Are you interested in real estate investing but don’t know where to start? Don’t worry, you are not alone. Many people are interested in this type of investment but don’t know how to get started. In this blog post, we will discuss 8 ways that you can get started in real estate investing. We will talk about the different types of real estate investments and provide some tips for getting started. So, whether you are a beginner or an experienced investor, read on for some valuable information!

Read also: Your Ultimate Guide to Finding the Best Place to Invest in Real Estate.

What is the profile of real estate investors?

Real estate investing is a popular pursuit among a wide range of individuals. At the most basic level, real estate investors can be divided into two categories: residential and commercial. Residential investors typically purchase properties to live in or rent out, while commercial investors often focus on large-scale investments such as apartment buildings and office towers.

Read also: Understanding the Importance of Location when Investing in Real Estate.

However, there are also a number of other factors that seem to influence an individual’s likelihood of entering the real estate market. For example, those with high incomes are more likely to invest in property than those with lower incomes, perhaps due to the fact that they have greater access to capital and financing options.

Read Tips to get an eco-sustainable kitchen.

Additionally, individuals who hold certain professional positions, such as financial advisors or investment bankers, are more inclined to invest in real estate than others. Ultimately, the profile of a real estate investor is quite diverse and depends largely on one’s personal interests and financial situation.

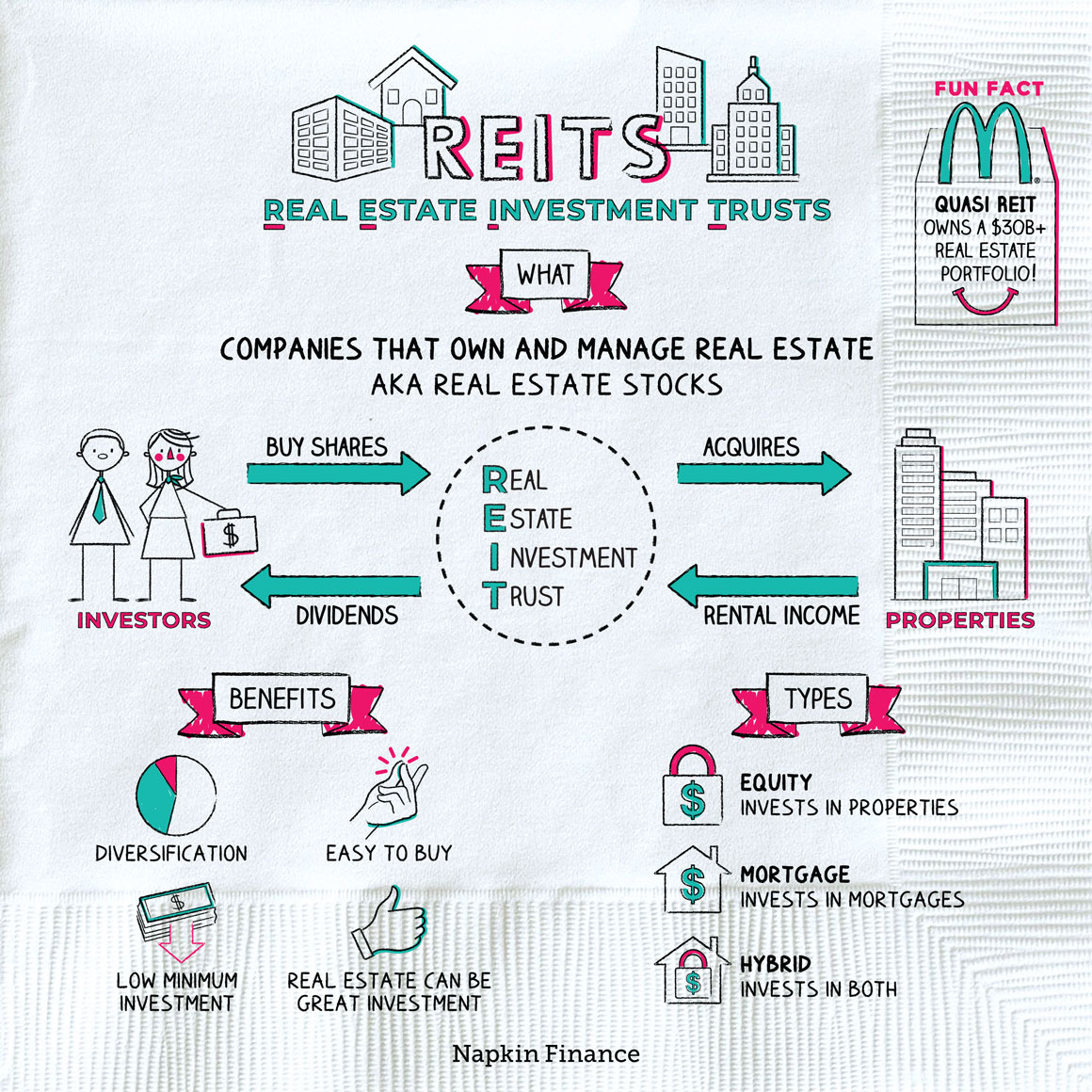

How to invest in real estate investment trusts?

Investing in real estate investment trusts, REITs or even in the best REIT stocks, is a great way to gain exposure to the real estate market without having to deal with the day-to-day management of rental property. There are several different options when it comes to investing in REITs, including stocks, mutual funds, or ETFs regulated by securities and exchange commission.

When choosing a specific REIT, it’s important to do your research and assess factors such as valuation, dividend yield, and portfolio diversification. Additionally, you should pay attention to things like fees and regulatory restrictions that may impact your investment.

Read also How Many Jobs Are Available in Real Estate Investment Trusts?

Overall, by taking advantage of the many benefits that come with investing in REITs, you can gain compelling returns from this important real estate asset class.

Real Estate Investing

1. Educate yourself about real estate investing

The first step is to educate yourself about real estate investing. This can be done by reading books, taking courses, or attending seminars. There are many resources available to help you learn about this topic. Once you have a good understanding of real estate investing, you can start looking for opportunities.

Read also: Exploring the Future of Real Estate: What Is Metaverse Real Estate and How Is It Changing the Game?

When deciding what kind of real estate to invest in, there are a number of factors to consider:

- One key consideration is location, since different markets will have different levels of demand and pricing. Another important factor is the type of housing that is available in the area, whether it be single family homes, condos, or apartment buildings.

- Other considerations include market trends and any government regulations that may impact investment opportunities.

- Ultimately, the choice comes down to finding an area with favorable conditions and flexible investment options that align with your goals as an investor.

Whether you are interested in short-term gains or long-term growth, there is a real estate market out there that is right for you. So take the time to do your research and find the perfect fit for your investment portfolio!

Read also this FintechZoom related article: Essential Points to Consider When Buying Real Estate in Raleigh, NC.

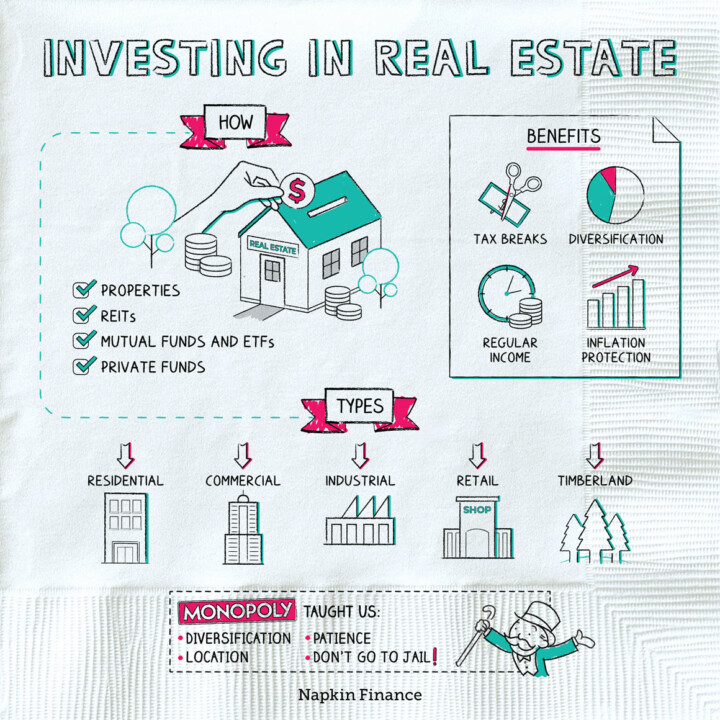

2. What types of Real Estate investments are?

There are many different types of real estate investments that investors can choose from. At the most basic level, these investment properties include buying and selling existing properties, such as residential homes or commercial buildings.

More advanced investors may choose to engage in more complex forms of real estate investment, such as developing new properties from scratch or entering into partnerships with other real estate firms. Another option is to invest in equity shares tied to real estate companies and exchange-traded funds (ETFs), which can offer a relatively low-risk way to tap into the real estate market.

Read this FintechZoom article: How to Become a Luxury Real Estate Agent: 6 Strategies.

Ultimately, the choice of investment will depend on a number of factors, including an investor’s risk tolerance and desired level of involvement in the maintenance and management of properties. Regardless of one’s choice, however, investing in real estate can be a highly rewarding way to build wealth over time.

3. What are the complex forms of real estate investment?

There are a variety of complex forms of real estate investment that are popular among both professional investors and individual homeowners. One such investment is the mortgage-backed security, which involves pooling together loans on residential properties and selling them to investors as securities.

Another is commercial mortgage-backed securities, or CMBS, which are backed by mortgages on commercial properties. In addition to these investments, some investors choose to purchase property directly rather than through a mortgage; this strategy allows them to earn rental income on the property while also benefiting from any appreciation in the value of the asset over time.

Regardless of which type of real estate investment you choose, it is important to carefully research all potential risks and rewards before committing your money.

4. Select Real Estate Consultants to help you?

Considering investing in real estate can be an exciting, but also potentially risky endeavor. There are many factors to consider, from choosing the right property and financing options to calculating potential returns on investment and managing the maintenance of your property. As such, it is important to work with a qualified real estate consultant who can help you navigate this complex marketplace, such as commercial property, and make informed decisions about your investments. For minor investments you can look for a commercial real estate or real estate agent more adapted to private real estate or residential real estate investments.

A good real estate consultant will have extensive knowledge of the local market and market trends, as well as access to investment opportunities that may not otherwise be available to individual buyers. They will also help you estimate potential returns on your property, considering factors like local rental rates, the condition of the property, and any necessary renovations or upgrades before putting the property up for sale. Additionally, they can help you develop a strategy for managing your property and dealing with possible emergencies down the line.

Also read: Is it Possible to Avoid Termite Damage?

Ultimately, when it comes to real estate investment, it is essential to have a reliable partner who can provide guidance throughout every step of the process. With the assistance of a real estate consultant, you can feel confident in all of your decisions while maximizing your potential return on investment.

5. Looking for Investment Property

Once you have decided on the type of real estate investment you want to pursue, it’s time to start looking for properties. There are many ways to find properties, such as online listings, real estate auctions, and real estate agents. Again, do your research to find the best way to locate properties that fit your investment criteria.

6. Start to Negotiating

Once you have found a few potential properties, it’s time to start negotiating the real estate prices! This is where your research and knowledge (our the consultant experience) about real estate properties investing will come in handy. You will need to negotiate with the seller to get the best price possible.

7. Due Diligence

Now that you have purchased a property, it’s time to start making money! There are many ways to do this, such as renting it out, fixing it up and selling it, or flipping it. Again, do your research to find the best way to make money with your new real estate investment.

8. Invest

This is the last step.

Real Estate Crowdfunding Investment Platforms

Real estate crowdfunding has actually changed the real estate investing landscape. When scheduled for only the most affluent investors, many crowdfunding platforms have actually considerably decreased the obstacle to entrance for this type of alternative investment.

Reduced account minimums, easy fee structures and tidy user interfaces make it less complicated than ever before to consist of real estate in a well-diversified portfolio. It is very important to keep in mind that some real estate crowdfunding systems, consisting of a few of our picks below, are open only to certified investors.

Conclusion

These are just a few of the many ways that you can get started in real estate investing. As you can see, there is a lot to learn but it is definitely possible to be successful in this industry. So, get out there and start learning!