The payments industry is undergoing rapid transformation due to technological advancements and evolving regulations. Payments regulations have become increasingly complex, challenging businesses to stay compliant while leveraging new technologies. This dynamic landscape affects financial institutions, payment service providers, and merchants alike, making it crucial to understand the latest developments in cybersecurity, anti-money laundering, and risk management.

Recent years have seen significant changes in payments technology and regulatory compliance requirements. This article explores the key technological innovations shaping the payments sector and examines the most impactful regulatory updates. It also discusses the challenges organizations face in adapting to new rules and offers strategies to navigate the changing regulatory environment. By understanding these shifts, businesses can better position themselves to thrive in the evolving payments ecosystem.

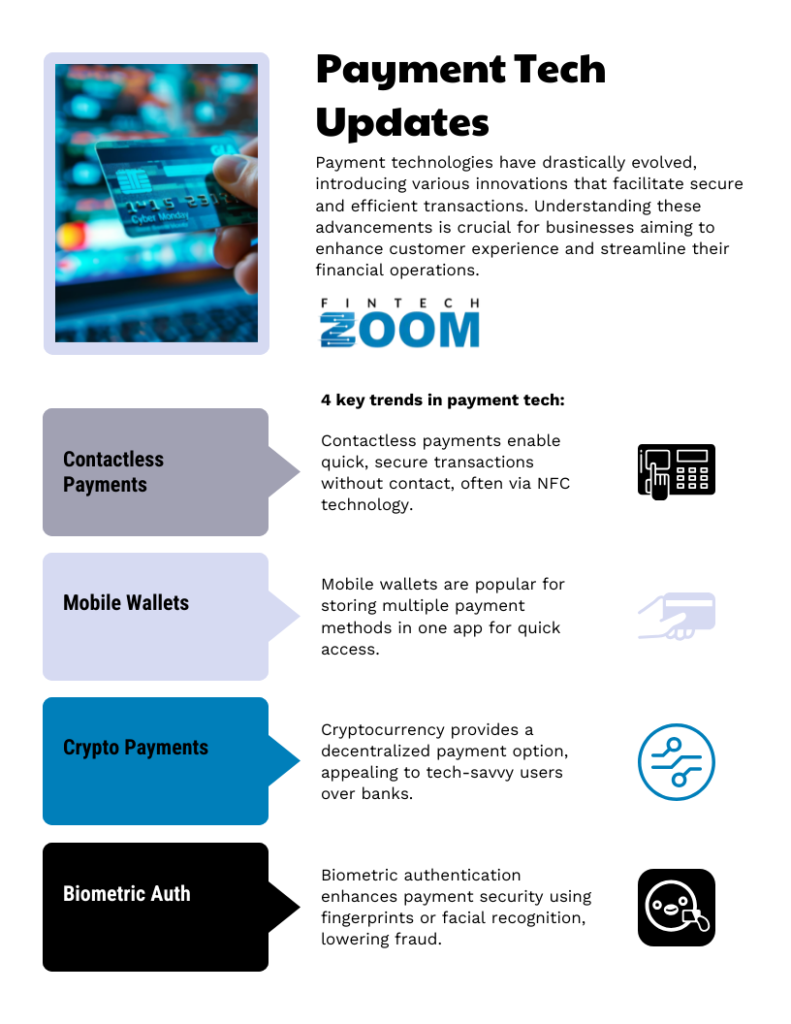

Recent Technological Advancements in Payments

The payments industry has undergone significant transformations in recent years, driven by technological innovations that have revolutionized how individuals and businesses conduct financial transactions. These advancements have not only enhanced the speed and efficiency of payments but also improved security measures and expanded the range of payment options available to consumers.

Mobile Wallets and Digital Payments

Mobile wallets have emerged as a convenient and secure method of making payments, transforming smartphones into digital versions of traditional wallets. This technology allows users to store their credit and debit card information on their mobile devices, enabling quick and easy transactions. The adoption of mobile wallets has been rapidly increasing, with the global market size reaching USD 8.00 billion in 2023 and projected to grow to USD 88.36 billion by 2033 1. A 2024 survey revealed that 59% of consumers reported using mobile wallets regularly in the past 90 days 2.

The technology behind digital wallets combines software and hardware components to ensure secure and seamless transactions. Near Field Communication (NFC) is a key technology that enables contactless payments by allowing communication between the mobile device and the payment terminal when they are in close proximity. Additionally, tokenization technology replaces sensitive card details with unique identification symbols, enhancing security and protecting user information from potential fraudsters.

Real-Time Payment Systems

Real-time payment systems have gained significant traction, offering immediate money transfers between bank accounts. These systems function independently of time or day, delivering funds within seconds. As of 2023, 80 countries have implemented or are in the process of implementing real-time payment infrastructure 3. The demand for immediacy and ease of use in the digital era has driven the adoption of real-time payments, with 19.1% of all electronic transactions in 2023 being real-time 4.

Real-time payments provide numerous benefits, including efficient cash flow management, improved transparency, and enhanced customer satisfaction. For businesses, particularly small and medium-sized enterprises, real-time payments enable instant access to funds, optimizing financial planning and mitigating liquidity risks.

Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies have emerged as disruptive forces in the payments industry. The global blockchain market size is expected to grow from USD 20.10 billion in 2024 to USD 248.90 billion by 2029 5. This growth is driven by increasing investment and adoption by major corporations.

Blockchain offers enhanced security, transparency, and efficiency in digital transactions by providing a decentralized and immutable ledger. Cryptocurrencies, built on blockchain technology, have gained popularity as alternative payment methods. As of July 2024, the market cap of Bitcoin reached USD 1.33 trillion, accounting for 52.72% of the total value of the crypto market 6.

These technological advancements have significantly impacted payments regulations, necessitating updates to cybersecurity measures, anti-money laundering protocols, and risk management strategies. As the payments landscape continues to evolve, regulatory compliance requirements must adapt to address the challenges and opportunities presented by these innovations in payments technology.

Key Regulatory Changes Affecting the Payments Industry

The payments industry has witnessed significant regulatory changes in recent years, aimed at enhancing security, promoting competition, and protecting consumers. These changes have had a profound impact on how payment service providers operate and comply with legal requirements.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Updates

Anti-money laundering regulations have become increasingly stringent, requiring payment providers to implement robust systems to detect and prevent financial crimes. The Bank Secrecy Act and its implementing regulations mandate that firms establish AML compliance programs to help detect and report suspicious activity 1. These programs must include written policies approved by senior management, risk-based customer identification procedures, and ongoing monitoring of transactions.

Know Your Customer (KYC) regulations have also evolved, with payment providers now required to conduct more thorough due diligence on their customers. This includes verifying the identity of customers before engaging in business and collecting information such as full legal names, dates of birth, and home addresses 2. The implementation of these measures helps protect the national payments system from financial crimes and mitigates the risk of fraudulent activities.

Data Privacy and Security Regulations

The protection of personal data has become a critical concern in the payments industry. Regulations such as the General Data Protection Regulation (GDPR) in the European Union have set new standards for data privacy and security. These regulations give consumers greater control over their personal information and require payment providers to implement strong data protection measures.

In the United States, while there is no comprehensive federal data privacy law, several sector-specific regulations affect the payments industry. For example, the Gramm-Leach-Bliley Act governs the collection of personal information by banks and financial institutions 3. Additionally, state-level privacy laws, such as the California Consumer Privacy Act (CCPA), have introduced new requirements for businesses handling consumer data.

Open Banking Initiatives

Open banking regulations have emerged as a significant trend, aiming to increase competition and innovation in the financial services sector. These initiatives require banks to share customer data with authorized third-party providers, subject to customer consent. The European Union’s revised Payment Services Directive (PSD2) has been at the forefront of open banking regulations, mandating banks to provide access to customer account information and payment initiation services to licensed third parties 4.

In the United States, while there is no comprehensive open banking regulation, the Consumer Financial Protection Bureau (CFPB) has proposed rules to implement Section 1033 of the Consumer Financial Protection Act. This proposal aims to give consumers the right to access and share their financial data, potentially paving the way for open banking in the country 5.

These regulatory changes have significantly impacted the payments industry, requiring providers to adapt their operations and invest in new technologies to ensure compliance. As the regulatory landscape continues to evolve, payment service providers must stay informed and agile to navigate the complex web of requirements while maintaining a focus on innovation and customer experience.

Challenges in Adapting to New Regulations

The rapidly evolving landscape of payments regulations presents significant challenges for businesses as they strive to stay compliant while maintaining innovation and efficiency. These challenges span various aspects of operations, from resource allocation to technological integration.

Compliance Costs and Resource Allocation

One of the most pressing issues facing organizations is the substantial cost associated with regulatory compliance. According to a 2014 survey by the National Association of Manufacturers, 68.4% of compliance costs in the US manufacturing sector are labor-related, while 13.4% are equipment-related 1. This financial burden can be particularly daunting for smaller businesses, which may struggle to allocate sufficient resources to meet regulatory requirements.

The cost of compliance has been steadily increasing, with research indicating that regulatory compliance costs for US businesses have grown by about 1% each year from 2002 to 2014 in real terms 2. This upward trend puts pressure on companies to carefully manage their budgets and prioritize compliance activities.

Integration with Legacy Systems

Adapting existing payment processing systems to comply with new regulations can be a complex and time-consuming process, especially for businesses with legacy systems. The transition to new standards, such as ISO 20022 for Fedwire payments, presents a significant challenge. A survey revealed that only 35% of North American respondents are highly confident in delivering cost-effective ISO 20022 compliance for Fedwire, indicating that nearly two-thirds still feel inadequately prepared 3.

Migrating existing systems to meet new regulatory standards often requires extensive planning, considerable investment, and a thorough understanding of regulatory requirements. In some cases, organizations may need to implement tactical translation solutions to insulate legacy systems from new standards, while in others, a complete replacement of legacy systems may be necessary 4.

Balancing Innovation and Regulatory Compliance

Striking a balance between innovation and regulatory compliance is a critical challenge for businesses in the payments industry. While new payment methods offer exciting opportunities, they also introduce new regulatory considerations. Organizations must navigate unclear regulations, especially in emerging industries where regulatory frameworks are still evolving 5.

The need for thorough compliance processes can sometimes slow down innovation and product development, creating tension between the desire for agility and the requirement for regulatory adherence. This is particularly challenging for startups and smaller businesses that thrive on speed to market but must also allocate resources to meet compliance requirements 6.

As the payments landscape continues to evolve, organizations must develop strategies to navigate these challenges effectively. This may involve investing in advanced technologies, such as artificial intelligence, to streamline compliance processes and mitigate risks. However, experts caution that human oversight remains crucial in ensuring the accuracy and effectiveness of compliance efforts 7.

Strategies for Navigating the Changing Regulatory Landscape

As the payments industry continues to evolve, organizations must develop effective strategies to navigate the complex and ever-changing regulatory landscape. By implementing robust approaches, companies can ensure compliance while fostering innovation and growth.

Investing in Regulatory Technology (RegTech)

One of the most promising strategies for managing regulatory compliance is investing in RegTech solutions. These technologies help financial institutions reduce costs and minimize risks associated with non-compliance. RegTech transforms the often cumbersome process of regulatory reporting by automating tasks such as regulatory change tracking, data validation, and processing. This automation ensures accurate and timely data delivery while reducing human errors 1.

RegTech solutions also play a crucial role in risk management and data security. They act as a digital detective, simplifying Know Your Customer (KYC) processes with AI and machine learning to swiftly gather and analyze data from various sources, creating comprehensive customer profiles. This approach enhances the effectiveness of anti-money laundering efforts and strengthens overall risk management strategies.

Collaborating with Regulators and Industry Partners

Collaboration between businesses and regulatory bodies has proven to be an effective strategy for navigating the changing regulatory landscape. By enabling the free exchange of resources, knowledge, and experience, these collaborative efforts can help pave the way for progress in the realm of financial technology. In fact, more than 60% of FinTech startups claimed that regulatory collaboration would have the biggest influence on their overall growth 2.

One example of successful collaboration is the implementation of regulatory sandboxes. These initiatives provide an easily accessible, cost-effective route to regulatory authorization and promote trust between firms and regulators. The FCA’s Regulatory Sandbox, for instance, has been praised for its effectiveness. Research has shown that companies participating in such sandboxes saw an average increase in capital of 15%, with the probability of raising capital going up by half 3.

Continuous Education and Training

To effectively navigate the changing regulatory landscape, organizations must prioritize continuous education and training for their employees. This approach ensures that staff members stay up-to-date with the latest regulatory requirements and best practices in payments technology and cybersecurity.

Implementing comprehensive training programs helps employees understand the importance of regulatory compliance and its impact on the organization’s operations. These programs should cover key areas such as anti-money laundering protocols, data privacy regulations, and risk management strategies. By fostering a culture of compliance through education, companies can reduce the likelihood of regulatory violations and strengthen their overall compliance posture.

Moreover, continuous education enables organizations to adapt quickly to new regulations and technological advancements. This agility is crucial in an industry where regulatory changes can have significant impacts on business operations and customer relationships.

Expert Comments

Nick Botha, Global Payments Lead at AutoRek told to FintechZoom.com:

The payments industry is undergoing constant transformation driven by technological advancements, regulatory changes and shifting customer demands. One of the most pressing challenges in the payments industry today is the effective utilisation of data. A staggering 86% of firms are lacking data quality required for accurate reporting, while many organisations struggle with data interoperability, infrastructure limitations and leveraging the potential of their data. This highlights a significant gap in the industry’s understanding and management of data – this needs to change.

However, educating firms on data usage and implementing innovative technologies like AI and machine learning could greatly enhance data sharing, security and reconciliation processes. AI can streamline the reconciliation process by extracting relevant data fields, reducing complexity and operational costs. As a result, in the long term, organisations will begin to see an increase in their margins.

Conclusion

The ever-changing landscape of payments regulations has a profound impact on the financial industry, shaping how businesses operate and innovate. As technology continues to advance, regulators and companies alike must stay ahead of the curve to ensure security, compliance, and customer protection. This balancing act between innovation and regulation presents both challenges and opportunities for the payments sector.

To thrive in this dynamic environment, organizations need to embrace strategies such as investing in RegTech solutions, collaborating with regulators, and prioritizing ongoing education. By doing so, they can navigate the complex regulatory terrain while still pushing the boundaries of what’s possible in the world of payments. In the end, those who can adapt quickly and effectively to new regulations will be best positioned to succeed in this fast-paced and evolving industry.

References

[1] – https://www.paymentsdive.com/topic/regulations_and_policy/[2] – https://www.nacha.org/newrules

[3] – https://www.nmi.com/resources/blog/2024-payment-prediction-government-regulation-will-reshape-payments-compliance/

[4] – https://www.federalregister.gov/documents/2024/07/02/2024-14002/update-of-regulations-regarding-payment-of-tax-by-commercially-acceptable-means

[5] – https://www.emarketer.com/insights/digital-payment-services/

[6] – https://www.appventurez.com/blog/how-technology-has-transformed-the-payments-industry

[7] – https://insights.discoverglobalnetwork.com/insights/innovations-shaping-digital-payments-industry