered trademark of Green Dot Corporation.