Crypto has grown into a lucrative space in which investors seek to create new avenues of return and wealth. From staking to trading, the manners in which one can make out-of-this-world returns with crypto are endless. Going into 2024, this is going to be a great avenue to make one wealthy with digital assets, which make it easier to earn rewards and find profitable strategies. In this article we are going to review, step by step, 5 ways to get rich through cryptocurrency in 2024 as mentioned below.

- Crypto staking

- Crypto trading

- Crypto Mining

- Crypto Lending

- Yield Farming

1. Crypto Staking

Crypto-staking is the most popular way to generate passive income with the help of your cryptocurrency. It means to participate in some kind of PoS network by locking up a certain amount of tokens in a special wallet, which later helps to validate transactions and keep this network safe. In return, stakers gain rewards, which often come as additional tokens.

This is advantageous in the sense that investors will be capable of raising their assets without necessarily trading and keeping abreast of market conditions frequently. With the coming of various staking platforms, investors can easily select the best options to maximize their returns.

StakingBonus: the best staking platform

StakingBonus is a leading platform designed to create the best user experience in staking. It will act as an overall source of information in comparing different staking options, thus enabling users to find the best rewards and features offered. In other words, StakingBonus focuses on education and transparency, so it will be perfect both for beginners and for investors who would like to inform themselves about every step in the best way. The website will host detailed descriptions of various staking platforms with which users can optimize their passive income by implementing better and wiser ways of staking.

Key Features of StakingBonus

- Comparisons: Compare any number of staking websites through the aspect of rewards, fees, and conditions.

- Educational Information: Complete guides and articles to gain a better perspective on staking.

- Market Insights: Regular updates on trends and overall developments in the space of staking.

- User-Friendly Interface: An intuitively designed interface makes navigation simple for any user.

- Real time analytics: access real time data on staking performance, rewards and market trends, to make informed decisions.

How To Sign Up for StakingBonus:

- Website: Access the StakingBonus website by login.

- Create Account: Press the sign-up button.

- fill in Your Info: provide your email address and password

- Verify Your Email: Confirm your email address through a verification link on your email.

- Complete the rest of your profile information by login.

- Start using It: Find staking options and resources created just for you.

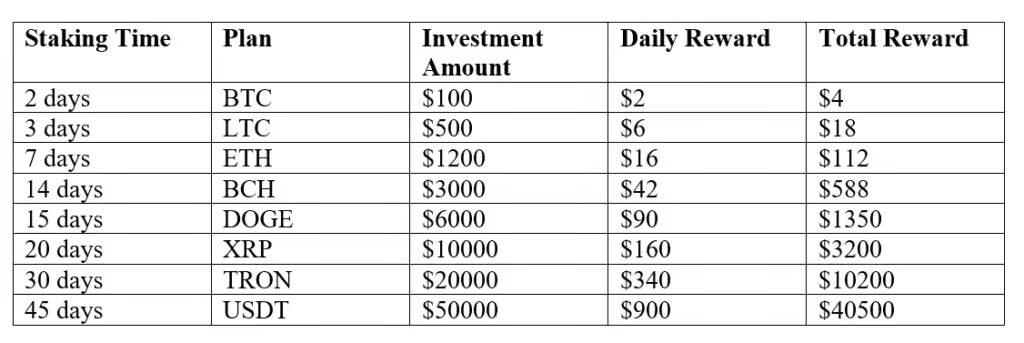

Staking plans at StakingBonus

The different plans open wide opportunities for choosing the most convenient investment variant through StakingBonus. According to the purpose of user activity, one can choose plans with different periods of lock up, with different minimums of staking, and with possible estimation of rewards.

The platform is prominent for staking determined cryptocurrencies, which also points at estimated returns for each created plan. Such flexibility brings more opportunities for users to be in any situation according to financial goals and risk tolerance. With clear details and easy access to relevant information on staking, StakingBonus facilitates ease in staking and increases the ability of users to make informed decisions.

- Bitcoin (BTC)

The Bitcoin network is based on a Proof of Work mechanism, hence it doesn’t support classic staking. You can, however, generate passive income with BTC via so-called Bitcoin lending or “crypto savings” accounts available on several platforms. These options allow you to earn interest on your BTC holdings with the caveat that it’s not a PoS coin.

- Litecoin (LTC)

Like Bitcoin, Litecoin also functions on a PoW system and is thus not traditionally staked. Many different types of platforms will allow users to lend or deposit LTC into interest-earning accounts. This isn’t traditional staking, but these programs offer a way for one to generate rewards without trading in their cryptos.

- Ethereum (ETH)

Due to the transition of Ethereum 2.0 to PoS, ETH has become a stakeable coin. You are able to stake this coin on platforms like StakingBonus and earn rewards by helping in transaction validation on this network. A typical direct staking might require 32 ETH, but some platforms allow pooled options for lower sums.

- Bitcoin Cash (BCH)

Bitcoin Cash is another PoW-based cryptocurrency, which, for that very fact, doesn’t natively support classic staking. However, passive income through lending programs or interest-bearing accounts is possible. These are great options to accrue a steady return on your BCH holdings.

- Dogecoin (DOGE)

Dogecoin is a PoW cryptocurrency, hence it cannot be directly staked. Similar to other PoW cryptocurrencies, there is the ability to lend your DOGE through various platforms or take part in interest-paying savings programs, enabling passive income for holders.

- Ripple (XRP)

XRP does not use PoS and thus cannot be traditionally staked. There is, however, lending available to XRP holders, besides interest-bearing accounts. These will also grant you rewards for lending out your XRP to borrowers or putting it in crypto saving programs.

- TRON (TRX)

TRON uses the Delegated Proof of Stake model that lets users stake their TRX and vote for Super Representatives. In return, you help secure the network and make some staking rewards. TRON provides an easy way to get rewards with low barriers to entry.

- Tether (USDT)

Unlike other cryptocurrencies, USDT is a stablecoin and thus cannot be staked because of the lack of PoS. However, numerous platforms provide users with opportunities to receive passive rewards either from lending their USDT or putting it into interest-bearing accounts. Such options protect and provide a secure way to grow one’s USDT holding.

2. Crypto Trading

Crypto trading remains one of the most popular ways people have for gathering their fortune in the cryptocurrency space. Through active buying and selling of digital assets at changing market circumstances, a trader can capitalize on the short-term price movements. Successful trading needs at least a good understanding of market trends and technical analysis with a substantial risk management strategy.

3. Crypto Mining

Crypto mining is another route of income within the field of cryptocurrencies. In effect, this is the validation of transactions and appending them to a blockchain after solving difficult mathematical problems. Rewards come in the form of newly minted coins for miners. Although mining may be lucrative, it entails lots of investments in hardware and electricity as well as technical know-how.

As mining is becoming increasingly competitive, many investors are experimenting with alternative mining opportunities. These alternatives include the facility of cloud mining, in which users can rent mining power without any physical equipment. Despite the fact that the competition is tough, successful miners are greatly rewarded in the bullish condition of the market.

4. Crypto Lending

Crypto lending has recently gained significant momentum regarding ways to make passive income from idle cryptocurrency assets. Crypto-lending platforms allow borrowers to receive lending for digital assets in return for interest payments, while the owners maintain ownership of the underlying assets.

Many of these types of platforms offer their users a lot of freedom in being flexible with terms-suited to their choice-for example, by determining the duration and rates of interest.

5. Yield Farming

Yield farming has been one of the innovative ways investors can earn passive income in the DeFi markets. For this, it allows users to earn rewards in the form of interest or additional tokens when they add liquidity to various protocols or pools.

Yield farming mainly depends on staking assets within decentralized exchanges or lending protocols most of the time, thereby giving users an opportunity to enjoy higher returns than traditional banking.

Conclusion

By 2024, a number of options still remained through which income could be generated in the cryptocurrency market, such as staking, trading, mining, lending, and yield farming, each with different options and risks. Make full use of platforms like StakingBonus, study various strategies, and make better decisions as an investor to increase your chances of earning more in the ever-changing world of digital assets.

Disclaimer

Investing in cryptocurrencies involves significant risks and may not be suitable for all investors. The value of cryptocurrencies can be highly volatile, and you could lose some or all of your investment.

Before investing in cryptocurrencies, you should carefully consider your investment objectives, risk tolerance, and financial circumstances. It is also important to do your own research and understand the risks involved.

Cryptocurrency investments are not regulated or protected by government agencies in the same way as traditional investments, such as stocks or bonds. This means that there is a greater risk of fraud and scams.

You should also be aware that the tax treatment of cryptocurrencies can vary depending on your jurisdiction.

Regulator Links: