In a world where the ebb and flow of financial markets can signal shifts in global economic landscapes, the movements of major stock indexes such as the Nikkei 225 today are closely monitored by investors and analysts alike. The Japanese Yen, Tokyo’s stock market, and indices like the Nikkei 225 index serve as bellwethers for not only Asia’s, but the global financial stability. The aftermath of the French election has painted a complex picture of mixed sentiments across global markets, spotlighting the interconnectivity of national events and their worldwide economic impact. This analysis becomes particularly pertinent when juxtaposed with the performance of other key Asian and global stock markets.

This article delves into the performance of the Nikkei 225 today, marking a decline of 0.3% amidst a backdrop of mixed global stocks following the French election results. The following sections will explore the wider Asian market trends, including the Shanghai Composite index, hong kong stock market today, and the S&P/ASX 200, providing insight into the current state of the Asian stocks and their implications for the global market. Additionally, the examination of the Nikkei 225 index today within this context aims to offer a comprehensive understanding of its position relative to other major indices such as Hong Kong’s Hang Seng index and the asx stock index. Through this, readers will gain a nuanced perspective on the dynamics influencing the nikkei 225 and the broader financial market landscape.

Global Market Overview

Impact of French Election

The recent French election has left the political landscape fragmented, with no single party securing a majority. This outcome has led to a mixed response in European markets. Initially, the euro and French bonds experienced fluctuations, but the euro eventually recouped its losses, and the yield spread between French and German bonds narrowed . Despite the divided parliament, European stock markets showed resilience. The CAC 40 in Paris initially dipped but later recovered, while Germany’s DAX and London’s FTSE 100 posted gains .

Mixed Performance in Major Markets

In contrast to Europe’s modest gains, Asian markets faced a downturn. The Hang Seng Index in Hong Kong dropped significantly by more than 1.5%, and Tokyo’s Nikkei 225 fluctuated throughout the day, ultimately closing slightly down. Other Asian markets like Sydney, Seoul, and Mumbai also experienced declines, reflecting the global uncertainty post-election . Meanwhile, Taipei emerged as a standout, with substantial gains driven by a surge in TSMC shares . This mixed performance underscores the varying impact of geopolitical events on global financial markets.

Performance of Nikkei 225

Factors Affecting Nikkei 225

The Nikkei 225, a prime indicator of Tokyo’s stock market health, is influenced by various global and domestic factors. Key fundamental events that impact the index include economic indicators such as GDP growth rates and employment data, which reflect the overall health of Japan’s economy . Monetary policies from the Bank of Japan, especially interest rate decisions, significantly affect the index by altering investment flows and economic activity . Additionally, global economic conditions and international trade dynamics, particularly with major partners like the USA and China, play a crucial role in shaping the index’s performance . Political stability within Japan and geopolitical events in the region also contribute to market volatility, thereby affecting the Nikkei 225 . Industry trends and innovations within major sectors such as technology and automotive, which are well-represented in the index, directly impact its performance .

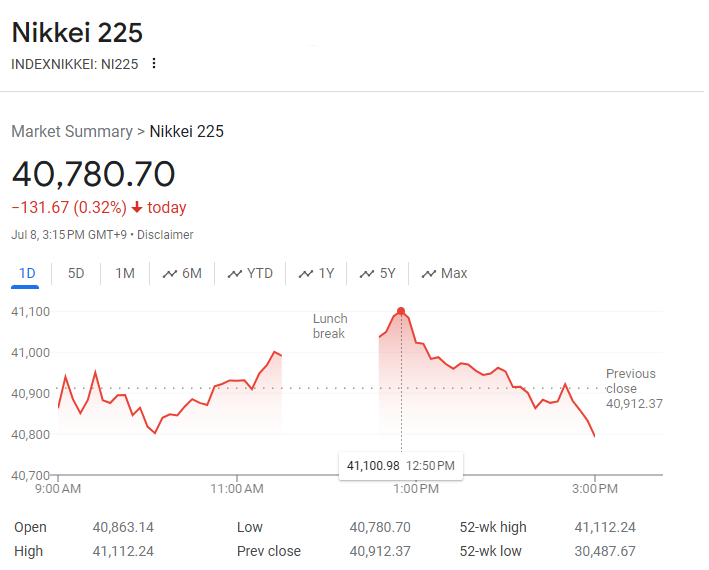

Key Statistics

On the day analyzed, the Nikkei 225 closed at 40,780.70, marking a decrease of 131.67 points or 0.32% . The index opened at 40,863.14 and fluctuated between a high of 41,112.24 and a low of 40,780.70 throughout the trading day . Over the past year, the index has seen a significant upward trend, with a year-to-date percentage change of 21.86% and a 1-year percentage change of 25.91%, reflecting robust growth amid fluctuating market conditions . The 52-week range for the Nikkei 225 has been between 30,487.67 and 41,112.24, indicating substantial volatility and trading opportunities . These statistics underscore the dynamic nature of the Nikkei 225 and its sensitivity to both domestic economic activities and international market shifts.

Asian Market Trends

Performance of Hang Seng Index

The Hang Seng Index, a major indicator of the Hong Kong stock market’s performance, experienced a notable decline, dropping 1.6% to close at 17,524.06 . This downturn reflects broader regional trends, influenced by global events such as the French elections and ongoing economic uncertainties.

Trends in Other Asian Markets

Asian markets overall have shown a downward trend in response to global and regional pressures. The Shanghai Composite index fell by 0.9% to 2,922.45, while Australia’s S&P/ASX 200 decreased by 0.8% to 7,763.20 . Similarly, South Korea’s Kospi edged lower by 0.2%, closing at 2,857.76 . These movements highlight the sensitivity of Asian markets to both domestic and international economic shifts.

Commodity Costs and Currency Effects

Rising commodity prices and fluctuating currency rates have significantly impacted Asian economies. The weakening yen and higher commodity costs have pushed up the cost of imports, affecting overall economic conditions in the region . For instance, the U.S. dollar strengthened against the Japanese yen, rising from 160.72 to 161.00 , further complicating the economic landscape for export-dependent Asian economies.

Conclusion

The analysis presented has meticulously explored the fluctuations in the Nikkei 225, illuminated by the backdrop of a mixed performance in global stocks following the recent French election. Through the lens of Asian market trends, commodity costs, and currency effects, we’ve embarked on a comprehensive journey understanding the dynamics at play within the global financial landscape. This synthesis not only stitches together the variegated financial outcomes across different geographies but also underscores the integral role of geopolitical events in shaping market sentiments and economic indicators.

Reflecting on the broader implications, it becomes evident that the interplay between political stability, global events, and economic policies continues to sculpt the contours of the financial markets. As we move forward, further research and keen observation of the mentioned factors will be pivotal in navigating the complexities of the global economy. It is in understanding these elements that investors and analysts can better position themselves in the ever-evolving marketplace, harnessing insights from today’s events to strategize for the uncertainties of tomorrow.