Are you interested in investing in Initial Public Offerings (IPOs) to grow your wealth? If so, you need to be aware of the largest new IPOs that are dominating the market. These high-profile companies are attracting significant investor attention and could potentially provide lucrative opportunities.

The stock market is constantly evolving, with new companies going public and offering shares to investors. IPOs have become a popular way for companies to raise capital and expand their operations. However, not all IPOs are created equal, and it’s important to understand which ones are the largest and most promising.

As an investor, staying updated on the largest new IPOs can give you a competitive edge and increase your chances of making profitable investments. In this article, we will explore some of the biggest IPOs to watch out for, highlighting their potential growth prospects and the industries they operate in. By understanding these IPOs, you will be better equipped to make informed investment decisions in the ever-changing market.

IPOs to Watch in 2024

2024 promises to be an exciting year for IPOs, with several high-profile companies vying for a public listing. Here are some of the most anticipated contenders:

Tech Giants:

- SHEIN: The Chinese fast-fashion giant, known for its viral TikTok presence and affordable clothing, is aiming for a valuation of up to $90 billion. Its reliance on social media and influencer marketing puts it on a unique path to public success.

- Canva: The popular online design platform has garnered millions of users with its user-friendly interface and freemium model. Expect a massive valuation and high investor interest for this design democratizer.

- Databricks: The big data software company serves leading tech giants like AWS and Microsoft Azure. Its strong financials and cloud-based solutions make it a compelling option for investors looking for exposure to the data analytics boom.

Beyond Tech:

- Instacart: The grocery delivery giant filed confidentially for an IPO in late 2023, but the timing remains uncertain. Its pandemic-driven surge has cooled off, but it still holds a dominant position in the online grocery market.

- Indigo Agriculture: This agtech company uses data and microbes to improve crop yields and soil health. With growing concerns about food security and sustainability, their IPO could attract strong interest from environmentally conscious investors.

- Beyond Meat: The plant-based meat pioneer has faced recent challenges but retains a loyal following and significant market share. An IPO could revitalize the brand and attract funding for further expansion.

Important Caveats:

- Remember, the IPO market can be volatile. Even the most promising companies can stumble at the public debut stage.

- Thorough research is crucial before investing in any IPO. Carefully evaluate the company’s financials, future plans, and market competition.

- Consider diversifying your portfolio and avoid putting all your eggs in one IPO basket.

Best IPOs Watched in 2023

Defining “best” for IPOs can be tricky, as performance involves multiple factors and risk tolerance. However, based on various metrics and investor interest, here are some of the notable IPOs from 2023:

Top Performers (Return on Investment):

- Atlas Lithium (ATLX): This lithium mining company surged over 400% since its January IPO, riding the wave of increasing demand for the battery metal.

- Genelux (GNLX): This gene therapy developer saw its stock rise over 300% since its January debut, fueled by promising clinical trial results.

- Klaviyo (KLVO): This email marketing platform enjoyed a solid 184% return since its July IPO, benefiting from the continued growth of e-commerce.

High-Profile Debuts:

- Instacart (CART): The online grocery delivery giant, though experiencing some market correction, still holds a significant share and brand recognition.

- Birkenstock (BIRK): The iconic sandal brand attracted attention for its heritage and potential as a lifestyle brand beyond footwear.

- Arm Holdings (ARM): This chip designer, known for its ubiquitous CPUs, sparked interest in the technology sector.

Other Noteworthy Mentions:

- Maplebear Inc. (MRB): The parent company of Canadian e-commerce platform Shop.ca surprised with a strong performance.

- CARGO Therapeutics (CRGO): This biotech company developing cancer treatments garnered interest for its innovative approach.

- Neumora Therapeutics (NMRX): This lung disease treatment developer showed early promise with its clinical trials.

Remember, past performance is not necessarily indicative of future results. These IPOs have their own set of risks and uncertainties. Thorough research and careful consideration are crucial before making any investment decisions.

Most Recommended Forthcoming IPOs to Watch in 2022

2022 has actually been a rough year for IPOs, however these 9 players can tremble things up prior to the brand-new year.

What a distinction a year makes. The contrast in between the marketplace for initial public offerings, or IPOs, in 2021 and in 2022 is all the time. U.S. IPOs hit a record high in 2021, with 1,073 business striking the general public markets. In the first six months of 2022, that number plunged to just 92, according to FactSet data. Extreme volatility in the securities market was just recently punctuated by the S&P 500 entering a bearish market. On top of that, the Federal Reserve has carried out a series of quick rate of interest hikes not seen because 1994, inflation is running at its best levels given that the very early 1980s, and also some kind of recession looks increasingly likely. That claimed, a number of private firms have actually been prepping to go public, as well as some might still do so in the second fifty percent of the year. Here are nine of the most anticipated upcoming IPOs to see in 2022.

Read: From IPO to Success: Companies That Their IPO in 2013 and How Are Thriving Today.

- Discord

- Instacart

- Databricks

- Chime

- Mobileye

- Impossible Foods

- VinFast

- Stripe

Read A Decade of Dreams Come True: Companies That Had Their IPO in 2010!

Discord

Called by U.S. News as one of the leading upcoming IPOs to view in 2022 back in December, the prominent social messaging application hasn’t yet validated a transfer to go public, yet signs in the very first half of the year began indicating a move to touch public markets. In March, Bloomberg reported that Discord was interviewing investment lenders to prepare to go public, with the application reportedly considering a straight listing. Discord, which surged in popularity throughout the pandemic and also enjoys a solid brand name and cultlike customer base, is a preferred communication tool in the pc gaming and also cryptocurrency neighborhoods. Positive in its capacity to maintain growing, Discord rejected a $12 billion acquistion deal from Microsoft Corp. (ticker: MSFT) in 2021. In September 2021, the business raised $500 million at a $15 billion appraisal.

Prospective 2022 IPO valuation: $15 billion

Read this article: Most Recommended Forthcoming IPOs to Watch in 2023.

Popular social networks and message board internet site Reddit filed in complete confidence for an IPO in late 2021, offering a great sign that it would be just one of the greatest future IPOs in 2022. Reddit’s valuation has gone allegorical recently, with private funding rounds valuing the company at $3 billion in 2020 and also $10 billion in 2021. In January, Reddit supposedly tapped Morgan Stanley (MS) as well as Goldman Sachs Group Inc. (GS) as lead experts for its going public, obviously going for a public evaluation of at the very least $15 billion There are signs the technology thrashing may compel that appraisal to find down a little bit, with early capitalist Fidelity Investments apparently marking down the value of its stake in Reddit by more than a third in April.

Potential 2022 IPO assessment: $10 billion to $15 billion.

Instacart

Instacart, like Discord, ended up gaining from pandemic-era lockdowns and also the succeeding work-from-home economic climate that persists in 2022. Yet after supposedly tripling revenue to $1.5 billion in 2020, an expected stagnation in growth has actually clutched the firm, as it tries to pivot to operations in a much more regular operating setting. One such initiative for the grocery store delivery app is its press right into digital advertising and marketing; Instacart postponed strategies to go public last year to focus on increasing that line of work. It’s an all-natural, higher-margin organization for the firm, which deals with clients already intent on buying. While a July 2022 executive team overhaul might indicate Instacart getting its ducks straight prior to an IPO, the firm cut its own valuation by almost 40% in late March in reaction to market problems, making an IPO at its highest possible evaluation of $39 billion not likely, at least in 2022.

Possible 2022 IPO assessment: $24 billion

Databricks

It’s uncommon for business to accomplish evaluations of greater than $30 billion without IPO babble, as well as cloud-based data storage and evaluation business Databricks is no exemption. Counting Amazon.com Inc. (AMZN), Salesforce Inc. (CRM) and Alphabet Inc. (GOOG, GOOGL) among its financiers, it’s quickly one of the hottest financial investments worldwide of venture capital. The state-of-the-art company, whose services utilize expert system to kind, clean and existing Big Information for customers, elevated $1.6 billion at a $38 billion evaluation in 2015 from financiers that consisted of Financial institution of New york city Mellon Corp. (BK) as well as the University of The golden state’s mutual fund. Unfazed by the market beatdown peer Snowflake Inc. (SNOW) has actually taken– the Warren Buffett holding is off around 56% in 2022 with mid-July– chief executive officer Ali Ghodsi claimed earlier this year that the business’s “growth rate will break through the several compression that’s happening in the market” if and when Databricks goes public.

Possible 2022 IPO assessment: $38 billion

Chime

Chime, a fast-growing monetary innovation, or fintech, company, has a worthy business design. Chime offers digital economic solutions to low-income and underbanked people and eliminates regressive plans like typical over-limit fees and also account minimums. Chime objectives to cast a vast net as well as satisfy the masses with this version, and also it makes money through Visa Inc. (V) debit cards it provides, making a piece of interchange charges every time its card is made use of. Noble as its business might be, Chime isn’t unsusceptible to market forces, and also the company, valued at $25 billion in 2021, was expected to go public in the first half of 2022 when the year started. Barron’s also reported that Chime had chosen Goldman Sachs to aid underwrite the IPO. Nonetheless, Barron’s additionally reported in late Might that the offering was no longer anticipated in 2022, mentioning people acquainted with the matter. Still, never ever claim never: If stock exchange view swiftly boosts, Chime may locate itself back in play this year.

Potential 2022 IPO assessment: $25 billion or even more

Mobileye

Mobileye has actually been public before and has concrete strategies to go back to the sweet accept of public markets. Or rather, chipmaker Intel Corp. (INTC) has strategies to take Mobileye public once more, five years after obtaining the machine vision business for $15.3 billion One of the leaders in self-driving-car innovation, Mobileye supplies its tech to significant automakers like Ford Motor Co. (F) and Volkswagen. Intel originally intended to integrate Mobileye’s modern technology as well as licenses into its own self-driving department, however the option to spin out Mobileye as a separate firm as well as preserve a majority possession in business might be the most effective means for Intel, which is having a hard time to reach faster-growing opponents like Nvidia Corp. (NVDA), to take advantage of one of its most valued belongings. That said, in July, a record broke that the Mobileye IPO was being postponed until the market stabilizes, although a fourth-quarter 2022 launching hasn’t been ruled out.

Prospective 2022 IPO appraisal: $50 billion.

Impossible Foods

As is the case with a variety of other hot IPOs to look for 2022, Impossible Foods has actually seen 2021’s superb home window of possibility devolve right into a bloodbath for lately public companies as investor risk tolerance continues to subside. The closest openly traded analog to Impossible Foods is the various other major player in plant-based meats, Beyond Meat Inc. (BYND), which took a 54% hairstyle from the start of the year with July 14. Impossible Foods’ products are brought by the likes of Burger King and Starbucks Corp. (SBUX). While Impossible Foods may be important to wait till the last half of 2022 for an IPO, the CEO called going public “inevitable” as lately as November, the exact same month the firm raised $500 million at a $7 billion valuation. While reaching a similar evaluation in public markets might confirm hard in 2022, you can be sure that private capitalists will certainly be pressing to optimize its go-public market cap.

Prospective 2022 IPO valuation: $7 billion

VinFast

Plain months ago, Vietnam’s largest conglomerate, Vingroup, was all but particular to look for an IPO for its electric automobile arm VinFast in the 2nd fifty percent of 2022. The firm has grand strategies, shooting for 42,000 vehicle sales in 2022– a yearly sales figure it sees soaring to 750,000 cars by 2026. VinFast expects to sink $4 billion into the growth of an electric SUV factory in North Carolina, where it has actually promised to produce 7,500 work. Having actually previously mentioned its need to raise $3 billion at a $60 billion assessment, the latest line from the firm has a much more mindful tone. In May, Vingroup Chairman Pham Nhat Vuong confirmed that the business, while still considering a fourth-quarter IPO, could perhaps postpone the offering till 2023 if market problems weren’t desirable.

Potential 2022 IPO evaluation: $60 billion

Stripe

Among the upcoming IPOs to see in 2022, San Francisco-based on the internet settlements Stripe is certainly the hottest and also best prepared for. Stripe’s ecommerce software processes repayments for huge tech players like Amazon.com and also Google as well as enjoys massive financing from personal venture resources and also institutional capitalists, enabling it to suffer any kind of market chaos. Typically contrasted to PayPal Holdings Inc. (PYPL), Stripe performed a $600 million May 2021 financing round actually valued the company at $95 billion PayPal’s own evaluation in the public markets was about $80 billion since July 14. While the growth of areas like shopping assisted drastically accelerate Stripe’s growth during the pandemic, even Stripe isn’t unsusceptible to recent events and simply reduce its interior evaluation by 28% to $74 billion, according to a July record from The Wall Street Journal.

Possible 2022 IPO evaluation: At the very least $74 billion.

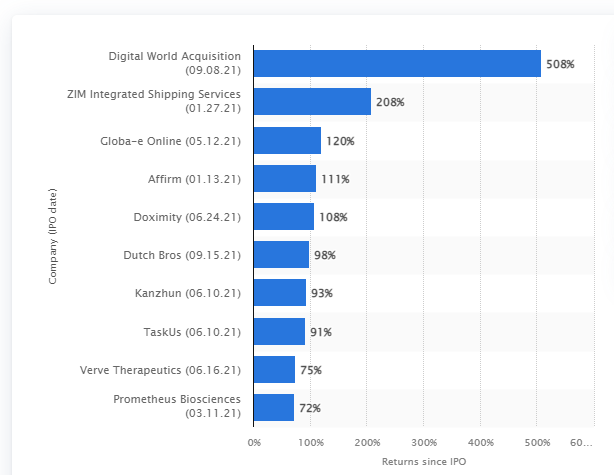

Best IPOs 2021 – highest returns in the United States in 2021

- Digital World Acquisition (09.08.21)

- ZIM Integrated Shipping Services (01.27.21)

- Globa-e Online (05.12.21)

- Affirm (01.13.21)

- Doximity (06.24.21)

- Dutch Bros (09.15.21)

- Kanzhun (06.10.21)

- TaskUs (06.10.21)

- Verve Therapeutics (06.16.21)

- Prometheus Biosciences (03.11.21)