Scaling a SaaS business globally is no longer optional—most software products now attract customers from multiple regions the moment they go live. Yet while global acquisition is relatively easy, global monetization remains deeply complex. Accepting recurring payments across borders introduces a minefield of challenges in currency management, subscription billing reliability, local compliance, advanced fraud control, and—critically—transaction success rates.

This is why global payment platforms have become the essential infrastructure for any SaaS company seeking predictable, scalable growth beyond its domestic borders.

The Operational Cost of Fragmented Payments

Many scaling SaaS businesses initially use fragmented payment systems—a domestic gateway here, a local bank account there. This approach creates massive operational overhead and financial risk:

- Manual Reconciliation Drain: Finance teams waste valuable time manually reconciling revenue data from disparate accounts, often across multiple currencies and fee structures.

- Exorbitant FX Fees: Reliance on traditional banks or basic gateways leads to non-transparent, high foreign exchange (FX) fees, quietly eroding profit margins by 1% to 3% annually.

- High Involuntary Churn: Fragmented systems lack the centralized logic necessary to maximize authorization rates, leading to unnecessary revenue loss from simple cross-border declines.

The need for a single, unified financial stack capable of handling these complexities is what drives the adoption of modern global payment platforms.

1. Faster Market Access Through Localized Payments

One of the biggest silent barriers to SaaS expansion is the inability to support local payment methods. Customers won’t convert if they can’t pay the way they’re used to, particularly in regions like Europe, Latin America, and Southeast Asia where alternative payment methods dominate.

Global payment platforms solve this critical conversion problem by enabling:

- Local Payment Options: Supporting high-growth, non-card methods like Brazil’s Pix, European direct debit (SEPA), and regional e-wallets through a single API integration.

- Local Acquiring: Processing transactions locally through relationships with banks in the target country. This simple step can drastically improve authorization rates by avoiding the friction associated with cross-border routing.

This strategy dramatically lowers friction for international customers and enables SaaS companies to enter new markets months faster.

2. Multi-Currency Mastery and Automated FX Management

Subscription-based businesses depend entirely on stable, predictable billing cycles and accurate forecasting. Cross-border transactions frequently lead to unpredictable FX fees and reconciliation headaches.

Modern global payment platforms give SaaS companies the ability to:

Price Subscriptions in Local Currencies: Offering customers transparent pricing without forced currency conversion on the customer side.

Collect and Hold Funds: Platforms offer Global Accounts for receiving and holding funds in multiple major currencies (USD, EUR, GBP, JPY) without immediate, forced conversion.

Automate Reconciliation: Unifying all global transactions under one roof simplifies the monthly closing process and maintains consistent revenue operations.

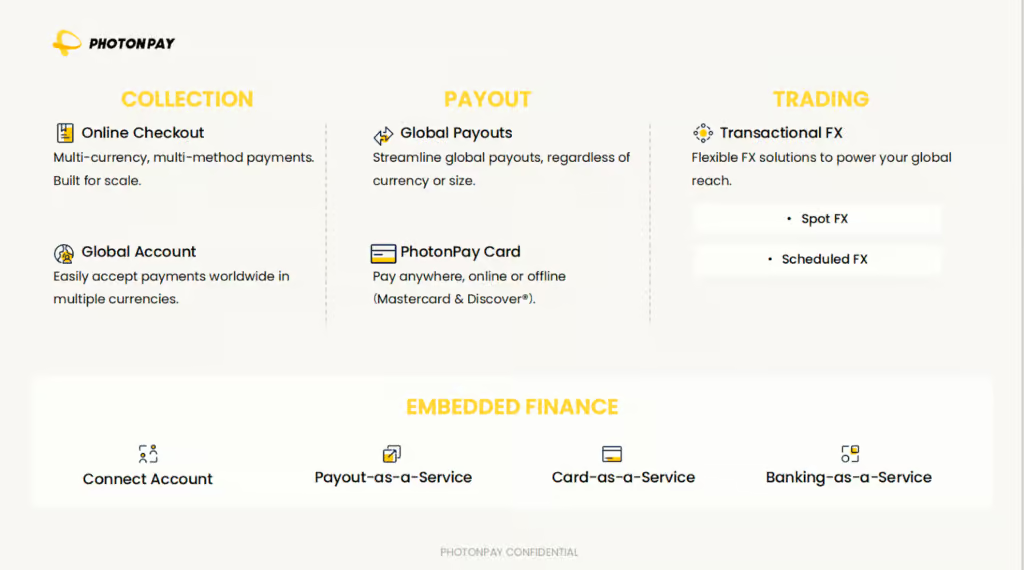

Navigating the complexities of local payment options, multi-currency pricing, and managing unpredictable FX is the true inflection point for global SaaS scalability. It requires a resilient technological foundation. This is where leaders in the sector, such as PhotonPay, define the standard. Launched in 2015, PhotonPay provides an AI-powered financial infrastructure that supports over 10 global offices and enables efficient, secure, and integrated global payments across 230+ countries/regions to drive business growth.

With this type of robust, integrated platform in place, SaaS companies can then focus on the next major revenue protector: reducing involuntary churn.

3. Lowering Involuntary Churn Through Higher Authorization Rates

Involuntary churn—customers losing access due to failed payments—is a persistent drain on recurring revenue. Declines often result from outdated card details, local banking restrictions, or the higher friction of cross-border processing.

Global payment platforms actively combat this major challenge using sophisticated, AI-driven tools:

- Intelligent Routing: Automatically sending the transaction through the acquiring bank most likely to approve it based on real-time data.

- Built-in Card Updater Services: Integrations with card networks (Visa/Mastercard) ensure subscriptions are automatically renewed even if a customer gets a new card number, eliminating expiration declines.

- Smart Retry Logic: Algorithms analyze the decline reason and automatically retry the charge at an optimal time to maximize success.

These optimizations can collectively boost authorization rates by several percentage points, protecting thousands of dollars in recurring revenue.

4. Ensuring Compliance and Security Across Multiple Regions

Going global means managing an evolving, highly fragmented regulatory landscape. Requirements like PSD2/SCA in Europe, various local tax policies, and stringent AML rules place a heavy burden on SaaS teams.

Payment platforms simplify this by acting as a compliance shield, offering:

- End-to-End Compliance: Maintaining the highest level of PCI DSS certification and ensuring local payment requirements are met without requiring the SaaS company to perform the work.

- Built-in Risk Monitoring: Using machine learning models to detect suspicious activity in real time, tailored to the risk profiles of different regions.

- Automated Tax Calculation: Handling region-specific taxes (VAT, GST) and providing necessary reporting tools.

Instead of hiring additional compliance specialists for every new market, SaaS companies can scale with the confidence that their payment infrastructure meets global standards.

5. The Strategic Advantage of Unified Revenue Data

Beyond the immediate transaction, the most strategic value a platform provides is a unified global data view. When all payment activity is centralized, it transforms accounting data into actionable business intelligence.

This single source of truth enables Revenue Performance Analytics:

- Regional Pricing Optimization: Clean data on authorization and conversion rates allows a SaaS company to test and optimize local pricing models.

- Churn Diagnostics: Teams can quickly differentiate between voluntary and involuntary churn and identify which regions are causing the most declines, allowing for targeted strategies.

- Financial Forecasting: Centralized reporting allows the CFO to generate accurate cash flow projections, essential for securing future funding and managing treasury.

Conclusion

Global payment platforms have evolved from mere transaction handlers into critical growth drivers for SaaS companies. They reduce friction at checkout, ensure subscription billing reliability, simplify the monumental task of compliance, and—most importantly—provide the sophisticated financial infrastructure needed to operate efficiently across borders.With modern, integrated tools, SaaS companies can expand internationally faster, convert more customers, and maintain healthier recurring revenue. In today’s digital-first world, the ability to accept and manage payments globally isn’t just a feature—it is the competitive advantage that separates global leaders from domestic players.