BBY Stock Price

BBY Stock News

BBY Stock Prices Change

Currently, Best Buy is facing a period when consumers are becoming less confident in the brands they purchase. For a long time, there will be higher rates and high inflation. BBY offers excellent dividend growth after a few years, but it is probably not the best stock for you if you do not enjoy volatility. Looking for someone to lend a hand to you in the market? There are exclusive ideas and guidance you can access through iREIT on Alpha that will help you navigate any climate.

Best Buy (NYSE: BBY) Stock

Best Buy (NYSE: BBY) has been severely beaten down by the market over the last few months, especially over the past year, as the stock has collapsed 35% from its highs of November 2021 and has fallen over 50% from these highs in the past year.

In recent years, Best Buy has been experiencing a significant turnaround after a difficult period. As a former employee of BBY, I recall the days when many people declared the company a dying company, as they considered it nothing more than an Amazon showroom (AMZN).

Best Buy is a large box retailer that relies heavily on its customer base’s strength to succeed. This company sells mostly wants at its store, not needs, which is why most of its products are wants. Businesses that sell big-screen TVs, home audio equipment, and appliances may have a difficult time during an economic slowdown coupled with weak consumer demand.

US consumer data released recently suggests the economy may be breaking down. As a result of high inflation, consumers in the US turned to credit cards in September to help cope with a balance of $916 billion on their credit cards. Today, personal savings rates have almost disappeared after we heard that individual savings rates had risen dramatically after the pandemic. Americans saved a record low of $555.7 billion in 2009, the lowest level since 2009.

The weakening of the consumer market may result in large purchases, such as big-screen TVs, appliances, and home equipment, and the consumer’s audio being put on hold.

As Best Buy prepares for a weak holiday season, this isn’t something it wants to hear. Inflation has already reached record levels for consumers.

Still too high expectations

As a result, BBY shares are trading at a multiple below their five-year average of 13x. Shares are currently trading at a 10.9x earnings multiple.

According to analysts, earnings per share are expected to grow by nearly 15% in 2023 to $6.99. In a year when many experts believe that a recession might slow down the economy, do analysts believe that Best Buy, of all places, can still produce nearly5% growth in earnings in 2023?

A high inflation period, like ours now, tends to result in balance by falling supply below demand, not the other way around. We have been experiencing increased demand for quite some time when monetary policy was loose. In the past few years, rates were in a range of 3.75% to 4.00%, but that has changed now that the Fed has raised them. Due to these hikes, a 5.00% increase is expected to be achieved in 2023.

There is no doubt that all of this is not good news for retailers like Best Buy. That is why I am taking the position that there still needs to be a reduction in expectations for the sector. I am also assuming that BBY’s shares need to be reviewed accordingly.

Weakening Trend

Sales at Best Buy dropped 12.1% year over year in the company’s most recent quarter, with consumer electronics and computing the hardest hit. Despite a strong performance during the quarter, appliance sales are down 1% compared to the same period a year earlier.

A 31% increase in online sales for the company during the quarter shows that this segment continues to be a bright spot.

In the form of falling profit margins, the company continues to face challenges from not only Amazon (AMZN) but also other major competitors such as Walmart (WMT), Target (TGT), and Costco (COST), who are all striving to outdo each other.

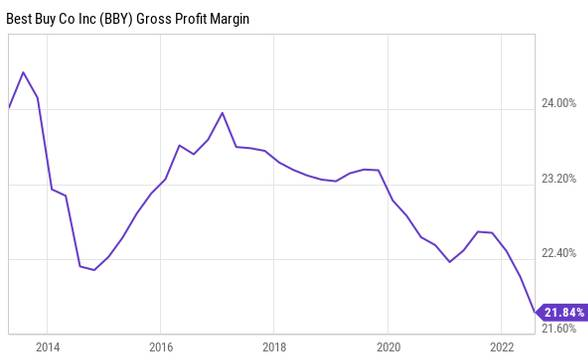

It is the first time in a decade that profit margins have fallen below 22% in the most recent quarter, which is the lowest level in a decade. In just one year, margins reached 23.5%.

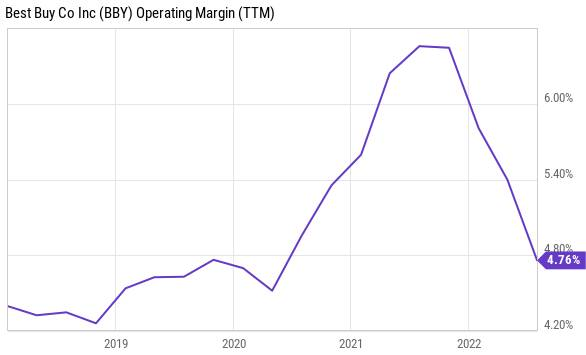

In the past year, the operating margin of this corporation has fallen from 6.5% to 4.7%, only a small increase from the 4.7% operating margin last year. Because it has a fairly low operating margin, there is not a lot of room for error in this business. It is easy to see how a rise in supply costs or wages could significantly impact Best Buy’s shares.

BBY’s negative operating margins could not be ruled out by a weakening consumer, which ultimately would result in sales declining.

Are Shares of BBY a Buy, Sell, Or Hold?

BBY shares are a sell, in my opinion. In my case and for the portfolio that I manage, I am convinced that the risks outweigh the rewards at this time. If we fall on hard times and enter a recession, a company such as Best Buy will struggle if it hasn’t already. The same thing happened in 2009, and I believe it will also happen again in the future.

Regarding Amazon and other competitors, it is difficult for me to see how Best Buy will sustain its competitive advantage. I wonder where they are gaining their competitive advantage.

Even though the company has a long history of growing its dividend, investing purely based on the company’s yield and dividend growth can become a disaster.

It has increased the dividend yearly for 11 consecutive years over the past five years at an average rate of 21%. Dividend growth rates have been high at the company over the past few years. Taking a cash-preserving strategy and slowing dividend growth could signal trouble ahead. The Best Buy dividend is usually raised in late February.

Due to this, I cannot justify holding the stock despite the current multiple.

Buy BBY Stock

BBY Stock Price History

BBY Stock Reddit

[wp-rss-aggregator feeds=”BBY”]