Financial technology continues to redefine how people manage, invest, and interact with their money. As 2025 approaches, a new wave of innovations is emerging, promising to make financial services more intuitive, secure, and tailored to individual needs. From advanced artificial intelligence to region-specific mobile solutions, these trends are setting the stage for a more connected and responsive financial ecosystem.

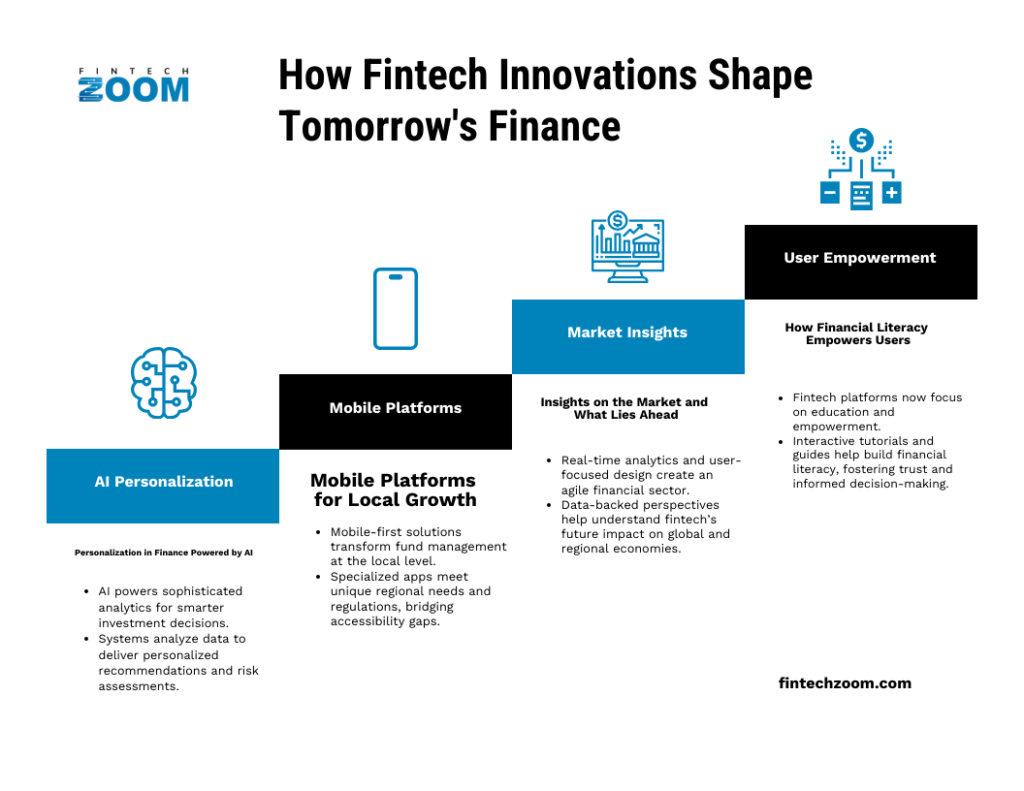

Personalization in Finance Powered by AI

Artificial intelligence is rapidly becoming the backbone of modern financial platforms. No longer limited to basic automation, AI now powers sophisticated analytics that help users make smarter investment decisions in real time. These intelligent systems analyze vast amounts of data, learning from user behavior and market trends to deliver personalized recommendations and risk assessments. This shift is making it easier for both seasoned investors and newcomers to navigate complex markets with confidence, as AI adapts to each user’s unique financial goals and preferences.

Mobile Platforms That Support Local Growth

Mobile-first finance solutions are transforming how people access and manage their funds, especially at the local level. In states with rapidly evolving regulatory environments, specialized mobile apps are emerging to meet unique regional needs. For example, the rise of tailored applications, such as the florida sports betting app, demonstrates how fintech providers are responding to state-specific regulations and consumer demand. These platforms not only offer convenience but also showcase how financial technology can bridge gaps in accessibility, ensuring that users have secure and compliant tools at their fingertips.

Insights on the Market and What Lies Ahead

As financial technology continues to advance, understanding the broader market landscape becomes essential for both consumers and industry professionals. Real-time analytics, regulatory updates, and user-focused design are converging to create a more agile and resilient financial sector. For a deeper understanding of how FintechZoom provides real-time market intelligence on emerging financial technologies—including AI-driven investment tools and the evolving landscape of mobile financial apps—read the detailed FintechZoom market insights at QuantumRun for a data-backed perspective on fintech’s future and its impact on both global and regional economies, such as the rapid growth of mobile platforms in markets like Florida.

How Financial Literacy Empowers Users

One of the most promising aspects of recent fintech advancements is the focus on education and empowerment. Modern platforms are integrating interactive tutorials, step-by-step guides, and transparent reporting features to help users build financial literacy. This commitment to clarity not only fosters trust but also encourages informed decision-making, ensuring that technology serves as a tool for growth rather than a barrier to entry. As fintech continues to evolve, these educational resources will play a crucial role in making financial services more inclusive and effective for everyone.

The coming years promise exciting developments in financial technology, with innovations designed to enhance personalization, accessibility, and transparency. By staying informed and engaged with these trends, users and professionals alike can look forward to a financial landscape that is smarter, more responsive, and better equipped to meet the needs of a diverse and dynamic economy.