In the ever-evolving landscape of the stock market, identifying the top stock gainers today can provide investors with critical insights into market trends and potential investment opportunities. The dynamic nature of the markets means that the stocks making significant moves on the S&P 500, Nasdaq, and other indices are a beacon for traders and investors looking to capitalize on momentum. Understanding which companies are experiencing substantial gains is essential for developing informed trading strategies and making intelligent investment choices in a landscape that rewards timely and well-informed decisions.

This article delves into the specifics of some of the biggest stock gainers today, including Morphic Holding Inc (MORF), Grifols SA (GRFS), R1 RCM Inc (RCM), IDEAYA Biosciences Inc (IDYA), and Lucid Group Inc (LCID). These companies have shown remarkable performance in the market, contributing to the day’s discussions on market movers and shaping trading strategies. By examining their market cap, recent performance, and potential drivers of their stock movements, investors can gain a deeper understanding of why these stocks stand out as the best stocks today and how they might fit into a broader investment strategy. Insights into their performance can serve as a guide for both seasoned and aspiring investors aiming to navigate the complexities of the stock market successfully.

Morphic Holding Inc (MORF)

Morphic Holding Inc (MORF) is a notable biopharmaceutical company dedicated to the discovery and development of oral small-molecule integrin therapeutics. Their leading product, MORF-057, is currently making strides in Phase 2 clinical trials aimed at treating inflammatory bowel disease. Over the past year, Morphic Holding has experienced significant momentum in its stock price, which more than doubled due to positive clinical data for MORF-057 and advancements in its pipeline of integrin-based therapies .

MORF Stock Momentum

The company recently announced the initiation of a Phase 2 clinical trial for MORF-057 in patients with ulcerative colitis and shared encouraging results from a Phase 1 trial of MORF-720, aimed at treating idiopathic pulmonary fibrosis. This progress has substantially fueled investor interest and led to several analyst upgrades and price target increases .

MORF Recent Developments

In a significant corporate development, Morphic Holding Inc is set to be acquired by Eli Lilly and Company for approximately $3.2 billion. This acquisition, expected to close in the third quarter of 2024, represents a premium of about 79.0% to the closing stock price on July 5, 2024, highlighting the substantial value recognized in Morphic’s innovative approach and promising drug pipeline .

MORF Investor Sentiment

Investor sentiment towards Morphic Holding remains positive, reflecting in various market analyses. The Relative Strength Index (RSI) for Morphic’s share is around 48, indicating a neutral market position, likely near its support level. This metric, along with the analysis of Morphic Holding’s hype-based predictions and investor biases, suggests a balanced view of the stock’s potential movements. Moreover, the implied volatility indicates that the market perceives potential for significant price swings, which could present opportunities for astute investors .

Morphic Holding Inc stands out in today’s market for its robust clinical developments and the significant corporate milestone of its impending acquisition, positioning it as a compelling choice for investors looking for growth and innovation in the biopharmaceutical sector.

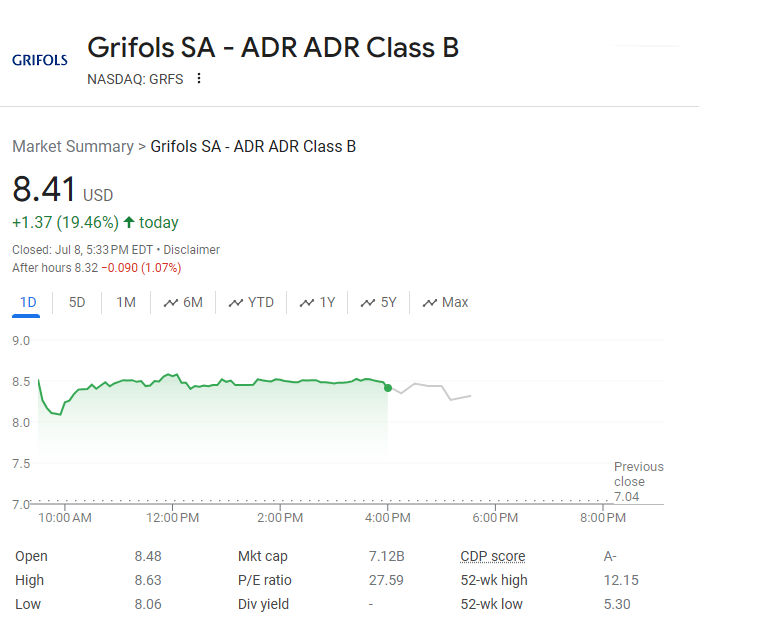

Grifols SA (GRFS)

Grifols SA (GRFS) operates as a global healthcare company specializing in plasma-derived medicines, with a significant presence in the production and distribution of these products alongside diagnostic and hospital pharmacy products. Recent developments have seen Grifols expanding its production capacity and venturing into new markets, which has positively influenced its stock momentum.

GRFS Stock Momentum

The company’s stock has shown strong momentum in recent months, attributed to its strategic expansions and operational enhancements. This upward trend is supported by positive investor sentiment and strong analyst ratings, reflecting confidence in Grifols’ financial and operational strategies.

GRFS Recent Developments

A key development for Grifols includes the acquisition of a 20% equity stake in Shanghai RAAS Blood Products Co., Ltd., which marks a significant strategic expansion in the Asian market. This move is part of Grifols’ broader strategy to enhance its global footprint and build on its core capabilities in plasma collection and processing .

GRFS Investor Sentiment

Investor sentiment towards Grifols has generally been positive, although it has faced fluctuations due to various factors including earnings reports and market conditions. For instance, recent earnings missed analyst estimates, which temporarily affected stock prices and investor confidence. However, the company’s long-term strategic initiatives, including significant investments in R&D and global expansion, continue to bolster investor outlook .

Grifols’ commitment to advancing plasma-derived therapies and expanding globally positions it well within the healthcare sector, making it a noteworthy entity for investors focusing on long-term growth and innovation in biopharmaceuticals.

R1 RCM Inc (RCM)

R1 RCM Inc (RCM), a leader in revenue cycle management (RCM) solutions, caters predominantly to healthcare organizations. Their comprehensive services range from patient access and revenue integrity to enhancing the patient financial experience . With a focus on sustainable financial improvements, R1 RCM’s technology and expertise are crucial for hospitals and health systems aiming to improve their financial performance and patient care .

RCM Stock Momentum

The company’s stock has demonstrated significant momentum recently, with a notable rise in share price. This increase is largely attributed to R1 RCM’s robust financial performance and promising growth prospects, bolstered by their strategic expansions and new client acquisitions .

RCM Recent Developments

In recent strategic moves, R1 RCM has expanded its service offerings and secured new client contracts, which have contributed positively to its market presence. Notably, the company has also made strategic acquisitions to enhance its operational capabilities, further solidifying its position in the healthcare technology sector .

RCM Investor Sentiment

Investor sentiment towards R1 RCM is overwhelmingly positive, reflecting confidence in the company’s future. Analysts and investors have favorably rated the stock, underpinned by R1 RCM’s continuous financial growth and expansion into new markets . This positive outlook is supported by the company’s recent presentations at major healthcare conferences, which have highlighted its strategic initiatives and growth trajectory .

R1 RCM’s commitment to leveraging technology for financial and patient care improvements makes it a standout in today’s healthcare sector, appealing to investors looking for robust growth and innovation.

IDEAYA Biosciences Inc (IDYA)

IDEAYA Biosciences Inc (IDYA) is a clinical-stage precision oncology company dedicated to developing targeted therapeutics. Their focus on molecular diagnostics to select patient populations has led to significant advancements in their pipeline, including therapies based on synthetic lethality and immuno-oncology approaches .

IDYA Stock Momentum

The stock of IDEAYA Biosciences has demonstrated strong momentum, with a notable increase of over 50% year-to-date. This growth is attributed to positive developments in their clinical trials and strategic collaborations .

IDYA Recent Developments

IDEAYA Biosciences has made considerable progress in its clinical programs. The initiation of Phase 2 trials for IDE196 in metastatic uveal melanoma and the presentation of Phase 1 data for IDE397 at a major oncology conference are among the key developments. Additionally, the company has expanded its collaborations with major pharmaceutical firms such as Pfizer and Novartis, which helps advance its targeted oncology therapies .

IDYA Investor Sentiment

Investor sentiment towards IDEAYA Biosciences is overwhelmingly positive, bolstered by several analyst upgrades and price target increases. The company’s strategic moves and the potential of its product pipeline continue to attract investment, reflecting confidence in its future prospects .

IDEAYA Biosciences stands out as a high-growth potential stock in the biopharmaceutical sector, particularly appealing to growth investors interested in precision medicine and oncology .

Lucid Group Inc (LCID)

Lucid Group Inc (LCID), a prominent player in the electric vehicle (EV) sector, has garnered attention with its high-performance luxury vehicles, particularly the flagship model, the Lucid Air. Known for its impressive range, sleek design, and advanced technology, Lucid continues to push the boundaries of EV innovation .

LCID Stock Momentum

Lucid Group’s stock has experienced significant volatility since its public debut in 2021. Initially, the stock surged to over $60 per share, driven by investor enthusiasm for the company’s potential. However, shares have since traded in the $20-$30 range, reflecting the broader market’s fluctuations and the challenges of scaling production .

LCID Recent Developments

In a strategic move to expand its market presence, Lucid has announced the launch of its more affordable Lucid Air Touring model. Additionally, the company is enhancing its manufacturing capabilities with plans to open a new factory in Saudi Arabia. These developments are part of Lucid’s ongoing efforts to meet growing demand and compete effectively in the global EV market .

LCID Investor Sentiment

Investor sentiment towards Lucid has been mixed, influenced by both the company’s promising advancements and the challenges it faces in ramping up production. While some investors remain optimistic about Lucid’s long-term potential, others are cautious, given the competitive nature of the EV industry and the need for consistent production growth .

Lucid’s commitment to innovation and its strategic initiatives to expand globally and improve production capabilities make it a notable company in the EV sector, attracting investors who are keen on advanced technology and sustainable transportation solutions.

Conclusion

Throughout our exploration of today’s most significant stock gainers, we’ve delved into the compelling narratives of companies like Morphic Holding Inc, Grifols SA, R1 RCM Inc, IDEAYA Biosciences, and Lucid Group Inc, each leading its respective field with innovation and strategic market moves. These companies, standing at the forefront of industries as diverse as biopharmaceuticals, healthcare services, and electric vehicles, not only underscore the vibrant dynamism of the stock market but also highlight sectors where growth and investor interest converge in response to technological advancements and strategic expansions.

These narratives reaffirm the importance of staying informed and agile in the constantly shifting landscape of investment opportunities. Whether it’s the groundbreaking clinical trials of Morphic Holding, Grifols’ strategic global expansions, R1 RCM’s advancements in healthcare technology, IDEAYA Biosciences’ pioneering precision oncology therapies, or Lucid Group’s innovations in electric vehicles, each story offers insights into where the market is moving and where future opportunities might lie. As the financial market continues to evolve, keeping a close eye on these developments will be key for investors aiming to capitalize on the next wave of market leaders and innovators.