The fintech universe has rapidly expanded in recent years with startups and big players all jostling for their piece of the growing pie. But amidst this gold rush, StocksToTrade CEO Zak Westphal, asks whether we are overlooking something fundamental – user education?

“I believe fintech has huge potential to change how everyday people manage their finances,” Westphal says. “But that’ll only happen if we teach users how these tools actually work so they can use them to make smarter money moves.”

After over a decade of navigating the winding roads of fintech, Westphal believes its future rests on an essential foundation: user empowerment through education. Without it, are we just creating more financial noise and confusion?

“We need to make simple, easy-to-understand user education priority number one,” he urges. “Or we risk just creating a mess of dazzling products that ultimately leave people more confused than ever. I want to see us streamlining systems that people can actually leverage – that’s the fintech future I’m excited about.”

Who Is Zak Westphal?

After years day trading penny stocks, Zak Westphal quickly spotted a key discrepancy – while institutions enjoyed a wealth of pro-level market tools and insights, average traders were left bench warming without access.

“It just didn’t seem fair for certain players to have an inherent advantage,” Westphal recalls. “Everyone should have the chance to succeed in the markets – not just bigwig firms with fancy analytics.”

So Westphal took matters into his own hands, founding StocksToTrade to democratize trading. His vision? To arm retail investors with institutional-caliber resources and education, finally leveling the playing field.

Under Westphal’s leadership, StocksToTrade has evolved into a thriving community pulsing with empowered traders – now equipped with the knowledge and skills to navigate the markets on their own terms.

“I wanted to make trading accessible to all – no matter your background,” he explains. “With the right guidance and technology, anyone can thrive in this arena.”

A decade later, Westphal’s mission remains unchanged. StocksToTrade continues working tirelessly to decrypt the markets for retail – proving that maybe David can take on Wall Street’s Goliaths.

The Current State of User Education in Fintech

Cutting-edge fintech innovations like blockchain, machine learning, and AI-powered trading tools continue bursting onto the scene. Their complexity dazzles – but without proper user education woven in, does the tech do more harm than good?

“I’ve seen too many companies rush blockchain products to market without explaining how average users can leverage them” Westphal explains. “It leaves users more confused and overwhelmed than empowered.”

Users get intrigued but then bounce off once they hit dense terminology and risky volatility they don’t grasp,” he notes. “Better onboarding could better protect and guide them.”

Even AI-trading tools – which promise automated insights – often lack user guardrails. “Handing advanced tech to novices without support is risky,” Westphal says. “Education needs to be embedded in these offerings or you’ll see newbie traders get burned.”

“If companies expect complex innovations like blockchain, machine learning, and AI to achieve mainstream adoption, they need user education fueling every step – not tacked on as an afterthought.”

StocksToTrade’s Approach to User Education

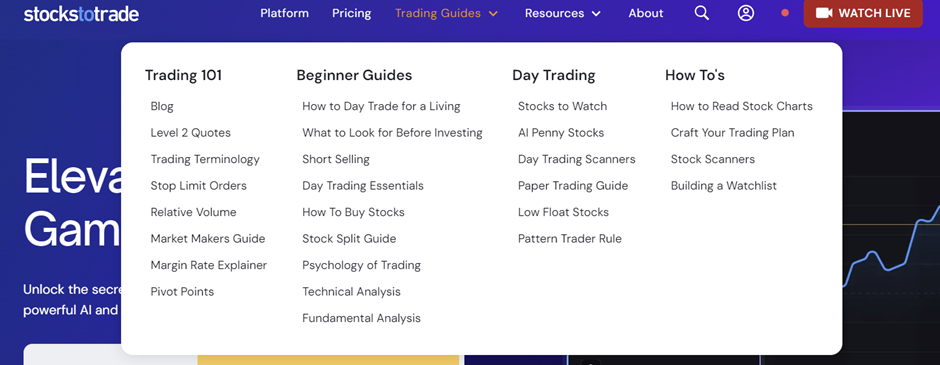

Education stands central to the StocksToTrade ethos. Through meticulously designed guides, community forums, and interactive media, users gain an illuminated pathway to trading mastery.

“We obsess over crafting premium educational assets so all traders can level up smoothly,” Westphal remarks. Unlike platforms offering complexity without context, StocksToTrade prioritizes clarity at every step.

Beginners dive into primer guides that decode key terminology and strategy. Veterans gain access to insider peer circles and advanced masterclasses to continue pushing their potential.

The platform nurtures its educational resources continuously – regularly updating obsolete content with cutting-edge insights. “Our goal is to tend this robust, living base of knowledge so traders always feel equipped, empowered and energized by the learning process itself,” Westphal explains.

The Benefits of Prioritizing User Education

When fintech players make user education a top priority, the benefits cascade – both for users themselves and the companies serving them.

Educated users tend to stick loyally with platforms invested in their success journey. “We find customers that understand our tools are far more likely to become longtime members,” Westphal notes.

Moreover, empowered with contextual knowledge, users make sharper financial decisions – avoiding unnecessary risks and friction. “Arming customers with real mastery over these tools leads to better outcomes on both sides. It’s not just an altruistic move – it also fuels sustainable growth,” Westphal explains. “When users succeed, we succeed. That loyalty and retention is priceless.”

Embedding education into fintech’s DNA sparks a virtuous cycle where companies and community members collectively benefit. As Westphal summed it up: “It’s fundamentally a win-win situation.”

Zak Westphal’s Call to Action for Fintech Leaders

“We need to ask ourselves honestly – are we doing enough to truly empower users with knowledge?” Zak challenges other fintech leaders. “If we can’t answer decisively, yes’, then it’s time for radical change.”

Westphal argues that comprehensively educating users should form fintech’s foundation before releasing new products. The impact of elevating financial literacy could be immense – transforming barriers into equitable access ramps.

“User empowerment can’t remain a peripheral box to check. It must sit at the core of fintech’s priorities from day one,” he states. Without it, innovation reaches only elite circles while excluding most individuals.

Westphal concludes with a galvanizing vision for industry-wide cooperation:

“Together, through comprehensive education woven into each new tool, we can create a landscape where all people confidently grasp financial opportunities. This inclusive future should drive our industry’s progress collectively.”