Fintech companies are increasingly turning to external expertise to enhance their operations and meet modern challenges. This strategic integration of talent is crucial for staying competitive in a rapidly evolving industry.

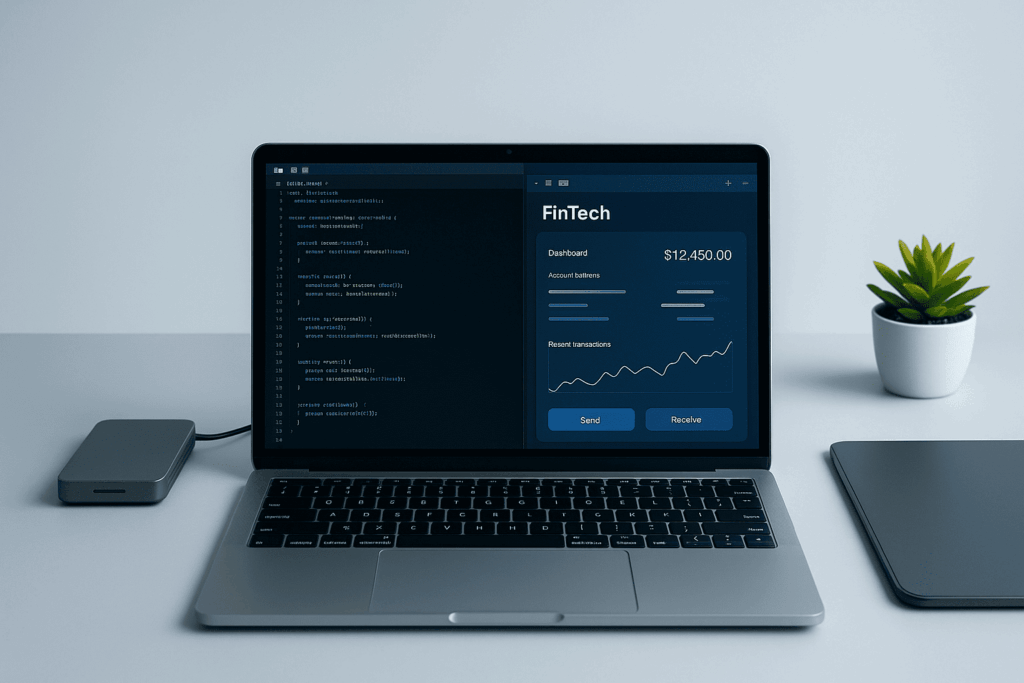

The fintech sector is undergoing significant transformation, driven by technological advancements and changing consumer demands. As companies strive to maintain a competitive edge, the need for specialized skills has become more critical. One effective approach to addressing this challenge is through staff augmentation, which allows fintech firms to integrate external talent seamlessly. This strategy enables companies to tackle complex projects and adapt to the ever-changing landscape without compromising on quality or efficiency.

Addressing challenges with specialized expertise

Fintech companies face unique challenges that require specialized solutions. Regulatory compliance demands constant vigilance and adaptation to evolving laws. Cybersecurity threats are a persistent concern, necessitating expertise in safeguarding sensitive financial data. Technological innovation presents opportunities and challenges, as companies must stay ahead of emerging trends to remain relevant. Integrating specialized talent provides fintech firms with the skills needed to address these issues effectively.

By bringing in experts with niche skills, companies can ensure they have the knowledge required to navigate complex regulatory environments efficiently. These experts can also help implement robust cybersecurity measures that protect against potential breaches and data theft. Furthermore, having access to cutting-edge technological expertise allows fintech firms to innovate rapidly, launching new products and services that meet market demands.

The complexity of modern fintech operations extends beyond traditional financial services, encompassing artificial intelligence, blockchain technology, and advanced data analytics. Companies must balance innovation with stability, ensuring that new implementations do not disrupt existing operations or compromise user experience. External specialists bring fresh perspectives and proven methodologies from diverse industry experiences, enabling fintech firms to implement best practices quickly. This cross-pollination of ideas and approaches accelerates problem-solving and reduces the learning curve associated with adopting new technologies or entering unfamiliar market segments.

Exploring the benefits of integrating external experts

The integration of external experts offers numerous benefits that traditional hiring processes may not provide. One primary advantage is flexibility; companies can scale their workforce up or down depending on project demands without committing to long-term employment contracts. This approach allows fintech firms to manage resources efficiently, reducing overhead costs associated with permanent hires.

Another significant benefit is cost-effectiveness. Traditional recruitment processes can be time-consuming and costly, with expenses related to advertising, interviewing, and onboarding new employees. By contrast, integrating external talent often involves fewer administrative burdens and lower costs, as these experts can be brought on board quickly to address immediate needs.

Steps for successful talent integration in fintech

Implementing talent integration effectively requires a strategic approach aligned with company goals and project requirements. The first step involves identifying specific skills or expertise gaps within the organization that need addressing. Once these areas are pinpointed, fintech firms can seek out external professionals who possess the necessary qualifications.

After identifying potential candidates, it is crucial to evaluate their cultural fit within the organization. This step ensures smooth collaboration between internal teams and external experts, minimizing potential communication barriers. Companies should also establish clear expectations and goals for each project to ensure alignment across all team members.

Navigating potential challenges when integrating external talent

While strategic talent integration offers numerous advantages, it is essential for fintech companies to anticipate potential challenges associated with this approach. One common issue involves ensuring cultural compatibility between internal teams and external experts; differences in work styles or communication practices may hinder effective collaboration if not addressed proactively.

Another consideration involves establishing clear channels of communication between all parties involved in a project. Regular updates on progress help prevent misunderstandings or delays due to misaligned expectations or objectives among team members from different backgrounds.

To overcome these challenges successfully requires thoughtful planning. Companies should invest time upfront developing comprehensive onboarding processes designed specifically for external experts joining their teams temporarily. This ensures smooth transitions while fostering positive working relationships from day one onward. Additionally, collaborating with a nearshore software development company can provide access to a pool of skilled professionals who can seamlessly integrate into existing teams, enhancing project outcomes.

FAQs about strategic talent integration in fintech

Talent integration is crucial for fintech companies because it allows them to access specialized skills and expertise needed to tackle complex challenges, such as regulatory compliance and cybersecurity, ensuring they remain competitive in a rapidly evolving industry.

Using external talent provides flexibility, cost-effectiveness, and access to niche expertise. This approach enables fintech firms to scale their workforce according to project demands and reduce overhead costs associated with permanent hires.

Successful collaboration can be achieved by evaluating cultural fit, establishing clear communication channels, and setting defined expectations and goals for each project. Comprehensive onboarding processes can also facilitate smooth transitions and foster positive working relationships.