Insurtech is a term used to describe the use of technology to improve the insurance industry. It is a relatively new concept, but it has already changed the way insurance companies do business. In this FintechZoom post, we will discuss what Insurtech is, the benefits it provides, and how it is changing the insurance industry.

Also read: Why Business Insurance is a Must-Have for Every Entrepreneur.

What is Insurtech?

Insurtech is a combination of two words – insurance and technology. It is the application of technology to the insurance industry to improve processes, reduce costs, and increase customer satisfaction. Insurtech can be used to automate processes, analyze data, and process claims more efficiently. It also enables insurers to offer more personalized services to their customers.

Insurtech is different from traditional insurance in that it is more customer-centric. Insurtech enables insurers to better understand their customers’ needs and provide them with more tailored services. This is done using advanced analytics and machine learning algorithms that can analyze customer data and create personalized products and services.

Insurtech is also different from traditional insurance in that it is more automated. Insurtech can automate processes such as policy issuance, claim handling, and customer service. This reduces costs and makes the insurance process more efficient.

Read also Extended Car Warranty Complete Guide.

Benefits of Insurtech

There are several benefits of Insurtech for both insurers and customers. For insurers, Insurtech can reduce costs, increase efficiency, and improve customer service. Insurtech can also enable insurers to better understand customer needs and provide more personalized services.

For customers, Insurtech can make the insurance process smoother and more convenient. Insurtech can automate processes such as policy issuance and claims handling, which can save time and hassle. Insurtech can also enable customers to access their policies and services more easily and quickly.

Insurtech can also improve customer satisfaction. By using advanced analytics and machine learning algorithms, insurers can gain valuable insights into their customers. This can enable them to provide more personalized services and better meet customer needs.

Insurtech Statistics

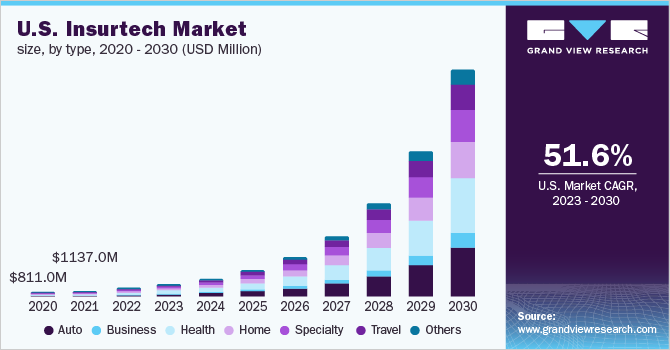

Insurtech is a rapidly growing segment of the insurance industry. According to a report from Deloitte, the global Insurtech market is expected to reach $11.5 billion by 2023. This represents a compound annual growth rate of 26%.

In terms of adoption, the report found that Insurtech is being adopted at a faster rate than traditional insurance. In the US, the Insurtech market is estimated to be worth $2.6 billion by 2021. This represents a compound annual growth rate of 41%.

Read also Proactively Planning for Long-Term Care as You Get Older.

Insurtech Trends

Insurtech is a rapidly evolving field, and there are several key trends that are driving its growth. The first trend is the shift towards digital and mobile technologies. Insurtech companies are using digital and mobile technologies to make the insurance process more efficient and accessible.

The second trend is the use of artificial intelligence and machine learning. Insurtech companies are using AI and machine learning to analyze customer data and create personalized products and services. This enables insurers to better understand customer needs and provide more tailored services.

Finally, there is a trend towards customer-centricity. Insurtech companies are focusing on customer experience, and are using technology to provide more personalized and convenient services. This includes providing customers with instant access to their policies, as well as automated customer service.

How Insurtech is Changing the Insurance Industry

Insurtech is having a profound impact on the insurance industry. It is changing the way insurers do business, and is enabling them to offer more customer-centric services.

Insurtech is helping insurers reduce costs and increase efficiency. By automating processes such as policy issuance, claims handling, and customer service, insurers can reduce overhead costs and improve efficiency. This enables them to offer more competitive prices and better meet customer needs.

Insurtech is also enabling insurers to offer more personalized services. By using advanced analytics and machine learning algorithms, insurers can gain valuable insights into their customers. This enables them to provide more tailored services and better meet customer needs.

Insurtech is also making the insurance process more accessible and convenient. Insurtech companies are using digital and mobile technologies to make the insurance process more efficient and accessible. This includes providing customers with instant access to their policies, as well as automated customer service.

Finally, Insurtech is enabling insurers to offer innovative products. Insurtech companies are using advanced analytics and machine learning algorithms to create innovative products and services. This enables insurers to stay competitive in a rapidly changing market.

Challenges of Insurtech Implementation

Although Insurtech can bring many benefits to insurers and customers, there are also some challenges that must be addressed. The first challenge is the cost of implementation. Insurtech can be expensive to implement, and insurers must take this into account when deciding whether or not to adopt it.

The second challenge is the lack of expertise. Insurtech requires specialized knowledge and skills, and insurers may not have the resources to hire the necessary personnel. This can be a barrier to adoption.

Finally, there is a risk of data security and privacy. Insurtech relies heavily on customer data, and there is a risk that this data could be compromised. Insurers must ensure that appropriate measures are in place to protect customer data.

Examples of Successful Insurtech Companies

There are several Insurtech companies that have seen success in recent years. One example is Lemonade, which is an Insurtech company that uses AI and machine learning to analyze customer data and provide personalized services. Lemonade has seen rapid growth in recent years and is now one of the largest Insurtech companies in the world.

Another example is Metromile, which is an Insurtech company that uses telematics to provide pay-per-mile insurance. Metromile has also seen rapid growth, and is now one of the leading providers of pay-per-mile insurance in the US.

Finally, there is Policygenius, which is an Insurtech company that uses AI and machine learning to compare insurance policies and provide tailored advice to customers. Policygenius has also seen significant growth, and is now one of the leading providers of personalized insurance advice.

But..What are the best Insurtech Companies?

The best insurtech companies are Zego, QuanTemplate, Wrisk, Shift Technology, Neos, Dinghy, Trov, Slice, Next Insurance, and Bdeo. Zego is a leading provider of on-demand insurance for gig-economy workers. QuanTemplate offers a comprehensive platform for digitalizing the underwriting process. Wrisk provides an AI-driven, end-to-end insurance platform. Shift Technology is a leading provider of AI-driven insurance fraud detection and claims automation solutions. Neos provides smart home insurance that allows customers to adjust their policies in real-time. Dinghy is a digital broker specializing in on-demand insurance for freelancers and SMEs. Trov specializes in on-demand insurance and subscription-based coverage for digital goods. Slice is a provider of digital insurance solutions for small businesses. Next Insurance is a digital platform for small business insurance. Bdeo provides AI-driven claims adjustment solutions. [1][2][3]

References:

[1] Top InsurTech Companies to Watch in 2023 – AI Time Journal [2] Top 7 Innovative Insurtech Companies of 2023: Detailed Guide [3] The top 10 most innovative and disruptive Insurtech companiesInsurtech Solutions

Insurtech companies are offering a wide range of innovative solutions to insurers and customers. These include automated policy issuance and claims handling, personalized advice and services, and digital and mobile technologies for a more convenient customer experience.

In addition, Insurtech companies are also offering solutions to help insurers better understand customer needs. These solutions include advanced analytics and machine learning algorithms that can analyze customer data and provide valuable insights.

Finally, Insurtech companies are also offering solutions to help insurers stay competitive. These solutions include innovative products and services, as well as tools to help insurers better understand customer needs and create personalized products and services.

Courses for Insurtech

Insurtech is a rapidly evolving field, and there are several courses available to help professionals stay up to date with the latest developments. These courses can help professionals increase their knowledge of Insurtech and gain an understanding of how it can be used to improve the insurance industry.

One example is the Insurtech Leadership Program offered by the MIT Sloan School of Management. This program provides an in-depth understanding of the industry and its opportunities and challenges.

Another example is the Insurtech Summer Course offered by the University of New South Wales. This course provides an overview of the Insurtech industry, as well as an understanding of the business opportunities and challenges.

Finally, there is the Insurtech Bootcamp offered by the University of Toronto. This program provides an introduction to the fundamentals of Insurtech and provides an overview of the industry and its opportunities.

FAQs about Insurtech

Insurtech is a term used to describe the application of new technologies in the insurance industry. It can include the use of technology to improve existing insurance processes and products, or the development of entirely new products and services. Examples of Insurtech solutions include the use of data analytics to better assess risk, the development of digital platforms to facilitate more efficient communication between insurers and customers, and the use of artificial intelligence and machine learning to automate elements of the insurance process.

These Companies can provide a number of benefits for both insurers and customers. For insurers, it can help to reduce costs, increase efficiency, and make it easier to access new markets. For customers, it can bring greater convenience, better pricing, and faster access to insurance products. Their can also help to improve customer experience by reducing the complexity of the insurance process and providing more tailored services.

The main risk associated with Insurtech is the potential for data security breaches. As more data is gathered and stored digitally, there is an increased risk of unauthorized access or misuse of personal or confidential information. Additionally, as new technologies continue to evolve, there is always the potential for unforeseen issues to arise. As such, it is important for insurers to have robust security protocols in place to protect their data and to ensure the safety of their customers.

Conclusion

Insurtech is a rapidly growing segment of the insurance industry, and it is changing the way insurers do business. It is enabling insurers to reduce costs, increase efficiency, and offer more personalized services. It is also making the insurance process more accessible and convenient.

However, there are also some challenges that must be addressed. These include the cost of implementation, the lack of expertise, and the risk of data security and privacy.

Nevertheless, there are several courses available to help professionals stay up to date with the latest developments in Insurtech. These courses can help professionals increase their knowledge of Insurtech and gain an understanding of how it can be used to improve the insurance industry.

In conclusion, Insurtech is having a profound impact on the insurance industry and is changing the way insurers do business. It is enabling insurers to reduce costs, increase efficiency, and offer more personalized services. By understanding the opportunities and challenges of Insurtech, insurers can use it to their advantage and stay competitive in a rapidly changing market.