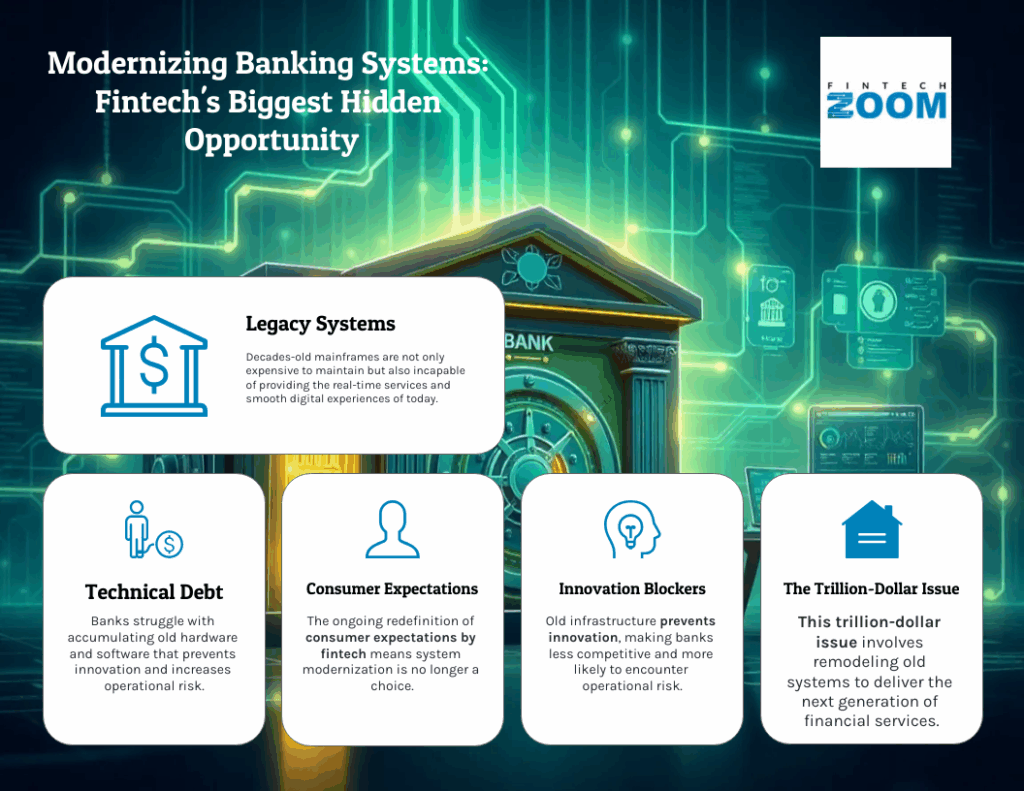

Legacy banking systems, which used to be the backbone of international finance, are quickly turning out to be one of the biggest burdens in the industry. These decades-old mainframes are not only expensive to maintain but also incapable of providing the real-time services, customer personalization, and smooth digital experiences of today. Behind the curtains, banks struggle against so-called technical debt—accumulating loads of old hardware and software infrastructure that are preventing innovation and making them more likely to encounter operational risk. The trillion-dollar issue does not simply concern re-coding but the remodeling of old roots into responsive systems that have the capability of delivering the next generation of financial services. Due to the ongoing redefinition of consumer expectations by fintech, consumer systems modernization is no longer a choice; it is the largest untapped market in the sector.

The Modernization Payoff: More Than Just New Code

In most cases the perceived risk and disruption is the fear of modernization for most financial institutions. However, those who consider it merely as a technical migration are not seeing the larger picture. The core banking systems are being modernized, and this isn’t merely opening the door to faster software but strategic benefits.

1. Radically Cut Operational Costs

Legacy systems are very costly to maintain: mainframes need special hardware and scarce skills and take a long time to update. A study conducted by Deloitte reveals that the IT budgets of many banks are more than 70 percent of the total amount spent by the banks to maintain the old systems in operation. The modern architectures can reduce these operation expenses significantly through consolidation of infrastructure, automation, and less downtime.

2. Unlocking the Power of Data and AI

The historical platforms were not planned to support the amount, speed, and diversity of the contemporary financial data. This makes most institutions have a goldmine of customer insights that they cannot access or use. Having the modern systems, banks are able to use real-time analytics, machine learning, and AI-based personalization to improve their decision-making and fraud detection and provide more personalized customer experiences.

3. Agility and Speed to Market

In the current world where financial technology is predominant, the product cycles are counted in weeks as opposed to years. Even the slightest innovation is agonizingly slow with legacy systems taking months to deploy. Moving to more modular, API-based platforms will allow banks to produce faster iterations, react to market changes in real-time and keep pace with a rapidly changing environment.

The purpose of modernization is not merely to copy the past operations with new technology. It is all about creating a platform on which it can grow in future. That’s why many financial institutions turn to development partners to support this transformation. As a financial software development company, GP Solutions is concentrating on developing systems that are not only efficient today, but are also fundamentally flexible to the financial products of tomorrow.

The Path Forward: A Strategic Approach, Not a Big Bang

The concept of shutting down an already existing system at night and putting another completely new system in place is not only obsolete but also risky. As a matter of fact, incremental, calculated, and low-risk are the most effective modernization strategies.

The Strangler Fig Pattern

One of the most used and effective strategies of system modernization is the Strangler Fig Pattern. New functionalities are developed in parallel and instead of replacing the old system in one step, they slowly replace operations. Such gradual change may enable organizations to create less harm, create value sooner, and lessen the probability of a disastrous collapse.

Key Steps in the Modernization Journey

The following are some of the steps to consider:

Assess and Analyze

Carry out a thorough codebase audit to determine core business logic, dependencies and pain points.

Place Superior Emphasis on High-Impact Functions

Modernize one particular business-critical function first—onboarding, payments, or customer service. This produces a quick win and proof of concept.

Build and Integrate

Create the new component based on modern architecture and connect the new with the old systems through APIs and an API gateway that routes the traffic.

Migrate and Decommission

When the new service is completely stable, start to route all the traffic to the new system and decommission the old code.

Why Now? The Cost of No Action

Legacy-based financial institutions are already lagging behind. A report by the Forbes Technology Council in 2025 says that banks that are still not starting to modernize are incurring more costs, their compliance loads are rising, and they are losing their capacity to serve digital-native customers.

At the same time, fintech startups that are fully developed on cloud-native projects are more rapid and efficient in scaling and providing more customer experiences. The later the traditional banks take to competition, the more difficult it will be to compete.

Risk management is also very vital when it comes to modernization. Older systems are more prone to attacks because cyberattacks are increasingly becoming more complex and advanced. The current platforms are more supportive of the current threat environment, with better encryption capabilities, access control and compliance automation.

The Role of Expert Partners

Modernization in the banking industry is complicated. It does not only need technical knowledge but also a great knowledge of financial regulations, legacy systems, and customer expectations. An experienced partner is necessary there.

Firms such as GP Solutions offer procurement of end-to-end financial software development services, which are aimed at closing the legacy infrastructure and digital transformation gap. They are strategic consultants who are integrated with sophisticated software engineering and domain knowledge to provide long term viable platforms.

Being one of the biggest financial software development firms, GP Solutions has assisted the international financial institutions to upgrade their systems without interfering with compliance, security, and uptime.

Conclusion: The Hidden Door Opportunity Waits

The need to modernize the legacy banking systems is not a technical problem anymore, it is a strategic imperative. The path to change is not always scenic. However, inaction poses an even greater cost of opportunity. Today, tools, technologies, and time-tested traditions stand ready to safeguard modernization and ensure its scalability and success.

Any financial institution that acts fast will acquire the agility, efficiency and intellectual strength to succeed in the future of digital banking. Those delayed run the risk of being ousted out of existence. This is a trillion-dollar problem that can be solved, but only with an appropriate partner. It demands a team that has high levels of domain expertise, the best engineering skills and has a given modernization plan. As well, it needs GP Solutions.

Are you willing to make your change? Collaborate with GP Solutions and begin to modernize your core systems, one strategical step by step.