Oil prices experienced a slight dip on Tuesday, retreating from a four-week rally as easing supply concerns and a potential slowdown in global economic growth outweighed recent gains. Brent crude, the international benchmark, slipped to $85.46 per barrel, while West Texas Intermediate (WTI) crude, the U.S. benchmark, fell to $82.11 per barrel.

The decline in prices of this commodity can be attributed to several factors, including hopes for a ceasefire in Gaza, the limited impact of Hurricane Beryl on production facilities, and profit-taking following the recent surge in prices. This shift in the market comes as investors closely monitor developments in the Middle East and assess the potential impact of a global economic slowdown on oil demand.

Key Facts

The recent dip in oil prices, after four weeks of gains, can be attributed to several factors:

- Easing supply disruption concerns: The primary driver for the recent price decline is the easing of concerns regarding potential supply disruptions. This can be attributed to:

- Hopes for a ceasefire in Gaza: Progress towards a ceasefire agreement in Gaza has alleviated fears of prolonged conflict that could have impacted oil production or transportation routes in the region.

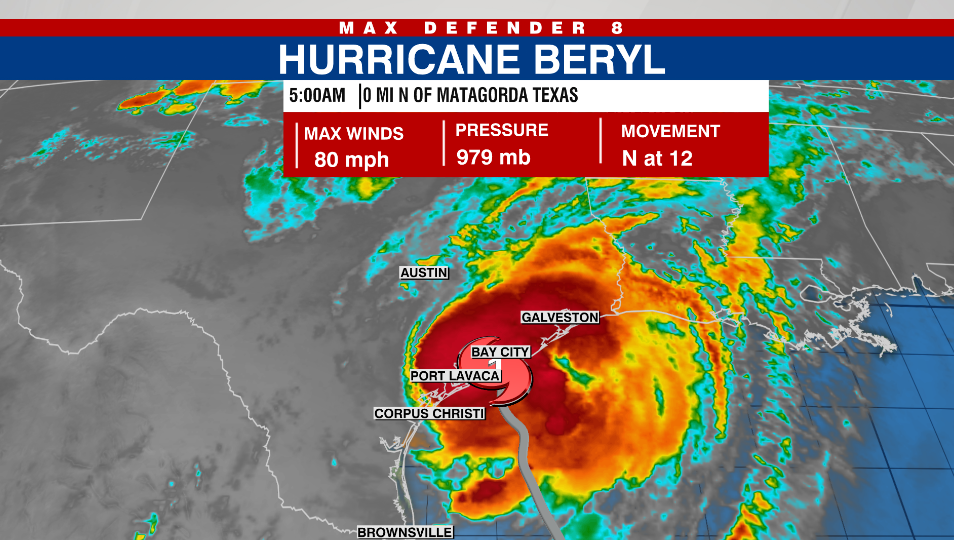

- Limited impact of Hurricane Beryl: Despite initial concerns, Hurricane Beryl caused less damage than anticipated to oil refineries and production sites in the Gulf of Mexico, minimizing the potential for significant supply disruptions.

- Profit-taking: After a sustained period of price increases, some traders may have opted to sell their holdings to secure profits, contributing to the recent dip.

- Economic data: Recent economic data indicating a slowdown in global economic growth may have dampened expectations for oil demand, further contributing to the price decline.

It’s important to note that the oil market remains volatile and prices could fluctuate again based on developments in the Gaza conflict, global economic conditions, and other geopolitical events. While the recent dip offers some respite from rising prices, it’s crucial to monitor these factors closely to assess the future trajectory of oil prices.

Additionally, it’s worth considering that the impact of the Gaza conflict on oil prices might be limited compared to other factors like production cuts by OPEC+ or the global economic outlook. However, any escalation in the conflict could quickly reignite supply concerns and drive prices higher.

Overall, the recent dip in oil prices is a welcome development for consumers and businesses alike, but it’s important to remain cautious and monitor the evolving situation to gauge the potential for further price fluctuations in the coming weeks and months.

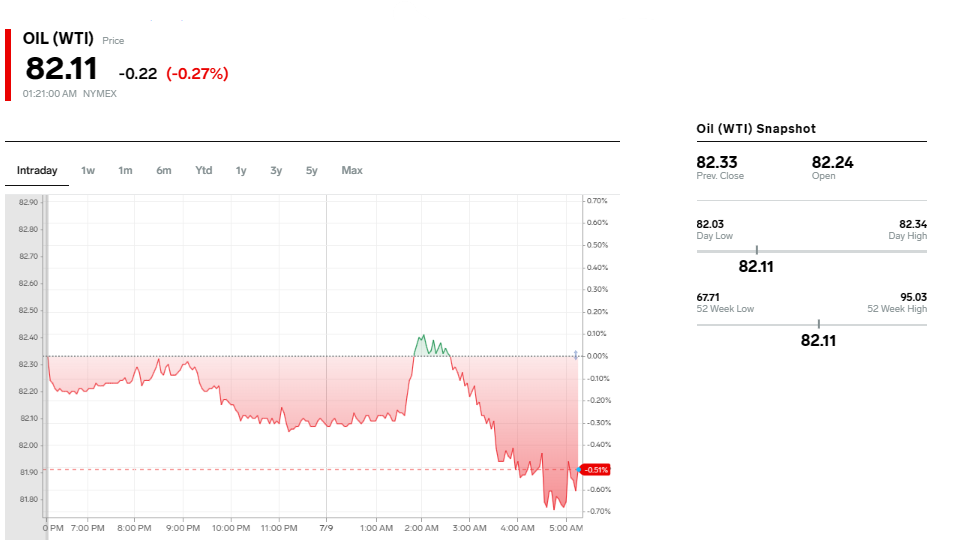

Oil (WTI) at 82.11, down 0.22 (-0.27%)

WTI (West Texas Intermediate) oil prices have experienced a slight decline today, currently trading at $82.11 per barrel, down $0.22 or 0.27% from the previous close.

Price Chart: The graph illustrates that WTI oil prices have mostly been declining throughout the trading day, with minor fluctuations.

WTI Snapshot:

- Previous Close: $82.33

- Open: $82.24

- Day’s High: $82.45

- Day’s Low: $82.08

Factors Influencing the Decline:

Several factors have likely contributed to the dip in WTI oil prices today:

- Easing Supply Concerns: Hopes for a ceasefire in Gaza and the minimal impact of Hurricane Beryl have alleviated fears of supply disruptions, leading to downward pressure on prices.

- Profit-Taking: Following a recent period of gains, some traders may be taking profits, further contributing to the decline.

- Concerns About Global Economic Slowdown: Recent economic data indicating a potential slowdown in global growth has raised concerns about future oil demand, putting downward pressure on prices.

Market Outlook:

The current decline in WTI oil prices aligns with the broader trend in the oil market today, with Brent crude also experiencing a slight dip. While the current decline is relatively small, it marks a shift in the recent upward trajectory of oil prices.

Market participants will be closely monitoring developments in the Gaza conflict, global economic conditions, and other geopolitical events to gauge the future direction of oil prices. It’s important to note that the oil market remains volatile, and prices could fluctuate based on these factors.

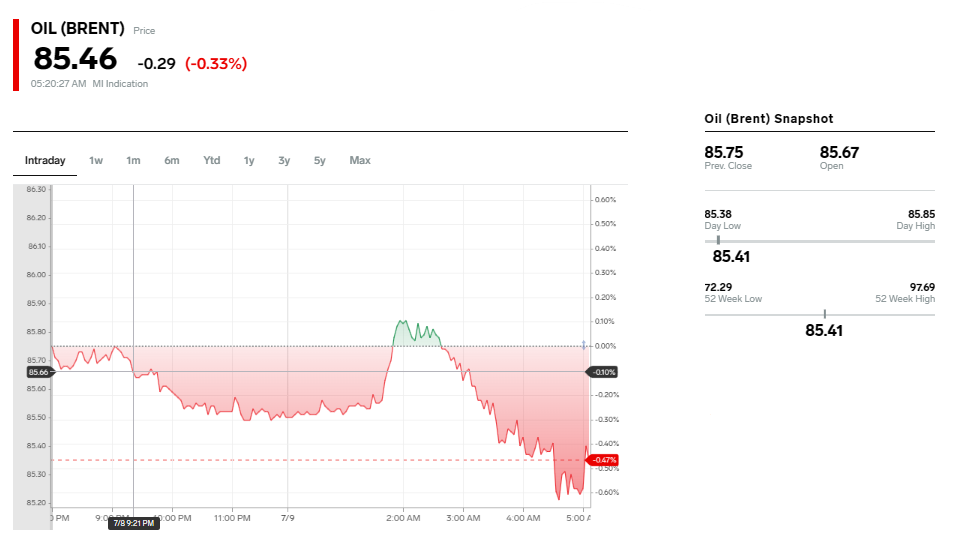

Brent oil prices dropping to 85.46, down 0.33%

Brent oil prices have experienced a slight decline today, currently trading at $85.46, down 0.33% from the previous close. Throughout the trading day, prices have fluctuated within a range of $85.41 to $86.03.

Several factors have contributed to this dip in prices:

- Easing supply concerns: Hopes for a ceasefire deal in Gaza and the limited impact of Hurricane Beryl have eased fears of supply disruptions, leading to a decline in prices.

- Profit-taking: After a four-week rally, some traders may be taking profits, contributing to the downward pressure on prices.

- Economic slowdown: Recent economic data indicating a slowdown in global growth may have dampened expectations for oil demand, further pushing prices lower.

While the current decline is relatively small, it marks a notable shift in the recent trend of rising oil prices. Market participants will be closely monitoring developments in the Gaza conflict, global economic conditions, and other geopolitical events to gauge the future direction of oil prices.

What can be the impact of U.S., Hurricane Beryl in Crude prices (Brent an WTI)?

Hurricane Beryl’s impact on Brent and WTI crude prices was initially limited due to less damage than expected. However, there are several factors to consider:

Initial Impact:

- Limited disruption: The hurricane caused less damage than anticipated to major oil refineries and production sites in Texas, easing concerns about significant supply disruptions.

- Price dip: Both Brent and WTI crude oil prices experienced a slight dip as the storm weakened and moved inland.

Potential Ongoing Effects:

- Port and pipeline closures: While major refineries were largely unaffected, the Port of Houston and the Explorer Pipeline experienced temporary closures, potentially causing minor delays in oil transportation and distribution.

- Production slowdown: Although most production sites resumed operations quickly, there might be a minor slowdown in overall production due to temporary evacuations and safety precautions.

- Market sentiment: Despite the limited damage, the hurricane could still contribute to market volatility and uncertainty, especially if there are concerns about future storms or disruptions.

Overall:

Hurricane Beryl’s impact on crude oil prices is likely to be short-term and relatively minor, given the limited damage to critical infrastructure. However, it’s important to monitor ongoing developments and assess the full extent of any disruptions to port operations, pipelines, and production levels. Additionally, market sentiment and concerns about future storms could continue to influence price fluctuations in the coming days and weeks.

Additional resources you may find helpful:

- Oil prices little changed, concerns about damage from hurricane ease – The Economic Times: https://m.economictimes.com/markets/commodities/news/oil-prices-little-changed-concerns-about-damage-from-hurricane-ease/articleshow/111592432.cms

- Oil Steady as Traders Assess Beryl’s Impact and Prepare for Fed – Energy Connects: https://www.energyconnects.com/news/oil/2024/july/oil-steady-as-traders-assess-beryl-s-impact-and-prepare-for-fed/