The creator economy has long gone beyond entertainment and hobbies. More and more content creators are building their businesses not only on charisma but also on expertise. This is especially true in the fields of finance, investment, and knowledge monetization. From budget tips on Instagram to detailed reviews of investment strategies on YouTube, financial creators are becoming modern mentors and guides in the world of money.

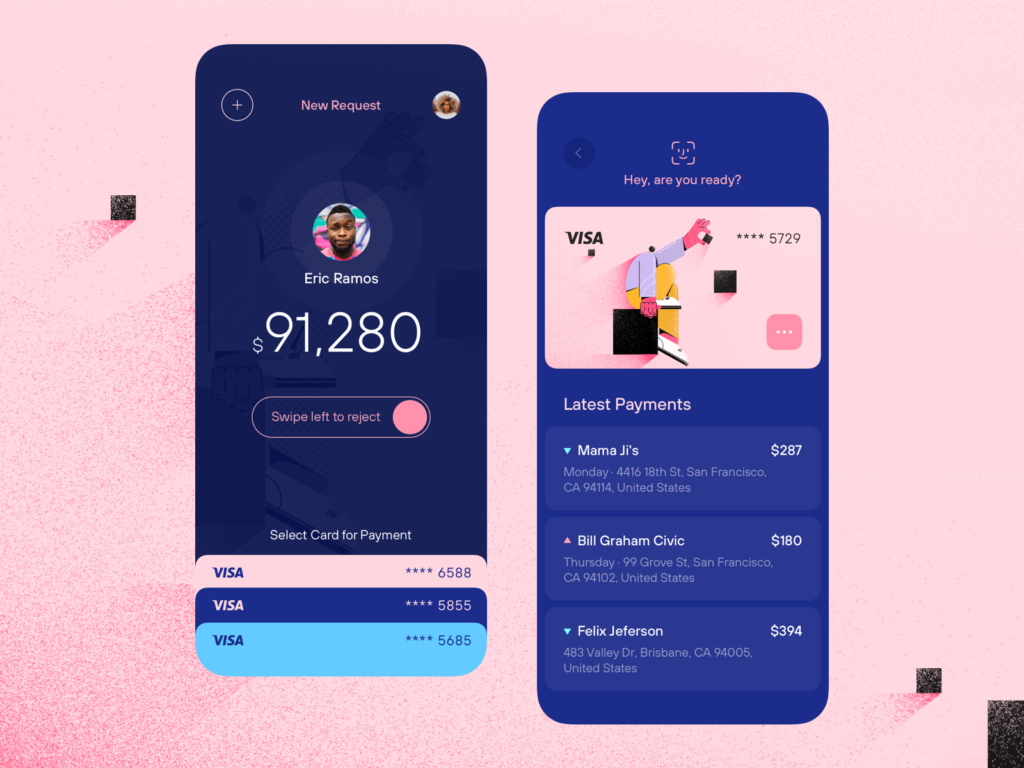

However, content alone is not enough to turn knowledge into a sustainable income; you need more than just payment links and subscribers. You need infrastructure. That is why fintech is not just providing payment solutions, but is becoming the core of systems that help creators operate as a full-fledged business. With the right tools, financial bloggers are turning into product experts, tutors, and service providers at the same time. Their success depends on how clearly their monetization strategy aligns with the technical foundation.

Why Fintech Is Betting Big on Creators

In today’s digital environment, you can notice an increase in the number of financial influencers. And this is not just by chance, since now it is much more engaging to listen to a specific expert than to receive information from a faceless bank.

Starting from investment reviews or courses on financial literacy, the demand for financial content is constantly growing. Moreover, people are ready to pay for expert advice.

But in this case, the key is trust, which should form the basis of a brand. Thanks to this, when content creators launch a course or a book for sale, it is not perceived as just a product. The audience sees it as a form of support for the influencer. Fintech is an opportunity to transform knowledge into a scalable product, ranging from niche topics like cryptocurrencies and real estate to basic courses on financial literacy.

What Financial Creators Need Beyond a Payment Button

Selling financial content is more than just a “Buy” button. It is also important for content creators in this niche to take care of their business structure, especially if they are providing paid consultations that involve an individual approach to each client. A properly organized structure allows effective interaction with each one.

Often, content creators organize their activities in the following ways:

- Subscriptions and tiered pricing – From monthly newsletters to premium coaching. Here, it is vital to manage different offer formats.

- Onboarding and compliance – Especially for tax, investment, and financial consultations, clear registration processes and secure data handling are critical.

The peculiarity of content in the fintech sphere is that it acts as a service, which means a competent infrastructure is essential.

Infrastructure That Scales — From Manual Hustle to Monetization Engine

There are many routine tasks that take up a lot of time. For example, it’s necessary to negotiate with the audience via personal messages, send invoices, and maintain records. For beginner content creators, these tasks can often be done manually. However, the larger the audience, the harder it becomes to manage them all.

In this case, it’s necessary to automate routine tasks to avoid turning the work process into complete chaos. How can automation help? Here are the main points:

- Automatic segmentation of clients.

- Sending welcome emails, forms, or payment links.

- Content delivery based on the subscriber’s plan.

- Automatic analysis of key indicators and generation of recommendations.

All this can be achieved with the help of a modern tool that eliminates the need to juggle multiple platforms. This is precisely the infrastructure that turns a hobby into a business. By the way, you can try out the OnlyMonster tool that helps creators streamline content delivery, centralize fan management, and grow revenue from custom offerings.

Monetization Models That Work in the Finance-Creator Space

If you are a content creator in the financial industry, you need to choose the right monetization model. Let’s look at a few proven formats:

- Subscriptions: Ideal for those who offer regular updates, tips, or exclusive reviews. Recurring payments create financial stability.

- Selling individual products: eBooks, budget templates, Excel spreadsheets, or calculators can be sold individually and automatically.

- Micro-courses: Short training modules of 30–60 minutes (for example, “How to Start Investing” or “Financial Plan in an Hour”) scale well.

- Personal coaching: For clients willing to pay more, with automated booking and payment through a platform.

What’s more, you can combine all these models. For example, subscribers receive discounts on courses, and coaching packages may include exclusive materials. The main thing is to ensure the infrastructure supports all of these formats without becoming overly complex.

Choosing the Right Stack — Tools That Reduce Work, Not Just Add Features

Content creators need to carefully manage their tool stack regardless of their niche. One of the biggest problems many creators face is tool overload. Canva, Google Sheets, Stripe, Mailchimp, Calendly, and Notion are frequently used and often simultaneously.

Of course, each of these tools is useful for generating content and managing workflows. But in practice, it all turns into a mess. The best stacks are integrated, automated, and mobile-friendly. When choosing relevant tools, look for those that:

- Handle multiple tasks (CRM + scheduling + content delivery).

- Easily integrate with others (Zapier, Webhooks, etc.).

- Ensure data privacy and offer export capabilities.

- Automate routine tasks: welcome emails, reminders, and access control.

Just one comprehensive tool can help you organize your workflow. This is a real opportunity to make your work easier so that you can spend more time on more creative tasks.

Conclusion

Financial creators are no longer just bloggers — they are mentors, experts, and entrepreneurs. That’s why infrastructure is essential for anyone looking to turn a passion into a real business. There is a need to choose the right monetization strategy that will generate income and the right tools to save your time, energy, and focus.

In an era where fintech and the creator economy are increasingly intersecting, modern platforms make it easier than ever to launch, manage, and scale digital financial products. Being a financial creator in 2025 means building full-fledged financial products, and your success depends on the tools you choose.