Monitoring the FTSE 100 today live offers invaluable insights into the global financial landscape, acting as a barometer for the health of the UK’s economy and investor sentiment. The movements within the FTSE 100, consisting of the largest 100 companies listed on the London Stock Exchange, are critical for investors, analysts, and the business community at large to understand. With factors such as geopolitical events, economic indicators, and company performances influencing its fluctuation, the importance of staying updated with the FTSE 100 today live chart cannot be overstated. These movements provide a snapshot of market trends, guiding investment decisions and financial strategies.

This article aims to give readers a comprehensive overview of the day’s activity on the FTSE 100, starting with the opening bell and moving through to the market close. It will include a thorough analysis of mid-morning and afternoon market behavior, summarizing the day’s events with a focus on key movers – the FTSE 100 fallers today live and the FTSE 100 risers today live. Additionally, the role of broader market drivers will be dissected, alongside expert opinions and predictions for future trends. For anyone looking to understand the dynamics of the FTSE 100 today live, including investors tracking the FTSE 100 chart or the broader FTSE 250 index, this article serves as a crucial guide to making informed decisions in the fast-paced world of finance.

FTSE 100 Opening Bell

Initial Performance

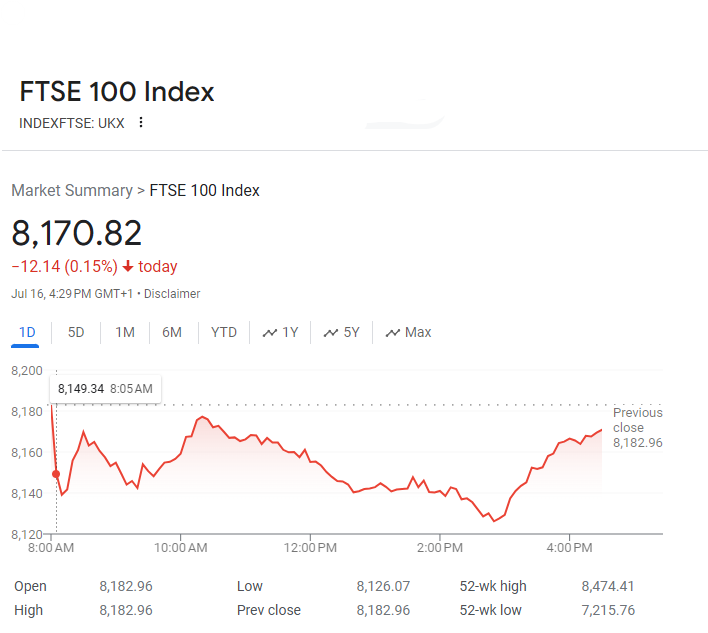

The FTSE 100 index experienced a subdued trading session today, closing at 8,170.82. This represents a decrease of 12.14 points or 0.15% compared to the previous day’s close. Throughout the day, the index exhibited fluctuations, reaching an intraday high of 8,149.34 before ultimately settling at its closing value.

The overall performance of the FTSE 100 today can be characterized as a slight decline, reflecting a cautious sentiment among investors. Several factors may have contributed to this performance, including global economic concerns, geopolitical events, or specific developments affecting the companies listed on the index.

Despite the slight decline, the FTSE 100 remains a key indicator of the UK stock market’s health and is closely monitored by investors and analysts worldwide. It is important to note that daily fluctuations are common in the stock market and do not necessarily indicate a long-term trend. Investors are advised to consider a broader timeframe and a range of factors when assessing the market’s performance.

Key Performers

Among the standout performers in the early trading hours, Rolls-Royce led the way, buoyed by positive reactions to its ongoing turnaround strategy under the leadership of CEO Tufan Erginbilgiç . This positive sentiment is a continuation of the trend observed last year, positioning Rolls-Royce as a significant contributor to the index’s performance . On the broader scale, the FTSE 100’s movement also reflects the broader UK market’s resilience, despite challenges such as potential government changes and economic uncertainties highlighted by the Bank of England’s monetary policy dilemmas .

The index’s performance is not only a reflection of individual corporate successes but also indicative of underlying economic currents and investor sentiment towards the UK market, making it a critical watchpoint for both domestic and international investors .

Mid-Morning Market Analysis

Major Indices Performance

During the mid-morning session, major indices demonstrated a positive trajectory. The S&P 500 index saw a modest increase of 0.3%, while the Nasdaq Composite experienced a slightly higher rise of 0.4%. The Dow Jones Industrial Average also contributed to the upward trend with a gain of 0.2% .

Sectoral Gains and Losses

In terms of sector performance, technology and consumer discretionary stocks led the gains, each rising by 0.6% and 0.5% respectively. These sectors showed resilience and investor confidence, reflecting optimism in their growth potential. Conversely, the energy and materials sectors faced slight declines, with energy stocks down by 0.3% and materials dipping by 0.2%, indicating a more cautious approach from investors in these areas .

Afternoon Market Recap

Significant Market Movements

The afternoon session witnessed a downturn in the market, primarily driven by investor concerns about the Federal Reserve’s intent to continue raising interest rates in response to inflationary pressures. The Dow Jones Industrial Average fell by 0.3%, while the S&P 500 and Nasdaq Composite saw declines of 0.5% and 0.7%, respectively . This downward trend was exacerbated by ongoing global economic uncertainties, including trade tensions between the U.S. and China and the potential impacts of the coronavirus outbreak on the global economy .

The energy sector emerged as the worst performer within the S&P 500, experiencing a notable drop of 1.6% due to declining oil prices . Similarly, the technology and consumer discretionary sectors also lagged behind the broader market, reflecting a cautious stance among investors .

Despite the overall negative trend, there were isolated instances of significant gains. Notably, Tesla’s stock rose by 4.8% following the announcement of robust vehicle deliveries, highlighting the market’s responsiveness to positive corporate news amidst broader economic concerns .

Global Market Influence

The FTSE 100‘s performance during the afternoon was significantly influenced by its international diversification and exposure to global economic activities. Over four-fifths of the sales from FTSE 100 companies are generated outside the UK, underscoring the index’s global reach and its susceptibility to worldwide economic shifts . Additionally, the index is particularly sensitive to changes in the UK currency; a weakening sterling typically boosts the FTSE 100 as foreign earnings increase in value when converted to pounds .

The index’s heavy weightings in the natural resources sectors, such as energy and basic materials, mean it is highly exposed to global economic trends. This exposure was evident in the afternoon’s trading session, where global dynamics played a crucial role in shaping market outcomes .

Market Close Summary

Final Performance Overview

The FTSE 100 concluded the trading day with a decline, closing at 8,182.96, down by 69.95 points or 0.9% . This marked a notable shift from the day’s high of 8,182.96, reflecting a broader downturn across several sectors . The FTSE 250 and AIM All-Share also experienced slight declines, closing down by 13.37 points and 0.69 points, respectively . Comparatively, major indices in New York presented a contrasting scenario, with the Dow Jones Industrial Average up by 0.8%, and the Nasdaq Composite rising by 1.3% at the close of European markets .

Key Takeaways

Luxury retail and mining sectors were among the hardest hit in the London market. Notably, Burberry‘s shares plunged by 16% following the departure of its CEO and the suspension of dividend payments, reflecting investor concerns over its future financial health . Similarly, miners like Antofagasta and Anglo American saw declines of 3.6% and 1.3%, respectively, influenced by disappointing economic data from China, a significant consumer of minerals . On the currency front, the pound ended slightly lower against the dollar, trading at USD1.2984, while the euro saw a minor increase .

Internationally, the performance of European indices also trended downwards with the CAC 40 and DAX 40 dropping by 1.2% and 0.8%, respectively . This broader decline in European markets underscores the global economic challenges impacting investor sentiment and market dynamics.

The day’s market movements highlight the sensitivity of the FTSE 100 to global economic shifts and investor reactions to corporate news, making it a critical index for gauging the economic climate in the UK and beyond.

Market Drivers

Economic Indicators

Economic indicators play a pivotal role in shaping market performance. Key metrics such as GDP growth, unemployment rates, and consumer spending significantly influence the FTSE 100 and broader market trends. For instance, robust GDP growth often signals a healthy economy, which can boost investor confidence and drive up stock prices. Conversely, high unemployment rates might indicate economic struggles, potentially leading to decreases in market indices .

Corporate Announcements

The impact of corporate announcements on market movements cannot be understated. Earnings reports, mergers and acquisitions, and new product launches are critical events that investors watch closely. Positive earnings reports or successful product launches can lead to stock price increases, while announcements of mergers and acquisitions provide insights into future corporate strategies and potential market shifts. These announcements directly influence the FTSE 100 as they affect the investor sentiment and the strategic direction of the companies within the index .

Expert Opinions and Predictions

Economist Views

In the current financial climate, economists are closely monitoring the FTSE 100, which was reported to be 0.3% lower at 8,160, reflecting a cautious sentiment ahead of significant economic data releases . This downturn is seen in the context of broader European market trends and is pivotal as it precedes the Bank of England’s policy rate decision scheduled for early August. The upcoming sessions are expected to unveil critical price and unemployment data, which could heavily influence future monetary policies .

Future Market Expectations

Looking ahead, the FTSE 100 shows a varied forecast over the next few years, with predictions indicating both upward and downward trends. For instance, the index is expected to see a slight increase of 0.4% in July 2024, followed by a minimal rise of 0.2% in August 2024. However, a notable decline of 1.3% is anticipated by September 2024 . This pattern of fluctuation continues into the following years, with December 2026 marking a 2.1% increase, while a significant drop of 12.2% is forecasted for September 2026 . These forecasts suggest a volatile period for the FTSE 100, reflecting the complex interplay of global economic forces and domestic financial activities. As we move further into the decade, predictions for the index become increasingly optimistic, with a steady rise expected to begin from early 2027, culminating in a 4.1% increase by March 2028 . This long-term outlook provides crucial insights for investors and policymakers alike, highlighting the need for strategic planning in response to predicted market conditions.

Conclusion

Reflecting on the day’s trading activity, the FTSE 100’s movements paint a vivid picture of the current state of the UK’s economic health and the broader global financial landscape. Throughout the day, from an optimistic opening bell to a cautious market close, the index’s fluctuations highlighted the interplay between corporate developments, geopolitical events, and investor sentiments. This narrative not only underscores the significance of keeping abreast of the FTSE 100 for informed investment decisions but also encapsulates the dynamic nature of financial markets, influenced by a myriad of factors ranging from economic indicators to corporate announcements.

Moving forward, it is imperative for stakeholders – ranging from individual investors to financial analysts – to digest these daily market movements as part of a larger economic puzzle. Understanding the underlying causes of these shifts, and the broader implications they may hold for future market behavior, remains crucial. As the global economic conditions continue to evolve, so too will the strategies required to navigate these complexities. Hence, staying informed and adaptable is paramount in leveraging these insights for more prudent investment choices and financial planning, amidst the ever-changing landscape of the global markets.