As we navigate the FintechZoom.com Business, it is crucial to navigate through the classification of sectors of the stock market. Investing and finance practises necessitate a comprehension of these sectors. The stock market consists of various indexes such as the S&P 500, which is further divided into sectors defined by activities in the economy. This structure assists us in monitoring and interpreting the changing patterns and state of the economy.

Here, we shall in turn explain what is meant by the sectors of the stock market and respond to the query, ‘How many stock sectors are there?’ The Global Industry Classification Standard (GICS), its 11 sectors, and specifics of sectors like that of technology, communication, finance and real estate will be discussed and explored. This will also include discussing each investment’s behaviour in an economic setting and therefore providing the complete perspective regarding this integral feature of the stock exchange.

Overview of Stock Market Sectors

Definition of stock market sectors

With further examination of FintechZoom.com Business, it is noted that stock market sectors are divisions of the economy based on coherent groups of companies providing similar services, commodities, or activities. It also helps divide and illustrate the different aspects of a stock market for easier comprehension of the prevailing conditions within the stock market by the investors.

For that matter, a stock market should be understood not as a monolithic structure but rather as a multitude of various markets of different industries and companies. In other words, segmenting the market into sectors helps in creating effective market structures from which performance can be tracked and new performance opportunities identified. This is especially applicable in scenarios such as analyzing the S&P 500 index which is an average representing a very large portion of the market.

Importance in investment strategies

It is very important to learn about stock market sectors in order to put up reasonable investment policies. From our practical experience, portfolios can be built up and managed excellently with the help of the sectors. The reasons as to why they are so significant are:

- Diversification: When we put our money in various administration with different sectors, we will reduce the effects of the loss that would have caused heavy investments in poor performing sector.

- Performance tracking: When it comes to sectors, these go a step further since they enable one to measure how each part of the market is doing as compared to one another and also in respect to the economy as a whole.

- Economic cycle alignment: Most sector in the economy will do well sometimes and do poorly other times as the economy goes through different phases. These trends can then be used to modify the way we invest.

- Capturing trends: Because sectors are different, we are able to take advantage of short term cycles and even the longer lasting changes that occur within the economy.

- Risk management: By looking at the amount of investment that is tied down in the various economic sectors, the risks that would be encountered in the investment portfolio can be appreciated and even controlled.

Major classification systems

To standardize the way we categorize companies into sectors and industries, several classification systems have been developed. The two most widely used systems are:

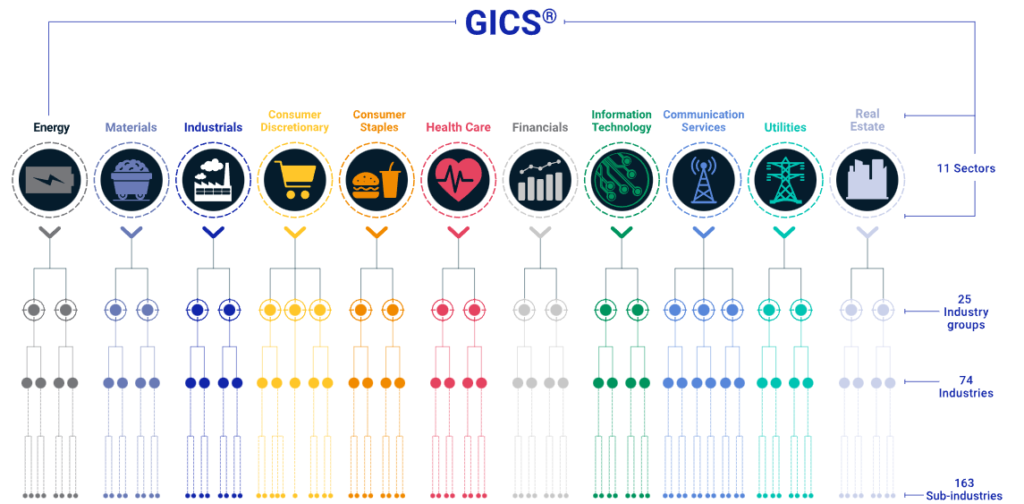

- Global Industry Classification Standard (GICS): Developed by MSCI and Standard & Poor’s in 1999, GICS is a market-based classification system. It divides the market into 11 sectors, which are further broken down into industry groups, industries, and sub-industries. The 11 GICS sectors are:

- Energy

- Materials

- Industrials

- Consumer Discretionary

- Consumer Staples

- Health Care

- Financials

- Information Technology

- Real Estate

- Communication Services

- Utilities

- Industry Classification Benchmark (ICB): Created in 2005 by Dow Jones and FTSE, the ICB also divides the market into 11 industries, which are then further categorized into supersectors, sectors, and subsectors.

GICS and ICB have been developed to address the issues of confusion in industry analysis. This enables research, portfolio management and asset allocation to be done more efficiently. There are however slight variations in how they have approached the problem. Both classification systems aim at the same targets and are used extensively by players in the global investment arena.

As an aside, it should be mentioned that these classification systems are dynamic and not fixed in nature. This is due to the fact that they change through time to accommodate the changes in economic structure and the rise of new sectors. As further evidence, a respect for real-estate markets has increasingly permeated investment practices around the world, which is why this sector was first included in GICS in 2016.

By looking at such classification systems and the functioning, the investor can appreciate the organization of the stock market and use this in make appropriate investment decisions with respect to FintechZoom.com Business and other markets.

The 11 GICS Sectors Explained

As we investigate further into FintechZoom.com Business, we find that the Global Industry Classification Standard (GICS) divides the stock market into 11 distinct sectors. In stock market contexts, it is imperative to understand the mention of numerous stock sectors since these sectors provide an ordering system. Therefore, we look at some key sectors and how they help in investment return generation.

Energy

The energy sector is included in the S&P 500 index and other indices contributing around 12% for major indexes. As we have seen in the past few years, energy stocks have also been cited to suffer from volatility, with performances soaring in 2021 and 2022 where high oil prices propelled the sector. However, in the year 2023, oil prices were generally flat and so were stock prices in the energy sector. It should be appreciated that, even though the world uses more energy compared to the 1970s, the energy share of the…

Materials

From a materials point of view, there are firms offering raw materials for different industries. This sector brings together both petrochemicals and timber, and companies that manufacture various goods such as cement, clay, and earth for constructions, and those practcing metals and minerals excavation. The presence of the materials sector in international commerce is significant, and this is because every sector made within production practices needs basic raw materials. Such expansion is observed because, in most cases, materials stocks are cyclical…

Industrials

As the name connotes, this is a managerial sector with products that include capital goods composed of all machinery and equipment that are manufactured for use in specific industries such as building and real estate, factories, bridge and road constructions, and other industries. For instance, this is comprised of industries such as aerospace, and defense, and industrial and transport machinery focused sectors.

Consumer Discretionary

Consumer discretionary stocks include companies that are engaged in the provision of goods and services which are non-essential. It is remarkable to note that this grouping covers the categories of industries like vehicles and their accessories, accommodation, food services, and sales. Such stocks are cyclical in nature in that consumers usually refrain from spending above the necessary limits when such downturns are experienced. On the other hand, these stocks can exhibit periods of substantial growth even in more favorable circumstances.

Consumer Staples

Unlike consumer discretionary, the consumer staples sector is comprised of companies that make products that are necessary for citizens and will be available disregarding how the economy is doing. We have learned that this sector usually incorporates firms that produce food, drinks and groceries. Consumer staple shares are viewed as defensive shares owing to the resultant behavior they exhibit during various cycles of the economy.

Health Care

The health care sector is gradually growing and becoming very popular in the recent past, being the third largest sector of the S&P 500. We have observed that such departments comprise the services of drug manufacturers, experts in bioscience and health maintenance organizations. Health care equities have had indifferent results in past years with the results varying a great deal by subsector. This is a critical sector for long-term investors due to the fact that many developed countries have an ever-increasing demand for health care services from the aging population.

As we continue to explore FintechZoom.com Business and analyze investment sectors, it’s crucial to understand how these GICS sectors interact and influence the overall stock market. By comprehending the unique characteristics of each sector, we can make more informed decisions about our investment strategies and better navigate the complexities of the financial markets.

Technology and Communication Sectors

As we explore FintechZoom.com Business, we find that the technology and communication sectors play a crucial role in the stock market. These sectors are at the forefront of innovation and have a significant impact on the S&P 500 and other major indexes.

Information Technology sector overview

Of all 11 sectors that comprise the Global Industry Classification Standard (GICS), the information technology (IT) sector is the most prominent and largest in stock markets. This is because the sector represents almost a third (31.9%) of the S&P 500 index based on its market capitalization. This sector has a wide coverage and is dynamic as almost all sectors are dependent on technological goods and services to operate.

The information technology sector incorporates entities that conduct research, develop and manufacture hardware and software products as well as services related to engineering and other applied sciences. It also includes different types of companies from those that design IT hardware and software to banks investing in self-driving cars, cloud technology, and machine learning.

The size of the IT sector in the US is estimated to be around USD 1.90 trillion which is over 10% of the country’s economy. Another 12.1 million people work in the industry, out of which 1.6 million are software and web developers.

Communication Services sector breakdown

The S&P 500 is composed of 9 % of the Communication services sector. This sector consists of companies that provide various products and services that enable individuals to communicate over the Internet and through the phone. It also consists of businesses such as entertainment and media, advertising, video games, and content and information on the Internet.

Once referred to solely as the telecoms sector, but after changes made in 2018, the sector is no longer home only to telecommunications organizations. Other well-known internet-based companies in Silicon Valley which are often referred to as ‘tech’ companies by investors are considered by law as commutation services stocks.

The communications services sector registered a breakaway year in 2023 which was partly due to a recovery from the disappointing performance of the previous year and partly driven by the investors’ interest in artificial intelligence (AI). Towards the end of 2023, valuations of the sector remain interesting, and earnings projections had been positive.

Key companies in each sector

In the information technology sector, some of the largest companies include:

- Apple Inc. (AAPL): Known for its iPhones, Mac computers, and other consumer electronics.

- Microsoft Corp. (MSFT): A global developer of software, devices, and cloud computing services.

- NVIDIA Corp. (NVDA): A leader in graphics processing units (GPUs) and AI technologies.

In the communication services sector, key players include:

- Alphabet Inc. (GOOG, GOOGL): The parent company of Google and YouTube.

- Meta Platforms Inc. (META): Formerly Facebook, known for its social media platforms.

- Netflix Inc. (NFLX): A leading streaming entertainment service.

Such companies are usually leaders in their industries and the investors’ excitement about their future prospects and growth often see them trade at steep GDP multiples.

Indeed, as we keep on evaluating verticals on FintechZoom.com Business, it is clear that the technology and communication verticals are major parts of the stock market. Their fast paced evolution and increased offerings provide avenues for investors who seek portfolio diversification in the hope of increased wealth. However, these sticks are prone to risks which is why prudence must be exercised in carrying out investment strategies.

Financial and Real Estate Sectors

As we further our analysis of FintechZoom.com and its activities with regard to Business, it is evident that the stock market depend greatly on the activities of the financial sector. The sector consists of multifarious industries such as banks, investment companies, insurance companies and real estate companies. It is worth noting that financial sector forms one of the largest percentages of the S&P 500, thus showing its importance in the whole market.

Financial sector components

The financial entity contains various components which as a whole perform in the sector. Banks are one of the industry groups under this sector and the most notable ones can be named as JPMorgan Chase, Bank of America, Wells Fargo and Citibank. In addition to that, these banking behemoths provide numerous services for individuals and organizations, with consumer banking and corporate finance being the most common.

Insurance companies also occupy a paramount position in the financial sector. American International Group (AIG) and Chubb are some of those well-known companies. Such companies underwrite a variety of risks such as life and property and casualty insurances.

Furthermore, investment banks and brokerage also contribute significantly to the financial sector. Such firms include Goldman Sachs and Morgan Stanley for instance that specializes in such services as offerings for initial public share placements, advising on the acquisition of companies and managing the clients’ assets.

The financial sector’s performance is often seen as a proxy for the health of the broader economy. When we look at how many stock sectors there are, it’s clear that the financial sector’s influence extends far beyond its own boundaries.

Real Estate as a separate sector

It is fascinating to note that real estate has become a separate wing in the market in recent times. Effective August 31, 2016, S&P Dow Jones Indices and MSCI reorganized equity REITs and other real estate stock-listed companies and transported them from Financials Sector to a Real Estate Sector which was created in their Global Industry Classification Standard (GICS®).

This was due to the increasing size and economic significance of real estate, equity REITs mainly, in the economic sphere. The Real Estate Sector was the first new headline sector added in GICS® after its inception in 1999, thus elevating stock sectors to eleven in number.

The formation of a Real Estate Sector on its own, enabled the more pronounced identification of REITs and real estate investment. Thus investors, managers and even advisors have been able to embrace real estate investment, primarily REITs, during the investment policy and portfolio formulation.

Major players in both sectors

In the financial sector, the bulk of the big companies is always into banking. JPMorgan Chase, Wells Fargo, Bank of America, Citigroup, and other stalwarts are the leading names in the industry. These establishments do not stop at commercial banking services but rather extend to integrate investment banking, asset management, and other bank related services.

Moving to the real estate sector, there is a different class of major companies. For example, Prologis, dedicated to the logistics property business, and CONAM Management Corporation, focused on investment and management of multifamily properties, are important players in this sub-sector.

Other companies in real estate include Legacy Partners which is private and invests and develops multifamily communities as well as Shorenstein which is largely invested in office and mixed-use assets.

As we continue to explore FintechZoom.com Business and analyze investment sectors, it’s crucial to understand the unique characteristics and major players in both the financial and real estate sectors. This knowledge can help investors make informed decisions when considering how to diversify their portfolios across different stock market sectors.

Sector Performance and Economic Cycles

As we go further into the business of FintechZoom.com, it becomes clear that for an investor, it is important to know how stock market sectors behave in response to the changes in the economic conditions. Intermediate term, business cycle, which is the variation of activity level within an economy, can be regarded as an important factor that influences equity sector performance.

The effect of economic conditions upon the performance of various sectors

We have noted that with every phase that the economy transitions into, stock market sectors tend to follow a certain rotation in performance from one phase of the cycle to another. Every phase of the cycle comes with its own opportunities and challenges for particular sectors.

When there is a contraction in the economy, we generally witness noncyclical sectors such as Consumer Staples, Utilities, and Health Care doing better than the general market. Such sectors do not rely on economic cycles much since they are based on the essential needs market. However, that phase is typically accompanied with dismal performances of sectors like Real Estate and Technology that generally depend on the consumer discretionary spending.

With Growth, we begin to see a change in the performance of sectors. The Consumer Discretionary and Real Estate sectors usually start to lead, thanks to more consumer confidence and low rates during this period. At the same time, those defensive sectors that sustained the recessions do not offer the same attractiveness as before.

In the expansion phase, there is a narrower sector dispersion as more sectors tend to grow with the economy. Periods like these see Technology and Financials perhaps in its easiest outperformance period as Business Investment remains high and interest rates begin to rise.

During the slowdown phase, as economic growth decelerates, we observe investors positioning more defensively. This leads to the outperformance of Health Care and Consumer Staples, while Consumer Discretionary and Real Estate tend to underperform.

Sector rotation strategies

In order to take full advantage of such trends over time, several market players practice the so-called sector rotation strategies. The strategy implies moving investments from one sector of S&P 500 or any other major index to another, depending on its projected performance in the present or future economic phase.

In example, in the process of economic improvement from recession, an investor may decide to cut down on the defensive positioning on sectors like Utilities and increase investment in Consumer Discretionary equities instead. However, this is done in anticipation of a downturn and such an investor may rotate back into more defensive sectors.

It is obligatory to mention that even if returns can be improved with the use of a sector rotation there are challenges in analyzing and timing. The business cycle approach to sector investing employs probabilistic analysis to determine the different stages in the life cycle of the economy and thus serves as a reason for investing in sectors depending on their chances of doing well or poorly.

Historical sector performance

By observing past cycles, trends for the different sectors can be examined across economic phases. For instance, it can be stated that the early cycle has offered the highest returns so far since average total return from the stock market went more than 20 percent year on year for period starting 1962.

In this period, interest rate sensitive sectors like the Consumer Discretionary and the Financials have always beaten the competitions in the market. Also, Information Technology, Real Estate and Industries that are sensitive to economic change have posted great performances in the economy’s transition from a downturn to an upturn.

In the mid-cycle strategy, which is usually the longest of all periods, buttressing the sector has changed several times. No sector has been outperformed or underperformed the total market less than 75 percent of the time in this phase.

The recovery phase, which is usually the shortest, has exhibited overperformance by defensive sectors such as Consumer Staples, Utilities, and Health Care. This is impressive as even during the three recessions since 1999, includig the severe global one, the Company also outperformed the broader market during every recession period.

As we pursue further Fintech Zoom Business and study investment areas, it can now be understood that without grasping such historical relationships and the performance of sectors throughout the business cycles, investors can hardly enhance their holdings over such varying market conditions.

Conclusion

The exploration of stock market sectors through FintechZoom.com Business has shed light on the intricate workings of the financial world. By understanding the 11 GICS sectors and their unique characteristics, investors can gain valuable insights to shape their investment strategies. The performance of these sectors during different economic cycles offers a roadmap to navigate market fluctuations and potentially enhance returns.

To wrap up, the stock market’s division into sectors has a significant impact on investment analysis and portfolio management. From technology giants driving innovation to financial institutions underpinning economic growth, each sector plays a vital role in the broader market ecosystem. As the economic landscape continues to evolve, staying informed about sector dynamics will be crucial for investors to make well-informed decisions and adapt to changing market conditions.