A recent survey of 1500 Canadians has found that purchases carried out using mobile devices have experienced a 27% year on year increase in the first half of 2024. This dramatic rise highlights a significant shift away from more traditional payment methods in recent years, with many consumers now swapping cash and credit cards for digital wallets and in-app payment systems.

What Does the Survey Say?

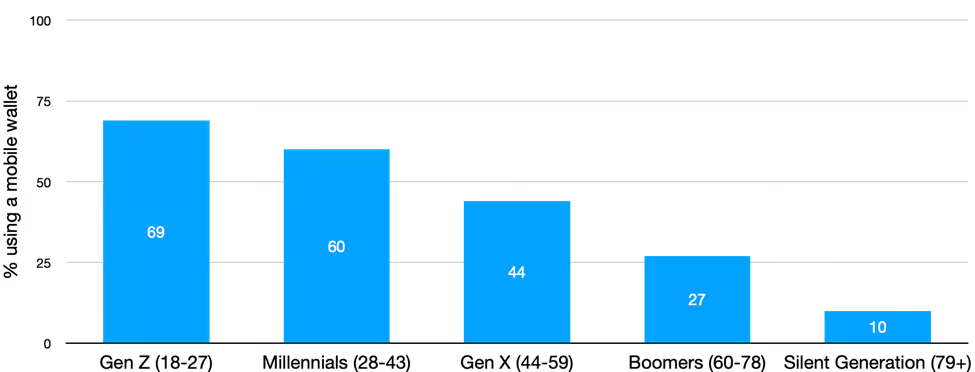

Carried out by one of Canada’s leading financial corporations, Interac, an interbank network which facilitates millions of financial transactions in Canada annually, the survey has unveiled that the main demographic driving this increase is Gen Z. The survey reported that 69% of Gen Z adults questioned, that is those between the ages of 18 and 27, said they used a mobile wallet. Perhaps unsurprisingly, this was higher than any other age demographic with the percentage of people indicating they used digital wallets getting smaller with increasing age. Millennials also appear to be increasingly using modern payment methods with approximately 6 in 10 stating they had a mobile wallet. Gen X and upwards sees a rapid decline in the amount of people using mobile transactions, with as few at 10% of people aged 79 and above saying they had a digital wallet.

Reasons behind generational differences

The results of the survey are undeniable, with a clear generational divide in consumer preferences when it comes to making purchases. Delving deeper, what are the reasons behind such contrasting behaviors?

Gen Z more tech savvy

Younger generations, in particular Gen Z are far more comfortable with modern technologies than their older counterparts, and so are more willing to utilize them for their everyday needs. Gen Z adults have grown up with digital technology, so much so that it has become a normal aspect to their lives. Contrastingly, those in Gen X and above will remember many years before the advent of modern technology and often will find it difficult to adopt to new tech. As the original drivers of the tech-boom in the late 1990s and early 2000s, Millennials fall somewhere in between, with many people in this age range also now using digital technology within their daily activities. For example, the main audience of online gambling platforms including Interac casinos, which allow players to make a deposit without disclosing their financial details, are largely Millennials highlighting the ability of this age range to acclimatize to emerging technology.

Impact of increased cost-of-living

It is common knowledge that it is Gen Z that has been worst hit by the increasing cost of living in recent years, with millions of young Canadians facing difficulties buying their first homes, dealing with rising interest rate and managing a turbulent job market. The Interac survey found that 62% of Gen Z participants wanted to be more mindful when spending with nearly 80% claiming that the cost of living has become too expensive. Younger generations are therefore using digital payment methods to help track their spending better, helping them to be smarter with their money.

Busy lives of younger people

With the increasing pace of working life, particularly in the urban areas dominated by younger adults, time has become a valuable commodity and many Gen Z adults search for speed and efficiency in every aspect of their life. The fact that 63% of Gen Z participants associated mobile payments with greater speed than physical card payments is a key marker as to why most young adults are now choosing digital wallets instead. The ability to quickly tap your phone to pay is increasingly convenient in a busy life, avoiding the need to think about bringing your card or taking cash out at the ATM.

Indications of a cultural shift

Ultimately, this is an indication of a broader cultural shift towards a cashless society, with younger generations evidently leading the way. The famous saying, ‘cash is king’ is becoming increasingly associated with older generations who struggle to, or refuse to, keep up with modern forms of transactions. For members of Gen Z, using cash to pay for things has become rarer, especially following the COVID-19 pandemic, in which many businesses limited to the use of cash for purchasing goods. Despite this, following recent economic downturns in North America, some consumers have begun to turn back to cash highlighting that physical payment methods still have a part to play in our societies.

What Does the Future Hold for Payment Methods?

While physical payments remain an important aspect to consumer spending, the findings from the Interac survey cannot be ignored. Mobile spending methods are on the rise, and as the Gen Z adult population continues to grow, it is likely that this surge will continue. Innovation in the fintech sector has not stopped either, with many novel financial technologies on the horizon likely to soon replace today’s digital wallets and payment apps. Biometric payments, those that bypass the requirement of a smartphone all together, utilizing biometric data like fingerprints, retina scans and voice recognition, could provide consumers even faster transactions with unmatched security. While this seems a futuristic proposition, financial leader Stripe expects the biometric payment to grow 118% in the next five years. This tech is very much becoming a reality.

Going one step further into the future, the concept of Brain-Computer Interface (BCI) payments is also making waves in the fintech world. Rather than manually completing payments with say a card, app, or fingerprint, BCI payments would allow your brain signals to be read and understood by external devices which would then process a purchase based upon these received signals. While still very much in the development stages, this revolutionary technology could soon take center stage in the world of digital transactions.

This recent survey has outlined the transformation being witnessed both in Canada and more broadly across the globe when it comes to paying for our everyday lives. It is perhaps unsurprising that Gen Z lead the way when it comes to utilizing mobile payment methods, however the dramatic rise in mobile payments indicates a more resounding shift in consumer preferences. For now, mobile payment methods lead the way, but it may not be long until a new form of payment takes charge.