Real estate investing apps have reshaped the scene of property investing. What was once a millionaire’s game is now available to almost anyone. You can build your real estate portfolio with just $5 through platforms like Landa.

Our team has tested the best real estate investing apps to help you make smart choices. HappyNest stands out as a great starter option that lets you begin with $10 in diversified, income-producing investments. Fundrise matches this $10 entry point and makes investing easy for newcomers. CrowdStreet takes a different approach with its $25,000 minimum investment requirement and ranks among the largest online commercial real estate marketplaces.

The best real estate investment apps cater to every budget and strategy. DiversyFund manages a $175 million portfolio of multifamily assets, while Landa pays monthly dividends with just a $5 minimum investment. Our expert picks for May 2025 will show you the best platforms, whether you’re just starting out or looking for more advanced options.

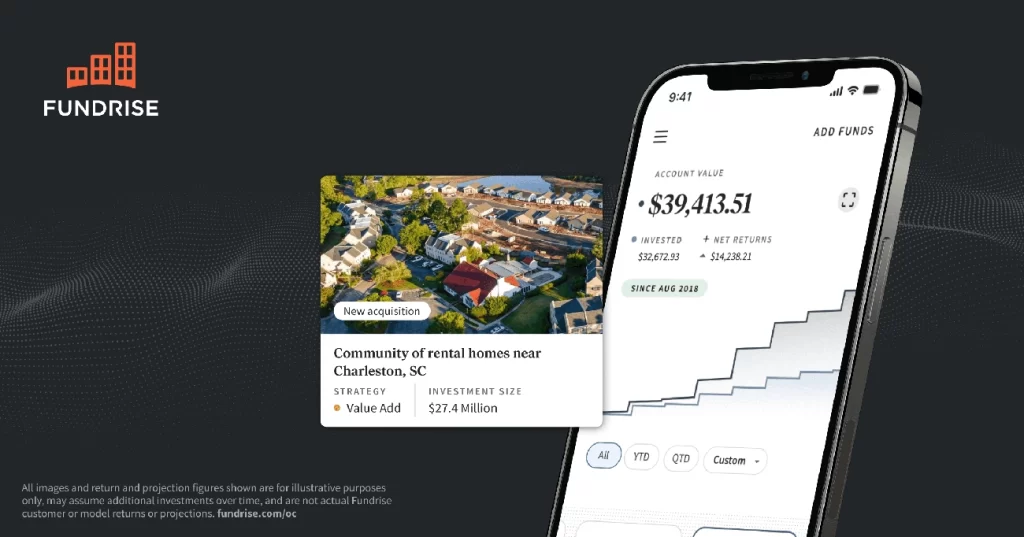

#1. Fundrise

Ben and Dan Miller founded Fundrise in 2012, establishing themselves as pioneers in crowdfunded real estate investing after the JOBS Act. The platform now manages $2.87 billion of equity for nearly 400,000 investors, making it one of the largest online private real estate companies you can find.

Fundrise Key Features

Fundrise makes real estate investing easier through these notable features:

- Low minimum investment of just $10 for standard accounts ($1,000 for IRAs)

- eREITs and eFunds that provide diversification in property types of all sizes, from apartment complexes to industrial facilities and single-family rentals

- Five portfolio options ranging from Starter Portfolio ($500 minimum) to Self-Directed IRA ($1,000 minimum)

- 90-Day Guarantee that allows investors to test the platform risk-free

- Fundrise Pro subscription ($99/year or $10/month) for advanced investors who want more portfolio control

The platform has expanded beyond real estate to include private credit and venture capital investments through their Innovation Fund.

Fundrise Pros and Cons

Pros:

- Available to non-accredited investors

- Wide diversification in different property types and geographic regions

- User-friendly platform with accessible dashboards

- Steady performance compared to stock market volatility

- Passive income potential through quarterly dividends

Cons:

- Limited liquidity with quarterly redemption periods (not guaranteed)

- Early withdrawal penalties if you redeem shares before five years

- Not suitable for short-term investing strategies

- Limited direct customer service access without a direct phone number

Fundrise Pricing

Here’s Fundrise’s simple fee structure:

| Fee Type | Amount | What It Covers |

|---|---|---|

| Advisory Fee | 0.15% annually | Reporting, customer support, portfolio construction |

| Management Fee (Real Estate) | 0.85% annually | Portfolio management and expansion |

| Management Fee (Innovation Fund) | 1.85% annually | Venture capital investments |

| IRA Fee | 1% annually + $125 annual fee | Retirement account administration |

These fees are competitive compared to traditional private REITs that often charge 9-10% of invested funds.

Fundrise Best For

Fundrise works best for:

- Long-term investors who can commit funds for 3-5 years or longer

- Beginners who want an affordable entry into real estate investing

- Passive income seekers looking for quarterly dividend payments

- Portfolio diversifiers wanting exposure to alternative assets beyond stocks and bonds

- Non-accredited investors who typically can’t access private real estate deals

The platform offers investment plans that match specific goals: Supplemental Income for steady dividends, Balanced Investing for a hybrid approach, and Long-Term Growth for maximum appreciation potential.

Investors who want hands-off exposure to private real estate with minimal capital will find Fundrise a great starting point. The platform has delivered relatively stable returns averaging 4.81% annual income.

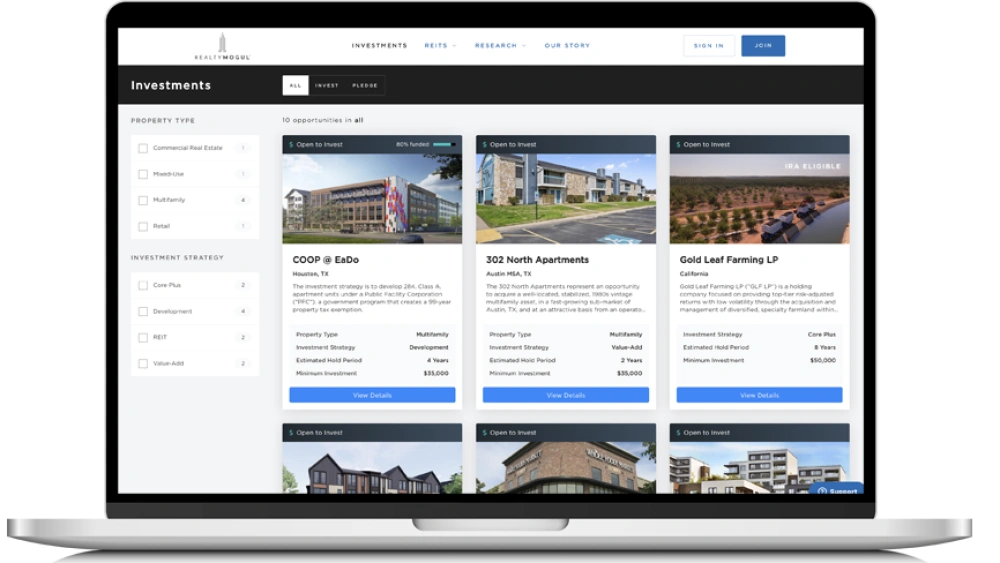

#2. RealtyMogul

11-year old RealtyMogul has grown into a leading brand in online real estate investing with a community of over 220,000 members. The platform connects investors with commercial real estate opportunities that were previously limited to institutional investors.

RealtyMogul Key Features

RealtyMogul stands out with these unique features:

- Rigorous due diligence process where only 1% of potential deals make it to the platform

- Two non-traded REITs that welcome both accredited and non-accredited investors

- Private placement investments in individual commercial real estate deals for accredited investors

- Multiple property types from multifamily and office to retail, industrial, and self-storage

- 1031 Exchange options that help investors defer capital gains taxes

- Self-directed IRA investing options for retirement account holders

The platform has helped fund over $3 billion in total deal capitalization through more than 300 investment opportunities, which shows its strong market presence.

RealtyMogul Pros and Cons

Pros:

- Available to both accredited and non-accredited investors

- Proven track record with 98 consecutive monthly distributions for Income REIT

- Detailed due diligence on all investments

- Investment spread across property types and geographic regions

- Support team available through phone, email, and social media

Cons:

- Higher investment minimums than competitors ($5,000 for REITs, $25,000-$35,000 for individual properties)

- Limited liquidity with typical 3-10 year holding periods

- Non-accredited investors can only access two REIT options

- Original 12-month lock-up period for REIT investments

- Mixed feedback from investors about returns and communication

RealtyMogul Pricing

| Investment Type | Minimum Investment | Asset Management Fee | Other Fees |

|---|---|---|---|

| Income REIT | $5,000 | 1% annually | Organizational costs capped at 3% |

| Apartment Growth REIT | $5,000 | 1.25% annually | Organizational costs capped at 3% |

| Private Placements | $25,000-$35,000 | 1% annually | Varies by property |

| Self-Directed IRA | $1,000 | Varies | Additional custodian fees may apply |

RealtyMogul skips upfront selling commissions, which puts more of your capital directly into real estate investments.

RealtyMogul Best For

My analysis shows RealtyMogul works best for:

- Commercial real estate enthusiasts who want institutional-quality deals

- Income-focused investors – the Income REIT aims for 6% annual distribution

- Long-term investors who can handle 3-7 year investment periods

- Non-accredited investors seeking real estate exposure beyond publicly traded REITs

- Diversification seekers interested in different commercial property types

RealtyMogul’s focus on commercial real estate, especially multifamily and office properties, makes it an attractive option for investors who want exposure to these sectors through a proven real estate investing app.

#3. Yieldstreet

Yieldstreet, an 8-year old platform in the alternative investment space, has made its mark by giving individual investors access to asset classes that were once limited to institutions and ultra-wealthy individuals. The platform has seen impressive growth with investors putting in over $3.9 billion since it started. They’ve already returned $2.4 billion to their investors. This creates a path to broaden beyond regular stocks and bonds.

Yieldstreet Key Features

Yieldstreet stands out with these notable features:

- Diverse alternative investments in real estate, private credit, venture capital, art, legal finance, and more

- Four-step due diligence process that approves only 9% of submitted offerings

- Regular income opportunities through investments that typically pay regular income, growth at maturity, or both

- Dedicated portfolio management team that keeps a close eye on investments

- Mobile app with high ratings – 4.6/5 on Apple Store and 4/5 on Google Play

- Yieldstreet 360 Managed Portfolios that give accredited investors automated exposure to private markets

The platform’s investor relations team is ready to answer questions anytime. This makes it easier for newcomers to understand alternative investments.

Yieldstreet Pros and Cons

Pros:

- Alternative investment options are available to investors of all types

- Strong track record with 9.6% net annualized return from nearly 150 matured investments

- Private real estate has beaten US equities and fixed income on absolute and risk-adjusted returns since 2000

- Real estate investments serve as a natural hedge against inflation

- Realized debt deals average about 9% in net annualized returns

Cons:

- Most offerings require at least $10,000 to invest

- All but one of these investments need accredited investor status

- Investments are highly illiquid with 6-month to 5-year terms

- Offerings are limited and can fill up fast

- SEC filed charges in 2022 over alleged failure to disclose key information

Yieldstreet Pricing

| Investment Type | Minimum Investment | Management Fee | Other Fees |

|---|---|---|---|

| Most Offerings | $10,000 | 0%-2.5% annually | Varies by investment |

| Alternative Income Fund | $10,000 | 1.0% annually | 3.74% total annual expense ratio |

| 360 Managed Portfolios | $25,000 | 1.25% advisory fee | 0.175% in expenses |

| Short-term Notes | $10,000+ | 0% | Varies |

The platform’s fees typically range from 0%-2.5% annually. Additional fees might apply based on specific fund structures.

Yieldstreet Best For

Let’s take a closer look at who benefits most from Yieldstreet:

- Accredited investors earning at least $200,000 yearly or having $1 million net worth

- Alternative investment enthusiasts who want exposure beyond traditional markets

- Income-focused investors seeking regular distributions

- Investors comfortable with illiquidity who can lock up money long-term

- Portfolio diversifiers looking for investments less tied to public markets

The Alternative Income Fund welcomes non-accredited investors. However, investors who need lower entry points might prefer other real estate investing apps. All the same, Yieldstreet remains a top choice for sophisticated investors seeking institutional-quality alternative investments with higher return potential.

#4. Ark7

Ark7 became an available option in the real estate crowdfunding world when it launched in 2018. The platform lets investors buy fractional shares in rental properties throughout the United States. Investors have received over $3.0 million in dividends, and the platform has funded more than $21 million in property value across 10 states.

Ark7 Key Features

Ark7 sets itself apart with these notable features:

- Ultra-low minimum investment starting at just $20 per share

- Diverse property options spanning single-family homes, multifamily properties, and short-term rentals

- Secondary marketplace for trading shares after a one-year holding period

- Monthly dividend distributions from rental income

- Both accredited and non-accredited investor access to most properties

- Self-directed IRA investing through partnership with Millennium Trust Company

- Mobile app availability on both iOS and Android platforms

The platform lets users select specific properties rather than investing in general funds, which creates a “discover and invest” approach.

Ark7 Pros and Cons

Pros:

- Entry point at just $20 per share makes investing simple

- Secondary market trading improves liquidity

- Properties in multiple states offer geographic diversification

- Clear fee structure without hidden costs

- Professional property management ensures passive investment

- SEC-qualified and FINRA-compliant platform

Cons:

- One-year minimum holding period required before selling shares

- Platform’s track record remains limited due to recent launch

- No automated investing options

- Property management fees can run high

- Annual IRA fees might affect smaller investments

Ark7 Pricing

| Fee Type | Amount | Notes |

|---|---|---|

| Acquisition Fee | 3% one-time | Applied when buying new property |

| Property Management | 8-15% | Varies by property type; deducted before dividend distribution |

| IRA Custodial Fee | $100 per property annually | Capped at $400/year; waived for accounts over $100,000 |

| Share Price | Starting at $20 | Minimum investment per share |

Ark7 focuses on property management services where they add real value and doesn’t charge monthly investment management fees, unlike many competitors.

Ark7 Best For

The platform works great for:

- Budget-conscious beginners who want affordable real estate investing options

- Diversification-focused investors looking to spread small amounts across multiple properties

- Passive income seekers interested in monthly dividend payments

- Geographic targeting enthusiasts preferring specific markets over funds

- Investors seeking shorter commitment periods who appreciate the one-year holding period versus longer alternatives

Ark7 stands out among real estate investing apps because of its low minimums and property-specific approach. Investors can build custom real estate portfolios without dealing with typical landlord hassles.

#5. HappyNest

HappyNest takes a mobile-first approach to real estate investing. The app lets investors build a property portfolio starting with just $10. This platform makes real estate investing less daunting for beginners who might feel overwhelmed by traditional investment methods.

HappyNest Key Features

- Ultra-low $10 minimum investment makes real estate available to almost anyone

- Commercial real estate focus with properties leased to tenants like CVS, FedEx, and Bonner Carrington

- Automated investing options include recurring deposits and a unique “spare change” round-up feature

- Goal-setting functionality tracks progress toward financial targets

- Target 5-6% annual dividend yield paid out quarterly

- Open to non-accredited investors with no wealth or income requirements

- Mobile-only platform with no desktop access available

HappyNest Pros and Cons

Pros:

- Entry point starts at just $10

- Investment approach needs no management from your side

- User-friendly mobile app with easy-to-use interface

- Round-up feature makes investing effortless

- Regular dividend payments every quarter

Cons:

- Investment term lasts about three years with limited liquidity

- Redemption windows open only twice yearly (March and September)

- Fee structure lacks clarity

- Portfolio contains only three commercial properties

- Desktop platform doesn’t exist

HappyNest Pricing

| Fee Type | Amount | Notes |

|---|---|---|

| Direct Platform Fees | $0 | Marketed as “no broker or platform fees” |

| Management Fee | 0.0417% monthly | Approximately 0.50% annually |

| Acquisition Fees | 3-6% | Charged when properties are bought or sold |

| Maximum Sponsor Fees | Up to 3% | Of total offering proceeds |

| Potential Administrative Fee | $1.00/month | Not currently being charged |

HappyNest advertises “no fees” but makes money through indirect costs that affect investor returns.

HappyNest Best For

My experience shows HappyNest works best for:

- Absolute beginners who want the lowest entry point into real estate

- Mobile-centric investors who prefer managing investments through an app

- Long-term investors ready to commit funds for about three years

- Passive income seekers looking for quarterly dividend payments

- Micro-investors who like features such as spare change round-ups

HappyNest might not offer as many options as other real estate investing apps. However, it gives beginners a simple way to start investing in commercial real estate with minimal capital.

#6. Roofstock

Roofstock has transformed single-family rental (SFR) investing since 2015 with over $6 billion in transaction volume. The platform stands out by connecting investors directly with tenant-occupied properties in 27 U.S. states, unlike most platforms that focus on fractional ownership.

Roofstock Key Features

- Direct ownership of income-producing properties that come with tenants in place for immediate cash flow

- Complete property inspections that cover quality assessment, repair cost estimates, and financial projections

- “Rent Up Guarantee” that covers your rent up to a year if a lease hasn’t been signed within 45 days on vacant properties

- Integrated financing options let qualifying buyers with 20% down close in as little as 30 days

- Network of vetted property managers handles day-to-day operations for remote investors

- Roofstock One gives accredited investors fractional ownership through tracking stock shares with a $5,000 minimum

Roofstock Pros and Cons

Pros:

- Non-accredited investors can make direct property purchases

- Transaction fees cost less than traditional real estate agents

- Money-back guarantee extends to 30 days on select properties

- Self-directed IRA investment options provide tax advantages

- Properties come with tenants already living there

Cons:

- Down payments require 20-30% of property value

- Direct ownership needs more capital than fractional platforms

- Properties are limited to 27 states

- Roofstock One serves only accredited investors with 5-year minimum commitment

- Rental properties need attention even with property managers

Roofstock Pricing

| Fee Type | Amount | Notes |

|---|---|---|

| Buyer Fee | 0.5% or $500 | Whichever is greater |

| Seller Fee | 3% or $2,500 | Whichever is greater [302] |

| Roofstock One | 0.5% asset management fee | Adjusts with gross rent changes |

| Property Management | ~10% of monthly rent | Varies by region if using Roofstock’s managers |

Roofstock Best For

Roofstock serves investors who want direct ownership of rental properties rather than fractional shares. The platform works best for:

- Remote investors ready to buy properties sight unseen with professional inspection reports

- Buyers looking for turnkey rental properties with existing tenants

- Investors who have substantial capital ($20,000+ for down payments) and want physical real estate assets

- People seeking to diversify beyond their local market

- Self-directed IRA investors who want real estate in retirement accounts

Roofstock connects traditional real estate investing with modern technology, making direct property ownership available to investors who are comfortable with larger capital commitments.

#7. CrowdStreet

CrowdStreet leads the commercial real estate investing world as a marketplace exclusively for accredited investors. The platform has helped investors put over $4.4 billion to work since its 2014 launch.

CrowdStreet Key Features

- Direct-to-investor model allows investors to work directly with sponsors rather than through intermediaries

- Rigorous vetting process accepts only 2% of applicants to the marketplace

- High minimum investment starts at $25,000 for most deals

- Focus on secondary metro markets (18-hour cities) like Denver, Austin, and Nashville

- Self-directed IRA investing options provide tax advantages

- Proven track record shows realized investments averaging over 19% IRR

CrowdStreet Pros and Cons

Pros:

- Completed deals show strong performance averaging 25%+ IRR

- Thorough due diligence helps reduce investor risk

- Investment offerings span properties of all types

- Easy-to-use interface simplifies navigation

- Investors can communicate directly with project sponsors

- Individual deals come with no platform fees

Cons:

- Only accredited investors can participate

- Minimum investment starts at $25,000

- Investments remain highly illiquid with few redemption options

- Deal fees follow a complex structure that changes per offering

- Some sponsors have faced issues, including alleged misuse of funds

CrowdStreet Pricing

| Fee Type | Amount | Notes |

|---|---|---|

| Investor Platform Fees | $0 for individual deals | Sponsors typically cover technology fees |

| Technology Fee | 1.5% (varies) | Investors might pay this fee |

| Fund Management Fee | 1% for Blended Portfolio | Applies to CrowdStreet’s managed funds |

| Sponsor Fees | Varies by deal | Includes acquisition, property management fees |

CrowdStreet Best For

The platform serves sophisticated investors who want institutional-quality commercial real estate. It fits well with accredited investors who have substantial capital and feel comfortable with longer investment periods of 3-5 years. The platform attracts investors looking for higher returns in secondary markets who prefer to work directly with property sponsors.

#8. DiversyFund

Image Source: The Modest Wallet

DiversyFund’s portfolio stands at about $175 million, establishing its place in the multifamily real estate sector. This real estate investing app targets apartment buildings and we used a value-add strategy that could boost investor returns.

DiversyFund Key Features

- Multifamily-exclusive focus on properties with 100+ units that can be renovated to increase value

- Vertically integrated structure where the fund owns, maintains, and manages all properties

- Value-add investment strategy targets buying, renovating, and increasing rents before selling

- Low $500 minimum investment available to non-accredited investors

- Mobile app and dashboard lets you track investments and portfolio performance

- 4-6 year investment horizon without early redemption options

- Three investment tiers (Gold, Silver, and Platinum) offer different support levels

DiversyFund Pros and Cons

Pros:

- Available to both accredited and non-accredited investors

- Returns hit double digits in 2017-2018 (17%+ annualized)

- Protected 7% preferred return before profit-sharing

- Direct investments come without platform fees

- SEC-qualified with regular financial disclosure requirements

Cons:

- You can’t withdraw funds early from these highly illiquid investments

- Non-accredited investors get just one fund option

- The website doesn’t clearly show the fee structure

- “Blind pool” model prevents choosing specific properties

- Small portfolio of about 12 properties in six states

DiversyFund Pricing

| Fee Type | Amount | Notes |

|---|---|---|

| Asset Management | 2% annually | Applied to capital raised |

| Acquisition | 1-4% | One-time fee when properties are purchased |

| Construction Management | 7.5% | On renovation costs |

| Developer | 2-4% | Per project |

| Profit Sharing | Above 7% return: 65/35 split | Above 12% return: 50/50 split |

DiversyFund Best For

Patient investors who don’t mind waiting make DiversyFund’s ideal customers. The platform suits beginners who want real estate exposure without large capital investments. People interested in multifamily properties benefit from not having to become landlords. The platform works best for investors focused on growing their capital rather than regular income, since all dividends automatically go back into investments.

On top of that, it appeals to investors looking to move away from traditional stocks and bonds through alternative real estate assets. The platform needs investors ready to lock their money away for 4-6 years without touching it during that time.

#9. Landa

Landa revolutionizes real estate investing through its smartphone app. The platform lets almost anyone build a property portfolio with shares starting at just $5.

Landa Key Features

- The platform offers an accessible $5 entry point to buy individual shares of rental properties

- Each property splits into shares – 10,000 for single-family homes and 100,000 for multi-family properties

- The team handles all aspects of property management including leasing, maintenance, and tenant relations

- Investors receive monthly dividends from collected rental income

- A secondary marketplace lets users trade shares after the properties are fully funded

- The accessible mobile app helps track investments and property performance easily

Landa Pros and Cons

Pros:

- Shares start at just $5, making investing accessible

- Anyone can invest without accreditation requirements

- Regular monthly dividends create steady passive income

- The platform handles all landlord duties

- No extra fees for membership or asset management

Cons:

- Most properties are located in Georgia

- Properties use interest-only adjustable-rate mortgages

- The 6% acquisition fee raises the effective property cost

- Share sales depend on buyer availability in the secondary market

- Legal challenges emerged in February 2025

Landa Pricing

| Fee Type | Amount | Notes |

|---|---|---|

| Acquisition Fee | Up to 6% | Added to property purchase price |

| Property Management | Up to 8% | Monthly fee during tenant occupancy |

| Trading Fee | 2% | Applies to share sales on secondary market |

| Deposit/Withdrawal | Up to $2 | Per transaction |

Landa Best For

The platform works best for newcomers to real estate investing. Tech-savvy investors who prefer managing investments through their phones will find Landa appealing. The app suits those who want to test property investing with small amounts before making bigger investments. Landa attracts investors focused on monthly income from rental payments rather than long-term appreciation.

Comparison Table

| Platform | Minimum Investment | Investor Requirements | Primary Investment Focus | Management Fees | Liquidity Options | Notable Features |

|---|---|---|---|---|---|---|

| Fundrise | $10 ($1,000 for IRAs) | Non-accredited allowed | eREITs and eFunds for properties of all types | 0.15% advisory + 0.85% management | Quarterly redemptions (not guaranteed) | 90-day money-back guarantee |

| RealtyMogul | $5,000 | Both accredited & non-accredited | Commercial real estate | 1-1.25% annually | 3-10 year investment terms | 98 consecutive monthly distributions for Income REIT |

| Yieldstreet | $10,000 | Mostly accredited | Real estate, private credit, art, legal finance | 0-2.5% annually | 6 months to 5 year terms | 9.6% net annualized return on matured investments |

| Ark7 | $20 per share | Both accredited & non-accredited | Single-family, multifamily, short-term rentals | 3% acquisition + 8-15% property management | Secondary market after 1 year | Monthly dividend distributions |

| HappyNest | $10 | Non-accredited allowed | Commercial real estate | 0.50% annually | Twice yearly redemptions | Spare change round-up feature |

| Roofstock | 20-30% down payment | Non-accredited allowed | Single-family rentals | 0.5% buyer fee | Direct property ownership | 30-day money-back guarantee |

| CrowdStreet | $25,000 | Accredited only | Commercial real estate in secondary markets | Varies by deal | 3-5 year investment terms | 19% average IRR on realized investments |

| DiversyFund | $500 | Non-accredited allowed | Multifamily apartments | 2% asset management | 4-6 year terms, no early withdrawal | Protected 7% preferred return |

| Landa | $5 | Non-accredited allowed | Single & multi-family properties | 6% acquisition + 8% property management | Secondary marketplace available | Monthly dividend payments |

Conclusion

Real estate investing apps have changed property investing by making it available to almost anyone with a few dollars. Platforms like Landa with its $5 entry point and Fundrise with its $10 minimum have removed traditional barriers that once kept average investors out of real estate markets. Each platform serves different investor profiles – Fundrise appeals to beginners seeking diversification, while CrowdStreet targets accredited investors with $25,000+ to commit.

Liquidity options vary widely between platforms. Ark7’s secondary marketplaces become available after a one-year holding period. DiversyFund needs a 4-6 year commitment without early withdrawal options. These timeframes substantially affect your investment strategy and should match your financial goals.

Your ideal platform choice depends on three main factors: available capital, desired level of involvement, and investment timeline. Beginners with limited funds might start with HappyNest or Landa. Investors seeking direct property ownership should head over to Roofstock. Monthly dividends from platforms like Ark7 and Landa are a great way to get regular income.

These apps have made it possible for anyone to build a property portfolio without the traditional headaches of being a landlord. Starting small with platforms that match your investment goals makes sense. You can gradually increase your exposure as you become more comfortable with this asset class.

Real estate shows its best results as a long-term investment. Most platforms need multi-year commitments to maximize returns. Patience remains crucial even with these trailblazing investing solutions. The best real estate investing app isn’t about the lowest minimum or highest projected returns – it’s about finding the platform that matches your personal investment strategy and financial objectives.

FAQs

The minimum investment varies widely between platforms. Some apps like Landa and Fundrise allow you to start with as little as $5-$10, while others like CrowdStreet require a minimum of $25,000. Many platforms fall in between, with minimums ranging from $500 to $5,000.

No, many real estate investing apps are open to non-accredited investors. Platforms like Fundrise, Ark7, HappyNest, and Landa allow anyone to invest regardless of income or net worth. However, some platforms like CrowdStreet are exclusively for accredited investors.

Liquidity varies by platform. Some offer secondary marketplaces or periodic redemption windows, while others require longer commitments. For example, Ark7 allows selling after a one-year hold, while DiversyFund has a 4-6 year investment term with no early withdrawals. Generally, real estate investments through these apps are considered less liquid than stocks or bonds.

The property types available depend on the platform. Many apps focus on residential real estate, including single-family homes and multi-family apartments. Others, like RealtyMogul and CrowdStreet, offer commercial real estate investments. Some platforms specialize in specific property types, such as DiversyFund’s focus on multifamily apartments.

These apps typically generate returns through a combination of rental income and property appreciation. Many distribute regular dividends (monthly or quarterly) from collected rents. Additionally, when properties are sold or refinanced, investors may receive capital gains. The specific return structure varies by platform and investment type.