Energy stocks can be a great investment choice, but it’s important to know which companies are performing the best. In this blog post, we will discuss the 10 top energy stocks of the year. These companies have seen significant growth in their stock prices and are expected to continue performing well in the future as the best stocks to buy right now. If you’re looking for a hot investment opportunity, these stocks are definitely worth considering!

How Volatile is Energy Sector?

The energy sector is one of the most volatile markets in the world. Energy prices can fluctuate rapidly, and this can have a big impact on the stock prices of companies in the sector. For example, when oil prices rise, energy stocks tend to do well. However, when oil prices fall, energy stocks often suffer.

This volatility can make it difficult for investors to make money in the energy sector. However, for those who are willing to take on the risk, there can be large rewards. Energy stocks often outperform the market during periods of economic growth. They can also provide a valuable hedge against inflation. As a result, despite its volatility, the energy sector can be an attractive place for investors to put their money.

How volatile are the natural gas prices?

Natural gas prices are highly volatile, and can change rapidly based on a number of factors. These include changes in production and consumption levels, geopolitical events, and weather patterns. As a result, predicting natural gas liquids or liquefied natural gas prices is difficult, and even small changes can have a significant impact on price levels. For consumers, this volatility can lead to higher energy bills, as prices may spike during periods of high demand. For businesses, natural gas price volatility can make it difficult to budget and forecast costs. As a result, managing risk is an essential part of managing exposure to natural gas prices.

How volatile are the crude oil prices?

Crude oil prices are notoriously volatile, often experiencing sharp swings from one day to the next. This volatility is driven by a number of factors, including global events, supply and demand, and speculation.

While it can be difficult to predict exactly how oil prices will move in the short-term, there are a few factors that tend to have a major impact on prices. For instance, geopolitical events such as war or natural disasters can cause prices to spike as demand for oil increases. Similarly, changes in production levels can also lead to price fluctuations.

When there is a surplus of oil on the market, prices tend to fall; conversely, when there is a shortage of oil, prices typically increase. Lastly, speculation can also have a significant impact on crude oil prices. When investors believe that prices will rise in the future, they may buy oil contracts in an effort to profit from the anticipated price increase. This buying activity can itself drive up prices in the short-term, creating a self-fulfilling prophecy. In sum, crude oil prices are very volatile and can be influenced by a variety of factors.

Experienced investors closely monitor these factors in order to make more informed decisions about when to buy and sell oil contracts.

How the war in Ukraine influence the energy sector?

The war in Ukraine has had a significant impact on the energy sector. One of the main objectives of the conflict has been to gain control of key energy infrastructure, including pipeline companies and coal mines.

This has led to damage and destruction of this infrastructure, as well as disruptions to supplies. In addition, the fighting has made it difficult for energy companies to operate safely and effectively. As a result, the war in Ukraine has had a major impact on the energy sector and is likely to continue to do so in the future.

What are the World Top 5 Natural Gas Producers?

The top five natural gas producers in the world are the United States, Russia, Iran, Qatar, and Saudi Arabia. The United States is the largest producer of natural gas, with an estimated production of 28.3 trillion cubic feet in 2020.

This is followed by Russia, which produced 21.9 trillion cubic feet of natural gas in 2020. Iran is the third-largest producer of natural gas, with an estimated production of 16.6 trillion cubic feet in 2020. Qatar is the fourth-largest producer of natural gas, with an estimated production of 14.5 trillion cubic feet in 2020. Saudi Arabia is the fifth-largest producer of natural gas, with an estimated production of 4.5 trillion cubic feet in 2020.

These five countries accounted for nearly 80 percent of the world’s total natural gas production in 2020. Natural gas is a vital energy resource that plays a significant role in the global economy. These top five producers play a vital role in supplying the world with this important resource.

Which Countries Have the Large Gas Reserves?

There are a number of countries with large gas reserves, and the top five countries with the largest gas reserves are Russia, Iran, Qatar, Turkmenistan, and United States.

Russia has the largest amount of natural gas reserves in the world, with an estimated 1,688 trillion cubic feet. A large portion of these reserves are located in the Ural Mountains region.

Iran has the second largest amount of natural gas reserves, with an estimated 907 trillion cubic feet. The majority of Iran’s natural gas reserves are located in the South Pars/North Dome field in the Persian Gulf.

Qatar has the third largest amount of natural gas reserves, with an estimated 893 trillion cubic feet. The vast majority of Qatar’s natural gas reserves are located in the North Field, which is also part of the South Pars/North Dome field.

Turkmenistan has the fourth largest amount of natural gas reserves, with an estimated 788 trillion cubic feet. These reserves are largely located in the Caspian Sea region.

The United States has the fifth largest amount of natural gas reserves, with an estimated 637 trillion cubic feet. The United States has a significant amount of unconventional gas resources, which include shale gas and tight gas.

While these five countries have the largest amount of natural gas reserves, it should be noted that much of these reserves are not yet exploited. For example, Russia has only exploited around 60% of its total natural gas reserves. As technology advances and more countries begin to exploit their own resources, we may see a shift in this ranking order in future years.

What are the World Top 5 Most Used Renewable Energy?

The World top 5 most used renewable energy are solar, wind, biomass, geothermal, and hydro. Solar power is derived from the sun’s energy and can be used to generate electricity or to heat water or air. Wind energy is created by the movement of the atmosphere and can be harnessed to generate electricity or to pump water.

Biomass is organic matter that can be converted into fuel, and it includes everything from wood to waste. Geothermal energy comes from the heat of the earth’s core, and it can be used to generate electricity or to heat buildings. Hydro power comes from the force of moving water, and it can be used to generate electricity or to pump water. All of these forms of renewable energy are important in helping to reduce our reliance on fossil fuels and in protecting the environment.

How Can we Produce Electricity?

There are many ways to produce electricity, but the most common method is by using a turbine. A turbine converts the energy from flowing water or steam into rotational energy, which is then used to generate electricity. The amount of electricity that can be generated by a turbine depends on the volume and speed of the water or steam passing through it.

Another way to produce electricity is by using solar panels. Solar panels convert sunlight into electrical energy. The amount of electricity that can be generated by solar panels depends on the amount of sunlight they receive.

Finally, wind turbines can also be used to generate electricity. Wind turbines work by converting the kinetic energy from the wind into rotational energy, which is then used to generate electricity. The amount of electricity that can be generated by a wind turbine depends on the speed of the wind.

All of these methods can be used to produce electricity. The most common method is by using a turbine, but solar panels and wind turbines are also effective methods.

Here are the Best Energy Sector Stocks

So, without further ado, here are the top energy stocks of the year:

1. Exxon Mobil Corporation (XOM)

Exxon Mobil Corporation is an American multinational oil and gas corporation headquartered in Irving, Texas. It is the largest direct descendant of John D. Rockefeller’s Standard Oil Company, and was formed on November 30, 1999 by the merger of Exxon and Mobil. ExxonMobil’s primary business is petroleum and petrochemical exploration and production; it also has significant refining and marketing operations.

The company has been accused of unethical behavior, particularly with regard to climate change, and has been the subject of multiple lawsuits. However, it remains one of the most profitable companies in the world, with a market capitalization of over $300 billion as of 2019. Despite its size and profitability, ExxonMobil faces a number of challenges in the coming years, including the transition to cleaner energy sources and increased regulation. Nevertheless, it remains one of the largest and most important oil companies in the world.

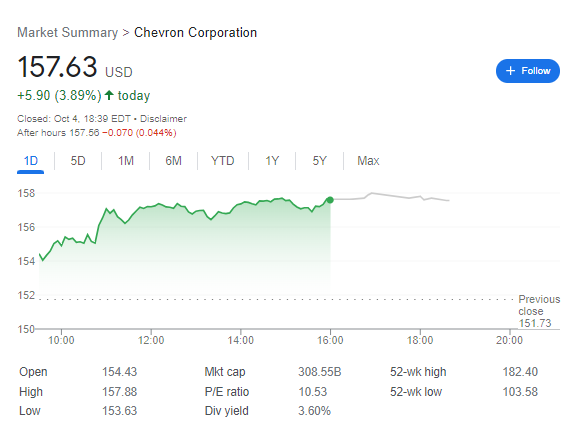

2. Chevron Corporation (CVX)

Chevron Corporation (CVX) is an American multinational energy corporation. Headquartered in San Ramon, California, and active in more than countries, it is engaged in every aspect of the oil, gas, and geothermal energy industries, including exploration and production, refining, marketing and transport, chemicals manufacturing and sales, and power generation. Chevron is one of the world’s largest oil companies; as of 2019, it ranked thirteenth in the Fortune 500 list of the largest United States corporations by total revenue.

It also ranked first in Petroleum and Natural Gas based on assets as of 2020. Chevron’s downstream operations manufacture and sell products such as lubricants , additives , gasoline , heating oil , motor oil , jet fuel , asphalt , Vice President – Investor Relations synthetic rubber .

The company’s most significant areas of operations are the west coast of North America South Africa Australia and South America . In 2020, Chevron sold its Geismar Louisiana chemical plant to Indorama Ventures for $3.3 billion. As of December 31 2020 Chevron had a market capitalization of $167.2 billion making it the 27th largest company in the United States by this metric. As of February 2021 Chevron was added to the Dow Jones Industrial Average replacing Pfizer which had split into two companies.

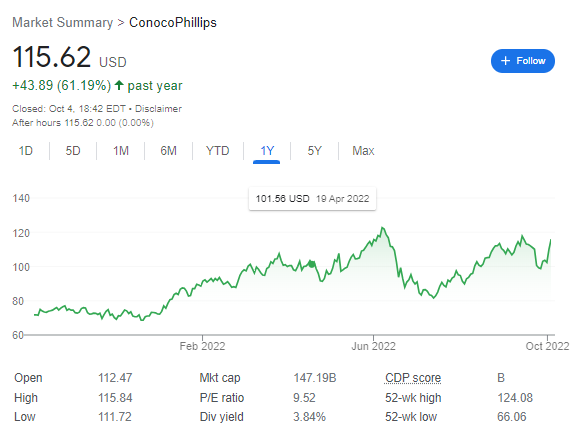

3. ConocoPhillips (COP)

ConocoPhillips is an American multinational energy company with its headquarters located in Houston, Texas. The company is engaged in the exploration, production, and marketing of crude oil and natural gas. As of December 31, 2019, the company had estimated proved reserves of 10.2 billion barrels of oil equivalent. In 2019, ConocoPhillips was the world’s largest independent exploration and production company based on production and proved reserves. The company’s operations are conducted through six business segments: Upstream, Midstream, Refining and Marketing, Chemical, Corporate, and Other.

ConocoPhillips was founded in 1875 as Continental Oil and Transportation Company. In 2017, the company announced it would be moving its corporate headquarters from Houston to Colorado Springs. In 2018, ConocoPhillips sold its San Juan Basin assets for $3.1 billion to DCP Midstream Partners.

The company’s common stock is traded on the New York Stock Exchange under the ticker symbol “COP.” As of February 21, 2020, ConocoPhillips had a market capitalization of $54.6 billion. It’s one of the best energy stocks.

The chairman and CEO of ConocoPhillips is Ryan Lance. The president of ConocoPhillips is Matt Fox.

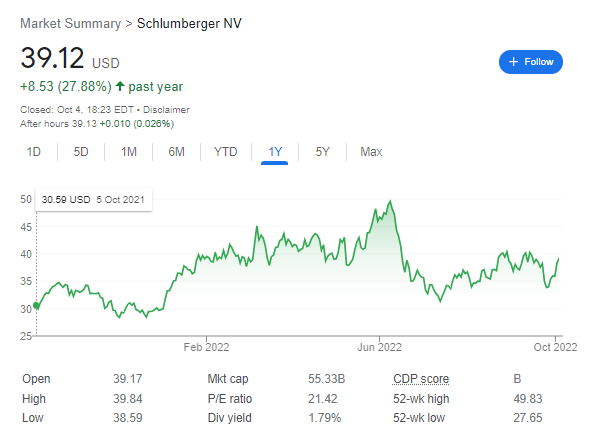

4. Schlumberger Limited. (SLB)

Schlumberger Limited is a French oil and gas company that provides services to the upstream oil and gas industry. Schlumberger is the world’s largest oilfield services company with operations in more than 85 countries. Schlumberger has two main business segments: exploration and production, and reservoir characterization and development.

Exploration and production services include drilling, testing, completion, and production services. Reservoir characterization and development services provide support for the planning and execution of reservoir development projects.

Schlumberger’s stock is traded on the New York Stock Exchange (NYSE) under the ticker symbol “SLB”. As of June 2020, Schlumberger had a market capitalization of $96.4 billion.

5. EOG Resources, Inc. (EOG)

EOG Resources, Inc. (EOG) is a publicly traded oil and gas exploration and production company with operations in the United States, Canada, Trinidad and Tobago, the United Kingdom, and China. EOG is one of the largest independent Exploration and Production (E&P) companies in the world with a proven reserve base of approximately 4 billion barrels of oil equivalent (BOE).

The company’s stock is listed on the New York Stock Exchange (NYSE) and is a component of the S&P 500 index. EOG operates in some of the most prolific oil and gas plays in the world including the Bakken Shale, Eagle Ford Shale, Permian Basin, and Williston Basin. The company has a strong reserve base in these plays as well as a large inventory of undeveloped drilling locations.

EOG also has significant positions in other key plays including the Barnett Shale, Haynesville Shale, Marcellus Shale, Montney Shale, Niobrara Shale, and Utica Shale. In 2017, EOG was ranked #1 in North America for crude oil reserves replacement ratio by Drillinginfo.com. The company’s stock has outperformed the broader energy sector as well as the S&P 500 index over the last ten years.

During this time frame, EOG has delivered annualized total returns of 18% to shareholders. Looking ahead, EOG is well-positioned to continue its success as it operates in some of the best basins in North America with a low-cost structure and a focus on value creation.

6. ChargePoint Holdings Inc. (CHPT)

Founded in 2007, ChargePoint Holdings Inc. (CHPT) is the leading provider of electric vehicle (EV) charging solutions. The company’s comprehensive product and service offerings include home chargers, public and semi-public chargers, fleet management solutions, office parking solutions, and residential parking solutions.

With over 70,000 charging stations across the globe, ChargePoint is committed to helping drivers make the switch to EVs. In addition to its expansive network of charging stations, ChargePoint also offers a suite of software products that helps drivers manage their electric vehicle charging experience.

The company’s web-based platform provides real-time data insights, customized settings, and remote monitoring capabilities. For businesses and organizations, ChargePoint’s Enterprise Suite includes features such as energy management and demand response integration. With its industry-leading products and services, ChargePoint is helping to accelerate the adoption of EVs worldwide.

7. Devon Energy Corporation (DVN)

Devon Energy Corporation (DVN) is an oil and gas exploration and production company with operations in the United States, Canada, and Australia. The company’s U.S. operations are focused in the Anadarko Basin, Permian Basin, STACK/SCOOP play in Oklahoma, and the Rockies. Devon Energy also has a number of international assets, including its interest in the Montney Formation in Canada and the Carnarvon Basin offshore Australia.

Devon Energy has a long history of success in oil and gas exploration and production. The company was founded in 1971 and was one of the original pioneers in horizontal drilling and hydraulic fracturing technologies. These technologies have allowed Devon Energy to tap into previously unreachable reserves of oil and gas, driving significant growth for the company.

Today, Devon Energy is one of the largest independent oil and gas producers in the world, with a market capitalization of over $20 billion. The company’s shares are traded on the New York Stock Exchange (NYSE) under the ticker symbol DVN.

Devon Energy is a well-established player in the oil and gas industry with a strong track record of success in energy industry. The company’s shares offer investors exposure to the sector through a high-quality company with a diversified portfolio of assets.

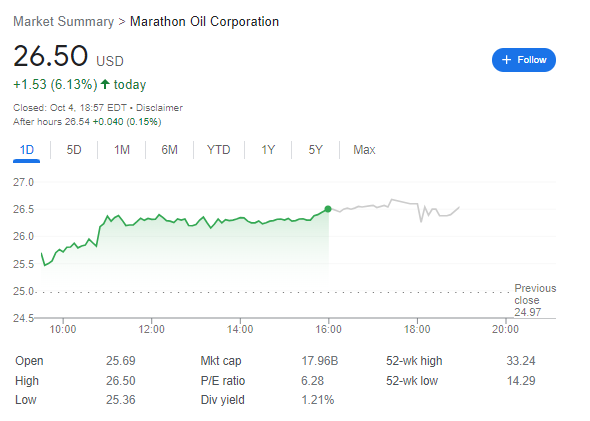

8. Marathon Oil Corporation (MRO)

Marathon Oil Corporation (MRO) is a leading international energy company with operations in more than 30 countries. The company is engaged in the exploration, production, and marketing of crude oil and natural gas. Marathon Oil also has refining and marketing operations in the United States, Canada, the United Kingdom, and Ireland. The company’s stock is traded on the New York Stock Exchange. Marathon Oil has a market capitalization of $25 billion.

Marathon Oil’s shares have outperformed the energy sector over the past year. The stock is up 25% during that period. Marathon Oil reported strong fourth-quarter results, with earnings and revenue beating analyst expectations. The company’s strong performance was driven by higher crude oil prices and cost-cutting measures.

Marathon Oil is one of the world’s largest independent oil companies, with a significant presence in some of the most active oil-producing regions. The company has a diversified portfolio of high-quality assets across the globe. Marathon Oil is well-positioned to benefit from higher crude oil prices in the future.

The company’s shares are attractively valued at current levels and offer upside potential. Marathon Oil is a good long-term investment.

9. Baker Hughes Incorporated (BHI)

Baker Hughes Incorporated (BHI) is an international provider of industrial technology and services for the oil and gas industry. It is headquartered in Houston, Texas and it has operations in more than 90 countries. The company’s product and service offerings include oilfield consulting, drilling, equipment manufacturing and maintenance, completion and production optimization services. Baker Hughes is a publicly traded company listed on the New York Stock Exchange (NYSE). As of May 2019, the company had a market capitalization of approximately $30 billion.

Baker Hughes has a long history, dating back to 1907 when two men – Edwin G. Baker and Howard R. Hughes Sr. – formed a partnership to sell rotary drill bits to the oil industry in Texas. The company has since grown through a series of acquisitions and strategic alliances. In 1987, Baker Hughes merged with General Electric Company’s oilfield services business to form Baker Hughes GE (BHGE), which was later spun off as an independent company in 2017.

Today, Baker Hughes is one of the leading providers of products and services to the oil and gas industry. It has a strong presence in North America, Europe, the Middle East and Asia Pacific region. The company employs more than 65,000 people and its products and services are used by customers in more than 100 countries.

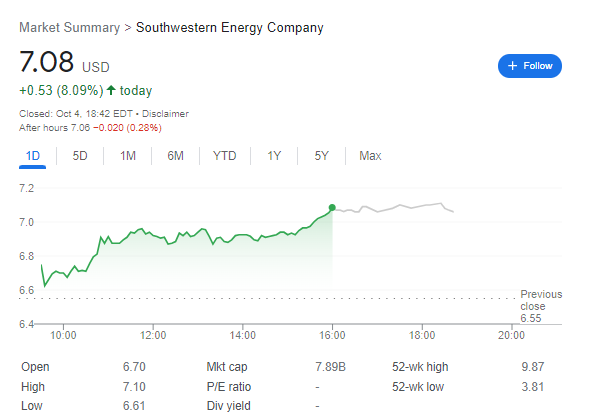

10. Southwestern Energy Company (SWN)

Southwestern Energy Company is a publicly traded company with a market capitalization of over $5 billion. The company is engaged in the exploration, development, and production of natural gas and oil in the United States. Southwestern Energy has operations in Arkansas, Louisiana, Oklahoma, Pennsylvania, and Texas. The company was founded in 1929 and is headquartered in Houston, Texas.

Southwestern Energy is one of the largest independent exploration and production companies in the United States with a focus on the Appalachian Basin and Arkansas’ Fayetteville Shale play. The company operates approximately 4,900 wells and has estimated proved reserves of over 10 trillion cubic feet of natural gas equivalent. Southwestern Energy’s stock is traded on the New York Stock Exchange under the ticker symbol SWN.

Southwestern Energy stock has a history of volatility but has generally trended upward over the past five years. The stock hit an all-time high in 2008 but then fell sharply during the financial crisis. Since then, the stock has recovered and reached new highs in recent years.

Overall, Southwestern Energy is a large and diversified energy company with a long history of operation. The company’s stock has been volatile but has generally trended upward over time. investors considering purchasing shares of SWN should research the company thoroughly before making any investment decisions.

What’s the Best Clean Energy for the Future?

There is no easy answer when it comes to the best clean energy for the future. With the rapid pace of climate change, it is clear that we need to transition to cleaner sources of energy as quickly as possible. However, there is debate about which clean energy source is the most effective and efficient.

Solar and wind power are two of the most popular renewable energy sources. Solar power harnesses the energy of the sun to generate electricity, while wind power uses the kinetic energy of wind turbines to generate electricity. Both solar and wind power are relatively inexpensive and have a low environmental impact.

However, solar and wind power also have some disadvantages. Solar power is only effective during daylight hours, while wind power is only effective when there is enough wind to turn the turbines. In addition, both solar and wind power require a significant amount of land in order to be effective.

Another option for clean energy is nuclear power. Nuclear reactors use uranium to generate electricity, and do not produce greenhouse gases during operation. Nuclear power plants also have a very small environmental footprint.

However, nuclear power also has some drawbacks. Nuclear accidents can have devastating consequences, and nuclear waste needs to be carefully managed and stored. In addition, nuclear power is expensive to build and maintain.

Ultimately, there is no perfect answer when it comes to the best clean energy for the future. Each type of clean energy has its own advantages and disadvantages, and the best option will vary depending on individual circumstances. However, it is clear that we need to transition to cleaner sources of energy in order to protect our planet from further damage.

Conclusion

These are all great companies to consider investing in and we expect them to continue performing well in the future. These best stocks can be a great way to diversify your portfolio and potentially make some big profits! Thanks for reading and we hope this was helpful.