In the intricate mosaic of global financial markets, the Nikkei 225 today stands out as a crucial indicator of Asia’s economic heartbeat, particularly Japan’s. As one of the most watched stock indices in the Asian markets, the Nikkei 225 offers valuable insights into the economic dynamics of the region and serves as a barometer for the health of the Japan economy. Its movements are closely monitored by investors around the globe, seeking cues from its performance to make informed decisions on stock prices and market trends. Understanding the current state of the Nikkei 225 is essential for anyone looking to grasp the broader picture of economic health in Asia and, by extension, the global financial landscape.

This article aims to provide a comprehensive analysis of the Nikkei 225 today, including its current performance on the Tokyo Stock Exchange and the major factors influencing its movements. Through technical analysis and projections, we will delve into the intricacies of what drives changes in the Nikkei index, offering readers market insights that could inform investment decisions. Whether you’re an investor focused on Asian markets or someone keen on understanding the dynamics of the Japan economy, this article offers a detailed examination of current trends, challenges, and opportunities in the context of the Nikkei 225’s recent performance.

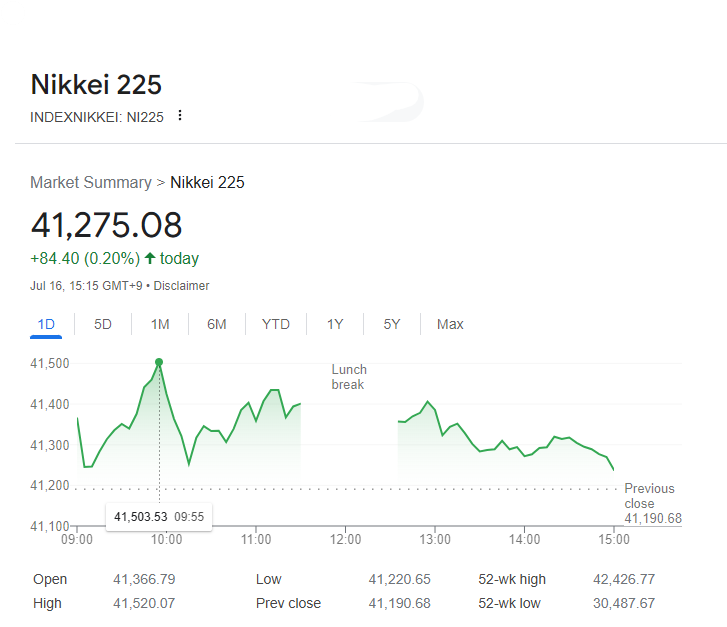

Current Performance of Nikkei 225

Latest Trends

The Nikkei 225 has been showcasing robust performance, notably trading near 33-year highs. This uptrend is attributed to Japan’s efforts in market restructuring and initiatives to attract foreign investment, which seem to be yielding positive results . Additionally, Japan’s GDP growth exceeded expectations in the first quarter of 2023, growing at a 2.7% annual rate, which is significantly higher than the anticipated 1.9% . Such economic indicators highlight a strong performance phase for the Nikkei 225, with the index climbing for three consecutive sessions and closing above 33,000 points for the first time since July 1990 .

Performance Metrics

In terms of specific metrics, the Nikkei 225 has advanced nearly 27% this year alone. On a recent trading day, the index increased by 1.8%, reflecting its ongoing positive momentum . Major contributors to this growth include prominent companies like Fast Retailing and SoftBank, with their American depositary receipts (ADRs) showing significant year-to-date gains of almost 27% and 7.3%, respectively . The weakening of the yen against the U.S. dollar has also played a crucial role, benefiting Japan’s vast export trades despite impacting the returns for U.S. investors . Furthermore, investment tracking through U.S. ETFs like the iShares MSCI Japan ETF and the WisdomTree Japan Hedged Equity Fund has shown impressive gains, underscoring the global interest in Japan’s equity market .

Major Factors Influencing Nikkei 225

Economic Data

The performance of the Nikkei 225 is significantly influenced by Japan’s economic indicators. Strong GDP growth, low unemployment, and robust industrial production typically boost investor confidence, leading to rises in the index. Conversely, weaker economic data can prompt declines. For instance, Japan’s GDP growth and inflation rates directly impact the index’s performance by shaping investor sentiment and expectations about the future economic environment .

Global Market Trends

Global market trends also play a crucial role in shaping the performance of the Nikkei 225. Movements in major international stock indices, such as the S&P 500 and the Dow Jones Industrial Average, often correlate with trends in the Nikkei 225. Positive developments in these indices generally lead to increased investor confidence globally, which in turn can boost the Nikkei 225. Similarly, downturns in global markets can lead to declines in the Nikkei index as investor sentiment sours .

Technical Analysis and Projections

Support Levels

The Nikkei 225 demonstrates resilience with a strong bullish pattern, maintaining a robust trajectory above key support levels. Currently, the index is vigilantly holding above the 38,260 short-term pivotal support. This level is critical as it forms a base for the ongoing bullish momentum. A failure to maintain this level could lead to a minor corrective decline towards the intermediate support at 37,570, and potentially further down to 36,880, which aligns with the upward sloping 20-day moving average .

Resistance Points

On the upside, the Nikkei 225 faces immediate resistance at 39,120 and a more significant barrier at 39,510/600, which marks the upper boundary of the minor ascending channel and a Fibonacci extension cluster level . These resistance points are crucial for determining the future trajectory of the index. A decisive break above these levels could pave the way for reaching new heights towards the medium-term resistance at 40,500/41,000, which coincides with the upper boundary of a major ascending channel projected from March 2020 and a Fibonacci extension cluster level .

Conclusion

Throughout this article, we’ve navigated the complexities of the Nikkei 225, illustrating its significance as a bellwether for Japan’s economic climate and a crucial component of the global financial ecosystem. The analysis has highlighted not only the index’s recent triumphant stance, with activities nearing 33-year highs, but also delved into the intricate elements that drive its performance. Reflecting on the vigorous GDP growth rate and the impactful contributions of leading companies, it becomes evident how these factors fortify investor confidence and shape the Nikkei 225’s trajectory.

Looking forward, understanding the dynamics of the Nikkei 225 remains vital for investors and analysts alike, offering a lens through which the health of the global economy can be viewed. The insights provided into the promising trends and the potential challenges ahead serve as a foundation for future analysis and decision-making. As we consider the broader implications of these findings, it’s clear that the Nikkei 225 will continue to be a pivotal index for tracing economic vitality in Japan and an indicator of global market sentiment, meriting close observation and study in the evolving landscape of international finance.