As someone who has recently gone through the process of buying a home, I know firsthand just how overwhelming and stressful it can be. One of the most important steps in the homebuying process is figuring out your budget, and that’s where a mortgage calculator online can come in handy. In this article, I’ll introduce you to what a mortgage calculator online is, the benefits of using one, and how to choose the best one for your needs. I’ll also share some tips for maximizing your homebuying budget with the help of a mortgage calculator online.

Also read: FintechZoom Mortgage Calculator: Your Ultimate Tool for Accurate Mortgage Estimates.

Introduction to Mortgage Calculators

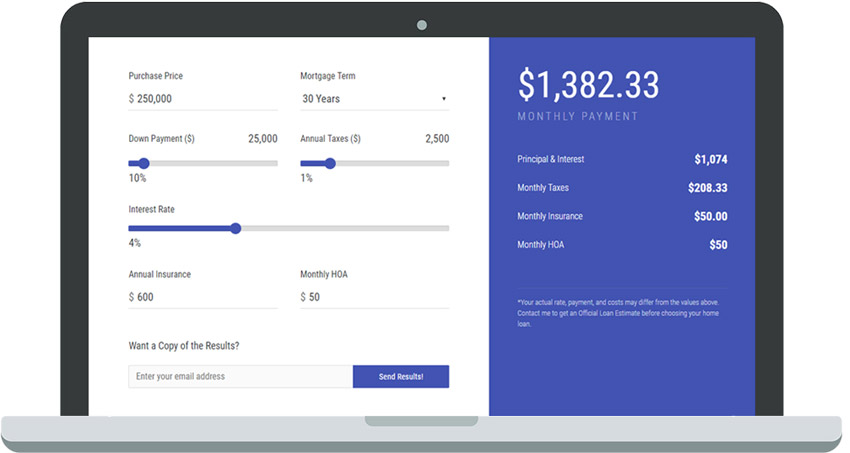

A mortgage calculator is a tool that helps you estimate the cost of a mortgage. It takes into account factors such as the loan amount, interest rate, and loan term to give you an idea of what your monthly payments would be. Mortgage calculators have been around for a long time, but with the rise of the internet, they have become more accessible than ever. Now, you can find a variety of mortgage calculators online that are free to use and can help you make informed decisions about your homebuying budget.

What is a Mortgage Calculator Online?

A mortgage calculator online is simply a mortgage calculator that is available on the internet. There are many different types of mortgage calculators online, each with their own set of features and capabilities. Some are simple and only require you to input a few basic pieces of information, while others are more complex and can give you a detailed breakdown of your mortgage costs. Most mortgage calculators online are free to use, although some may require you to sign up for an account or pay a fee to access certain features.

Types of Mortgage Calculators

There are several types of mortgage calculators online, each designed to help you with a specific aspect of the homebuying process. The most common types of mortgage calculators include:

Mortgage Payment Calculator

A mortgage payment calculator helps you estimate your monthly mortgage payments based on factors such as the loan amount, interest rate, and loan term. This type of calculator can be very helpful in determining how much you can afford to spend on a home.

Mortgage Refinance Calculator

A mortgage refinance calculator helps you determine whether it makes sense to refinance your existing mortgage. It takes into account factors such as your current interest rate, the new interest rate, and any fees associated with the refinance.

Amortization Calculator

An amortization calculator helps you determine how much of your monthly mortgage payment goes towards paying down the principal balance of your loan versus how much goes towards interest. This can be useful in understanding how your mortgage payments will change over time.

Benefits of Using a Mortgage Calculator Online

There are several benefits to using a mortgage calculator online, including:

Saves time and effort

Using a mortgage calculator online can save you time and effort by providing you with quick and easy estimates of your mortgage costs. Rather than manually crunching the numbers yourself, you can simply input your information into the calculator and get an instant estimate.

Helps you make informed decisions

A mortgage calculator online can help you make informed decisions about your homebuying budget. By giving you an idea of what your monthly payments will be, you can determine how much you can afford to spend on a home and avoid overextending yourself financially.

Provides flexibility

There are many different types of mortgage calculators online, each with their own set of features and capabilities. This provides you with the flexibility to choose the calculator that best suits your needs and helps you achieve your homebuying goals.

How to Use a Mortgage Calculator Online

Using a mortgage calculator online is easy and straightforward. Here are the basic steps:

- Choose the type of mortgage calculator that best fits your needs.

- Input your information into the calculator, including the loan amount, interest rate, and loan term.

- Review the results to get an estimate of your monthly mortgage payments.

It’s important to note that while a mortgage calculator online can provide you with a good estimate of your mortgage costs, it’s not a substitute for professional advice. You should still consult with a mortgage professional to get a more accurate picture of your mortgage costs and to ensure that you’re making the best decisions for your financial situation.

Factors to Consider When Choosing a Mortgage Calculator Online

When choosing a mortgage calculator online, there are several factors to consider, including:

Accuracy

It’s important to choose a mortgage calculator online that is accurate and reliable. Look for calculators that are based on current interest rates and that take into account all of the factors that will impact your mortgage costs.

User-friendliness

Choose a mortgage calculator online that is easy to use and understand. Look for calculators that provide clear instructions and that are intuitive to navigate.

Features

Consider what features are important to you when choosing a mortgage calculator online. Do you need a calculator that provides a detailed breakdown of your mortgage costs, or are you looking for a simple estimate of your monthly payments?

Top Mortgage Calculators Online

There are many mortgage calculators online to choose from, but here are some of the top ones:

Zillow Mortgage Calculator

The Zillow Mortgage Calculator is a simple and easy-to-use calculator that provides estimates for monthly payments, interest rates, and total costs. It also allows you to compare different loan options and see how changes in interest rates and loan terms will impact your payments.

Bankrate Mortgage Calculator

The Bankrate Mortgage Calculator is a comprehensive calculator that provides detailed estimates for monthly payments, total costs, and more. It also allows you to compare different loan options and provides helpful tips and advice for homebuyers.

NerdWallet Mortgage Calculator

The NerdWallet Mortgage Calculator is a user-friendly calculator that provides estimates for monthly payments, interest rates, and total costs. It also allows you to compare different loan options and provides helpful information on the homebuying process.

Pros and Cons of Using a Mortgage Calculator Online

Before using a mortgage calculator online, it’s important to consider the pros and cons. Here are some of the main advantages and disadvantages:

Pros

- Provides quick and easy estimates of mortgage costs

- Helps you make informed decisions about your homebuying budget

- Can save you time and effort

Cons

- May not be as accurate as working with a mortgage professional

- Some calculators may require you to create an account or pay a fee

Tips for Maximizing Your Homebuying Budget with a Mortgage Calculator Online

Here are some tips for maximizing your homebuying budget with the help of a mortgage calculator online:

Be realistic about your budget

When using a mortgage calculator online, be realistic about what you can afford. Don’t overextend yourself financially and make sure you have enough money left over for other expenses.

Consider all of the costs

When using a mortgage calculator online, make sure you take into account all of the costs associated with buying a home, including closing costs, property taxes, and homeowners insurance.

Shop around for the best interest rates

Interest rates can have a big impact on your mortgage costs, so it’s important to shop around for the best rates. Use a mortgage calculator online to compare different interest rates and see how they will impact your monthly payments.

Conclusion

A mortgage calculator online can be a valuable tool in the homebuying process, helping you estimate your mortgage costs and make informed decisions about your budget. When choosing a mortgage calculator online, consider factors such as accuracy, user-friendliness, and features. And remember, while a mortgage calculator online can be helpful, it’s not a substitute for professional advice. Use it as a starting point and work with a mortgage professional to get a more accurate picture of your mortgage costs.