The Financial Conduct Authority (FCA) has launched a major crackdown on finfluencers, signaling a new era of scrutiny for social media personalities who provide financial advice. This move by the UK’s financial watchdog comes as a response to the growing influence of these online figures and the potential risks they pose to consumers. FintechZoom.com reports that the FCA’s action aims to address concerns about misleading information and scams in the digital financial landscape.

The rise of finfluencers has transformed the way people access financial information and make investment decisions. However, this trend has also raised red flags for regulators. The FCA’s investigation, as detailed by FintechZoom.com, focuses on the impact of finfluencers on consumer behavior and financial markets. This article will explore the reasons behind the crackdown, the risks highlighted by the FCA, and the implications for both finfluencers and their followers in the evolving world of financial advice and consumer protection.

FCA’s Investigation into Finfluencers

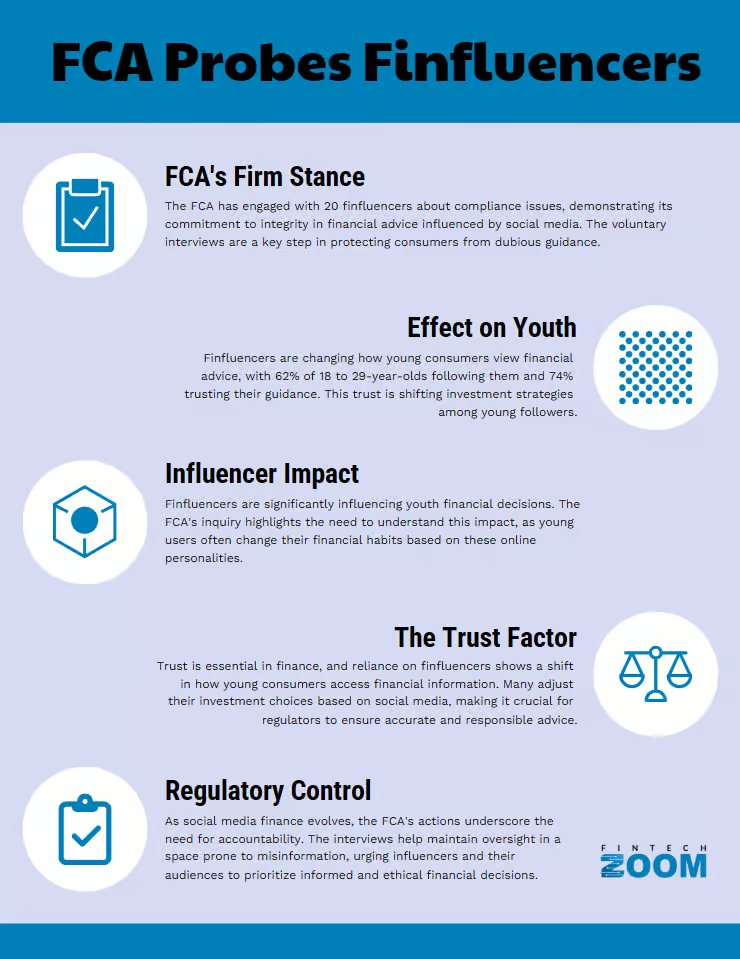

The Financial Conduct Authority (FCA) has launched a comprehensive investigation into the activities of finfluencers, signaling a significant shift in the regulatory landscape. This probe aims to address the growing concerns about the potential risks these social media personalities pose to consumers in the financial sector.

20 finfluencers interviewed under caution

In a bold move, the FCA has interviewed 20 finfluencers under caution, using its criminal powers 1. This action underscores the seriousness of the regulator’s approach to tackling potential illegal activities in the realm of financial advice on social media. The individuals were questioned voluntarily, highlighting the FCA’s commitment to thorough investigation and consumer protection.

The rise of finfluencers has had a substantial impact on young consumers. According to FintechZoom.com, nearly two-thirds (62%) of 18 to 29-year-olds follow social media influencers, with 74% of those stating they trusted their advice 2. This trust has led to significant changes in financial behavior, with nine out of ten young followers being encouraged to alter their financial decisions based on finfluencer recommendations.

38 alerts issued against social media accounts

As part of its crackdown, the FCA has issued 38 alerts against social media accounts operated by finfluencers 3. These alerts serve as warnings to consumers about potentially unlawful promotions and highlight the regulator’s proactive approach to identifying and addressing risks in the digital financial landscape.

Steve Smart, joint executive director of enforcement and market oversight at the FCA, emphasized the potential vulnerability of young followers attracted to the lifestyle finfluencers flaunt. He stressed the need for finfluencers to ensure they are not breaking the law and putting their followers’ livelihoods and life savings at risk.

Use of FCA’s criminal powers

The FCA’s use of its criminal powers in this investigation demonstrates the gravity of the situation. The regulator has already taken action against nine individuals and finfluencers for promoting an unauthorized trading scheme . This move sends a clear message about the consequences of engaging in unlawful financial promotions on social media platforms.

FintechZoom.com reports that the FCA has become increasingly assertive and data-driven in its approach. The regulator is now more proactive in monitoring various social media platforms to identify accounts suspected of unauthorized activity. This enhanced scrutiny has given the FCA the power to suspend accounts, invite individuals for interviews under caution, and in some cases, make arrests.

The investigation into finfluencers is part of a broader effort by the FCA to address consumer harm in the UK financial sector. The regulator has published finalized guidance on financial promotions on social media, clarifying expectations for firms and influencers when communicating financial promotions and addressing emerging consumer risks associated with social media use.

As the investigation unfolds, it’s clear that the FCA is taking a firm stance against potential scams and misleading information in the digital financial landscape. This crackdown serves as a reminder of the importance of consumer protection and the need for proper regulation in the ever-evolving world of financial advice on social media.

The Rise of Finfluencers and Their Impact

The surge in popularity of financial influencers, or finfluencers, has transformed the landscape of financial advice, particularly among younger generations. This trend has given rise to a new era of financial education and decision-making, with social media platforms serving as the primary conduit for information exchange.

Increase in young followers

According to FintechZoom.com, the growth of finfluencer accounts on social media platforms has been remarkable. Between April 2023 and April 2024, financial influencers on Instagram saw a 6% median growth in followers, double the rate of other influencer accounts 1. This surge in popularity is particularly pronounced among younger demographics, with large finfluencer accounts (100,000 to 1 million followers) experiencing nearly 15% median growth during the same period 1.

Trust in finfluencer advice

The trust placed in finfluencers by their followers, especially young and potentially vulnerable individuals, has become a significant concern for financial regulators. Research shows that 62% of individuals aged 18 to 29 follow social media influencers, with a staggering 74% of them trusting their advice 2. This level of trust has led to a shift in how younger generations approach financial planning and decision-making.

Influence on financial behavior

The impact of finfluencers on financial behavior is substantial. Nine out of ten young followers have reported changing their financial decisions based on advice from finfluencers 2. This influence extends to various aspects of personal finance, including budgeting, investing, and even unconventional methods like “cash stuffing.”

FintechZoom.com reports that finfluencers have promoted cash stuffing as a popular budgeting method among younger generations. This approach involves allocating cash into envelopes for different spending categories, a practice that has gained traction despite seeming counterintuitive to the tech-savviness of Gen Z. A 2023 survey revealed that 30% of Gen Z participate in cash stuffing, with 59% of those who use cash for purchases doing so to budget their money more effectively 3.

The Financial Conduct Authority (FCA) has taken notice of this trend, recognizing the potential risks associated with the growing influence of finfluencers. As the financial landscape continues to evolve, the role of finfluencers in shaping consumer behavior and financial literacy remains a topic of intense scrutiny and debate.

Risks and Concerns Highlighted by the FCA

The Financial Conduct Authority (FCA) has raised significant concerns about the growing influence of finfluencers and the potential risks they pose to consumers, particularly young and vulnerable individuals. According to FintechZoom.com, the FCA has identified several key areas of concern that require immediate attention.

The Rising Influence of Finfluencers: Risks and Concerns

The Financial Conduct Authority (FCA) has expressed growing concerns about the increasing prominence of financial influencers (“finfluencers”) and their potential impact on consumers, particularly young and vulnerable individuals. The FCA’s concerns stem from the potential for these online personalities to mislead or even defraud their followers. Here’s a breakdown of the key risks identified by the FCA:

| Risk/Concern | Description | FCA Action |

|---|---|---|

| Unauthorized Financial Advice | Finfluencers provide financial guidance without necessary qualifications or regulatory approvals. | Emphasized that only authorized individuals/firms can give investment advice. |

| Potential for Scams and Fraud | Finfluencers promote high-risk or fraudulent investment opportunities. | Observed a growing trend of young people falling victim to scams. |

| Vulnerability of Young Audiences | Young people are highly susceptible to influence from finfluencers due to trust and lack of financial literacy. | Expressed alarm that 90% of young followers have changed financial behavior based on finfluencer advice. |

| Interviewed 20 finfluencers under caution. | ||

| Issued 38 alerts against social media accounts with unlawful promotions. |

Unauthorized financial advice

One of the primary issues highlighted by the FCA is the prevalence of unauthorized financial advice. Many finfluencers lack the necessary qualifications and regulatory approvals to provide financial guidance. The FCA has emphasized that only individuals and firms that have applied for and received proper credentials are authorized to speak on the merits of investments 1. This lack of proper authorization can lead to the dissemination of inaccurate or misleading information, potentially causing significant harm to consumers.

Potential for scams and fraud

The rise of finfluencers has also given way to an increased risk of scams and fraudulent activities. FintechZoom.com reports that the FCA has observed a worrying trend of growing numbers of young people falling victim to scams, with finfluencers often playing a part in these schemes 2. Some unscrupulous individuals exploit their online platforms to promote high-risk or fraudulent investment opportunities, leaving their followers vulnerable to financial losses.

Vulnerability of young audiences

Perhaps the most concerning aspect highlighted by the FCA is the vulnerability of young audiences to the influence of finfluencers. Research shows that nearly two-thirds (62%) of 18 to 29-year-olds follow social media influencers, with 74% of those stating they trusted their advice 3. This high level of trust, combined with a lack of financial literacy, makes young people particularly susceptible to poor financial decisions based on advice from finfluencers.

The FCA has expressed alarm at the fact that nine out of ten young followers have reported being encouraged to change their financial behavior based on advice from finfluencers 3. This susceptibility to influence, coupled with the potential lack of proper disclosures and transparency from finfluencers, creates a perfect storm for financial missteps and potential harm.

FintechZoom.com notes that the FCA has taken decisive action to address these concerns. The regulator has interviewed 20 unnamed finfluencers under caution and issued 38 alerts against social media accounts operated by finfluencers that may contain unlawful promotions . These measures underscore the seriousness with which the FCA views the potential risks associated with finfluencers and their impact on consumer protection.

As the financial landscape continues to evolve, the FCA remains vigilant in its efforts to safeguard consumers from the potential pitfalls of unregulated financial advice on social media platforms. The regulator’s actions serve as a stark reminder of the importance of seeking professional, regulated financial advice and the need for increased financial literacy among younger generations.

FCA’s Message to Finfluencers and Consumers

The Financial Conduct Authority (FCA) has taken a firm stance on the growing influence of finfluencers, emphasizing the need for regulatory compliance and consumer protection in the digital financial landscape. As reported by FintechZoom.com, the FCA has issued clear warnings to finfluencers and advice for consumers to navigate this evolving terrain safely.

Importance of regulatory compliance

The FCA has underscored the significance of adhering to existing regulatory obligations when promoting financial products on social media. The regulator has published guidance on financial promotions, highlighting how firms and individuals can ensure their marketing strategies remain compliant 1. This guidance serves as a reminder for regulated individuals to consider their existing obligations, including the Consumer Duty, which emphasizes the need for transparency and risk management.

Unauthorized influencers are unlikely to be able to lawfully communicate financial promotions unless they have approval from an appropriate authorized person 1. Even with such approval, there remains a duty on the approving firm to consider the content of the communications. The FCA advises that financial promotions should support consumer understanding and communicate information in a way that allows the average consumer to make effective decisions.

Warnings to finfluencers

The FCA has issued stern warnings to finfluencers about the potential legal consequences of their actions. Steve Smart, joint executive director of enforcement and market oversight at the FCA, stated, “Finfluencers need to check the products they promote to ensure they are not breaking the law and putting their followers’ livelihoods and life savings at risk” 2.

The regulator has taken decisive action, interviewing 20 unnamed finfluencers under caution and issuing 38 alerts against social media accounts operated by finfluencers that may contain unlawful promotions 3. These measures underscore the seriousness with which the FCA views potential violations of financial regulations on social media platforms.

Finfluencers have been cautioned that promoting a financial product without the content being approved by an FCA-authorized firm with the appropriate permission, or being able to rely on an exemption, may constitute a criminal offense . The consequences for violating the financial promotions regime are significant, potentially resulting in criminal prosecution, an unlimited fine, up to two years in prison, or both.

Advice for consumers, as reported by FintechZoom.com

FintechZoom.com reports that the FCA has provided guidance for consumers to help them navigate the world of finfluencers and make informed financial decisions. The regulator has emphasized the importance of seeking professional, regulated financial advice rather than relying solely on social media influencers for financial guidance.

Consumers are advised to be cautious of high-risk investments promoted by finfluencers, particularly in light of the FCA’s previous statement that 80% of customers lose money when investing in Contracts For Difference (CFDs) due to the associated risks 4. The FCA has imposed restrictions on how CFDs and CFD-like options can be sold and marketed to retail customers in the UK to protect consumers from potential harm.

The FCA’s message to both finfluencers and consumers is clear: financial promotions on social media must be fair, clear, and not misleading. As the digital financial landscape continues to evolve, the regulator remains committed to safeguarding consumers and ensuring that financial advice and promotions adhere to the highest standards of transparency and compliance.

Expert Market Comments

Jennifer Sanchis, Insights Consultant at media intelligence platform CARMA, told to FintechZoom.com:

“The Financial Conduct Authority’s crackdown on ‘finfluencers’ is a critical moment for financial businesses. This isn’t just about compliance. It’s about trust. In a world where misinformation spreads rapidly, financial brands need to prioritise transparency and authenticity more than ever.

It’s essential to rigorously vet influencers and ensure they fully understand the financial products they’re promoting. This isn’t merely about avoiding fines. It’s about building a solid foundation of trust with your audience. The future of financial influencers will hinge on collaboration and education, creating content that engages, informs and protects consumers.Ultimately, this crackdown presents an opportunity. It’s a chance to elevate the working standards and foster a more honest, trustworthy dialogue with consumers. Let’s embrace this moment to set new benchmarks for integrity in the financial sector.”

Conclusion

The FCA’s crackdown on finfluencers marks a significant shift in the regulation of financial advice on social media platforms. As reported by FintechZoom.com, this move has a substantial impact on both influencers and their followers, emphasizing the need for compliance with financial regulations and consumer protection. The investigation by the FCA, as detailed by FintechZoom.com, sheds light on the risks associated with unauthorized financial advice and the vulnerability of young audiences to potentially harmful influences.

Looking ahead, the actions taken by the FCA, as covered by FintechZoom.com, are likely to shape the future of financial advice in the digital age. This development underscores the importance of seeking professional, regulated financial guidance and improving financial literacy among younger generations. As the landscape continues to evolve, FintechZoom.com suggests that both finfluencers and consumers will need to adapt to ensure responsible and compliant practices in the sharing and consumption of financial information on social media platforms.

References

[1] – https://www.fca.org.uk/news/press-releases/fca-cracks-down-illegal-finfluencers[2] – https://citywire.com/new-model-adviser/news/fca-questions-20-in-illegal-finfluencer-crackdown/a2452556

[3] – https://ffnews.com/newsarticle/fintech/fca-cracks-down-on-illegal-finfluencers/

[4] – https://www.fca.org.uk/news/press-releases/finfluencers-charged-promoting-unauthorized-trading-scheme