As financial institutions journey through a sea of change — from changing regulations to growing technology usage — enterprise risk management (ERM) is more relevant than ever. Institutions of all sizes, resources, geographies, and risk appetites are using ERM to survive and thrive in an ever-evolving risk and regulatory environment.

But what exactly is ERM, and how does it differ from other forms of risk management? How can institutions successfully implement ERM? Let’s dive into the ‘why’ behind this risk management approach and best practices for institutions that want to improve their risk management programs.

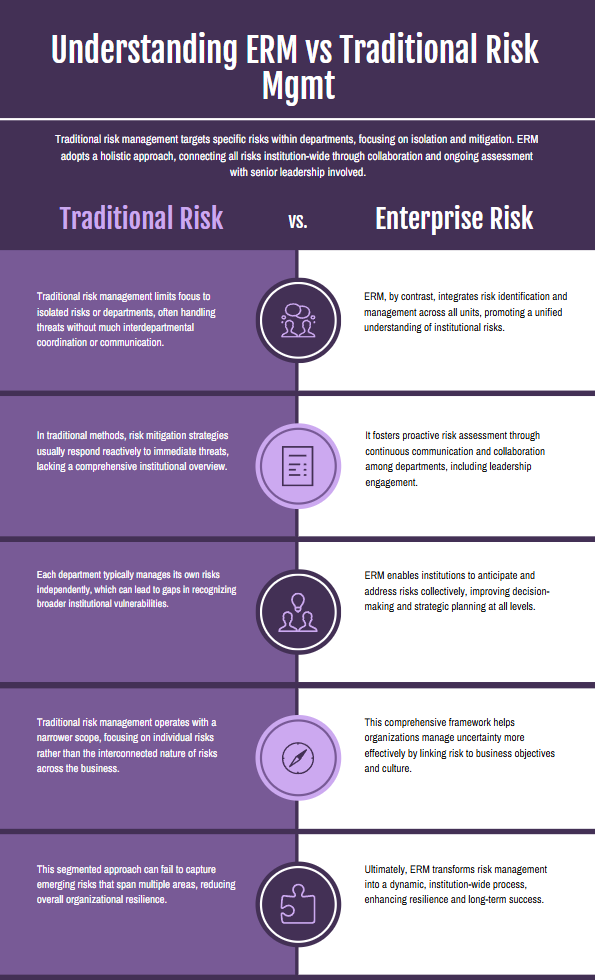

ERM vs. Traditional Risk Management

Traditional risk management often focuses on specific risks or departments within an institution. It involves identifying, assessing, and mitigating individual threats or uncertainties that can impact a part of the organization. Typically, there is not much cross-department collaboration and coordination, as most risks are handled at the departmental level.

ERM takes a more holistic, proactive approach to risk management by considering all types of risks across the institution. It emphasizes communication and collaboration between different business units, including senior management, to continually assess risks.

ERM in Action

One of the best ways to understand the value of ERM is to consider how your institution currently makes strategic decisions.

Organizations that take a siloed (or traditional risk management) approach to decision-making may not consider the long-term consequences of their choices. Say a financial institution is on the cusp of losing its small business lending market share to an unregulated fintech.

While some potential risks are brought up, there is no systematic approach to analyzing potential risks. Worse yet, key stakeholders across departments (Compliance and IT, for example) aren’t included in the conversation, so when the institution begins offering unsecured small business loans 24 hours later, senior leadership and team members at all levels are surprised, confused, and unsure of the institution’s direction and long-term mission, vision, and values. Later on, the institution faces compliance, operational, and financial challenges because it failed to properly assess the risks associated with its new product offering.

Imagine the same situation is approached with an ERM mindset. Key decision-makers across the institution are in the same room. They talk and uncover potential problems and risks across multiple areas. However, because the conversation is happening early in the process, they can be flexible in their approach. Not only do they assess the risks, but they can better allocate their resources by fostering collaboration and clearer communication. As a result, when the new product offering is released, the staff and leadership are excited about the new service, aligned on the strategic objectives, and ready to mitigate any issues that arise.

Tips for Properly Implementing ERM at Your Institution

So, what does it take to implement an effective ERM program? Consider these best practices as you begin — or revisit — your ERM journey.

- Gain executive support. Secure buy-in from top management and the board of directors. The commitment of the leadership team, or tone from the top, is crucial for fostering a risk management culture throughout the organization.

- Define a clear risk management framework. Choose a recognized risk management framework, such as the Committee of Sponsoring Organizations of the Treadway Commission’s (COSO) ERM framework. It has played a significant role in shaping the modern ERM approach and continues to be the go-to standard for many financial institutions.

- Conduct comprehensive risk assessments. Identify and assess the range of risks facing your institution, including credit, market, operational, and compliance risks. Use methodologies like SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis or risk matrices to prioritize these risks.

- Integrate with strategic planning. Ensure that risk management processes are embedded in the strategic planning and decision-making processes. Link risk assessments to your institution’s mission, vision, and strategic objectives to maintain alignment.

- Establish roles and responsibilities. Define roles for risk management across all levels of the organization. Ensure that staff understand their responsibilities related to risk management.

- Promote a risk-aware culture. Foster an organizational culture that encourages transparency and open communication about risks. In-depth training and relevant resources can help employees better understand their role in managing risks.

- Implement risk mitigation strategies: Develop and implement strategies to manage identified risks. This might include risk avoidance, reduction, sharing, or acceptance, based on the institution’s risk appetite.

- Review and revise the ERM process. If your ERM process doesn’t change over time, it’s probably stale. Periodically review and update your framework and practices to adapt to external changes, regulatory requirements, or internal operations updates.

- Leverage technology. Use automated technology and data analytics to enhance risk detection, reporting, and decision-making processes. Tools for risk assessment and management offered through ERM systems such as Ncontracts can streamline workflows and improve effectiveness.

- Engage in regular training and awareness programs. Continuous training ensures that employees remain informed about the latest risk management practices and regulatory changes.

- Encourage collaboration. ERM thrives on cooperation from all team members and departments. Facilitate collaboration to enhance information sharing and improve your institution’s overall risk management practices.

ERM is an ideal risk management approach for financial institutions facing today’s dynamic challenges. By moving away from siloed approaches to a holistic framework, institutions can better identify and mitigate risks across all levels, align risk management with strategic objectives, and help their organizations maintain operational resilience for years to come.