Online payments are no longer a niche feature. They’re a cornerstone of global commerce. What once felt like a convenience is now an expectation, and increasingly, a necessity. From street vendors accepting digital wallets to entire nations moving away from cash, online payments are changing how people interact with money.

In this article, we explore why online payments are becoming the norm worldwide and what key factors are accelerating this shift.

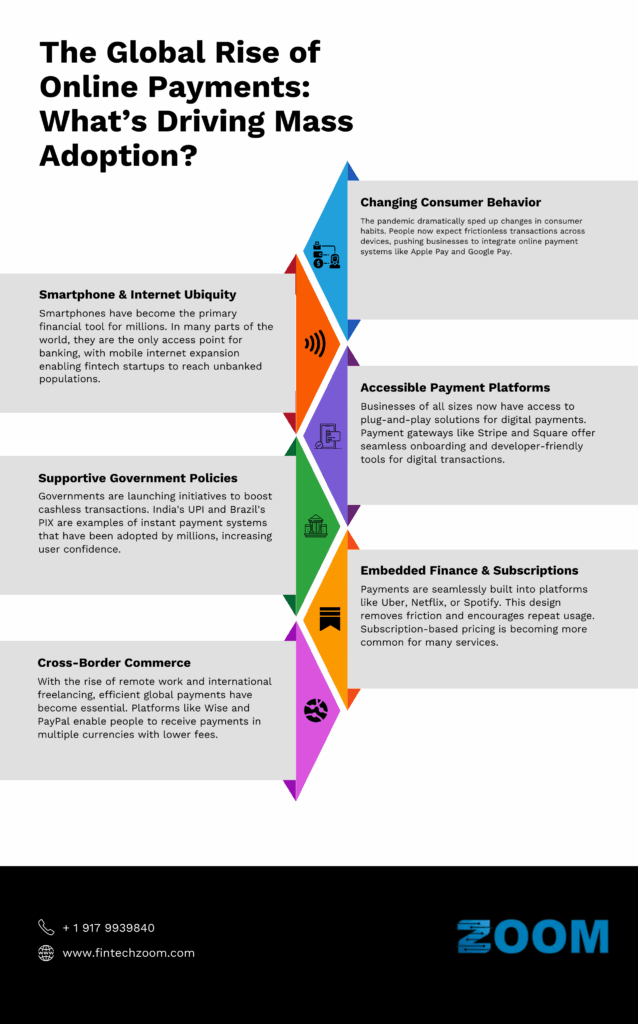

Consumer Behavior Has Changed — Permanently

One of the clearest drivers of mass adoption is the evolution in consumer habits. The pandemic dramatically sped up changes that were already in motion. Shoppers who previously preferred physical stores found themselves buying groceries, clothes, and even cars online.

But the change stuck.

People now expect frictionless transactions across devices and platforms. This demand has pushed businesses to integrate online payment systems, from traditional debit/credit card checkouts to Apple Pay, Google Pay, and regional mobile payment apps like M-Pesa in Kenya or Paytm in India.

Even older generations have embraced digital payments. Convenience, safety, and speed outweigh hesitation. More importantly, trust in online payment systems has steadily increased due to better security protocols and widespread user experience improvements.

Ubiquity of Smartphones and Internet Access

Smartphones have become the primary financial tool for millions. The average person is more likely to open a wallet app than reach for cash. In fact, in many parts of the world, smartphones are the only access point for banking and digital transactions.

Internet accessibility has played a massive role here. In Southeast Asia, for instance, mobile internet expansion has enabled fintech startups to reach previously unbanked populations. Payment apps like GCash (Philippines) and Dana (Indonesia) are now mainstream tools.

China’s mobile-first model, driven by Alipay and WeChat Pay, shows just how quickly online payments can reshape a country’s financial system. Today, everything from utility bills to rent can be paid with a scan of a QR code.

Platforms Are Making It Easier to Pay — and Get Paid

Businesses of all sizes now have access to plug-and-play solutions for digital payments. Whether you’re a solo Etsy seller or a multinational retailer, integrating online transactions has become faster, easier, and more cost-effective than ever.

Payment gateways like Stripe, Square, and Payoneer offer seamless onboarding and developer-friendly tools, making it simple for businesses to serve customers in the digital space. At the same time, marketplaces and entertainment platforms are embedding payment systems that reflect how people actually shop and play online.

This shift is especially visible in the world of online entertainment, where digital payments have become second nature. Gamers regularly buy titles on platforms like Steam with just a few clicks. Music, streaming services, and even virtual events rely on fast, secure transactions to meet user expectations. The trend extends to online casino gaming as well, where smooth and reliable payments are part of the overall experience.

Players who play MrQ bingo games, for example, often use familiar methods like Mastercard, PayPal, Visa, or Apple Pay, highlighting how mainstream digital payments have become. These options provide a sense of control, trust, and convenience that traditional methods struggle to match. It’s this ease of use and accessibility that continues to drive the global rise of online payments.

Governments and Policies Are Paving the Way

Legislation and public policy also play a critical role in shaping digital payment ecosystems. Governments are launching initiatives to boost cashless transactions, especially in economies where the informal sector dominates.

India’s Unified Payments Interface (UPI) is one of the best-known examples. It offers instant bank-to-bank transfers and has been adopted by millions across the country. Other governments are following suit. Brazil launched PIX, an instant payment system developed by its central bank. Nigeria has similar ambitions with its eNaira platform.

Regulations are also ensuring safer digital experiences. The EU’s Revised Payment Services Directive (PSD2) promotes innovation while requiring stricter authentication. These frameworks increase confidence among users and encourage further adoption.

The Rise of Embedded Finance and Subscription Models

Consumers are engaging with payments less as a one-off event and more as part of a long-term service experience. Embedded finance, where payments are seamlessly built into platforms, is reshaping everything from transportation to media.

Think of apps like Uber, Netflix, or Spotify. Once your payment method is stored, it becomes invisible. This design removes friction, encourages repeat usage, and builds brand loyalty. Subscription-based pricing is becoming more common in food delivery, digital tools, fitness programs, and even personal finance apps.

This shift also empowers smaller businesses. For instance, personal trainers or yoga instructors can now charge subscriptions via platforms like Patreon or Ko-fi. The barriers to entry for digital entrepreneurship are significantly lower because payments are no longer a bottleneck.

Cross-Border Commerce and Global Workforces

With the rise of remote work and international freelancing, efficient global payments have become essential. Platforms like Wise, Revolut, and PayPal are enabling people to receive payments in multiple currencies with lower fees and faster processing times than traditional banks.

E-commerce giants like Amazon and Alibaba have also helped standardize the checkout experience across countries. Buyers in France can pay sellers in Japan just as easily as buying from their local supermarket.

Digital wallets that support multi-currency use, such as Apple Pay and Payoneer, are smoothing out once-complicated transactions. As borders blur for work and shopping, so must the payment experience.