For a long time, fraud prevention in finance focused on a single moment: the payment itself. Controls were built around transaction monitoring, reconciliations, and post-payment reviews. Those measures still matter, especially in regulated environments. But on their own, they are no longer sufficient.

Finance operations today move faster and are more distributed than ever. Remote teams, shared service centers, and decentralized spending mean that many risks emerge well before payment. Fraud, misuse, and policy violations often start at the decision stage, when a transaction is approved. If approvals are weak or informal, downstream controls are left trying to fix problems after the fact.

This shift has changed how finance leaders think about fraud prevention. Instead of asking whether a payment looks suspicious, they are increasingly asking whether it should have been allowed to happen at all.

Why Payment Controls Alone Leave Gaps

Payment monitoring tools are designed to detect anomalies. They are effective at flagging duplicate payments, unusual amounts, or transactions that fall outside expected patterns. What they often cannot determine is whether a transaction should have been approved in the first place.

A payment system can confirm that an invoice matches a vendor record and that bank details are valid. It cannot confirm whether the spend aligns with policy, budget, or authority limits. By the time a payment reaches that stage, the decision has already been made.

Regulatory guidance and audit findings across industries consistently highlight weak internal accounting controls as a contributor to fraud and misuse. That risk shows up in everyday scenarios, such as:

Common risk scenarios include:

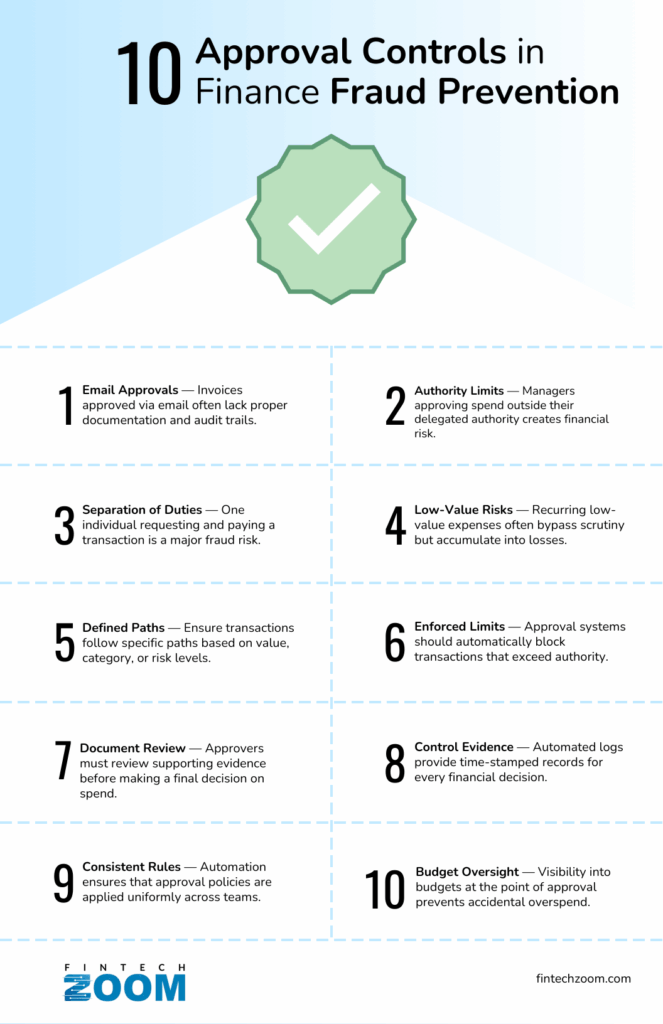

- invoices approved over email without proper documentation

- managers approving spend outside their delegated authority

- the same individual requesting, approving, and later paying a transaction

- recurring low-value expenses approved repeatedly with limited review

From a system perspective, these payments may appear valid. From a control perspective, they represent clear risk. Research shows that roughly 50% of fraud cases are linked to insufficient internal controls, and many organizations only strengthen those controls after a fraud event has already occurred. This pattern highlights the risk of relying on reactive checks instead of preventive controls embedded earlier in the process. This is why approval discipline is increasingly viewed as a preventive control rather than a secondary check.

What Approval Controls Actually Do in Finance Operations

Approval controls bring structure and accountability to financial decisions. They define who can approve a transaction, under what conditions, and with what level of visibility. In well-designed finance operations, approvals are not a formality. They are a documented control point.

Effective approval controls typically ensure that:

- transactions follow defined approval paths based on value, category, or risk

- authority limits are clearly enforced

- approvers review supporting documentation before deciding

- approvals are recorded with clear time stamps and ownership

A core principle behind these controls is separation of duties. By ensuring that no single individual can initiate, approve, and execute a transaction end to end, finance teams reduce both accidental errors and deliberate misuse. This principle is widely embedded in internal control frameworks and audit standards because it addresses risk at its source.

Many finance teams support approval controls using dedicated approval workflow tools that operate alongside their accounting systems. These tools formalize invoice, purchase order, and payment approvals, ensuring decisions are captured consistently before transactions are processed. By embedding approvals into structured workflows, finance teams turn decision-making into reliable control evidence rather than an assumption.

Preventive Controls and Why They Matter

In risk management and audit frameworks, controls are commonly classified as preventive or detective.

Detective controls identify issues after they occur. Examples include reconciliations, audits, variance analysis, and post-transaction reviews. Preventive controls are designed to reduce the likelihood of issues occurring in the first place.

Approval controls fall squarely into the preventive category.

By enforcing authority limits and requiring documented review before a transaction moves forward, approval controls reduce the number of high-risk items that ever reach payment. This lowers the burden on detective controls and reduces the volume of exceptions finance teams must investigate later.

From a practical perspective, preventive controls are also less disruptive. Stopping an issue before payment avoids clawbacks, write-offs, and uncomfortable conversations after the fact.

Where Approval Controls Commonly Break Down

Even in mature finance organizations, approval controls often weaken over time.

Typical issues include:

- approvals handled through email or messaging tools rather than controlled workflows

- inconsistent rules across departments or business units

- approvals granted without reviewing supporting documents

- outdated authority limits after role or organizational changes

These breakdowns are rarely intentional. More often, they reflect processes that have not evolved alongside business growth. According to the ACFE Report to the Nations, a significant share of occupational fraud cases involve weak or overridden internal controls. In many of those cases, approvals existed in name but not in substance. What worked when spend volumes were low and teams were small becomes fragile as transaction counts increase and responsibilities spread across the organization.

When approvals rely on informal channels, finance loses visibility. It becomes difficult to demonstrate that controls were applied consistently, especially during audits or internal reviews.

How Automation Improves Approval Discipline

Automation does not replace judgment. It reinforces discipline.

When approval workflows are automated:

- approval rules are applied consistently

- authority limits are enforced by design

- approvals are logged with context and time stamps

- exceptions are visible and reviewable

Automation removes the variability that creeps into manual processes. Approvers still make decisions, but the system ensures those decisions happen within defined boundaries.

This is why approval controls are often discussed alongside other finance automation tools that address different stages of the risk lifecycle. Payment systems, expense management platforms, and accounting software all play a role. Approval workflows focus specifically on decision-making, ensuring that spending is reviewed and authorized before it reaches execution.

Approval Controls and Budget Oversight

One area where approval controls add additional value is budget enforcement.

Without structured approvals, budget breaches are often discovered after the fact, during reporting or reconciliation. By that point, corrective action is limited. Approval controls allow budget context to be surfaced at the moment of decision.

When approvers can see available budget, prior spend, or forecast impact as part of the approval process, decisions become more deliberate. This reduces accidental overspend and shifts budget conversations earlier, when adjustments are still possible.

From a fraud prevention perspective, budget visibility also reduces the risk of spend being fragmented into smaller amounts to avoid scrutiny.

Approval Controls Within the Broader Finance Control Framework

Approval controls do not operate in isolation. They typically sit within a broader framework that includes:

- procurement and spend policies

- accounts payable controls

- expense management rules

- accounting and financial reporting oversight

Together, these layers create continuity from intent to execution. Approval controls provide the link between business decisions and financial outcomes, making it easier to demonstrate why a transaction was allowed to proceed.

This continuity matters during audits, investigations, and internal reviews. When approvals are clearly documented, finance teams can trace decisions without reconstructing events after the fact.

Approval Evidence as Audit-Ready Documentation

One often overlooked benefit of structured approval controls is audit readiness.

Approval records serve as primary evidence that controls operated as designed. When approvals are embedded into workflows, documentation is generated automatically, reducing reliance on screenshots, email trails, or manual explanations.

This shifts audit preparation from a reactive exercise to an ongoing state. Instead of gathering evidence under pressure, finance teams can point auditors directly to approval records that already contain timing, authority, and context.

What Auditors Look for in Approval Evidence

During audits, approval evidence is commonly reviewed to confirm that internal controls operated effectively.

Auditors typically look for:

- approvals that occurred before processing or payment

- confirmation that approvers had appropriate authority

- documentation showing what information was reviewed

In audit practice, this review of supporting documentation is often referred to as vouching. It helps confirm that transactions are valid, authorized, and properly supported.

When approval records are missing or informal, finance teams are forced to rely on explanations and judgment calls. When approval controls are embedded into workflows, those questions can be answered directly.

The Cultural Impact of Strong Approval Controls

Beyond controls and compliance, approval discipline influences behavior.

When approval expectations are clear and consistently enforced, employees understand that spending decisions matter. This reduces casual policy breaches and reinforces accountability across the organization.

Over time, strong approval controls create a culture where financial decisions are made with intent rather than habit. That cultural shift is difficult to measure, but it plays a meaningful role in long-term fraud prevention.

Final Thoughts

Fraud prevention is no longer just about stopping bad payments. It is about controlling how financial decisions are made before money moves.

Approval controls play a critical role in that shift. When they are treated as a core control rather than an administrative step, they reduce fraud exposure, support audits, and improve accountability across finance operations.

As expectations around governance and oversight continue to rise, approval controls are increasingly viewed as a foundational part of modern finance fraud prevention strategies.