The banking and finance sectors have been increasingly relying on mobile technology to meet the demands of modern consumers. They have gradually moved the financial ecosystem from instant payments to digital-first banking and mobile wallets. These improvements have set new standards that fulfill customer expectations of speed, convenience, and borderless accessibility.

This is all thanks to eSIM, an in-demand, low-cost, high-utility product aligned perfectly with the global, tech-savvy customers. It has fueled a borderless world in fintech by providing flexible solutions like secure customer authentication, instant activation, and reliable global connectivity. Read on to learn how eSIM is powering fintech in a borderless world.

eSIMs vs physical SIMs: enabling instant digital access across borders

Despite the continued technological advancement, financial management remained a challenge given the constant need for physical SIM swaps, connectivity issues, security risks, and expensive roaming fees. However, all these have since changed with the introduction of eSIMs.

These digital SIM cards eliminate the traditional wait times and logistics of purchasing, inserting, and activating a physical SIM card. eSIMs enable secure, convenient, and fast remote provisioning even in cross-border banking by:

- Facilitating immediate access to digital banking platforms while abroad

- Offering cheaper data and SMS plans, and reduced transaction costs, making it easy to access digital banks

- Allowing for remote user verification by linking SIM accounts to Wi-Fi

- Minimizing the chances of fraud through enhanced security

- Enabling multi-currency accounts

- Enabling instant network switching

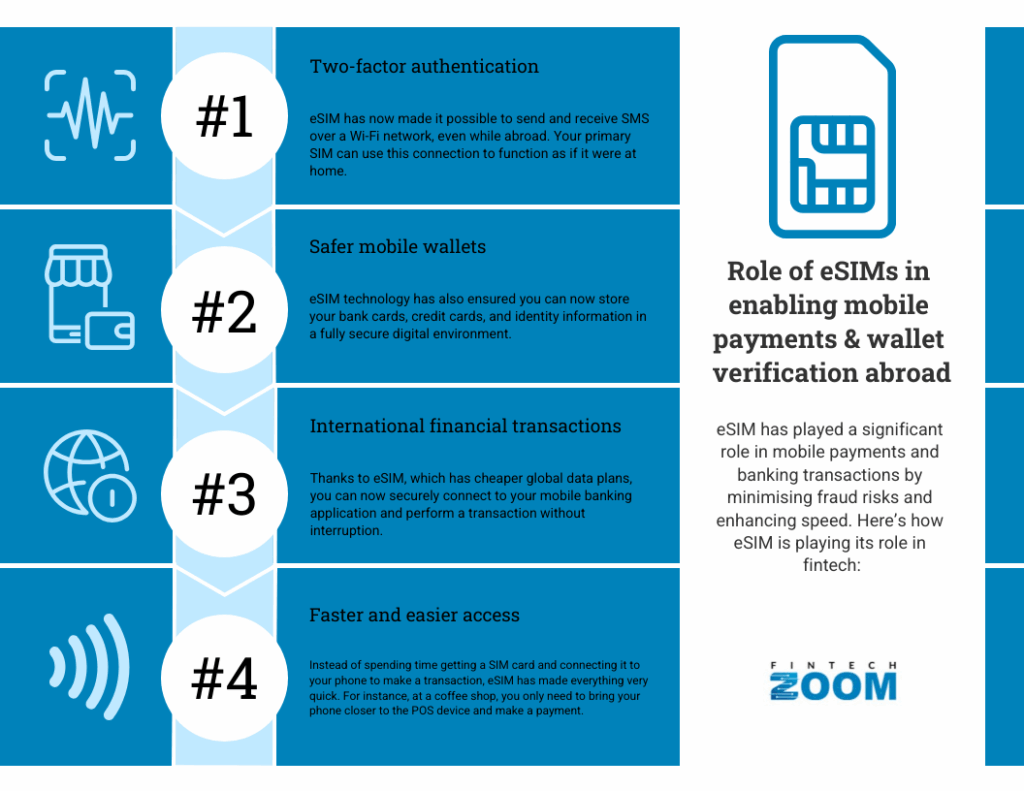

Role of eSIMs in enabling mobile payments & wallet verification abroad

eSIM has played a significant role in mobile payments and banking transactions by minimising fraud risks and enhancing speed. Transactions such as passwords, two–factor authentication, and even wallet verification have become more reliable.

Here’s how eSIM is playing its role in fintech:

- Two-factor authentication: eSIM has now made it possible to send and receive SMS over a Wi-Fi network, even while abroad. Say you installed the Holafly’s eSIM for Spain and already purchased a data plan, your primary SIM can use this connection to function as if it were at home.

- Safer mobile wallets: eSIM technology has also ensured you can now store your bank cards, credit cards, and identity information in a fully secure digital environment.

- International financial transactions: Thanks to eSIM, which has cheaper global data plans, you can now securely connect to your mobile banking application and perform a transaction without interruption.

- Faster and easier access: Instead of spending time getting a SIM card and connecting it to your phone to make a transaction, eSIM has made everything very quick. For instance, at a coffee shop, you only need to bring your phone closer to the POS device and make a payment.

Use cases: remote onboarding & identity verification in FinTech

One of the main challenges that neobanks face is the lack of physical branches in most regions. It is hard to differentiate the market and appeal to its target customers. However, eSIM has solved most of these challenges by enabling:

- Remote onboarding: eSIM has allowed enterprises to hire across geographies without waiting for couriers or negotiating roaming contracts. The IT teams can now deliver secure, compliant connectivity at scale, ensuring employees are always productive.

- Real-time compliance & KYC verification: eSIM has made the KYC verification and compliance process more efficient. While traditionally, you needed to present your documents in banks to verify physically, eSIM allows you to do it all online, regardless of location.

- Global reach: eSIM has also made it possible for fintech to ensure maximum global reach by allowing for instant activation of service and switching banking providers. Additionally, with the enhanced security and flexibility, fintech companies can tap into a new customer base. Without hassle.

Security implications: protecting data and avoiding fraud with eSIMs

Although eSIMs minimise physical theft and tampering, they face various cyber threats. These include SIM swapping, phishing scams to steal identities and personal data, and compromising of bank accounts. Below are the steps you can take to ensure your safety while using eSIMs:

- Set a strong password to secure your eSIM profile and stop hackers from guessing it. You can even use biometric authentication

- Perform regular updates to your device and eSIM apps

- Regularly check your bank accounts for suspicious activity and immediately report to your service provider if you detect any.

- Do not click on or share foreign links and QR codes to avoid any possibility of phishing.

- Continually learn and keep up on safety information, as cybercriminals constantly develop new methods of stealing your money and personal information.

Like any tech, all the security concerns of eSIMs are entirely avoidable. However, the burden lies with you as a user, and you have to take the proper steps to ensure that you are always secure while online. Do not share your personal data with anyone; take all possible security steps.

Trends: cross-border agreements, roaming, and regulation affecting eSIM usage

The Roaming Tariffs Global Strategic Business report of 2024 estimated the market to be at $79.2 and projected it to reach $105.6 by 2030. With continued growth, there is a greater need for a regulatory framework to ensure continuous connectivity across borders.

The legal frameworks governing international agreements are primarily based on a complex interplay of international treaties, national regulations & industry standards. These laws protected personal data transmitted across different jurisdictions, each with distinct legal standards.

Additionally, the roaming agreements serve as the foundations for defining the rights and obligations of the telecommunications operators to ensure seamless cross-border service delivery and minimise ambiguities.

However, policymakers are still assessing how best to govern eSIMs to balance security concerns, user privacy, and tech innovations. Here are some of the existing regulations regarding the use of eSIM:

- Some countries now restrict the activation of eSIM before arrival and require you to register only after landing in their country.

- Other regions impose mandatory certification schemes for eSIM-enabled devices.

- However, other areas allow eSIM usage for free, contingent on bilateral roaming agreements.