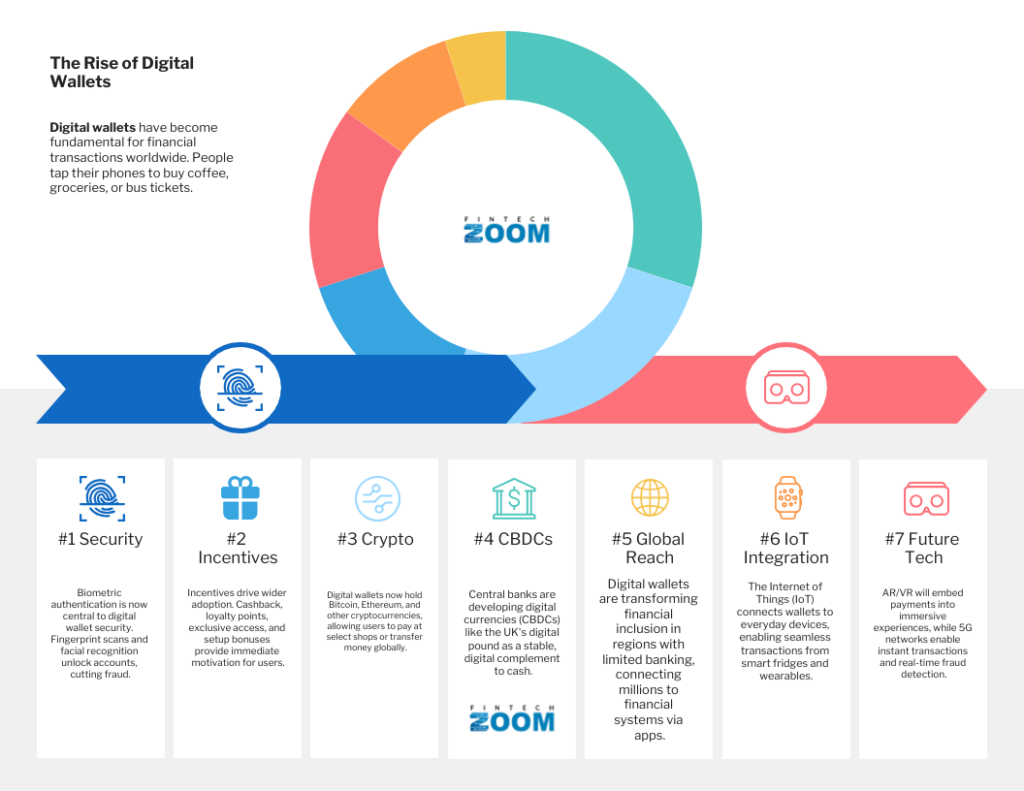

Digital wallets have become fundamental for financial transactions worldwide. People tap their phones to buy coffee, groceries, or bus tickets. By mid-2025, about 4.3 billion users are estimated to rely on these tools, driven by smartphone adoption and demand for contactless payments. Starting as card storage, wallets now manage budgets, loyalty programmes, and instant transfers. Security advances keep pace, while cash and physical cards fall out of favour in many markets.

Transaction values are on track to approach £13 trillion by 2029, reflecting rapid growth in adoption and usage. Governments recognise the potential for wider financial access, businesses benefit from quicker sales, and users monitor spending live. Future wallets will streamline daily routines as they integrate more with shopping, travel, and banking apps.

Incentives Encourage Adoption

In the fintech world, security upgrades build trust, but incentives often drive wider adoption. Much like shoppers drawn to loyalty points and welcome discounts in retail apps, or players seeking the latest bonuses, high payout rates, VIP loyalty perks, and fair promotions in online casinos. Fintech platforms, on the other hand, use different perks to encourage users to try new tools. Cashback, loyalty points, exclusive access, and setup bonuses provide immediate motivation, while clear terms ensure users fully benefit. This combination of trust and tangible rewards fosters adoption and ongoing engagement.

Biometrics Strengthen Security

Biometric authentication is now central to digital wallet security. Fingerprint scans and facial recognition unlock accounts in seconds, cutting fraud since these traits are harder to steal than passwords. Juniper Research projects biometrics will secure over £2.5 trillion in payments by 2025. Encryption keeps data safe, and banks and fintechs are rolling out these tools widely, while developers improve reliability in low light or with everyday facial variations.

Early adopters prioritise speed, while others follow once they see smoother transactions and fewer disputes. Beyond banks, contactless and biometric payments are being trialled by UK retailers, public transport networks, and even gaming platforms. Providers focus on user-friendly apps, regular updates, and employee training, making transactions quicker, safer, and more appealing in crowded urban areas.

Cryptocurrencies Blend In

Digital wallets now hold Bitcoin, Ethereum, and other cryptocurrencies alongside traditional funds. Users can pay at select shops or transfer money globally, with blockchain ensuring fast, transparent, and often cheaper transactions. Travellers bypass currency exchange hassles, and more retailers are accepting crypto, while apps let users convert assets instantly.

Security is a priority, with two-step verification, privacy controls, and market alerts. Exchanges streamline setup and verification, often in minutes. Transaction volumes are surging in 2025, as businesses reach global markets and customers avoid conversion fees. Wallets simplify trading for both beginners and experienced users, making daily crypto use, from online shops to local vendors, routine and pushing cryptocurrencies toward mainstream adoption.

Central Bank Digital Currencies Advance

Central banks are developing digital currencies as a stable medium of exchange. The UK’s digital pound is advancing through its design phase, with the Bank of England and HM Treasury exploring it as a digital complement to cash. Phase 2 of the Digital Pound Lab allows firms to test use cases and business models.

Designed to work like cash in digital form, the digital pound can be stored securely in wallets and used to automate payments such as bills. Regulations aim to reduce risks compared to cryptocurrencies, while merchants prepare for integration and unbanked users gain access. Apps will support stable digital flows, balancing privacy with oversight, and trials will explore real-world use, from retail to remittances, with collaboration and public input refining the approach.

Growth in Underserved Regions

Digital wallets are transforming financial inclusion in regions with limited banking. Smartphones connect millions to financial systems, enabling small vendors to accept micro-payments and providing access to loans and insurance via apps. Affordable data plans, local language interfaces, and low fees make them accessible.

Asia and Africa are seeing rapid adoption, with remittances becoming cheaper and governments supporting rollout through training programmes. Offline modes allow transactions in low-signal areas and then syncing later, while e-commerce grows as trust strengthens. Adoption is doubling yearly in some regions, bringing financial services to millions previously excluded.

Smart Devices Expand Reach

The Internet of Things (IoT) connects wallets to everyday devices, enabling seamless, secure transactions. Smart fridges can automatically reorder low-stock items, while wearables like watches facilitate tap-to-pay fare payments. Secure codes and end-to-end encryption protect data during these transactions. Users can set approval limits. Developers prioritise secure connections, and adoption is propelled by the availability of affordable devices. As households integrate these payment methods into daily routines, the convenience of IoT payments continues to expand across markets.

AR and VR Transform Interaction

Augmented and virtual reality are changing wallet use by embedding payments directly into immersive experiences. Shoppers can view real-time price overlays, make gesture-based purchases in virtual stores, and track budgets in 3D spaces. Tech-savvy users are particularly embracing these formats, with devices requiring no specialised hardware. Trials have shown strong engagement, making finance feel intuitive and engaging. As technology spreads, accessibility widens, and retailers test virtual checkouts, users can browse and buy in immersive settings. Adoption grows as simpler interfaces are developed.

5G Powers Performance

With 5G networks, transactions happen instantly, and fraud can be detected in real time, making mobile banking more secure. Urban areas enjoy strong, reliable connections that keep pace with busy lifestyles. AI-powered apps provide personalised spending recommendations, and stores can handle high transaction volumes without any delays. Fast networks enable apps to handle complex tasks, such as live market updates. Expanding coverage ensures connectivity for consumers in rural areas, maintaining digital wallets at the centre of everyday finance.

Conclusion

With security, accessibility, and speed at the forefront, digital wallets are revolutionising how we interact with money. UK initiatives, such as the digital pound, are a good example, but cooperation is needed to overcome privacy issues. Wallets help people manage their daily finances and encourage efficiency and inclusivity in addition to convenience. They gradually reshape economies by empowering people and connecting them to new opportunities.