Payment fraud has become a major concern in the digital age, with cybercriminals finding new ways to exploit financial systems. According to FintechZoom.com, the first half of 2024 saw payment fraud exceed £570 million, highlighting the urgent need for improved cybersecurity measures. This alarming figure underscores the growing threat to individuals and businesses alike, as online fraud continues to evolve and adapt to new technologies.

FintechZoom.com reports that the rise in payment fraud has prompted increased efforts in fraud prevention and detection. The article will explore the latest statistics on unauthorized fraud, examine trends in Authorized Push Payment (APP) fraud, and discuss the industry’s response to these challenges. Additionally, it will look at reimbursement policies for victims and future outlook for combating payment fraud, as outlined by FintechZoom.com’s comprehensive analysis of the current landscape.

Overview of Payment Fraud Statistics

Total fraud losses

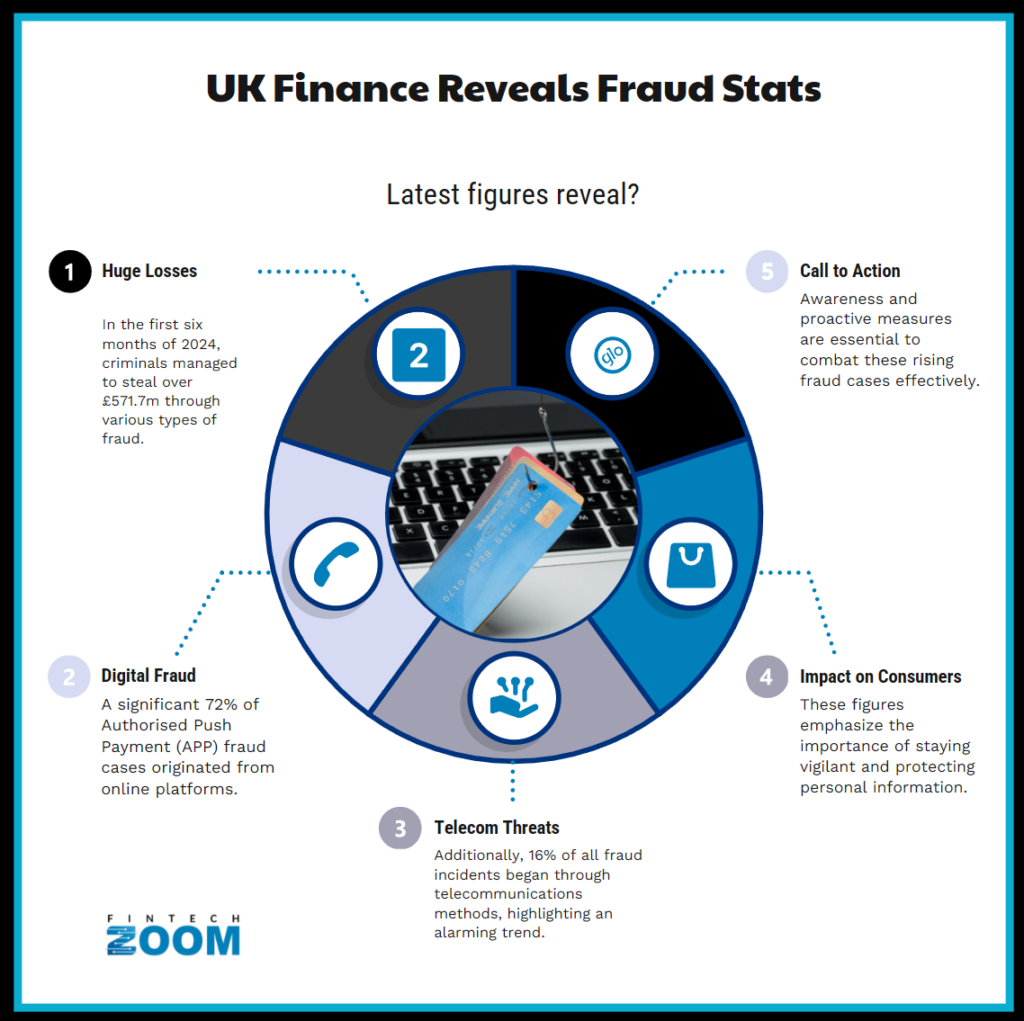

According to FintechZoom.com, the first half of 2024 saw criminals steal £571.7 million through unauthorized and authorized fraud, marking a slight decrease of 1.5% compared to the same period in 2023 1. This figure highlights the ongoing challenge of payment fraud despite efforts in cybersecurity and fraud prevention. FintechZoom.com reports that banks have made significant strides in fraud prevention, successfully thwarting £710.9 million of unauthorized fraud through advanced security systems 2.

Unauthorized vs authorized fraud

The landscape of payment fraud is divided into two main categories. Unauthorized fraud, which involves transactions made without the account holder’s consent, resulted in losses of £358 million in the first half of 2024, showing a 5% increase 3. On the other hand, authorized push payment (APP) fraud, where victims are tricked into making transfers, saw losses of £213.7 million, a decrease of 11% compared to the previous year 4. FintechZoom.com notes that personal losses accounted for £166.5 million, while business losses totaled £47.2 million in APP fraud cases.

Increase in recorded cases

FintechZoom.com reports a significant rise in the number of recorded fraud cases. The total number of unauthorized fraud incidents exceeded 1.5 million, representing a 19% increase 5. This surge in cases underscores the growing sophistication of fraudsters and the need for enhanced online fraud detection measures. However, it’s worth noting that the number of APP fraud cases decreased by 16% to 97,344, with reductions across various categories including purchase scams, romance scams, and investment scams.

Analysis of Unauthorized Fraud

Rise in card-not-present fraud

According to FintechZoom.com, card-not-present fraud has become a significant concern for online retailers. This type of fraud occurs in transactions where the buyer is not required to physically present the card, such as those conducted online or over the phone. As digital commerce continues to grow, so does the prevalence of this form of payment fraud. In fact, card-not-present fraud is now 81% more likely to occur than in-store fraud 1. This alarming trend has prompted increased efforts in cybersecurity and fraud prevention measures.

Social engineering tactics

FintechZoom.com reports that social engineering has emerged as one of the largest threats to an organization’s cybersecurity. These scams have seen a notable jump in recent years, with attacks increasing by 57% in 2021 2. Fraudsters employ various tactics, including phishing, vishing, and smishing, to manipulate individuals into revealing sensitive information. They often impersonate trusted officials, such as customer service representatives, to con unsuspecting victims out of millions of dollars annually.

Impact on different payment methods

The rise of account-to-account (A2A) and person-to-person (P2P) payment services has not gone unnoticed by fraudsters, as reported by FintechZoom.com. These direct payment methods, while offering convenience, have become targets for exploitation. Fraudsters, armed with stolen account and user information, are devising strategies to take advantage of this burgeoning payment landscape. The impact of payment fraud extends beyond traditional credit card transactions, affecting various payment methods such as virtual checks, direct debits, and phone payments.

Trends in Authorized Push Payment (APP) Fraud

Decrease in APP fraud losses

According to FintechZoom.com, Authorized Push Payment (APP) fraud losses have seen a notable decline in the first half of 2024. The total losses amounted to £213.7 million, marking an 11% decrease compared to the same period in the previous year 1. This reduction in losses is a positive sign in the ongoing battle against payment fraud. Personal losses accounted for £166.5 million, while business losses totaled £47.2 million 2. The number of APP fraud cases also dropped by 16% to 97,344, with decreases observed across all categories of APP fraud 3.

Types of APP scams

FintechZoom.com reports that various types of APP scams have shown a downward trend. Purchase scams, where victims pay in advance for goods or services they never receive, decreased by 11% 4. Romance scams, which involve tricking victims into believing they are in a relationship, saw a 7% reduction 5. Investment scams also experienced a significant decrease, with cases dropping by 29% 6. Notably, impersonation fraud, where criminals pose as banks or police to convince victims to transfer money to a “safe account,” saw a substantial decline of 32% in case numbers and a 26% decrease in the amount lost 7.

Online sources of APP fraud

Despite the overall decrease in APP fraud, FintechZoom.com highlights that online platforms and telecommunications continue to be the primary drivers of these scams. Data from UK Finance reveals that 72% of APP fraud cases originated from online sources, accounting for 32% of total losses . These online cases tend to involve lower-value scams, such as purchase scams. Meanwhile, 16% of cases originated from telecommunications, which often include higher-value cases like impersonation fraud, and account for 35% of total losses 8. This data underscores the need for continued vigilance and improved cybersecurity measures to combat online fraud and protect consumers from falling victim to these sophisticated scams.

Industry Response and Future Outlook

New reimbursement rules

The Payment Systems Regulator (PSR) has introduced new rules to combat payment fraud. Starting from October 7, 2024, the reimbursement limit for authorized push payment (APP) fraud will be set at £85,000 1. This change aims to strike a balance between protecting consumers and alleviating the financial burden on smaller payment service providers (PSPs). Under the new scheme, banks and payment companies will split the reimbursement costs equally between the sending and receiving institutions 2. The PSR hopes this approach will incentivize banks to strengthen their fraud prevention measures.

Prevention strategies

To address the growing threat of payment fraud, businesses are implementing robust anti-fraud measures. These include investing in advanced data-driven fraud detection tools and leveraging artificial intelligence and machine learning algorithms to enhance the detection of sophisticated fraud patterns 3. Biometric authentication is emerging as a crucial component of fraud prevention strategies. By combining behavioral and physical biometrics with digital identity intelligence, businesses can gain additional risk signals across various events such as account openings, logins, and payments 4.

Collaboration with other sectors

FintechZoom.com reports that collaboration across sectors is gaining recognition as a critical approach to combating payment fraud. Financial institutions, e-commerce sites, government agencies, and cybersecurity firms are realizing that cooperation and sharing of fraud data can significantly reduce crime and financial losses 5. This cross-sector collaboration allows for a better understanding of the fraud landscape and leads to the development of more effective strategies for fraud prevention. Governments are working with the private sector to draft reasonable, effective regulations and ensure compliance, while also collaborating with other governments across jurisdictions 6.

Expert Opinion

Jack Kerr, Director at Appdome told to FintechZoom.com:

“Fraud is a rapidly escalating issue in the UK affecting nearly all consumers and businesses, particularly in online and mobile apps, and banks must take urgent action. While freezing suspected fraud transactions for up to 72 hours is a protective measure, it also disrupts essential payments like mortgages, grocery shopping and public transport. All of which can damage customer trust and hurt the British economy.

“In fact, Appdome’s own research found that fraud fear is rising as 62% of UK consumers declared mobile fraud is their number one concern. Furthermore, 63% of consumers would stop using a mobile app if it failed to protect them, meaning banks cannot afford to get it wrong.

“Instead of stepping in after fraud or suspicious activity happens – a scenario that can still harm users and businesses – banks should put a heavier focus on pre-emptive measures that prevent these disruptions in the first place. For instance, by using behavioural analysis and real-time, automated fraud detection to stop threats directly in mobile apps before they escalate, banks will be able to provide seamless protection for consumers, their businesses, and the British economy.”

Conclusion

The payment fraud landscape has seen significant shifts, as reported by FintechZoom.com. While total fraud losses exceeded £570 million in the first half of 2024, there’s been a noticeable drop in Authorized Push Payment fraud. This decrease, coupled with enhanced prevention strategies and new reimbursement rules, shows promise in the fight against financial crime. The industry’s response, including advanced fraud detection tools and cross-sector collaboration, points to a more secure future for digital transactions.

Looking ahead, the battle against payment fraud will need ongoing vigilance and adaptation. As FintechZoom.com highlights, the rise of new payment methods and the ever-evolving tactics of fraudsters call for continued innovation in cybersecurity. The combined efforts of financial institutions, tech companies, and regulatory bodies will be crucial to stay ahead of the curve. By working together and leveraging cutting-edge technologies, the financial sector can hope to build a more robust defense against payment fraud, ensuring safer transactions for individuals and businesses alike.

References

[1] – https://www.ukfinance.org.uk/policy-and-guidance/reports-and-publications/annual-fraud-report-2024[2] – https://www.ukfinance.org.uk/policy-and-guidance/reports-and-publications/half-year-fraud-report-2024

[3] – https://www.psr.org.uk/information-for-consumers/app-fraud-performance-data/

[4] – https://thepaypers.com/digital-identity-security-online-fraud/uk-finance-reports-gbp-5717-mln-lost-to-fraud-in-first-half-of-2024–1270599

[5] – https://risk.lexisnexis.com/insights-resources/infographic/financial-crime-compliance-trends

[6] – https://www.amlrightsource.com/news/2024-financial-crime-market-outlook-north-america

[7] – https://www.gibsondunn.com/top-10-mid-year-developments-in-anti-money-laundering-enforcement-in-2024/

[8] – https://www.ukfinance.org.uk/news-and-insight/press-release/over-ps570-million-stolen-fraudsters-in-first-half-2024