SEPA Instant payments are transforming the European financial landscape, offering a fast and seamless way to transfer money across borders. As reported by FintechZoom.com, these instant payments are gaining traction due to their ability to enhance customer experience and improve interoperability between financial institutions. The European Payments Council has been at the forefront of developing SEPA instant payments, aiming to create a unified and efficient payment system across the continent.

With new instant payment regulations on the horizon, banks face the challenge of adapting to evolving requirements. FintechZoom.com highlights that these upcoming changes will impact how financial institutions handle SEPA instant transactions. This article will explore the current state of SEPA instant payments, delve into the forthcoming regulations, and discuss how banks can prepare to comply with these new standards. Additionally, we’ll examine the potential benefits and challenges that lie ahead for both banks and consumers in this rapidly changing payments landscape.

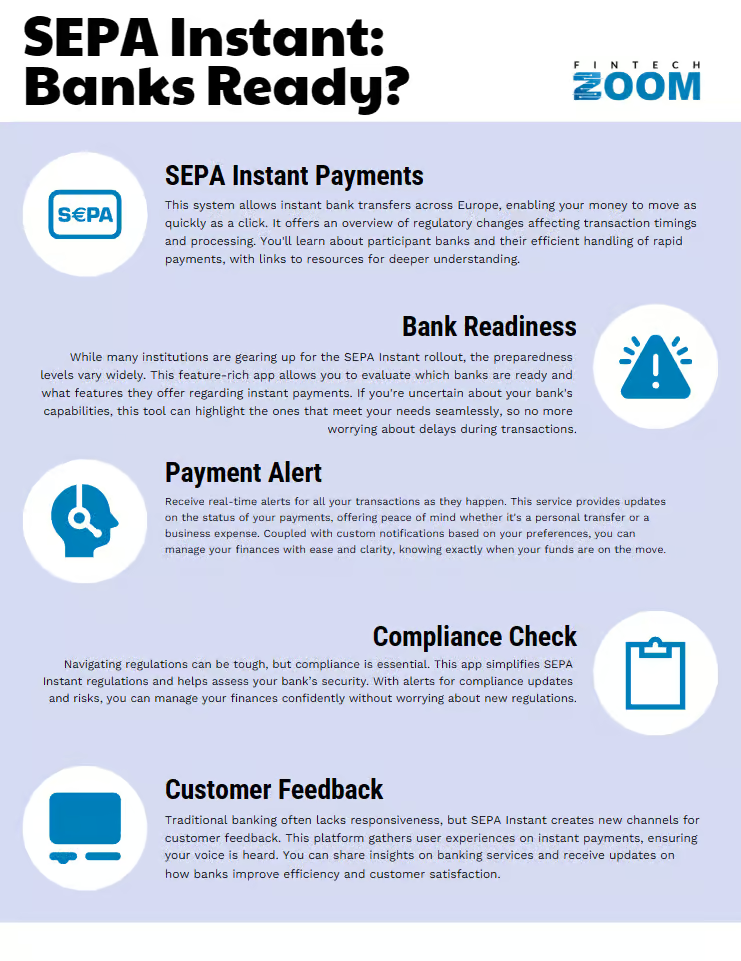

Overview of SEPA Instant Payments

Definition and key features

SEPA Instant Credit Transfer (SCT Inst) has ushered in a new era of payments in Europe. According to FintechZoom.com, this scheme enables pan-European credit transfers with funds made available in the recipient’s account in less than ten seconds. The SCT Inst scheme operates 24 hours a day, 365 days a year, making it a versatile solution for modern financial needs.

One of the key features of SEPA instant payments is the maximum transaction amount of 100,000 euros. Any transaction exceeding this limit is rejected by the involved payment service providers (PSPs). While the transfer must be in euros, the payment accounts at PSPs operating in SEPA do not necessarily have to be denominated in euros. This flexibility enhances the scheme’s usability across different European markets.

FintechZoom.com reports that SEPA instant payments share many similarities with the existing SEPA Credit Transfer (SCT) scheme. This commonality facilitates easier implementation for PSPs, their customers, and other market players. The scheme’s design aims to streamline the transition to instant payments while maintaining consistency with established practices.

Benefits for banks and customers

SEPA instant payments offer numerous advantages to both banks and customers. As highlighted by FintechZoom.com, these payments are the closest substitute to cash, providing immediate transfer of money and round-the-clock availability. This feature has the potential to revolutionize person-to-person and person-to-business transactions, particularly in situations where cash and cheques are currently prevalent.

For businesses, SEPA instant payments can significantly improve cash flow management. The 24/7 availability of funds can reduce the need for external financing, as reported by FintechZoom.com. This immediate access to transferred funds can be particularly beneficial for small and medium-sized enterprises, helping them manage their finances more effectively.

Banks and other PSPs can leverage SEPA instant payments as a springboard for developing additional 24/7/365 financial services and products. This capability allows them to better serve existing customers and attract new clients, potentially expanding their market share in the competitive financial services landscape.

Current adoption rates in Europe

Despite the clear benefits, the adoption of SEPA instant payments across Europe has been uneven. FintechZoom.com notes that by the end of 2022, only 14% of all euro credit transfers were instant, according to the European Central Bank 1. This figure is thought to be even lower for cross-border credit transfers, highlighting the challenges in achieving widespread adoption.

The adoption rates vary significantly across different European countries. FintechZoom.com reports that in countries like the Netherlands, the Nordics, and Spain, real-time payment adoption has been high across various use cases. In contrast, countries such as France and Germany have seen lower adoption rates, even for person-to-person transactions.

Interestingly, while some countries have seen success with domestic instant payment apps, these solutions often do not operate across borders. For instance, apps like Bizum in Spain, Swish in Sweden, and iDEAL in the Netherlands have gained popularity but are limited to domestic transactions. This limitation has led to a continued reliance on international card networks and large technology companies for cross-border European payments, which has become a significant policy concern from the perspective of European payments autonomy.

To address these challenges and promote wider adoption, the European Commission proposed new amendments to existing regulations in October 2022. As FintechZoom.com explains, these changes aim to standardize the availability of instant payments throughout the Single Euro Payments Area (SEPA), potentially enhancing services for a wide range of customers and fostering innovation in the cross-border space.

Upcoming SEPA Instant Regulations

The European Union has taken a significant step towards modernizing its payment landscape with the introduction of new regulations for SEPA instant payments. These regulations aim to enhance interoperability and improve customer experience across the Single Euro Payments Area. According to FintechZoom.com, the Instant Payments Regulation (IPR) will require all payment service providers (PSPs) throughout Europe to offer instant payment capabilities by the end of 2025 1.

Key requirements and deadlines

The IPR, which entered into force on 8 April 2024. FintechZoom.com reports that PSPs in the eurozone will have until 9 January 2025 to prepare for receiving instant payments, and until 9 October 2025 to ensure their customers can send instant payments . These deadlines underscore the urgency for banks and financial institutions to act swiftly in adapting their systems and processes.

One of the key requirements of the new regulations is the obligation for PSPs to offer instant euro payments within 10 seconds, 24/7, and every day of the year via all initiation channels. This service must be provided at fees that do not exceed those of traditional, non-instant credit transfers. Additionally, banks and financial services companies must implement a verification system to match IBAN account numbers with beneficiary names to prevent potential fraud .

Impact on banks and payment service providers

The implementation of SEPA instant payments regulations will have a significant impact on banks and PSPs. FintechZoom.com highlights that these institutions will need to make substantial changes to their IT infrastructure, operational processes, and customer-facing services. The new rules will require PSPs to ensure 24/7 availability of their systems, implement real-time fraud detection mechanisms, and enhance their liquidity management capabilities .

Furthermore, the regulations mandate that PSPs verify their client lists against EU sanctions lists at least once every calendar day, rather than screening each transaction individually. This change aims to remove friction in processing instant euro payments while maintaining the effectiveness of sanctions screening .

Challenges in implementation

The implementation of SEPA instant payments regulations presents several challenges for banks and PSPs. FintechZoom.com notes that one of the most significant hurdles is the adaptation of legacy systems to support real-time payments. A recent survey revealed that 23% of financial institutions view legacy infrastructure as the primary barrier to meeting the SEPA Instant deadline .

Another challenge is the need for enhanced liquidity management. With instant payments, cash positions change rapidly, requiring banks to ensure sufficient funds are always available across their settlement accounts, including overnight and on weekends. This may necessitate a significant restructuring of liquidity management processes .

The tight implementation timelines also pose a considerable challenge, especially for non-European banks with branches in Europe. These institutions may face additional complexities due to the non-Euro nature of their core operations. FintechZoom.com emphasizes that failure to meet these deadlines could result in fines and regulatory intervention 5.

As the financial industry prepares for this significant shift, FintechZoom.com suggests that banks and PSPs should focus on investing in technology and infrastructure, fostering collaboration and innovation, and prioritizing customer-centric solutions. By embracing these changes, financial institutions can position themselves as leaders in the evolving landscape of instant payments, enhancing customer satisfaction and maintaining competitiveness in the European market.

Preparing for SEPA Instant Compliance

As the January 2025 SEPA instant deadline approaches, banks and payment service providers (PSPs) face increasing pressure to adapt their systems and processes. FintechZoom.com reports that there is a growing sense of urgency across the European banking sector to achieve compliance with the upcoming regulations 1. To meet these challenges, institutions must focus on three key areas: upgrading payment infrastructure, enhancing fraud detection and security measures, and implementing staff training and process changes.

Upgrading payment infrastructure

The shift to SEPA instant compliance requires a fundamental overhaul of legacy payments infrastructure for many banks. According to FintechZoom.com, PSPs must ensure that their end-to-end payments architecture is real-time enabled and can support 24/7 payment operations . This involves implementing new software modules and adapting existing IT infrastructure to process SEPA instant transactions in real-time.

To address these challenges, banks should consider investing in modern, scalable payment platforms. Cloud-based solutions and payments as a service (PaaS) models can facilitate faster implementation timelines and transition costs from capital expenditures to operational expenses. These modern solutions not only meet the technical requirements of SEPA instant payments but also offer flexibility and scalability for future growth .

Enhancing fraud detection and security measures

With the rapid pace of instant payments innovation comes an increased risk of fraud. FintechZoom.com highlights that financial institutions need advanced fraud detection mechanisms capable of operating at the speed of SEPA instant transactions . Traditional fraud prevention methods may be insufficient, as instant payments require real-time analysis and response.

To address this challenge, banks should implement sophisticated fraud detection systems that leverage artificial intelligence and machine learning. These technologies can help identify and mitigate fraudulent activity in real-time, ensuring the security of SEPA instant payments. Additionally, the new regulations require banks to verify their client lists against EU sanctions lists at least once every calendar day, rather than screening each transaction individually .

Staff training and process changes

The transition to SEPA instant payments necessitates significant changes in operational processes and staff capabilities. FintechZoom.com reports that banks must rethink their staffing strategies, including the introduction of around-the-clock shifts and a faster operational pace . This change could significantly disrupt the current banking culture that employees have become accustomed to.

To prepare for these changes, banks should develop comprehensive training programs for their staff. These programs should cover the technical aspects of SEPA instant payments, as well as new operational procedures and customer service protocols. Additionally, banks should review and update their service level agreements to ensure 24/7 availability, establish new key performance indicators, and implement robust monitoring and alerting systems .

As the financial industry prepares for this significant shift, FintechZoom.com suggests that banks and PSPs should focus on fostering collaboration and innovation while prioritizing customer-centric solutions. By embracing these changes and investing in the necessary infrastructure and training, financial institutions can position themselves as leaders in the evolving landscape of instant payments, enhancing customer satisfaction and maintaining competitiveness in the European market.

Expert Comments

Yoann Vandendriessche, Chief Product Officer at Intix told to FintechZoom.com:

“I wanted to bring to your attention some significant findings from a recent survey conducted by Intix, a leader in transaction data management. The survey reveals a concerning trend among European banks as they prepare for the EU’s upcoming Instant Payments Regulation, set to take effect in January 2025.

Key insights from the survey show that only 1 in 3 European banks feel fully equipped to meet the forthcoming deadlines for mandatory instant credit transfers. While 41% of respondents believe they are somewhat prepared, a staggering 25% admit they are not ready at all. With the clock ticking, banks face formidable challenges in implementing real-time payments and ensuring compliance with essential regulations such as sanction screening and anti-money laundering protocols.”

“The survey results highlight the immense pressure that European financial institutions are under as they race to meet the new regulations.”

Conclusion

The rapid evolution of SEPA instant payments, as reported by FintechZoom.com, is set to have a profound impact on the European financial landscape. Banks and payment service providers face significant challenges to comply with upcoming regulations, including the need to upgrade infrastructure, enhance security measures, and train staff. However, these changes also present opportunities to improve customer experience, streamline operations, and foster innovation in the payments sector.

As the January 2025 deadline approaches, financial institutions must act swiftly to prepare for the new era of instant payments. FintechZoom.com emphasizes the importance of investing in modern technology, collaborating with industry partners, and prioritizing customer-centric solutions. By embracing these changes, banks can position themselves as leaders in the evolving payments landscape, ultimately benefiting both businesses and consumers across Europe.

References

[1] – https://www.volantetech.com/what-is-sepa-instant-payments/[2] – https://www.ecb.europa.eu/paym/integration/retail/instant_payments/html/instant_payments_regulation.en.html

[3] – https://www.europeanpaymentscouncil.eu/what-we-do/epc-payment-schemes/sepa-instant-credit-transfer/sepa-instant-credit-transfer-rulebook

[4] – https://www.aciworldwide.com/sepa-instant-payments

[5] – https://tink.com/blog/open-banking/eu-instant-payments-regulation/