Need a detailed BYDFi Crypto Exchange review that stacks up against major trading platforms? When I first explored BYDFi, I wondered if this established exchange, now in its fifth year, could effectively compete with giants like KuCoin. My thorough testing shows BYDFi stands out as a reliable option for traders of all skill levels.

Crypto investors often search for exchanges that deliver the right mix of security, features, and ease of use. BYDFi’s platform addresses many of these needs. The exchange offers impressive leverage up to 200x on certain assets and user-friendly copy trading features. The platform’s ratings appear positive as traders evaluate its competitive fees and responsive support team. KuCoin has been a significant market player for over seven years, but BYDFi’s growing recognition suggests it’s becoming a strong alternative. This review breaks down how these platforms compare and why BYDFi could be the dependable choice you need.

What Is BYDFi and Who Is It For?

BYDFi has emerged as a notable platform in the crypto exchange world. Launched in April 2020, the platform offers features that appeal to traders of all types. My BYDFi crypto exchange review analyzes the platform’s unique aspects and compares it to long-standing platforms like KuCoin, which was founded in 2017.

Platform background and launch history

The crypto world needed flexible trading platforms, and BYDFi stepped up to meet this need. Unlike some older exchanges that can have complex systems, BYDFi aimed to create an accessible interface with powerful trading tools. Forbes has recognized BYDFi in its listings of notable cryptocurrency exchanges.

BYDFi’s strength lies in its ability to provide comprehensive trading options without overwhelming users. The exchange lists around 600 cryptocurrencies for spot trading, with access to a vastly larger number of on-chain assets via its MoonX tool. This offering is substantial, though KuCoin provides access to 700-900+ digital assets. The platform balances security and user control – something many other exchanges strive to achieve.

Supported countries and user base

BYDFi may present an alternative for users in certain regions, particularly considering KuCoin’s recent regulatory challenges. KuCoin faced significant regulatory actions in the United States, including substantial financial settlements and an agreement to cease serving U.S. customers, announced around March 2024, with an exit from the US market to be completed. These developments may lead some users to seek alternatives like BYDFi, which holds Money Services Business (MSB) registrations in the US (FinCEN) and Canada (FINTRAC) and continues to serve these markets.

The platform takes a proactive stance on regulations in the jurisdictions it operates in. This approach aims to build an international user base while navigating the complex global regulatory landscape.

Target audience: Beginners vs. advanced traders

BYDFi caters to both new and experienced traders with well-designed features. New traders get:

- Demo trading accounts to practice strategies with no risk.

- Copy trading functionality to follow successful traders.

- A simple interface that’s generally considered easy to navigate.

Advanced traders enjoy:

- Leverage options up to 200x for specific trading pairs (e.g., BTC, ETH).

- Advanced trading bots with Spot/Futures grid and Spot Martingale options.

- Perpetual contract trading for sophisticated financial instruments.

BYDFi allows users to access many trading features without mandatory KYC verification for lower withdrawal limits, unlike KuCoin’s increasingly strict requirements. KuCoin now uses tiered KYC: KYC1 (basic verification), KYC2 (advanced verification with government ID), and Institutional KYC. Users who value privacy and convenience may prefer BYDFi’s flexible approach for basic access.

My analysis shows BYDFi as a solid alternative to KuCoin. The platform works well for users potentially affected by KuCoin’s U.S. market exit or those who want flexible verification for certain features without giving up advanced trading tools.

Core Features of BYDFi Exchange

My BYDFi crypto exchange review reveals that its core features are competitive. Launched five years ago, BYDFi’s offerings can be compared to established exchanges like KuCoin. I tested each component and can say with confidence that BYDFi’s trading tools work well for both beginners and experienced traders.

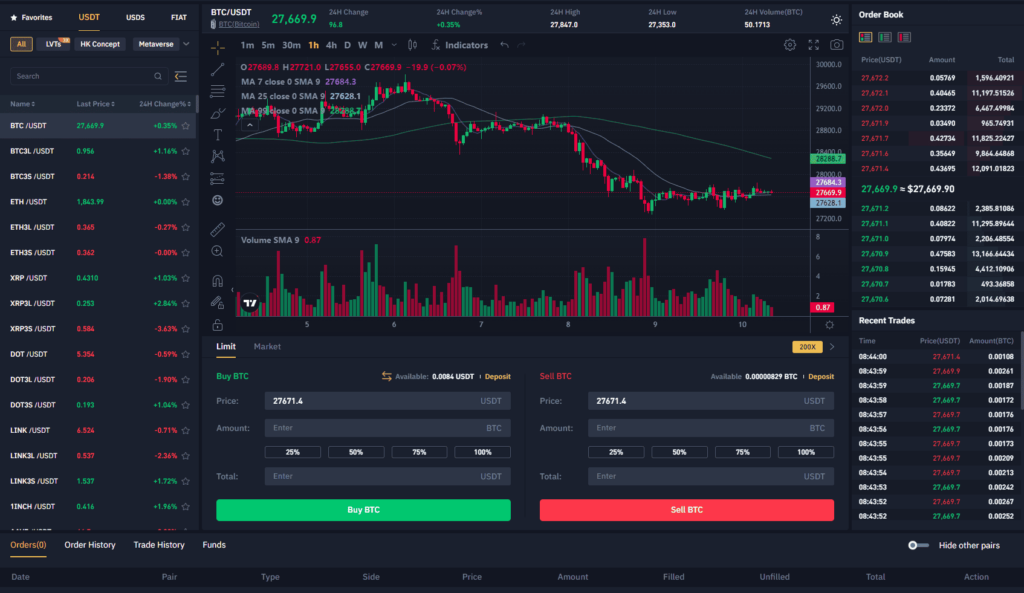

Spot and perpetual contract trading

BYDFi’s spot trading interface offers users a clean, generally user-friendly experience to trade around 600 cryptocurrencies. While the selection is smaller than KuCoin’s extensive list of 700-900+ assets, it still provides ample options to diversify a portfolio. The platform comes with live data feeds and advanced charting tools from TradingView.

BYDFi’s perpetual contract trading aims for simplicity. While many exchanges can have complex interfaces, BYDFi attempts to keep things straightforward without sacrificing essential features. Traders can open long and short positions to profit from various market directions. User feedback often notes BYDFi’s perpetual contracts can offer a smooth experience.

Copy trading and demo trading options

BYDFi distinguishes itself with its copy trading feature. New traders can automatically mirror successful investors’ trades, potentially learning while they earn. As traders build confidence, they can transition to making their own decisions.

The demo trading feature also makes BYDFi accessible. Users can test their strategies with virtual funds before using real money. This gives newcomers a chance to build confidence without risking their capital – a significant advantage over platforms that might push users straight into live trading.

Trading bots and automation tools

BYDFi includes several smart trading bots to automate strategies:

- Spot/Futures Grid Bots that buy low and sell high within predefined price ranges.

- Spot Investment Bots for steady, long-term accumulation strategies.

- Spot Martingale Bots that implement strategies adaptable to various market conditions.

These tools are competitive with KuCoin’s offerings, though each platform implements them differently. Some users may find BYDFi’s interface for bot setup more intuitive.

Leverage up to 200x for advanced users

While BYDFi welcomes beginners, it also serves professional traders well. The platform offers leverage up to 200x on select major cryptocurrencies. This is higher than KuCoin’s typical maximum leverage of up to 100x or 125x on its futures products. Advanced traders can aim to increase potential profits with high leverage, though this inherently comes with higher risks.

Given KuCoin’s exit from the US market due to regulatory reasons, BYDFi stands as an option for US-based traders seeking platforms with advanced features like high leverage. The platform aims to balance powerful tools with user safety through risk management features.

My testing indicates BYDFi performs reliably, even during market volatility. This is vital when rating exchanges and picking a dependable platform for serious trading.

User Experience and Interface Design

My extensive testing of both platforms for this BYDFi crypto exchange review shows that user experience significantly affects trading efficiency and satisfaction. The way an interface looks and works often determines whether traders stay loyal or look elsewhere.

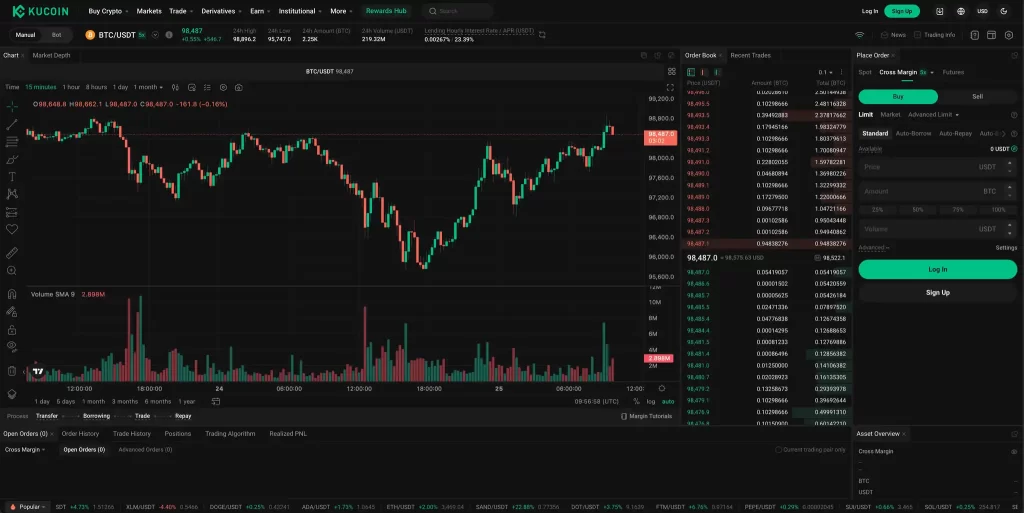

Mobile and web platform usability

BYDFi provides multiple access points, similar to KuCoin, but takes its own approach to usability. The web platform has a clean, generally well-laid-out design that helps users navigate between trading sections. The dashboard typically presents necessary information without excessive clutter—an aspect some users find challenging on KuCoin’s interface during busy market periods.

BYDFi’s mobile app is often cited for its responsiveness. The app generally works smoothly on iOS and Android devices. My tests showed consistent performance, which is crucial when traders need quick order execution during market swings.

BYDFi provides developers and advanced traders with API access, allowing for automated trading and custom tool development, much like KuCoin’s API features. Some users have found BYDFi’s API documentation accessible.

Account setup and KYC process

Creating a BYDFi account typically involves a few simple steps:

- Head to BYDFi’s website or download the mobile app.

- Sign up with your email or phone number.

- Pick a strong password and verify your account.

- Add extra security measures like two-factor authentication (recommended).

A key difference from KuCoin lies in its KYC (Know Your Customer) requirements. KuCoin uses strict, tiered verification—KYC1 (simple), KYC2 (government ID needed), and Institutional KYC. BYDFi offers a more flexible approach for initial access. Many trading features on BYDFi work without mandatory KYC checks for users staying within lower withdrawal limits, making it appealing for privacy-conscious users or those wanting quick entry.

BYDFi still maintains security measures and aims to balance accessibility with regulatory considerations. KuCoin’s past challenges in the US, leading to significant financial settlements and its market exit, highlight the complexities of global crypto regulation.

Community feedback and exchange ratings

User reviews for BYDFi are growing, though as a younger platform, it has fewer reviews than older exchanges like KuCoin. KuCoin’s ratings vary widely across different review platforms. For instance, Capterra users often give KuCoin around 4 out of 5 stars, praising its crypto selection. However, sites like Sitejabber show much lower scores, and Reviews.io presents mixed feedback, with a notable percentage of users not recommending it.

It’s common for dissatisfied users to be more vocal in reviews. BYDFi’s generally positive, albeit smaller, pool of reviews might indicate a different user satisfaction profile compared to KuCoin’s more polarized feedback.

The interface design, account access flexibility, and user feedback position BYDFi as a considerable alternative to KuCoin, especially for traders seeking efficient trading with potentially fewer initial regulatory hurdles for basic use.

Security, Compliance, and Transparency

When I evaluate cryptocurrency exchanges for security measures, I look for platforms that have reliable protective systems alongside reasonable verification requirements. My research into BYDFi crypto exchange shows key differences in how exchanges balance security with user convenience.

KYC tiers and verification levels

Identity verification is a cornerstone of exchange security and compliance. BYDFi takes a different path compared to KuCoin. KuCoin employs a strict three-tier KYC system—simple verification (KYC1), advanced verification requiring government ID (KYC2), and institutional verification. BYDFi has maintained a more flexible approach for initial access.

BYDFi allows users to trade with certain limits without mandatory KYC verification. This policy appeals to privacy-conscious traders but means users must be aware of the limitations for unverified accounts. The platform implements security protocols for higher-value transactions and verified users to balance accessibility and protection.

Asset protection and wallet structure

Both exchanges protect assets through multi-layered systems. KuCoin keeps user assets in separate cold, warm, and hot wallets to mitigate risk and has previously mentioned working with custodians and having insurance coverage.

BYDFi also makes asset security a priority, utilizing cold storage for the majority of user funds and employing essential account safeguards like two-factor authentication. KuCoin offers additional features such as withdrawal whitelisting and anti-phishing tools, which can provide enhanced protection against unauthorized access.

Regulatory status and global compliance

Comparing the regulatory journeys of these exchanges is insightful. KuCoin has faced serious challenges in the US:

- Significant financial settlements and forfeiture agreements with US authorities (DOJ, CFTC, FinCEN, NYAG) related to operating an unlicensed money-transmitting business and Bank Secrecy Act violations, with announcements primarily in 2023 and 2024.

- Agreed to cease operations for US customers.

- Experienced a major security breach in 2020 resulting in the theft of approximately $281 million in assets (most of which was reportedly recovered or covered).

BYDFi, while younger, has maintained a relatively cleaner regulatory slate in major Western markets, holding MSB registrations with FinCEN (US) and FINTRAC (Canada). This proactive licensing in key regions contrasts with KuCoin’s reactive situation in the US.

However, KuCoin has actively pursued compliance elsewhere. The exchange has sought licensing under the EU’s Markets in Crypto-Assets (MiCA) regulation via registration in member states and successfully registered with India’s Financial Intelligence Unit (FIU) in 2024.

Looking at both platforms’ security setups, compliance approaches, and transparency records, BYDFi stands out as a viable alternative to KuCoin—especially for traders who prioritize accessibility and a clearer current regulatory standing in North America, without giving up essential security.

BYDFi vs KuCoin: Which One Should You Choose?

Choosing between cryptocurrency exchanges boils down to your individual needs and values. My review of BYDFi crypto exchange and analysis of KuCoin reveals key differences that could help you pick the right platform.

Feature comparison: Trading tools and assets

KuCoin lists approximately 700-900+ cryptocurrencies, while BYDFi offers around 600+ for spot trading (with many more accessible via its on-chain MoonX tool). KuCoin has an edge in the sheer number of directly listed spot assets, but both platforms provide traders with extensive options.

KuCoin and BYDFi share these features:

- Advanced trading bots (grid trading, DCA tools).

- High leverage options (BYDFi up to 200x on some pairs, KuCoin up to 100-125x).

- Spot and futures markets.

The biggest difference often lies in accessibility. KuCoin generally requires KYC verification for full access to its features and higher limits. BYDFi allows access to many features with more flexible initial verification for lower limits.

Fee structure and value for money

KuCoin’s base spot trading fee is 0.1% (maker/taker), which can be reduced by 20% if paying with its KCS token, plus further discounts for higher trading volumes. Their futures trading fees typically start at 0.02% for makers and 0.06% for takers. BYDFi offers a similar competitive fee structure, with spot fees often at 0.1% and futures fees at 0.02% (maker) / 0.06% (taker). For new traders without significant volume or holdings of native tokens, the base fees are comparable. Any perception of one being “cheaper” would depend on specific trading tiers, available promotions, or the types of trades being made.

Both platforms reward higher trading volumes with lower fees.

User experience and support differences

KuCoin’s user ratings are mixed across various platforms. It scores well on Capterra (around 4/5 stars) but has very low scores on Sitejabber (around 1.1/5) and mixed results on Reviews.io (around 2.1/5). This feedback often points to support response times and concerns following their 2020 hack.

KuCoin’s regulatory challenges in the US have been significant. BYDFi, in contrast, currently appears more stable from a US regulatory perspective and generally receives positive comments on its user interface. Subjective user satisfaction with support can vary widely for any exchange.

BYDFi proves to be a solid alternative to KuCoin, particularly for users seeking less stringent initial verification, a platform with a currently clearer regulatory standing in the US, and comparable core trading tools.

Conclusion

My deep dive into BYDFi and KuCoin reveals BYDFi as a solid alternative, especially for certain trader demographics. The platform, now in its fifth year of operation, effectively balances advanced trading features with ease of use.

Traders looking for high-end features without immediate strict verification rules for basic access will find BYDFi appealing. The platform lists around 600 cryptocurrencies for spot trading (and many more via MoonX). While KuCoin offers a broader selection of directly listed spot assets, BYDFi’s selection meets most traders’ needs. BYDFi’s current clearer regulatory standing in North America also stands out, especially compared to KuCoin’s required exit from the US market and past financial settlements.

Security-minded traders will appreciate that BYDFi implements important safeguards while offering more flexible initial KYC rules compared to KuCoin’s current policies. The platform still packs advanced features like trading bots, copy trading, and impressive leverage up to 200x on certain assets, surpassing KuCoin’s typical maximums.

User feedback presents an interesting contrast. KuCoin experiences mixed ratings across platforms, while BYDFi’s growing user base generally provides consistent, often positive reviews regarding usability.

My hands-on testing suggests BYDFi delivers on its core promises. It’s a great fit for newcomers and seasoned traders who desire feature-rich trading, particularly those impacted by KuCoin’s regulatory situation in the US or who prioritize trading flexibility with less initial KYC burden. BYDFi deserves serious consideration.